eBook - ePub

Making Mergers and Acquisitions Work

From Strategy and Target Selection to Post Merger Integration

- 228 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Making Mergers and Acquisitions Work

From Strategy and Target Selection to Post Merger Integration

About this book

For many industries, mergers and acquisitions have become the main pathway for reaching strategic objectives like growth, technological leadership, or efficiency in production and distribution. However, the success rate of most M&A deals is low - and flawed. Unrealistic synergies, wrong target selection, culture clashes and, most of all, weak post-merger integration processes pose huge challenges, and this book addresses the salient question of how to make M&A deals work.

The authors offer readers unique access to each stage of the M&A process, with added depth and perspective provided by Prysmian - the global leader in energy and telecom cables. Prysmian's perspective enables the authors to deliver a manual for successful M&A in mature industries that require high levels of integration between operating companies.

This collection of existing M&A experiences that identify clear action steps will be an essential tool for managers to develop their growth strategies and accelerate their post-merger integration processes. This guide will also prove useful for practitioners and academics as they seek to improve the ability of firms to conduct M&A, through dissemination in academic and executive classrooms.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

1

INTRODUCTION

M&A is a risky growth option, but for many business situations it remains the most promising alternative to reach strategic objectives. As a proof of this concept, we can observe how the level of M&A transactions across borders has not only increased, but reached a record high in 2015. Does it create value? Not always. Existing studies claim that only 10–50% of M&A deals create value. So, if we know that most M&A deals eventually fail, why are so many executives eager to find the next opportunity to acquire a firm? The answer is: overconfidence.

A recent case in point, and the reason why this book is so relevant to any business seeking growth, is Kraft Heinz’s failed attempt to acquire Unilever. Kraft Heinz’s spectacular missteps despite its own long history of growth by acquisitions suggest that even the giants with track records have much to learn about M&A, yet lack the Emotional Intelligence/Emotional Quotient (EQ) to recognize how far they are falling short as potential buyers.

To put it bluntly, Kraft Heinz was arrogant in its approach. Its $143 billion offer would have been the largest in the history of the food and beverage industry and put the world’s best-known consumer brands under one roof. But its early announcement of its intention suggests it failed to understand its target and “read the room.” Although Kraft Heinz stated its actions were “friendly,” its premature and public eagerness to forge ahead suggested to the market and, it seems, to Unilever, that it was launching a hostile takeover. Whether or not that was truly the case, it demonstrates that the prospective acquirer was tone deaf.

The proposed merger was a mismatch on many levels. Kraft Heinz, a much smaller entity in terms of market capitalization, is a debt-laden investment vehicle of a private equity (PE) fund. It was attempting to buy a cash-rich company with solid results and a relatively slow-moving share price to boost its own growth, which likely could no longer be sustained by its own aggressive cost-cutting approach. But Unilever, a complex organization with a dramatically different culture and two strong national interests — Great Britain and the Netherlands — rebuffed the deal, likely fearing heavy rounds of layoffs and asset stripping under Kraft Heinz’s ownership.

We’ll dive into the reasons for the bid’s failure later in the book, but the point is that even seasoned corporate leaders — like Kraft Heinz board member Warren E. Buffet — don’t always get it. Kraft Heinz was genuinely surprised by the resistance of Unilever’s managers. It failed to take into account the fact that their differences in culture and business model are too high. Unilever’s Chief Executive Officer (CEO) strongly opposed the deal despite the possibility of an extra 12 million pounds’ worth of shares in his pocket. It was about so much more than price.

Kraft is hardly alone in its cockiness. Most managers think that they are better at finding and executing deals than their peers. Overconfidence is one of the most important cognitive problems as it induces us to come to incorrect conclusions without ever once questioning ourselves. According to the Cognitive neuroscientist Tali Sharot, 80% of human beings suffer from an overconfidence bias.1 She points out that 2 out of 5 marriages eventually fail, but 0% of couples think their marriage could fail when they decide to get married, or in the words of Samuel Johnson, “Remarriage is the triumph of hope over experience.”

