- 74 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

The People's Republic of China is a highly decentralized unitary state with local governments having a dominant share of public service delivery responsibility. Local governance is critically linked to a local public finance system that creates incentives and accountability mechanisms. To ensure the policy response, this project focused on the three interrelated areas in local public finance management, i.e., local budgeting, local debt management and local taxation, and produced policy options in the short, medium and long terms. The overall purpose of the reforms is to improve local accountability and transparency, strengthen local fiscal capacity, and institutionalize formal frameworks for local public debt management.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Local Public Finance Management in the People's Republic of China by in PDF and/or ePUB format, as well as other popular books in Politics & International Relations & Public Affairs & Administration. We have over one million books available in our catalogue for you to explore.

Information

1 Introduction

Since initiating economic liberalization in 1978, the People’s Republic of China (PRC) has had a remarkable record of economic growth. Today, PRC is the second-largest economy behind the United States, and the largest exporter and manufacturer in the world. While many other Organisation for Economic Co-operation and Development (OECD) countries are languishing under mounting public debt burdens with unsustainable public finances, PRC has emerged largely unscathed from the recent global financial crisis, enjoying a rising positive net worth with large reserves to deal with any budding fiscal calamity.

As PRC is one of the most decentralized countries in the world in terms of fiscal expenditures, its success is inexorably linked to the capabilities, incentives, and accountability of its local governments. Indeed, local governments in PRC have played a catalytic role in bringing about the country’s historic economic transformation, as they have assumed a dominant role in service delivery and local economic development. However, at the local level, there has also been a lack of attention to fiscal transparency in budgeting; fiscal responsibility in borrowing; and underprovision of public goods such as environmental protection, food security, orderly urban growth, and social inclusion.

Since 1978, a series of radical as well as incremental fiscal system reforms has been conducted in the PRC. Faced with declining transfer of revenues from the provinces, the central government in 1988 introduced fiscal contracts with the provinces by which the provinces were to provide the central government lump-sum transfers and retain the remainder of revenues for own use. This solution still could not provide the central government with enough financing and as a result radical fiscal reforms were introduced in 1994 to recentralize the tax system, and its administration, and initiate a new system of central-local tax sharing and transfers. Under these reforms, the provinces only retain 25% of the value-added tax (VAT), 40% of income tax, and 50% of security and exchange transactions tax. In addition, the central government introduced prohibitions on local government access to private market capital financing to protect against macro fiscal risks.

Over the past decades, it has also introduced incremental reforms in central-provincial transfers, budget transparency and comprehensiveness. More recently in 2012 introduced a new framework for raising and reporting local debt. These reforms have had positive impact on local public finance management yet many areas of concern remain. These include: (i) local governments having inadequate access to tax and bond finance; (ii) unconditional transfers have limited equalization impacts, and conditional transfers are not focused on setting national minimum standards for public services and creating incentives for results based accountability; (iii) provincial-local transfers lack transparency and predictability; (iv) local budgets remain segmented and nontransparent; and (v) new borrowing framework is welcome but not yet available to most local jurisdiction.

Meanwhile, local governments face strong incentives for local economic development. This is because political and bureaucratic careers are directly linked to growth in local GDP. The 1994 reforms significantly curtailed opportunities for local tax financing and the situation was further aggravated by prohibitions on access to capital finance. Local government motivated by their commitment for uplift of local economy sought imaginative solutions, some with questionable legal basis, to overcome these centrally imposed constraints. They were helped in these efforts by having antiquated cash based segmented budgeting systems. Many local governments set up commercial enterprises, known as urban development investment corporations (UDICs), and public service units, and borrowed from these enterprises with no oversight by the central government or the financial market. They also followed aggressive land-grab policies from adjoining rural areas to support their expansion, and provided off-the-books guarantees to attract private businesses.1 In the process, according to the National Audit Office (NAO), they accumulated CNY10.7 trillion of debt obligations by December 2010. These debt obligations are estimated to have grown by 12.9% in 36 sample local jurisdictions based upon an audit report released by NAO in June 2013 (Shuli 2013). By applying the same growth rate, the aggregate local debt would have risen to CNY12.08 trillion by 31 December 2012 (Liu unpublished).

The pace of rapid growth and urbanization has also brought forth newer challenges in dealing with regional inequalities; services to migrants, the elderly, and the rural poor; environmental preservation; and higher expectations regarding quality and quantity of public services and social safety nets. However, local governments’ fiscal limitations, especially their mounting debt obligations, constrain effective responses. Fiscal system reforms are thus necessary to provide local governments with more fiscal space while enabling the central government to have better oversight over their fiscal health. To ensure adequate policy response to the reform needs, a key is to improve local budgeting and execution, local public debt management and local taxation. These are interrelated and underlying issues in local public finance management. The Asian Development Bank (ADB) has developed a technical assistance project on these three issues, reviewing their current status supplemented by lessons from international experiences. 2 This technical assistance served as the basis for policy dialogue and training of local government officials at workshops and for final consultations with central government officials in Beijing in June 2013. This report draws upon the policy research informed by the feedback from these policy dialogues. It is intended to inform policy makers in developing policy options and building consensus for achieving medium-term local public finance management reform objectives.

