eBook - ePub

Factors Affecting Firm-Level Investment and Performance in Border Economic Zones and Implications for Developing Cross-Border Economic Zones between the People's Republic of China and its Neighboring GMS Countries

- 76 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Factors Affecting Firm-Level Investment and Performance in Border Economic Zones and Implications for Developing Cross-Border Economic Zones between the People's Republic of China and its Neighboring GMS Countries

About this book

This series features the scholarly works supported by the Phnom Penh Plan for Development Management, a region-wide capacity building program of the Asian Development Bank that supports knowledge products and services. It seeks to disseminate research results to a wider audience so that policy makers, implementers, and other stakeholders in the Greater Mekong Subregion can better appreciate and understand the breadth and depth of the region's development challenges.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Factors Affecting Firm-Level Investment and Performance in Border Economic Zones and Implications for Developing Cross-Border Economic Zones between the People's Republic of China and its Neighboring GMS Countries by Xianming Yang, Zanxin Wang, Ying Chen, Fan Yuan in PDF and/or ePUB format, as well as other popular books in Economics & Development Economics. We have over one million books available in our catalogue for you to explore.

Information

1. Introduction

1.1 Background

Despite its vast land area, western People’s Republic of China (PRC) is economically underdeveloped, far behind eastern PRC in terms of gross domestic product (GDP) and income per capita. To narrow the gap between eastern and western PRC, the Government of the PRC enacted policy measures for the development of Western PRC in 2000. The policy measures signaled the start of the Western Development Program.

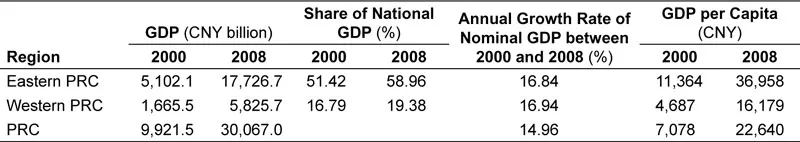

Although much improvements have been made since the implementation of the program, the economic gap between eastern and western PRC is still large (Table 1). This situation is inconsistent with the central government’s objective of developing the PRC into a society in which the income gap is small and all citizens are prosperous and developing together.

Table 1 Comparison of the Economic Development between Eastern and Western People’s Republic of China

GDP = gross domestic product, PRC = People’s Republic of China.

Note: Eastern PRC covers the municipalities directly under the central government including Beijing, Tianjin, and Shanghai; and the provices of Hebei, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, and Hainan; while western PRC includes the Autonomous Regions of Guangxi, Xinjiang, Tibet, and Inner Mongolia; and the provices of Yunnan, Guizhou, Sichuan, Qinghai, Gansu, Shănxi, and Shānxi, and Chongqing municipality directly under the central government.

Sources: National Bureau of Statistics (NBSC), 2001 and 2009. China Statistical Yearbook. China Statistics Press. Beijing, PRC.

In January 2010, the 10-year-anniversary of western PRC’s development program was observed. The Government of the PRC is now formulating new policies to promote the further development of western PRC. One of the priorities to facilitate its development is by opening up the border areas, increasing border trade, and encouraging economic and technical cooperation with circumjacent countries.

The opening up of the PRC’s border area has a sound foundation in international cooperation with neighboring countries, in particular with members of the Association of Southeast Asian Nations (ASEAN). Two important initiatives are the Greater Mekong Subregion (GMS) Economic Cooperation Program and the “10+3” (10 ASEAN member states and the PRC, Japan, and the Republic of Korea) cooperation mechanism.

The GMS Economic Cooperation Program was launched in 1992 by six countries that share the Mekong River—Cambodia, the PRC, the Lao People’s Democratic Republic (Lao PDR), Myanmar, Thailand, and Viet Nam—with the support of the Asian Development Bank (ADB). The GMS Program set out to promote economic and social development by strengthening economic ties among its members. The program seeks to facilitate (i) subregional trade and investment, (ii) subregional development opportunities, (iii) the resolution of transborder issues, and (iv) the fulfillment of common resources or other needs (ADB, 1999).

