eBook - ePub

Breaking up the Global Value Chain

Opportunities and Consequences

- 310 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Breaking up the Global Value Chain

Opportunities and Consequences

About this book

With intensified global competition, institutional changes and reduced communication costs the propensity of firms to reconfigure their global value chain and separate their activities across national boundaries has increased markedly. It enables firms to combine the benefits arising from specialization and increased flexibility with location advantages. Consequently, large parts of manufacturing and other more standardized activities have been offshored to emerging countries. However, recent developments are challenging this traditional separation between advanced and emerging economies as host of knowledge- and production-intensive activities, respectively. Recent research has emphasized the role of intra-organizational relationships and links among the different parts of the value chain. Innovative and productive activities are affected by strong interdependencies and complementarities, and for some companies the co-location of R&D and manufacturing is critical for development and innovation. This volume will interest scholars in International Business, Economic Geography, Operations and Supply Chain Management, International Economics, and Political Science.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Breaking up the Global Value Chain by Torben Pedersen, Timothy M. Devinney, Laszlo Tihanyi, Arnaldo Camuffo, Torben Pedersen,Timothy M. Devinney,Laszlo Tihanyi,Arnaldo Camuffo in PDF and/or ePUB format, as well as other popular books in Business & Gestione. We have over one million books available in our catalogue for you to explore.

Information

OFFSHORING, OVERSHORING, AND RESHORING: THE LONG-TERM EFFECTS OF MANUFACTURING DECISIONS IN THE UNITED STATES

ABSTRACT

Companies must adapt their strategies to changing market conditions. Global supply strategies have become the source of competitive advantage over the last several decades, particularly in the manufacturing industry, as US firms offshored manufacturing operations to low-cost locations such as China. The rationale was based on cost savings and other location opportunities. In the quest for a cost advantage, many firms departed from conventional outsourcing wisdom and began offshoring higher value and specialized activities such as engineering, design, testing, and research and development. As market conditions changed and cost advantages eroded, firms who offshored high value activities discovered strategic costs and unintended consequences. The extent of the challenges became more apparent as US firms began reshoring manufacturing to reposition in rapidly changing market conditions. The purpose of this research is to provide insight into the decision making process of offshoring and reshoring, to introduce a new concept to understand progressive offshoring, and to build supply chain knowledge by establishing a theoretical understanding for reshoring and strategic costs.

Keywords: Offshoring; overshoring; reshoring; global value chain; supply chain strategies

INTRODUCTION

Offshoring from the United States and other high-cost economies to low-cost locations like China has been a dominant and progressive theme in manufacturing since the late 1970s. At the onset, few US companies thought that within a span of 30 years China would become a major global economic power, with the world’s largest economy, the world’s largest manufacturing base, and the world’s second largest number of Fortune Global 500 companies (Lin & Milhaupt, 2013; Shih, 2014). Massive offshoring and foreign direct investments, together with China’s own development, have enabled China to rise to manufacturing dominance. To be clear, China produced $7.8 trillion in exports in 2014 (Morrison, 2015). This prominent position will not be easily recaptured by the United States, who now faces diminished manufacturing capability, and produced just $2.3 trillion in exports during the same period (US Department of Commerce, 2015). Much of what led to the widening gap in exports is the decision of US firms to offshore.

To further illustrate the unintended consequences of US offshoring, this research will begin by examining the case of the appliance division of General Electric (GE). GE moved the bulk of its US appliance manufacturing to Asia in the 1980s and 30 years later moved it back. The market for appliances in the United States had been on a structural decline since 2006 (Moffett, 2016). With low margins, decreasing market share and competitive pressures, GE Appliances had declining sales year-over-year for long periods. Furthermore, the entry of major Asian competitors such as LG and Samsung introduced significant price pressures because of their lower costs of manufacturing and subsidies. GE attempted to spin off the appliance division in 2008 for $8 billion but the offer didn’t generate any interest (Moffett, 2016). Consequently, GE decided to bring its appliance division back to the United States and invest $1 billion between 2009 and 2014 to reshore manufacturing and product development. At the time of the reshoring decision, Charles Blankenship, President of GE appliances said, “Although outsourcing production to other countries offered a one-off cost benefit, over time they realized this was not a sustainable business model” (Chip Blankenship, Jr., 2017). GE also received $17 million in government incentives to reshore the appliance division. GE opened Appliance Park in Louisville, KY to headquarter the appliance business and brought back hundreds of jobs that had been offshored and created thousands of new ones (Blanchard, 2013).