In many ways, the typical M&A deal is just like marriage. From experience, we know that too many M&A operations fail, but we seem to live in hope that the next one will provide value, despite the logic. So how can we inject a little bit of “self-doubt”? Isn’t it risky to develop an M&A playbook that suggests we have everything under control? Is executing an M&A deal successfully something that can be learned? Yes. If not, we would not bother you with this book.

Of course, there is a consolidated stream of literature which suggests that increasing M&A experience has negative effects on M&A success. The reason is that firms tend to apply universal rules to very different deals, and this cookie cutter approach can be a recipe for failure. But if firms begin with the critical recognition that every deal is different, creating an M&A playbook and codifying past experiences will be beneficial for M&A success. Just be sure to resist the temptation of applying generic M&A rules blindly. Before you engage in M&A, make sure you have all stakeholders mapped out and establish a clear view on the various steps throughout the M&A process.

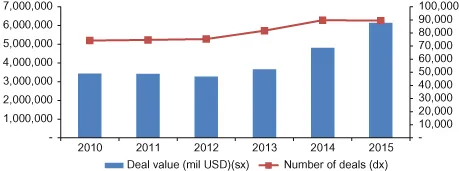

Never has the time for an M&A playbook been more necessary. Acquisitions remain a popular growth mode for many firms, as evidenced by the fact that 2015 has been one of the biggest M&A years ever, with a global value of about 4.7 trillion dollars of signed deals (Farrell, 2015). These 131 megadeals pushed 2015 ahead of 2007’s total (Baker & McKenzie, 2015), when the previous record of $4.296 trillion of mergers was struck. Cross-border deal values in the fourth quarter of 2015 rose to the highest level ever recorded in a single quarter, fueled by megadeals such as the Anheuser-Busch InBev US$120.3 billion merger with SABMiller. Many of these deals included cross-border acquisitions, which amounted to 5441 deals, for a total value of US$1658.4 billion (Figure 1).

Figure 1:. Global Deals by Volume and Value.

Source: Elaboration on Bureau Van Dijk data.

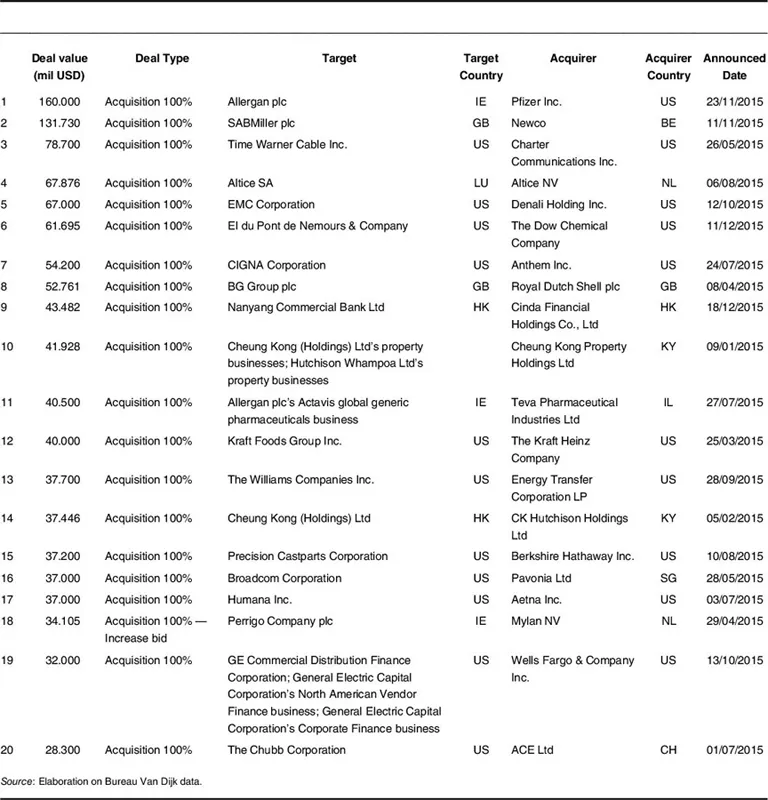

Source: Elaboration on Bureau Van Dijk data.