1.1 Overview of Local Public Finance Management

PRC is a unitary state with one government administratively organized into a hierarchical five-tier governance structure (Figure A1, Appendixes). Below the central government, there are 23 provinces, 4 province-level municipalities (i.e., Beijing, Chongqing, Shanghai, and Tianjin) and 5 autonomous regions (i.e., Guangxi, Inner Mongolia, Ningxia, Tibet, and Xinjiang), and 2 special administrative regions. Provinces and autonomous regions are then divided in prefectures, counties, autonomous counties, and cities. Several provinces directly manage the counties. Counties and autonomous counties are divided into townships, nationality townships, and towns. As of December 2012, there were 333 prefecture-level governments, 2,852 county-level, and 40,446 township-level governments.

All government levels have executive branches separate from legislative branches. Executive branch staff members at the local level are appointed by higher-level governments, whereas local people’s congress members are directly elected by local residents. The central government exercises some control over the number of total staff positions and wages and benefits at the local level, and does appoint staff members to top positions. However, local governments have discretion in personnel management and hiring and firing of personnel. In addition, in each government level, the Communist Party has party committees providing oversight. Local governments also use contracting and other innovative methods in delivering public services.

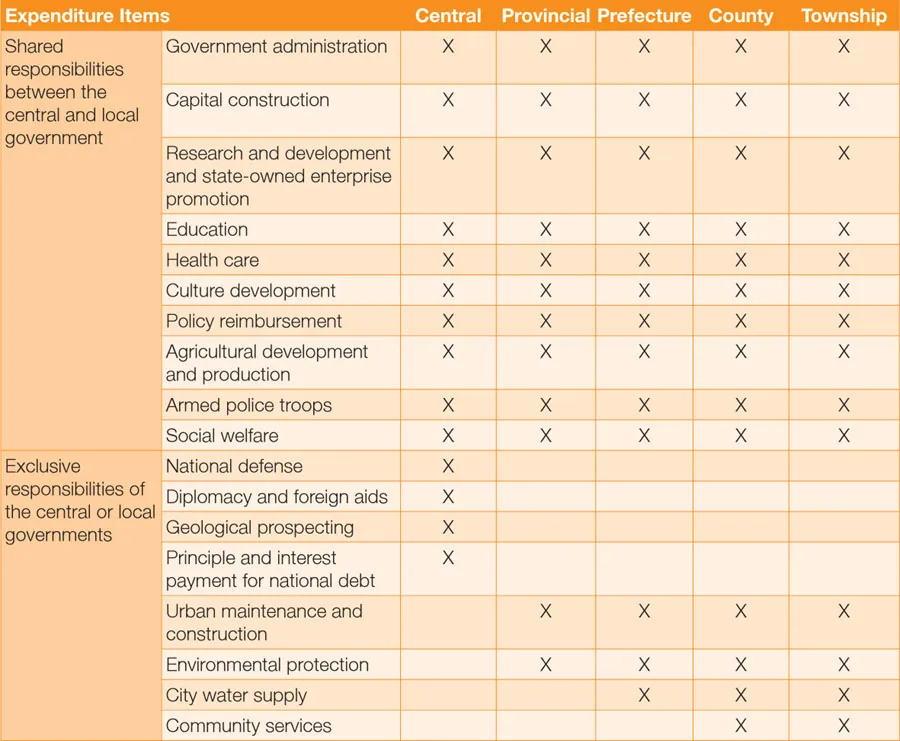

The central government has exclusive responsibility for currency, banking, foreign affairs, defense, and communications. The National People’s Congress (NPC), the national legislature, also has overriding legislative powers in all areas. Local governments, however, have responsibility over all people-oriented services, such as social and welfare services including pensions and unemployment insurance.3 Local governments also have exclusive responsibilities for property-oriented services, such as urban construction and water supply. Most responsibilities are shared between the central and local governments if they involve policy making, standards setting, and financing of shared services (Table 1).