The ASEAN “10+3” mechanism was created to facilitate financial cooperation among member countries after the Asian financial crisis in 1997. To deal with the financial crisis, the finance ministers of the 13 countries reached the Chiang Mai Agreement in 2000. Although the mechanism initially targeted cooperation in finance, it has been expanded to cover political, economic, and technical cooperation.

The ASEAN–China Free Trade Area came into force on 1 January 2010. It is a landmark cooperation agreement between the PRC and ASEAN.

Bordering three ASEAN and GMS countries—the Lao PDR, Myanmar, and Viet Nam—Yunnan Province of the PRC has a geographic advantage for cooperation with neighboring countries on economic development, trade, and investment, especially against the background of the PRC’s policy for the development of western PRC, and the 10+3 and GMS cooperation mechanisms. However, like many other economies in the GMS, the economy of Yunnan Province is underdeveloped, and is characterized by low GDP and income per capita and a high rate of poverty.

To facilitate the development of the provincial economy in response to the central government’s policy, the Yunnan provincial government has planned to set up three cross-border economic zones (CBEZs) in cooperation with neighboring countries, based on its existing border economic zones (BEZs). The plan will be implemented in two steps: First, Hekou–Lao Cai CBEZ will be constructed on the PRC–Viet Nam border, Ruili–Muse CBEZ on the PRC–Myanmar border, and Mohan–Moding CBEZ on the PRC–Lao PDR border. Second, the three CBEZs will be expanded through cooperation of special economic zones (SEZs) in Yunnan Province with those in the border provinces of the Lao PDR, Myanmar, and Viet Nam. At the 15th GMS Ministerial Meeting held in Cha-Am, Thailand, on 19 June 2009, one of the key recommendations of the GMS North–South Economic Corridor Strategy and Action Plan was to create CBEZs along the economic corridors. The planned CBEZs will allow freer flows of capital, people, and cargo; and will play an important role in facilitating trade between pairs of countries traversed by the corridor, boosting economic ties and enhancing PRC–ASEAN cooperation. The application to set up the three CBEZs has been submitted to the State Council of the PRC for approval; and, on 8 June 2010, the Yunnan provincial government entered into an agreement—the Framework Agreement on the Further Construction of China Hekou–Viet Nam Lao Cai Cross-Border Economic Zone—with the provincial government of Lao Cai, Viet Nam.

It is the common aspiration of the governments of the PRC and its neighboring countries in Southeast Asia to introduce domestic capital and foreign direct investment (FDI) into the CBEZs to exploit the rich local resources, promote the development of trade and manufacturing, expand trade and job opportunities, and increase the revenues of the local government and the people. Thus, various forms of economic development and economic and trade cooperation zones have been established in border areas by the governments of the PRC and neighboring countries. With improvements in infrastructure, effective policies for introducing investments are also needed to attract FDI and domestic industrial capital to the border economic development zones.

Since the 1990s, the PRC has adjusted its investment incentive policies to attract FDI. Different investment incentive policies have come into force to speed up industrial development. In the process, the establishment of economic development zones in the border areas has played an important role in facilitating trade and the development of manufacturing. However, it is still far from achieving the goal of transforming the southwestern border areas of the PRC into a subregional industrial base centered on processing trade. The expected goal of developing industries based on local resources has not been met yet, and so far only few relatively small-scale industrial projects have been introduced into the economic development zone along the border of Yunnan Province.

It is necessary to assess the effects of current investment incentive policies in border areas. Although there are diverse and multilevel investment incentive policies, they play a limited role in attracting investments to the region. It is also generally the case that neither administrative authorities nor policy researchers assess the effects and, especially, the suitability of investment incentive policies. Thus, it is difficult to know how to improve these policies. The 2008 financial crisis has attached greater importance to subregional international economic cooperation; and the PRC government’s great efforts in building CBEZs, under the policy of opening up to border countries, further highlighting the strategic significance of studying and redesigning existing policies to stimulate investments.