Unfortunately, many of those acquisitions are doomed to fail, and those losses will tally up to billions more dollars. It did not have to be the case. Disaster could have been averted if certain steps had been taken even before their merger talks began and if these business leaders had access to, and followed the steps of this playbook.

The purpose of this book is therefore to reduce the number of acquisitions that are made for flawed strategic motives, with the wrong partner, using questionable valuations methods, and weak integration mechanisms.

There are many prominent examples of failure. The M&A “hall of shame” is composed of, among others, Daimler and Chrysler, Sears and K-mart, AOL and Time Warner, Quaker and Snapple, eBay and Skype, Sprint and Nextel, BMW and Rover, as well as Royal Bank of Scotland and ABN Amro. The motives of failure are many: cultural clashes, incompatible market positions, wrong assessment of the value of the synergies, sloppy due diligence, or hostile reaction of existing customers (Table 1).

Table 1:. Top 20 Announced Global Deals by Value.

But still, M&A can not only be a valuable option to grow, it is often the only alternative to obtain a strategic goal. Apple, for example, acquired around 50 firms from 2010 to 2016, most of them are software firms located in the United States. One could also argue that Prysmian’s very DNA is based on other companies it had acquired in the past, dating back to its earliest years as Pirelli’s cable division, but in more recent history, through Siemens, Nokia, NKF, and British Insulated Callender’s Cables (BICC). There have been numerous other acquisitions of smaller firms, which were quickly absorbed into the Prysmian bloodstream, and a few strategic alliances, or joint ventures in emerging markets, with mixed results. But where the company excels is in taking control, leveraging the strengths of a business in areas where it was weakest, and discarding the rest.

So what is Prysmian? It is the world’s largest cable company, with deep roots in industrial Italy, where it was part of the famed Pirelli group of companies before it spun off to become its own global entity more than a decade ago.

Because it is a business to business company, Prysmian’s existence is relatively unknown outside of the cable industry for which it sets the bar. Few realize that the world simply could not run without the products that Prysmian develops, manufactures and installs throughout the globe — cables that are as necessary to connecting and powering our modern-day existence as the human body’s nerves are to sustaining life. In effect, Prysmian specializes in building the central nervous systems of the world.

How? Prysmian is everywhere. Its energy cables are designed, produced, and sold for industrial applications such as the nuclear, oil, renewable energies, defense, mining, transportation (marine, railway, aviation, and automotive), aerospace and electro-medical industries. Prysmian also provides power transmission cable systems, such as high voltage underground and submarine cables and cable solutions for power distribution grids to transmission systems operators (TSOs) and utilities. Prysmian also produces cables for construction with special fire behavior characteristics that are essential in major commercial and residential properties, and services the telecommunications industry with multimedia cable solutions, optical cables, optical fiber, and copper cables. Prysmian’s products make the world run. There simply is no major industry, city, power, or telecom infrastructure that has not somehow been touched by the connective threads of Prysmian’s cables.

In many respects, M&A has been the secret to Prysmian’s success in an industry with limited organic growth opportunities, where margins are tough to maintain in a market characterized by price erosion. Its motivation in pursuing an external growth strategy through M&A was twofold: first, to seek efficiency gains in every corner of the company; second, to use the cash generated by these savings to acquire and restructure underperforming rivals to generate yet more cash to acquire the next firm, and the next …

“Our main strategy is to grow through acquisitions,” notes Laurent Tardif, CEO Prysmian South Europe. “This is what we have always done and what we are good at: buying, digesting, generating cash by reducing fixed costs, reducing debt … and then starting the cycle again.”

But Prysmian may be the exception that proves the rule. The high risks associated with acquisitions have induced some firms to strongly prefer organic growth alternatives. Ferrero, for example, doubled its revenues from roughly 5 billion Euros to 10 billion Euros without any major acquisition. Only very recently, Ferrero has decided to complement organic growth strategies with acquisitions. The main driver of growth of firms like Ferrero is product innovation and the ability to develop new customer segments.

