- 315 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

The Asia SME Finance Monitor 2014 is the knowledge sharing product on small and medium-sized enterprises (SMEs) in Asia and the Pacific, specially focusing on SME access to finance. This publication reviews various country aspects of SME finance covering the banking sector, nonbank sector, and capital markets. It is expected to support evidence-based policy making and regulations on SME finance in the region.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Asia Small and Medium-sized Enterprise (SME) Finance Monitor 2014 by in PDF and/or ePUB format, as well as other popular books in Business & Finance. We have over one million books available in our catalogue for you to explore.

Information

Country Reviews

Central Asia

Kazakhstan

Kyrgyz Republic

Tajikistan

Kazakhstan

SME Landscape

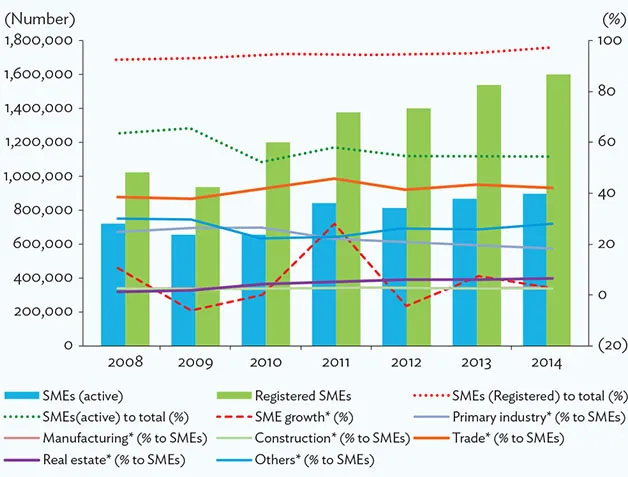

Registered small and medium-sized enterprises (SMEs) numbered 1,541,885 in 2013, a 10.2% increase from the previous year. This number further expanded to 1,594,317 in 2014, a 3.4% increase from 2013, comprising 97.5% of the total number of registered businesses (Figure 4.1 and Table 4.1). Among them, active SMEs totalled 871,497 in 2013 with a 7.6% increase from 2012, backed by the gradual improvement of the Kazakhstan economy from the aftermath of the 2008/09 global financial crisis. The number of active SMEs further increased by 2.7% to 895,409 in 2014, accounting for 54.7% of the total number of SMEs.

Figure 4.1: Number of SMEs

Primary industry = agriculture, forestry, and fisheries; SME = small and medium-sized enterprise.

* based on active SMEs.

Source: Agency for Statistics of the Republic of Kazakhstan.

Table 4.1: SME Landscape

GDP = gross domestic product; primary industry = agriculture, forestry, and fisheries; SME = small and medium-sized enterprise.

* based on active SMEs.

Sources: Agency for Statistics of the Republic of Kazakhstan and National Fund Damu.

By business sector, the wholesale and retail trade accounted for 42% of total active SMEs in 2014, followed by other economic sectors including services and transportation at 27.9% and the agriculture sector at 18.2%.

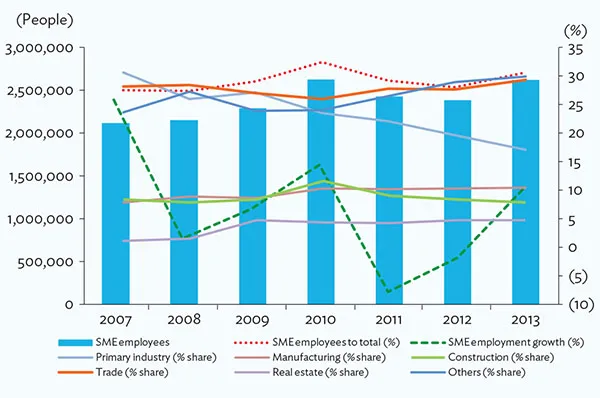

In line with the increased number of SMEs, employees in the SME sector also increased by 10.6% to 2.6 million people in 2013, whose number reached 2.7 million people in 2014, a 3.9% increase from the previous year, making up 32.1% of the total Kazakh workforce. While a continuous decline of the employment in agriculture was identified, standing at 17.1% of total SME employees in 2013 from 19.6% in 2012, employment growth in the wholesale and retail trade sector compensated for the decrease, representing 29.5% of total SME employees in 2013, up from 27.7% in 2012, which resulted in the upward trend of employment by SMEs on the whole (Figure 4.2).