Table 1 Expenditure Assignment in the PRC

Source: Qiao and Shah (2006)

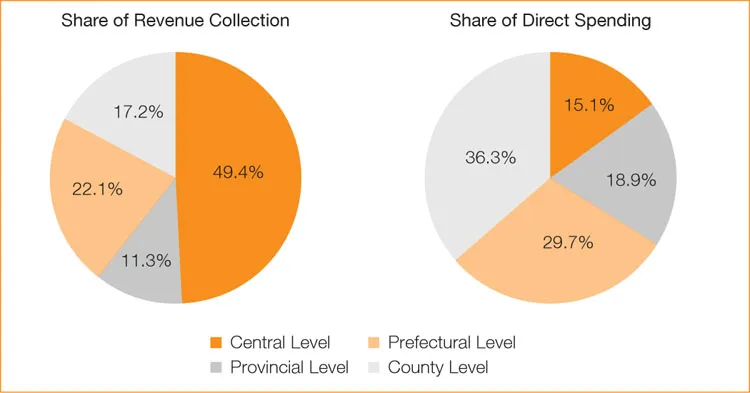

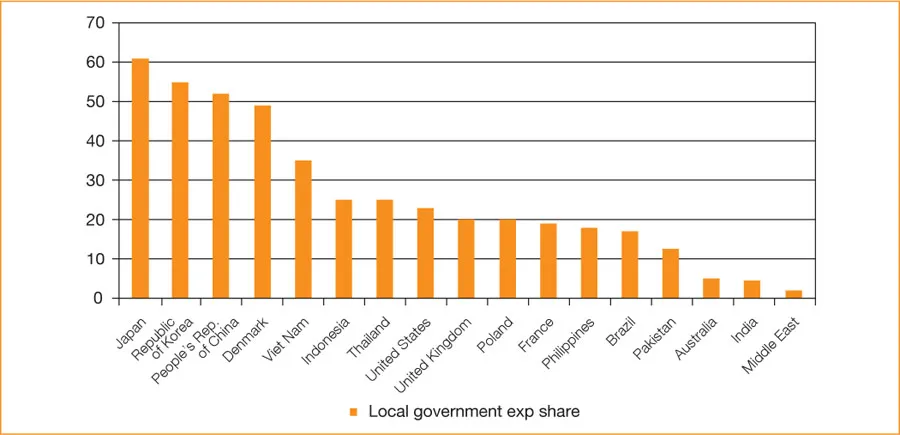

Local governments account for nearly 85% of total state expenditures (Figure 1). Thus, in expenditure decentralization, PRC ranks among the top quintile of countries globally. Even on the basis of subprovincial governments including provinces and below provincial governments, PRC ranks favorably with most OECD countries in terms of importance of local governments (Figure 2).

Figure 1 Share of Revenue Collection and Direct Spending by Level of Government, 2011

Sources: National Bureau of Statistics. 2012. China Statistical Yearbook (2012) (Zhongguo Tongji Nianjian-2012). Beijing: China Statistics Press. Table 8-2 and Table of 8-3. http://www.stats.gov.cn/tjsj/ndsj/2012/indexch.htm; National Bureau of Statistics. 2012. China Statistical Yearbook for Regional Economy (2012) (Zhongguo Quyujingji Tongji Nianjian-2012). Beijing: China Statistics Press. Table 3-6, Table 3-7, and Table 4-1. Central government-level data are from Tables of 8-2 and of 8-3 of the China Statistical Yearbook (2012); other data are calculated from Tables of 3-6, 3-7, and 4-1 of the China Statistical Yearbook for Regional Economy (2012).

Figure 2 Relative Importance of Subprovincial Governments as Measured by Local Government Expenditure Share

Sources: Ivanyna and Shah (2012).

