eBook - ePub

The Responsive Global Organization

New Insights from Global Strategy and International Business

- 274 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The Responsive Global Organization

New Insights from Global Strategy and International Business

About this book

The responsive global organization can adapt business operations across multinational markets in response to unpredictable changes in the turbulent global marketplace. This book deals with different aspects of the effective multinational corporation (MNC) pointing to new ways in which the MNC can enhance responsiveness faced with increasing market turbulence. Drawing on contemporary research in strategy and international business, the book considers relevant aspects including subsidiary autonomy, individual and team engagement, local knowledge, knowledge-based innovation, dynamic integrative processes, cross-cultural management, crisis handling, and the impact of abrupt events.

The diversity of multinational business provides many opportunities, but also distinct challenges that must be managed effectively. Here an interactive dynamic between headquarters and local business units is driving responsiveness and adaptive behaviors. Corporate headquarters must structure a multinational organization so adaptive initiatives exploit local market insights where opportunities evolve from autonomous responses around the world. This can entail crisis responses involving both local and corporate efforts as a robust way to handle unexpected incidents. Such interactive approaches constitute a combination of central integration and decentralized local responses as the basis for a dynamic adaptive system. To make this work in a multinational context, we must consider the intricate interplay between corporate values and local cultures, and understand how leadership philosophies influence how diverse employees act as team players and global corporate citizens.

The book provides relevant insights on all these important issues.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access The Responsive Global Organization by Torben Juul Andersen in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

Information

CHAPTER 1

MULTINATIONAL CORPORATE STRATEGY-MAKING: INTEGRATING INTERNATIONAL BUSINESS AND STRATEGIC MANAGEMENT

ABSTRACT

This chapter contends that the international business (IB) and strategic management (SM) fields have many commonalities that should be considered in a turbulent globalized business context. IB studies refer to the need for local integration and local adaptation whereas empirics in SM pinpoint the complementary effects of central planning and decentralized decision-making. We present and synthesize these rather field specific perspectives and try to synthesize insights from both fields in an adaptive strategy-making model including the effects of autonomous subsidiary initiatives and intended mandates from corporate headquarters. The model considers local subsidiary actions of both operational and strategic nature and we argue that it may be futile to distinguish between these effects as incremental operational responses can cumulate into more substantial changes over time with dimensions of strategic adaptation. The model provides a foundation for further considerations about how to combine central intent and direction with decentralization and autonomous initiatives in the multinational corporation.

Keywords: Central coordination; decentralized decision-making; global integration; interactive strategy-making; local adaptation; subsidiary autonomy

The international business (IB) and strategic management (SM) fields have evolved over the past decades along their own separate paths engaging constituent scholars along particular research streams and traditions forming their own scholarly communities with distinct traits. However, these communities do to some extent share common memberships and we represent a contemporary example of that. This has also been the case in the past, which we claim is one reason why the fields of international business and strategic management share some common elements that nonetheless have been treated separately along different research trajectories over the years. In this chapter, we would like to pinpoint some of the commonalities between these rather intertwined academic fields. For this purpose, we draw on both literatures to form a generic multinational strategy-making model considering the central coordinating influences from the headquarters and the decentralized functions of subsidiaries operating in local overseas markets. We contend that the effectiveness of the multinational corporation (MNC) thrives both on formal direction provided by a mandate from headquarters and local autonomy in the subsidiaries, where informal information exchanged across hierarchies, functions, and geographies can enhance the value-creating potential of subsidiaries to the benefit of overall MNC performance.

The turbulence of global markets represents the ultimate managerial and strategic challenge expressed by highly uncertain and unpredictable conditions. The multinational adaptive system needed to deal with this arguably derives from the dynamic interplay between central coordination and ongoing directions from headquarters and current information updating from the decentralized business entities that experience the emergent changes directly from local activities. Hence, the MNC must remain true to its overarching purposes and aims while adapting the dispersed corporate activities to local market changes orchestrating and reconfiguring resources to retain a good fit with the changing environmental requirements.

These basic views reflect insights from research that point to the importance of combined central planning and decentralized strategy-making modes (e.g., Andersen, 2004, 2013; Andersen & Foss, 2005; Andersen & Joshi, 2008) while heeding the value-creating potential of autonomous subsidiaries (e.g., Ambos, Anderson, & Birkinshaw, 2010; Andersson, Björkman, & Forsgren, 2005; Andersson, Forsgren, & Holm, 2002, 2007). The implied dynamic resonates with discussions about strategic response capabilities to restore fit in turbulent business environments (e.g., Teece, 2007, 2014; Teece, Pisano, & Shuen, 1997). It further captures the conundrum between the need to integrate corporate activities while retaining the ability to respond to local market needs (e.g., Bartlett & Ghoshal, 1989; Doz, Bartlett, & Prahalad, 1981). Hence, the proposed multinational strategy model in effect synthesizes complementary logics promoted jointly by the SM and IB fields.