Figure 4.2: Employment by SMEs

Primary industry = agriculture, forestry, and fisheries; SME = small and medium-sized enterprise.

Source: National Fund Damu.

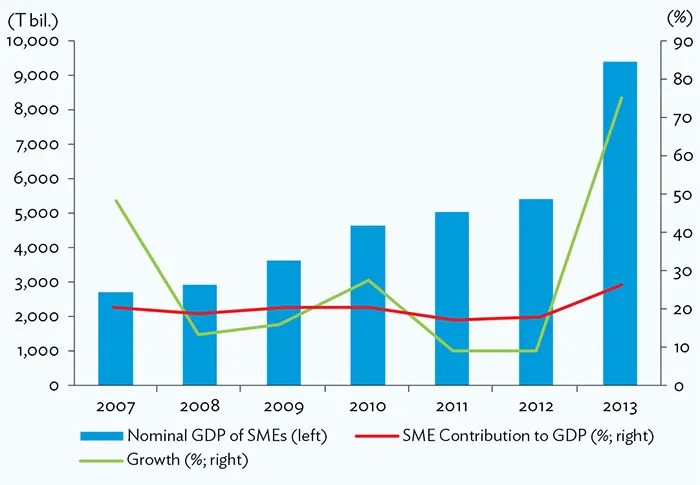

In 2013, SMEs contributed to 26% of gross domestic product (GDP) in Kazakhstan, amounting to T9,020 billion, a sharp increase of 71.8% on the previous year’s contribution (Figure 4.3). Since the government launched a new program, called Increasing Competitiveness and Performance of SMEs, in 2011, the output of SMEs has been steadily increasing. The target is for 40% SME contribution to GDP by 2030, and 50% by 2050. The government’s efforts began to yield tangible results in 2013.

Figure 4.3: SME Contribution to GDP

GDP = gross domestic product, SME = small and medium-sized enterprise.

Source: Agency for Statistics of the Republic of Kazakhstan.

In September 2014, the legal definition of SMEs stipulated under the Private Entrepreneurship Law 2006 was amended. The main revised points are: (i) the creation of a micro enterprise category, where a firm having fewer than 15 employees or annual average income of less than 30,000 times the monthly calculated index (MCI) annually set by the government is regarded as a micro enterprise; (ii) expanded size of the small firm segment in relation to employment and the MCI; and (iii) diminished range of the medium firm in relation to employment and the MCI. For 2014, the MCI equates to net assets of less than T5.2 billion to classify SMEs. The National Bank of Kazakhstan, commercial banks, and other financial institutions follow this definition for financing SMEs.

Banking Sector

Under the two-tier banking system in Kazakhstan, the National Bank of Kazakhstan (central bank) is placed on the first tier, while all other banks, with the exception of the Development Bank of Kazakhstan, are in the second tier. The National Bank of Kazakhstan reported as of 1 September 2014 that there were 38 second-tier banks (17 of which have foreign investment) operating in Kazakhstan, with a combined total of 395 branches across the country. According to the National Bank of Kazakhstan, the share of the five largest banks (Kazkom bank, Halyk Bank, BTA bank, Sberbank, and Tsesnabank) in the total bank loan portfolio has reached 60.8%.