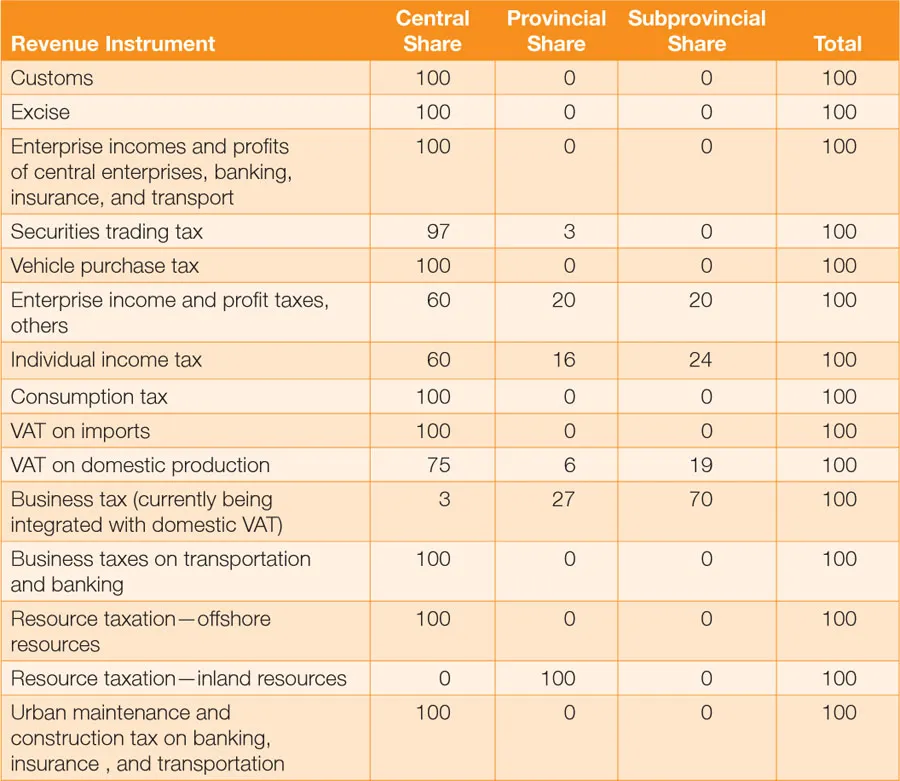

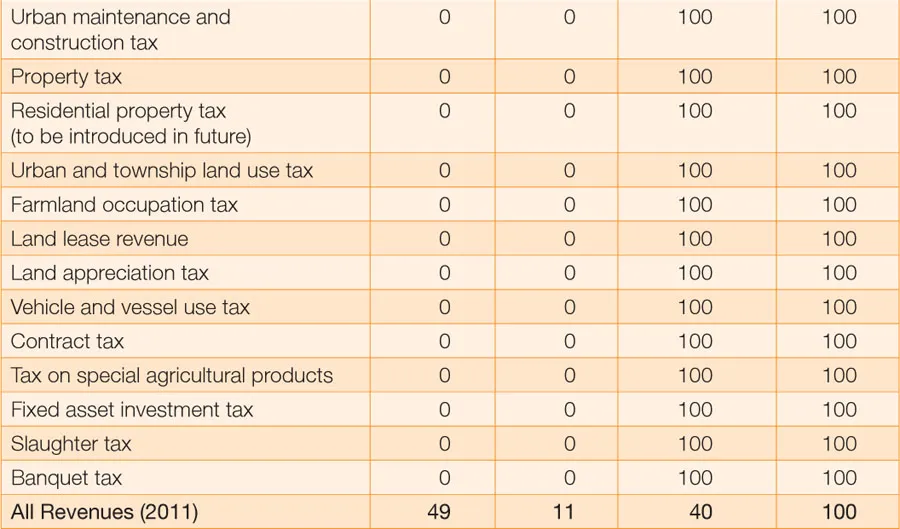

As previously stated, since 1994, tax legislation has been centralized for all revenue sources. Local governments have no ability to vary the base or rate of any tax without central approval. Moreover, productive tax bases, such as the VAT, enterprise tax, and personal income tax, are centralized, creating greater fiscal space for the central government to support regional development and economic integration of lagging regions. More recent reforms also integrate local business taxes with the VAT, further enlarging the fiscal space for the central government. Table 2 provides an overview of the current tax assignment in PRC. Major local revenue in relative order of importance is land-leasing revenue, the urban maintenance tax, contract tax, and vehicle purchase and use taxes. Overall, local governments collect about 50% of national revenues.

Table 2 Tax Assignment in the People’s Republic of China (%)

VAT = value-added tax.

Source: Updated and adapted from Qiao and Shah (2006).

Central–local transfers (including tax rebates) finance about 40% of local expenditures. These transfers flow through the governance structure, as provinces receive these transfers from the central government and pass them down to local governments either using the same criteria utilized by the central government or modified to suit local circumstances.4 Two-thirds of fiscal transfers are provided as general-purpose transfers, that is, without conditions. General-purpose transfers include (i) revenue sharing from the VAT, enterprise tax, and personal income tax; (ii) VAT rebates equaling previous-year rebates inflated by 30% of the growth in VAT and consumption tax revenues in local jurisdictions to compensate for the 1994 centralization of VAT and excise taxes and to provide incentives for growth in productive activity and consumption; and (iii) equalization transfers using complex, need-based criteria. Specific-purpose transfers include (i) wage grants, (ii) grants for rural tax reform, (iii) financing of rural...

Table of contents

- Front Cover

- Title Page

- Copyright Page

- Contents

- Tables, Figures, and Boxes

- Foreword (Ayumi Konishi)

- Foreword (Li Kouqing)

- Acknowledgments

- Abbreviations

- Executive Summary

- 1 Introduction

- 2 Reforming Local Budgeting and Budgetary Institutions

- 3 Local Tax Reforms

- 4 Conclusion

- Appendixes

- References

- Back Cover