- 25 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Taxation in Asia

About this book

This publication presents an overview of tax policy and tax administration issues---how countries in Asia and the Pacific compare with the rest of the world in main taxes, revenue collections, tax morale, and others. The implications of reducing reliance on customs tariff revenues and of using the value-added tax on a broader basis, especially in the services sector, have been analyzed. This note suggests an agenda for reform by discussing whether there is space to increase national revenue collections, how to improve tax administration and enforcement, and how these reforms interact with the decentralization paradigm. The individual country performances, the extent of the shadow economy, and lessons on reforming tax administration have been referenced.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

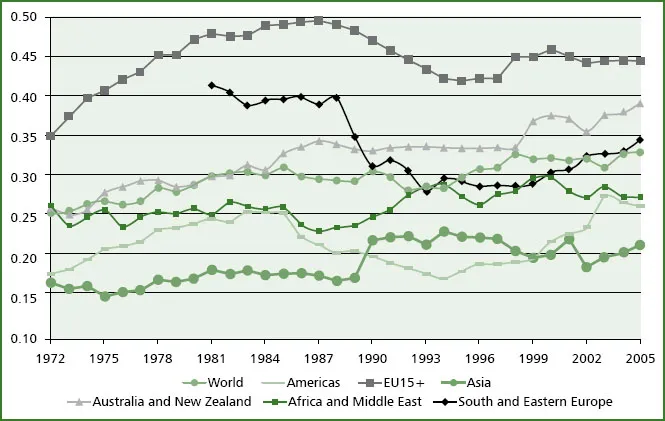

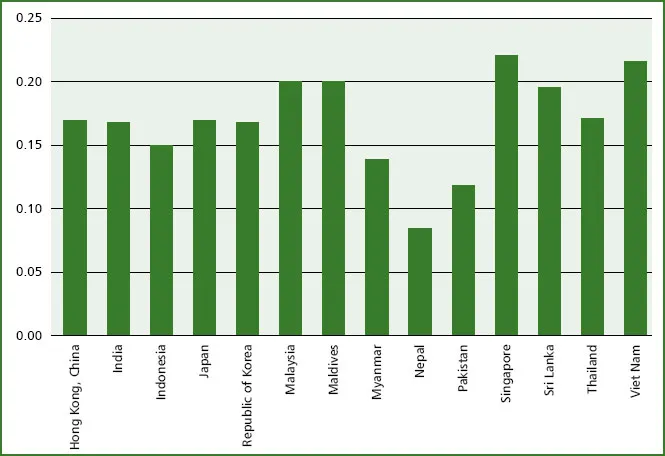

The Singularity of Asia’s Tax Systems

Overall Tax Burdens

Tax Composition: Direct versus Indirect Taxes in Asia and the World

Table of contents

- Front Cover

- Title Page

- Copyright Page

- Contents

- Tables and Figures

- Abbreviations

- Acknowledgments

- Introduction

- The Singularity of Asia’s Tax Systems

- General Scope for Tax Policy Reform

- Centrality of Tax Administration Issues for Improving Performance

- General Tax Administration Reform

- Some Common Lessons for Tax System Reform

- References

- Back Cover