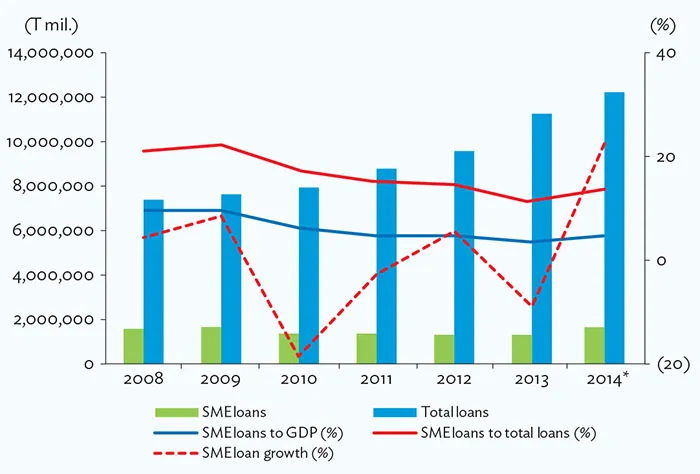

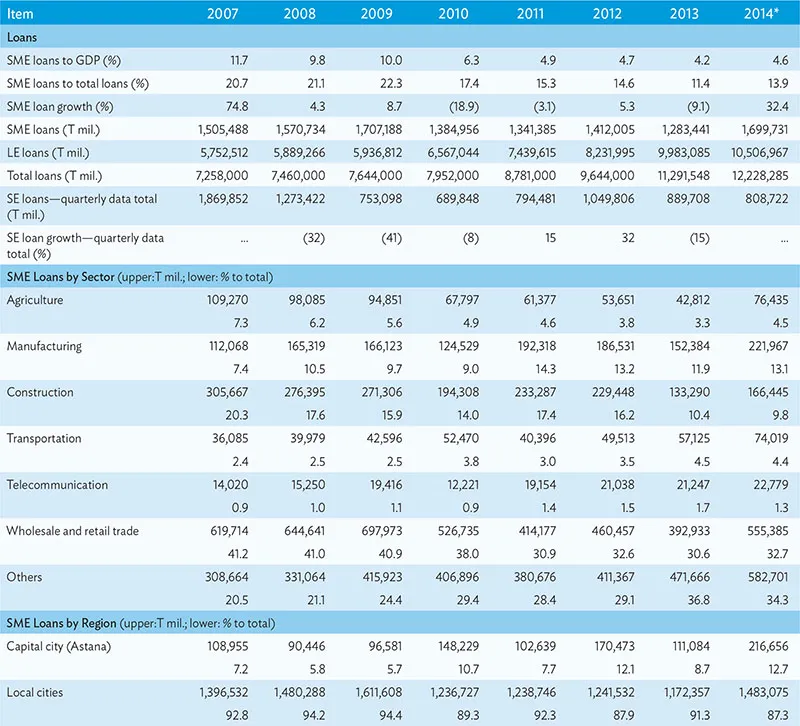

The banking sector is a main source of external funding for SMEs in Kazakhstan. SME loans disbursed by second-tier banks amounted to T1,283 billion in 2013, a 9.1% drop from the previous year. As of September 2014, the volume of SME loans disbursed moderately recovered, with tangible funding for SMEs amounting to T1,699 billion, a 32.4% increase from 2013. This accounted for 13.9% of the total second-tier bank lending, a figure that has yet to exceed the level before the 2008/09 global financial crisis (GFC) (Figure 4.4 and Table 4.2). The share of SME loans to GDP has continuously remained low however, 4.6% as of September 2014.

Figure 4.4: SME Loans Disbursed

GDP = gross domestic product, SME = small and medium-sized enterprise.

* data as of September 2014.

Source: National Fund Damu and National Bank of Kazakhstan.

Table 4.2: Banking Sector—SME Loans

GDP = gross domestic product, LE = large enterprise, SE = small enterprise, SME = small and medium-sized enterprise.

* data as of September 2014.

Source: National Fund Damu and National Bank of Kazakhstan.

High interest rates and strict collateral requirements are major obstacles for SMEs to access bank credit. What’s more, there are critical external factors that may constrain SME access to finance. Firstly, Kazakhstan has decided to introduce Basel III for banking supervision, which requires tighter risk management for banks, and may constrain their lending to SMEs.

Secondly, highly deepened dollarization in the Kazakhstani economy will pose additional threats to the banking system as well as to its SME borrowers. The tenge devalued by 20% in February 2014, significantly increased the debt burden of SMEs holding their liabilities to banks in foreign currency, while keeping their revenues mainly in local currency. The government of Kazakhstan, together with the central bank, is currently working on a strategy that aims to reduce the dependence on dollarization in the economy.

The GFC s...

Table of contents

- Front Cover

- Title Page

- Copyright Page

- Contents

- Foreword

- Acknowledgments

- List of Data Contributors

- Abbreviations

- Rationale and Methodology

- Highlights

- Regional SME Finance Update

- Thematic Discussion: Mobile Technology for Financing SMEs in Asia and the Pacific: Challenges and Opportunities

- Country Reviews

- Appendix: SME Definitions

- Back Cover