- 168 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

The Asia Small and Medium-sized Enterprise (SME) Finance Monitor 2013 is the knowledge sharing product on SMEs in Asia and the Pacific, specially focusing on SME access to finance. The Monitor reviews various country aspects of SME finance covering the banking sector, nonbank sector, and capital markets. It is expected to support evidence-based policy making and regulations on SME finance in the region.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Asia Small and Medium-sized Enterprise (SME) Finance Monitor 2013 by in PDF and/or ePUB format, as well as other popular books in Social Sciences & Poverty in Sociology. We have over one million books available in our catalogue for you to explore.

Information

COUNTRY REVIEW

Bangladesh

SME Landscape

Small and medium-sized enterprises (SMEs) are the backbone of the national economy in Bangladesh. They are expected to create jobs, reduce poverty, and drive a resilient national economy. The International Monetary Fund (IMF) Country Report (2012)1 indicated that SMEs in Bangladesh accounted for more than 99% of private sector industrial establishments and created job opportunities for 70%–80% of the nonagricultural labor force. The share of SMEs’ production value added to gross domestic product (GDP) ranged between 28% and 30%. The report also mentioned that the contribution of SMEs to national exports is significant.

There are no comprehensive SME statistics available at the national level. The Bangladesh Bureau of Statistics collects annual production data from sampled manufacturing industries that employ 10 or more workers, but the data do not include nonmanufacturing sectors. There are some initiatives to develop an SME database in the country. The South Asia Enterprise Development Facility, managed by the International Finance Corporation (IFC) in partnership with the Department for International Development of the United Kingdom and the Norwegian Agency for Development Cooperation, launched the SME Database in 2011. However, estimates and reports on SMEs have yet to become available through this database.

The Bangladesh Industrial Policy 2010 set a unified definition of SMEs which is followed by fiscal, monetary, and financial authorities. The Bangladeshi definition is based on the value of fixed assets (excluding land and building) and/or the number of employees. Cottage and micro industries were also defined for greater financial inclusion. This definition has been adopted by the Bangladesh Bank (the central bank) through its Circular No 1 of 2011. Manufacturing, service, and trade firms with fixed assets of less than Tk0.5 million and 10 or less employees (including family members) are considered cottage enterprises. Manufacturing firms with fixed assets of Tk0.5 million–Tk5.0 million and 10–24 employees, and service and trade firms with fixed assets of less than Tk0.5 million and less than 10 employees are considered micro enterprises. Manufacturing firms with fixed assets of Tk5 million–Tk100 million and 25–99 employees, and service and trade firms with fixed assets of Tk5 million–Tk10 million and 10–25 employees, are considered small enterprises. Manufacturing firms with fixed assets of Tk100 million–Tk300 million and 100–250 employees, and service and trade firms with fixed assets of Tk10 million–Tk150 million and 26–100 employees are considered medium-sized enterprises.

The IMF Country Report also suggested that SMEs in Bangladesh suffer from poor access to finance, infrastructure bottlenecks (especially unreliable power), low levels of technological competency, difficult market access, and regulatory barriers.

The Government of Bangladesh has recognized the roles played by SMEs in national economic development and poverty reduction. To this end, the government has taken several measures to prioritize SME sector development through provision of adequate infrastructure (e.g., better supply of electricity), credit, entrepreneurship development, and training and research.

Banking Sector

Bangladesh is a leading country in microfinance with a world-renowned success story of Grameen Bank, but SME finance is needed to vitalize the “missing middle” (the SME sector that is reconciled to lower productivity). While microfinance is promoted as an effective tool for poverty reduction, SME finance is seen as an instrument to realize sustainable, resilient economic growth.

There are two types of commercial bank in Bangladesh: scheduled and nonscheduled. Scheduled banks are licensed under the Banking Companies Act 1991 (amended in 2003), while nonscheduled banks are those established under special legislation enacted to meet particular objectives; their activities are more limited than those of scheduled banks. There are 52 scheduled banks working in Bangladesh: (i) 4 state-owned commercial banks, (ii) 4 specialized development banks, (iii) 28 conventional private commercial banks, (iv) 7 Islami Shariah-based private commercial banks, and (v) 9 foreign commercial banks. There are four nonscheduled banks.

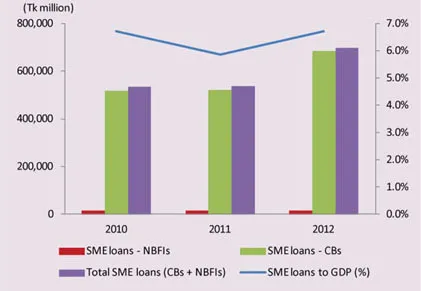

Bangladesh Bank compiles SME credit data, but most data consolidate the figures on both bank and nonbank financing to SMEs. SME commercial lending, combining banking and nonbanking sectors, is quite small in scale in Bangladesh; in 2012 Tk697,539 million (6.7% of GDP) was disbursed as SME commercial loans (Figure 4.1 and Table 4.1). While nonbank loans to SMEs are decreasing, bank lending to SMEs has been expanding; in 2012, Tk682,629 million was disbursed as SME bank loans, an increase of 31.1% over the previous year. SME lending interest rates typically range between 14% and 16%.