In the following we first present predominant perspectives in the two fields of IB and SM, and discuss the related multinational corporate strategy issues before developing a proposed model for responsive multinational strategy-making.

INTERNATIONAL BUSINESS

The traditional theories in IB have considered the firm-specific advantages driving foreign direct investment (FDI) as a vehicle for multinational business expansion (Dunning, 1979; Vernon, 1971). The investment perspective is based on home-country features around the corporate headquarters of the MNC where the local subsidiaries constitute the transmission mechanisms of inherent corporate capabilities, which achieve superior performance in overseas markets. This analysis considers the potential advantages of existing home-based capabilities and their superior use in overseas markets with little need to modify applications to local market conditions.

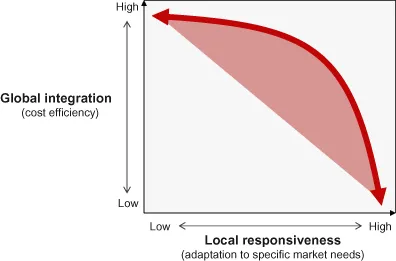

The IB literature has considered how firm-specific advantages may drive a multinational organization to engage in FDI expanding the international business activities of the corporation (e.g., Dunning, 1979; Vernon, 1971). From a headquarter perspective the local subsidiaries are seen as vehicles transmitting unique corporate capabilities with a capacity to achieve superior performance into overseas markets without modifications to cater to the local markets. In later extensions the tension between concerns for global efficiency pressures and local adaptation to national market conditions were seen as a central strategic theme for the multinational organization (Prahalad & Doz, 1987). This introduced a preoccupation with the specific structure applied to manage the multinational business activities as exemplified by typologies represented by global, international, multi-domestic (multinational) or transnational strategies (Bartlett & Ghoshal, 1989). This thinking promoted the existence of a proper balance between the dual pressures for global integration to gain cost efficiency and local responsiveness to adapt to specific market needs with an overarching aim of achieving both efficiency and effectiveness at the same time (Figure 1.1).

Figure 1.1. Trade-off between integration and responsiveness in multinational strategy-making.

IB research adopted the integration-responsiveness (I-R) framework to better understand how to organize an extended international presence and the two dimensions identified the generic typological choices determined by the relative emphasis on the two strategic orientations (Harzing, 2000; Prahalad & Doz, 1987). Research on the I-R framework has tried to determine how different external market conditions induced firms to engage in cross-border business activities managing their international expansion. The resource-based view (RBV) has also been used to explain the sourcing dimensions of multinational enterprise (e.g., Tallman & Li, 1996) where successful internationalization is assumed to build on unique multinational resource bundles, which can sustain competitive advantage. These unique multinational capabilities should consider the ability to deal with the conjoint pressures for economic efficiency and responsiveness (Venaik, Midgley, & Devinney, 2004). Hence, both market-positioning and resource-based perspectives can provide a better understanding of the dynamic across the alternative IB strategies.

The joint consideration between differentiation and integration was initially considered in studies that analyzed more complex organizational structures (Lawrence & Lorsch, 1967) that later was adapted in the studies of multinational management (Bartlett & Ghoshal, 1989; Prahalad & Doz, 1987). Organizational differentiation was confined as the segmentation of specialized operating subsystems geared to deal with specific environmental requirements and integration was defined as the coordination of the subsystems to accomplish a unified organizational purpose. This distinction between differentiation and integration was used to demonstrate how complex multinational corporations must respond to local market requirement by differentiating activities whereas these disperse activities should be integrated to obtain cost efficiency (Prahalad & Doz, 1987). Diverse national market contexts would require that local activities be modified in response to regional needs whereas global cost pressures would drive a need for economic efficiency through operational integration and coordination to obtain scale and scope economies.

An orientation toward global integration implies that operational management is centralized and resource-committing decisions coordinated in a corporate planning function consistent with the overarching strategic directions (Prahalad & Doz, 1987). It is a centralized structure where the complex global interdependencies are coordinated at the corporate level. Corporate decisions are carried out in accordance with the central plans and scaled across the multinational markets where the local business units operate according to the strategies mandated by the headquarters (Bartlett & Ghoshal, 1989; Harzing, 2000). An orientation toward local responsiveness implies that the local business units can accommodate activities to the national market conditions and take actions toward these ends within a decentralized decision structure (Prahalad & Doz, 1987). So decision power is delegated to local managers with regional market responsibilities that have freedom to generate resources in the local market. This forms a loosely coupled global structure with decision power dispersed to the local business units (Bartlett & Ghoshal, 1989, 1999; Harzing, 2000).