GE’s reshoring could have been viewed as a preemptive move to refurbish the appliance unit in preparation for a spin off in the future, because in 2016, GE sold its appliance division to Chinese-owned Haier for $5.8 billion. Over the last few decades, Haier rose to the position of the world’s leading appliance manufacturer, but held just 1% of the US appliance market prior to the acquisition of GE’s appliance division. No doubt Chinese appliance manufacturers gained a manufacturing advantage in their role as suppliers to the United States. It can be argued that an unintended consequence for GE moving manufacturing to China, was that GE trained their suppliers to one day become their competitors.

THE CONSTRUCTION OF THE GLOBAL VALUE CHAIN

Many firms have broken up their value chain to access low-cost overseas suppliers that provide a wide range of activities. The segmentation of the supply chain has led to a dramatic acceleration of offshore activity, and resulted in highly complex global chains (Gereffi & Lee, 2012; Handley & Benton, 2013; Niforou, 2015). According to Organisation for Economic Co-operation and Development (OECD) trade policy research, over half of current global trade consists of transactions in the context of global value chains (Ali-Yrkkö & Rouvinen, 2015). The idea behind global value chains is to reduce costs and increase competition by cutting up parts of the value chain with cross border production and distribution transactions. “The trend is the retention only of brands, design and marketing functions, especially in certain industries, like apparel, toy and electronics” (Niforou, 2015). In fact, the global value chain has been sliced up to the degree that China no longer creates most of its own value chain export processes, but outsources many activities to other low-cost Asian countries such as Taiwan (Gereffi & Lee, 2012).

In the United States, managers began offshoring production primarily in response to competitive pressure from foreign competitors. For example, production facilities were established overseas to extract raw materials and maximize profits through exploiting a cost advantage in low-wage countries (Moxon, 1975). Financial considerations related to labor-cost arbitrage were the central driver of location decisions in the 1970s and 1980s, as the threat of Japanese competition in the electronics and automobile industries motivated managers of US firms to offshore as a way of competing (Moxon, 1975). Fig. 1 illustrates the time sequencing of value chain activities, and how global value chains grew dramatically between the 1990s and 2000s. By the 2000s, offshore activities included not only finished goods, but R&D activities and industries outside of manufacturing such as food, energy, and call centers. (Gereffi & Lee, 2012).

Fig. 1. Offshore Sequencing.

At the onset, US firms had alternatives to offshoring such as investing in technology to enhance quality, developing worker skill sets, or investing in automation to reduce costs. These alternatives, however, had implementation requirements and a longer-time horizon for pay-off. The labor-cost advantages were a quick, profitable, and highly attractive option for many US firms, resulting in a mass migration of manufacturing work offshored by the United States to locations like China. The wage differential was quite substantial with labor costs in China being 5% of what they were in the United States (Kumar, 2009; Wang, Singh, Samson, & Power, 2011). Furthermore, technology-based logistics transformation that occurred in the early 2000s allowed for goods and information to be transmitted globally, and US firms pursued offshoring with expediency (Kumar, 2009).

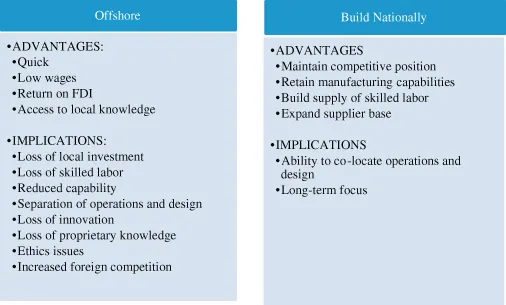

Both high-income economies and emerging economies participate in these chains and most global value chains are strongly shifting toward value being added through capital and high-skilled labor and away from less-skilled labor (Timmer, Erumban, Los, Stehrer, & Vries, 2014; Ketchen & Hult 2011; Jensen & Pedersen, 2012). “In emerging economies, the share of low-skilled labor and their value added is declining and they are specializing in capital intensive activities, suggesting a process of technological change that is biased toward the use of skilled labor and capital” (Timmer et al., 2014). Faced with strategic and competitive issues, organizations are beginning to look at their manufacturing location decisions through a much broader lens beyond cost (Ellram, Tate, & Petersen, 2013). The lens is multifaceted in that offshoring impacts the capabilities of the company offshoring, as well as the capabilities of the recipient company (see Fig. 2).

Fig. 2. Impact of Offshoring Decision.

IDEOLOGICAL INFLUENCES

It is clear offshoring played a role in the rise of globalization and advancing global economic growth and prosperity. The wave of offshoring activity by US companies was fueled by an era of opportunity-driven cost ideologies (Mugurusi & deBoer, 2013), resulting from trade agreements and pro-business policies that promoted labor market flexibility and foreign direct investment. But with the rise of offshoring came protectionist fears and back lash about domestic job losses, wage reduction, disruption of business innovation and productivity. This led governments to propose anti-offsh...

Table of contents

- Cover

- Title Page

- Case Examples

- Organizational Forms

- Consequences of Fragmenting

- About the Authors

- Index