Figure 4.1: SME Loans Disbursed

CB = commercial bank, NBFI = nonbank financial institution, SME = small and medium-sized enterprise.

Source: Bangladesh Bank.

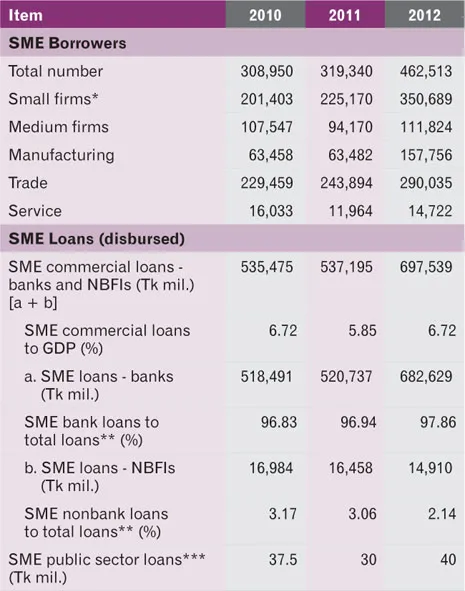

Table 4.1: Banking and Nonbank Sectors—SME Loans

*including cottage enterprises.

** % of total lending by banks and NBFIs. *** lending by SME Foundation included. ****SME commercial loans (banks + NBFIs).

Source: Bangladesh Bank.

Bangladesh Bank set an indicative annual credit volume target to SMEs for all banks and nonbank financial institutions (NBFIs). In 2012, the overall SME loan target was Tk590,127 million, but actual provision exceeded this by 18.2%, resulting in 29.8% annual growth of total SME commercial lending. As of the end of March 2013, banks and NBFIs provided Tk193,520 million, 26.1% of the annual target of Tk741,869 million.

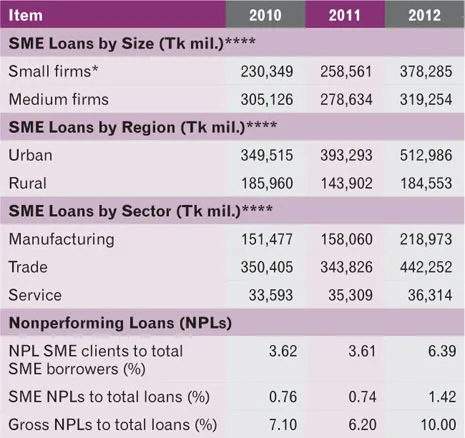

By firm size (Figure 4.2), loans to small enterprises (including cottage firms) accounted for 54.2% of total SME commercial loans in 2012, a sharp increase of 46.3% over 2011. However, a widening geographical gap in SME financing has been identified. SME loans disbursed in urban areas accounted for 73.5% of total SME commercial loans, and indicated a constant increasing trend (30.4% increase in 2012 over 2011).

Figure 4.2: SME Loans by Size, Region, and Sector

SME = small and medium-sized enterprise.

Note: SME loans disbursed by commercial banks and nonbank financial institutions.

*including cottage enterprises.

Source: Bangladesh Bank.

The most active sector in SME lending is the wholesale and retail trading sector (63.4% of total SME commercial loans) which increased by 28.6% in 2012 over 2011, followed by the manufacturing sector at 31.4% share of total SME lending with 38.5% increase in 2012 over 2011 and the service sector at 5.2% share with 2.8% increase in 2012 over 2011.

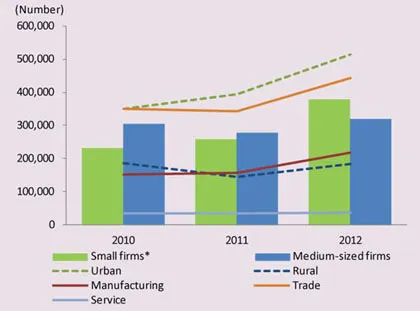

There were 462,513 SMEs with access to bank and nonbank loans in 2012 (Figure 4.3). Among th...

Table of contents

- Front Cover

- Title Page

- Copyright Page

- Contents

- Foreword

- Acknowledgments

- List of Data Contributors in Participating Developing Member Countries of the Asian Development Bank

- Abbreviations

- Rationale and Methodology

- Highlights

- Regional SME Finance Update

- Thematic Discussion: Supply Chain Finance for SMEs in Asia – Trends and Key Challenges

- Country Review

- Appendixes

- Back Cover