The IB literature has examined the extent to which the strategy typologies proposed by the I-R framework can be validated (e.g., Harzing, 2000; Roth & Morrison, 1990). Here the verdict is rather uncertain with some studies reporting broad support for the typologies (Roth & Morrison, 1990) while others are unable to verify the proposed strategy clusters in the relevant industry contexts (Leong & Tan, 1993). Subsequent studies have found partial conformity around the typologies (e.g., Harzing, 2000) although not universally supported. It is merely implied that if the strategy typologies are applied within their proper market contexts, they will be associated with superior corporate performance. However, this implication of the I-R framework has barely been studied leaving us to await a final resolution.

As a consequence, the strategy typologies formed within the context of dual pressures for cost efficiency and local responsiveness have mostly served to pinpoint specific strategy exemplars around the multinational corporation to illustrate the structural and operational choices for strategy-making process. Hence, no single firm may fit squarely into any of these fairly idealized strategy typologies that mainly serve a pedagogical or analytical purpose clarifying an underlying logic that can be helpful when studying concrete business cases. Whereas, parts of the IB literature for some time attempted to study the effectiveness of the pure typologies, the results of these efforts are rather unequivocal. In reality the global competitive landscape is constantly changing across turbulent multinational markets that may gradually transform the prevailing conditions that formed conventional wisdom calling for a more dynamic approach to conduct longitudinal quantitative studies of optimal strategy-making modes.

The structural complexity observed across contemporary MNCs can mean that different parts of the same enterprise may pursue different strategic orientations at the same time giving rise to a more multifocal perspective to the strategy typologies. So the two dimensions of global cost efficiency and adaptation to local markets are not simple high-low bifocal constructs but represent continuous variables that may apply in different combinations across different business, functional, and multinational market contexts. In highly complex and dynamic market environments, global integration, and local responsiveness can be balanced if local managers are authorized to use own contacts and alliances to handle new challenges rather than being tied to follow predetermined actions mandated by the corporate headquarters (Doz et al., 1981). This provides new opportunities for global competitive advantage through an efficient coordinated multinational structure where offerings in the local markets can be adapted to the specific market needs supported by advanced communication and information systems linking individuals across self-established collaborative networks.

STRATEGIC MANAGEMENT

The conventional view of strategy is that organizations and their leaders think first and then act accordingly by setting up the proper organization to effectuate the planned initiatives, i.e., strategy comes before structure (e.g., Chandler, 1990). This is often recognized with the distinction between strategy formulation, where leaders at headquarters typically lay out the strategic plan to be pursued going forward, and strategy implementation, reflecting the subsequent process of executing the strategic plans throughout the organization. A common strategic management methodology is constituted as a rational analytical approach (Anthony, 1965; Schendel & Hofer, 1979) where the environmental and competitive conditions are studied as the basis for choosing a given strategic direction with long-term corporate goals and policies to guide the intended actions. This can engage many individuals throughout the organization in discussions including corporate executives, business unit managers, and knowledgeable people with functional responsibilities to generate diverse views and gain better insights. This process may enhance the comprehension of the turbulent business environment and may at best develop a shared understanding about strategic aims and needed corporate actions to reach them (Andrews, 1980; Ansoff, 1988). However, it is generally accepted that a realistic depiction of the complex strategy execution process (implementation) must embrace both the planned (intended or formulated) as well as various (emerging) activities initiated as and when the environment uncovers unexpected threats and opportunities that challenge the initial planning assumptions (Mintzberg, 1978; Mintzberg & Waters, 1985).

A number of studies have demonstrated how significant these eme...

Table of contents

- Cover

- Title Page

- Introduction: Adaptive Corporate Strategies in a Turbulent World

- Chapter 1 Multinational Corporate Strategy-Making: Integrating International Business and Strategic Management

- Chapter 2 The Implications of Subsidiary Autonomy for Multinational Flexibility☆

- Chapter 3 Democratizing the Multinational Corporation (MNC): Interaction between Intent at Headquarters and Autonomous Subsidiary Initiatives

- Chapter 4 Internationalization Effects in a Global Knowledge-Based Industry: A Study of Multinational Pharmaceutical Companies

- Chapter 5 Navigating a Global Corporate Culture: On the Notion of Organizational Culture in a Multinational Corporation

- Chapter 6 Building a Global Responsive Organization: The Case of the Haier Group

- Chapter 7 Effective Crisis and Emergency Responses in the Multinational Corporation☆

- Chapter 8 Global Catastrophe Effects – The Impact of Terrorism☆

- Index