A CBEZ is a transnational economic zone in a border area, supported with special policies on finance, taxation, investment, trade, customs regulation, and industrial development; and where the flows of persons, goods, funds, and technology are concentrated and interactive. The establishment of CBEZs has emerged as a growth strategy of transitional regions. Their objective is to exploit the locational advantages of border areas and boost economic and trade cooperation and development in the area. These economic zones derive their competitiveness from complementary factor endowments, cross-border infrastructure services, and reduced border barriers. They are an upgraded version of the BEZ, which is an economic zone confined to the border area of a country.

It is recognized that the development of industries is critical for CBEZs to operate successfully. Thus, a major objective of CBEZ is to attract investments both from home and abroad (Li 2009). The potential of a region for attracting investment is determined by its locational advantage. By surveying firms in BEZs, the main factors attracting investment to the BEZs, and the effects of current investment incentive policies on investment decisions can inform the design of effective investment incentives for CBEZs. In the PRC–Viet Nam border area, the BEZs are relatively mature. In the PRC–Lao PDR and PRC–Myanmar border areas, some BEZs on the PRC side are well established; while BEZs on the Lao PDR and Myanmar side of the border are still under construction. Thus, the study focused on BEZs in Yunnan Province, PRC, and in Lao Cai Province, Viet Nam. The BEZs in these regions have a relatively long history and reveal the problems associated with current investment incentive policies, thus providing valuable insights for the development of CBEZs.

1.2 Objectives of the Study

The analysis will be based on the investment climate of BEZs, as none of the CBEZs is yet operational. Thus, policy implications for CBEZs will be drawn from the study of BEZs. The primary objectives of the study are to assess the investment climate, especially the incentive policies, and geographic location for investments in CBEZs in the PRC–GMS border areas; and to analyze their impact on regional production networks and economic diversification.

More specifically, the study will

i. assess the impacts of the investment climate in terms of infrastructure, factor endowments, governance, and incentive policies on firms’ decisions to invest in BEZs;

ii. draw policy implications for CBEZs; and

iii. analyze the possible impacts of cross-border investment on the local and regional economy.

1.3 Scope and Significance of the Study

The study covers the PRC, the Lao PDR, Myanmar, and Viet Nam. The major survey areas include Yunnan Province, the major cities on both sides of the borders of the PRC and its neighboring GMS countries, and some major industrial areas in Yunnan Province and neighboring GMS countries.

The effectiveness of incentive policies can be assessed at various levels, including its effects on (i) a firm’s decision to invest; (ii) the volume and quality of investments; and (iii) the macro economy, i.e., whether incentives created distortions in factor prices and markets. The study will focus on the effects of the incentive policies on the firm.

The study has the following significance:

First, the study of the effects of incentive policies on firms’ decisions to invest in SEZs will provide a basis for establishing the economic rationale for FDI incentives and SEZs, especially those at the border areas in the GMS. Establishing the economic rationale for SEZs is particularly important because in the PRC, SEZs were established to perform a special role in FDI promotion when the country opened up its economy. The SEZs function not only as vehicles for expanding exports, but also as laboratories where economic policy experiments are carried out in a geographically restricted area. The SEZs also function as government units, unlike other processing zones in Asia that are run by management boards. Given this particular context in the PRC, the research should be able to yield significant inputs for policy making.

Second, the project is of great strategic value to policy making. The study will identify obstacles to the implementation of incentive policies, and gather firms’ perceptions of existing policies and expectations for new policies. The results will provide a justification for policy improvement or new policy design, as well as for measures to be taken to overcome difficulties that are barriers to the implementation of existing policies.

Third, the study will identify elements of different countries’ policies that are in conflict with each other, if any, and compare the effects of incentive polices in different countries. The results will provide inputs for the promotion of economic cooperation between the PRC and its neighboring GMS countries, in particular, for the development of CBEZs.