M&A transactions could result in both kinds of growth drivers. But M&As tend to be riskier, since they often create more value for target firm shareholders than for the acquiring firm. The performance of acquisitions in terms of share value tends to show a positive effect for the target in the short run, but a negative effect for the acquirer (Andrade, Mitchell, & Stafford, 2001). Why is that? The reasons are several, and, more often than not, related to the emotions of those involved in the M&A process — a factor that does not appear to be present in the more gradual and calibrated process of organic growth. While in some cases you can choose between M&A and organic growth, in others M&A remains the only way.

Many companies like Prysmian which operate in mature markets can’t necessarily rely on Ferrero’s strategy of organic growth. They lack the same opportunities of innovation or of an expanded customer base. Those businesses must ask themselves about the potential pitfalls of expansion through acquisition. So how does M&A potentially destroy value?

According to the academic literature, one of the biggest traps is managerial self-interest. Managers are empire building, creating conflict between property and control, driven by managerial hubris rather than by economic rationality. Managers and executives are often tempted to increase the size and scope of their power and influence and to increase the size of the company they manage through M&As is a way to do this. To increase the size of business units, their staffing levels and the dollar value of their assets are way for executives to acquire greater resource control and more personal power within the company. However, this does not mean to create value and wealth for shareholders, since resources are not always efficiently allocated.

Still, the game is worth the gamble. Indeed, thanks to diffused payment schemes, when the acquisition increases shareholder wealth, there is a significant increase in the compensation and wealth of the top executives — especially for the Chief Executive Officer (Lambert & Larcker, 1985). While the risk of a given transaction is particularly high for shareholders, the risk for managers is conversely very low, as good acquisitions increase compensation while bad acquisitions have no or little negative effect on theirs’ wealth (Khorana & Zenner, 1998). With some exception. In Prysmian, more than 50% of employees are also shareholders. CEOs are discouraged to engage in wealth-reducing mergers only when they own a significant amount of shares (Bliss & Rosen, 2001).

Another reason why M&As destroy value is the departure rate of highly qualified executives. Voluntary turnover of target firms’ executives reveals an adverse selection phenomenon, namely that, often, the managers who leave are those who are the most prepared or qualified to see through the transition (Walsh & Ellwood, 1991). It is therefore essential to assess the management and clarify as soon as possible who will be on board and who has to leave the combined entity. At Prysmian, all managers (direct reports to the CEO and two levels beyond that) had been assessed with the support of a specialized firm. Within six months after the merger with Draka, the new organizational model was released and any uncertainty about who would lead what unit was eliminated. Ideally, the top positions should be discussed and assigned before the deal is signed.

Yet another reason for value destruction is culture. The role of culture and cultural differences in M&A can be controversial as it revolves around the need to find a meeting point between potentially very different personal and managerial styles. On the one hand, a common cognitive basis or shared background could enable better coordination (Puranam, Singh, & Chaudhuri, 2009). To have the same points of view and to share the way of doing things can create value in continuity with respect to how businesses were run before the transaction, without any major change. On the other hand, the combination of different cultures exposes firms to different routines that could enhance innovation and improve performance (Morosini, Shane, & Singh, 1998). Interestingly, it does not happen very often that a due diligence is interrupted because of cultural incompatibility. However, the circumstance has to be tied to the fact that often those who manage the process poorly omit to touch upon the topic, considering it less important than the financials or tax and legal aspects.

Prysmian, for its part, has not always executed its post-merger perfectly. The 1998 acquisition of part of Siemens cable division by Prysmian pre-cursor Pirelli resulted in a series of culture clashes between two companies with strong individual identities. Siemens, like Pirelli, started its cable business at around the same time, toward the end of the nineteenth century, and was just as global, with a presence from the United Kingdom to India.

“They started differently, in the same age, and for 100 years they were competing, then the two companies came together,” observes Hakan...

Table of contents

- Cover

- Title Page

- 1. Introduction

- 2. Strategy

- 3. Target Selection

- 4. Due Diligence

- 5. Negotiation and Deal Closing

- 6. Post-Merger Integration

- Bibliography

- Index

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Making Mergers and Acquisitions Work by Markus Venzin,Matteo Vizzaccaro,Fabrizio Rutschmann in PDF and/or ePUB format, as well as other popular books in Business & Business Strategy. We have over one million books available in our catalogue for you to explore.