2. Literature Review

2.1 Factors Affecting Investment

FDI is not only one means of affecting service trade, but it is also important in the production of goods. Under appropriate conditions, FDI can generate employment directly and indirectly, promote competition, improve the efficiency of host country workers, and transfer technology from one country to another (Goldin and Reinert 2007). FDI is usually associated with new job opportunities and enhancement of technology transfer, and it boosts overall economic growth in host countries (Chowdhury and Mavrotas 2006).

The theoretical foundation of FDI is rather fragmented, comprising bits and pieces from different fields of economics to elucidate the location pattern of firms (Sun 2002). Several theories have been put forward to explain FDI. Hymer (1960) views multinational corporations (MNCs) as oligopolist. FDI is considered to be the outcome of broad corporate strategies and investment decisions of profit-maximizing firms facing worldwide competition. Dunning (1977) and Rugman (1981) invoke transaction costs to explain firms’ internationalization, putting emphasis on the intangible assets that firms have acquired. Bhagwati and Srinavasan (1983) and Grossman and Helpman (1991) use the international trade theory to explain the allocative aspects of FDI. Dunning (1996) identifies four types of MNC activity: resource-seeking, market-seeking, efficiency-seeking, and strategic asset or capability-seeking.

In the early 1980s, no large FDI inflows to the PRC occurred because of poor infrastructure (OECD 2000); while during 1983–1991, a steady growth and relatively large inflows could be seen as the SEZs expanded from 4 to 14 cities, and FDI incentives were introduced in 1986 (Ali and Guo 2005). FDI began to pour in the PRC after 1992, and annual flows have been over $50 billion since 2002 (Yin 2008). A study by the World Bank (Broadman and Sun 1997) indicates market size and preferential policy as the two most important determinants of the location of FDI in the PRC (Hu and Wang 1999). Some other studies give more specific determinants, such as preferential tax status to foreign investors, lower tariffs, better infrastructure, more flexible labor markets, and less bureaucratic control (Panagariya 1993).

Sun (2002) identifies eight potentially important determinants of FDI distribution across provinces in the PRC. These are (i) market demand and market size; (ii) agglomeration, which refers to the concentration and co-location of economic activities that give rise to economies of scale and positive externalities; (iii) labor quality; (iv) labor cost; (v) level of scientific research; (vi) degree of openness; (vii) political risk; and (viii) FDI substitutes. Swain and Wang (1995), Liu et al (1997), Zhang (2000), Wei and Liu (2001), Zhang (2002), and others argue that the determinants of FDI inflows into the PRC, as identified by FDI theories, can be classified into three categories: micro, macro, and strategic determinants. Micro factors concern firm-ownership specific advantages, such as product differentiation and the size of the firm. Macro determinants of FDI emphasize the market size and the growth of the host country, which is measured by gross domestic product (GDP) and GDP per capita, since rapid economic growth may create large domestic markets and business opportunities. Other macro factors include taxes, political risk, and exchange rates. Strategic determinants refer to long-term factors, such as to defend existing foreign markets, to diversify firms’ activities, to gain or maintain a foothold in the host country, and to complement another type of investment.

Incentive policies are an important factor to consider, especially in developing countries (Sun et al 2002). FDI incentives include tax and other fiscal inducements, financial subsidies, and derogations from regulations offered to foreign-owned enterprises with the purpose of making them invest. More completely, the incentives may include duty-free privileges; concessionary tax rates, breaks, and exemptions; preferential fees for land or facility use; favorable arrangements on project duration, size, sector invested in, location, and type of ownership; flexible treatments regarding business management, employment, and wage schemes; and so on. The aim of policies for attracting FDI must necessarily be to provide investors with ...

Table of contents

- Front Cover

- Title Page

- Copyright Page

- Contents

- List of Tables and Figure

- Acknowledgments

- Abbreviations

- Foreword

- Abstract

- 1. Introduction

- 2. Literature Review

- 3. Theoretical Framework

- 4. Profiles of Border Economic Zones and Industries

- 5. Active Incentive Policies: A Comparative Analysis

- 6. Nonparametric Analysis

- 7. Parametric Analysis

- 8. Conclusion and Policy Implications

- References

- Research Team

- Back Cover