- 83 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

The Tax Administration Management Information System (TAMIS) Tool Kit was developed with the objective of guiding and helping tax agents in developing countries undertake a holistic transformation of tax administration using information and communication technology. The tool kit provides guidance on key activities any tax agency should undertake in introducing TAMIS in various stages---including diagnostic assessment, prioritization of target taxes and services, implementation approaches, and monitoring and evaluation framework.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Tool Kit for Tax Administration Management Information System by in PDF and/or ePUB format, as well as other popular books in Politics & International Relations & Public Affairs & Administration. We have over one million books available in our catalogue for you to explore.

Information

1. The Tax MIS Tool Kit

Reforms in government administration and service delivery have been on the policy agenda of countries and donor agencies over the past 2 decades, with several billion dollars having been invested toward achieving the objectives of this agenda. Factors such as (i) a heightened focus on quality, timeliness, and transparency in public service delivery; (ii) extensive growth in the volume of public service delivery transactions; and (iii) limited manpower have necessitated governments to pursue innovative methods for improving internal efficiency and delivering better services to citizens and businesses. Leveraging information and communication technologies (ICTs), in particular, for the modernization of public administration and service delivery has received wider attention from governments and donor agencies. Governments have benefitted substantially by adopting ICT to minimize the time, cost, and resources used in administration and service delivery, which has led to enhanced convenience, transparency, and trust in public service delivery. At the same time, public sector ICT projects have received criticism for not being able to deliver the desired results and/or leading to unproductive investments in ICT systems and infrastructure without much enhancement in the quality of service delivery. The experiences of ICT investments have been diverse and many factors—such as strategic planning, commitment from the government, ICT maturity levels among stakeholders, acceptance of the systems within and outside the government, and technological complexities—have influenced the outcomes of these projects. Well-planned, coordinated, and managed ICT initiatives have generally proven effective in delivering desired results to stakeholders, both in the public and private sectors.

The application of ICT in tax administration is receiving increasing attention from governments worldwide considering its significance in generating much-needed revenues to fund development and social programs. Limited manpower, exponential growth in the taxpayer base, and related transactions have presented various challenges to the tax authorities, including (i) incomplete coverage of businesses and individuals in the taxpayer base; (ii) inadequate monitoring of taxpayer compliance with obligations; (iii) inconveniences, longer times, and higher costs for taxpayers in complying with taxation requirements; and (iv) delays and discretion in the collection and remittance of state revenues. Several governments have been successful in adopting ICT to address these issues and in achieving higher levels of compliance and increased revenues. The World Bank’s Doing Business1 study focuses on the efficiency and effectiveness of tax administration systems worldwide and measures the performance of various countries in parameters such as tax rates, number of payments, and time to comply with tax regulatory requirements. Studies over the past few years on these parameters have shown reasonable to substantial improvements in tax administration in various economies around the world and have revealed that tax authorities are increasingly relying on ICT for enhancing administrative performance.

Similar to other sectors, the adoption of ICT in tax administration has delivered mixed results for tax authorities. Few countries have been entirely successful in leveraging ICT in enhancing convenience, compliance, and revenues. The countries at an advanced stage of using ICT in tax administration (e.g., the Republic of Korea and Singapore) have focussed on multiple dimensions, including (i) convenience for taxpayers (e.g., online services to the taxpayers for registration, filing of returns, and payment of taxes); (ii) compliance monitoring, including gathering data on financial and related transactions performed by taxpayers to validate tax returns and support the collection of due taxes; and (iii) enhanced revenue collections by supporting tax authority staff in monitoring the compliance, assessment, and collection of taxes. On the other hand, several countries are still at the middle or low level of the maturity curve in using ICT in tax administration. As per the World Bank study,2 the performance of tax administration systems in a number of countries still requires several hundred hours (thousands in a few cases) for taxpayers to comply with their tax obligations. Poor coverage of the taxpayer base and inadequate monitoring of taxpayer compliance have a spiralling effect on tax administration, leading to a higher tax burden on a limited taxpayer base complying with the requirements. Tax authorities have been working on leveraging ICT as a key enabler in addressing these issues and several initiatives are currently in the conceptualization, design, or implementation stage.

1.1. Overview and Structure of the Tax MIS Tool Kit

The Tax MIS Tool Kit has been developed with the overall objective of guiding and helping policymakers and tax administrators in undertaking a holistic transformation of tax administration in their respective agencies by implementing Tax MIS. This tool kit will support tax authorities in the planning and implementation of Tax MIS in an informed manner and focuses on the (i) needs, roles, and scope of ICT systems for tax administration; (ii) key factors that influence the outcomes of ICT initiatives in tax administration; and (iii) experiences from such initiatives around the world to minimize the learning curve and maximize the benefits from ICT investments to stakeholders. The tool kit will provide guidance, including key activities that any tax agency should undertake, in assessing the current status of ICT-based tax administration, identifying key problem areas, developing a Tax MIS transformation roadmap, and designing an ICT-based tax administration system. There is wide variation in the degree of maturity of the current Tax MIS in use by tax agencies in developing countries in Asia. A tax agency can use this tool kit based on its level of maturity in Tax MIS implementation. The tool kit also refers to key lessons learned from select cases of Tax MIS implementation around the world.

1 http://doingbusiness.org

2 http://data.worldbank.org/indicator/IC.TAX.DURS

2. The Business Case for Tax MIS

Compliance with tax laws by taxpayers requires them to undertake a range of administrative activities—such as retrieval of information, assessment, calculation, filing, and payment—using both internal resources and (increasingly) the assistance of external parties such as tax accountants and lawyers. In most of countries, these compliance processes are cumbersome and complex, resulting in significant time and economic losses both for the taxpayer as well as the tax agency. This not only generates a significant administrative burden, but also a huge economic loss for the country. This section discusses some of the key issues encountered in tax administration and how ICT can be used effectively to address these problems. This tool kit has also presented several successful case studies highlighting how ICT has helped tax agencies in streamlining service delivery and reducing the administrative burden.

2.1. Key Issues in Tax Administration

Based on the size, geographical coverage area, and structure of the overall government administration in a given country, tax administration at the national level can be performed either by a single agency or multiple agencies. Usually, local governments are also entrusted with the administration and collection of certain taxes (e.g., property tax) to support their capital and operational expenditure requirements for creating and maintaining civic infrastructure and services. The similarities in the challenges confronted by different countries in tax administration are also based on similarities in the tax administration systems and structures adopted by these countries. Small to medium-sized countries, in terms of geographical size, generally entrust tax administration responsibilities to a single agency for all central government taxes, while medium-sized to large countries can have multiple agencies responsible for the collection of central government taxes. The complexities of tax administration in a federated structure with multiple agencies performing tax administration and collection duties are much higher. In such scenarios, the challenges confronted by taxpayers are related to multiple interactions and transactions for registration, filing, and the payment of taxes. Challenges impacting the performance of tax authorities include disparate information sources on taxpayers, an inability to achieve an integrated view on taxpayer liabilities, and difficulty in exchanging data in various formats in a timely manner.3

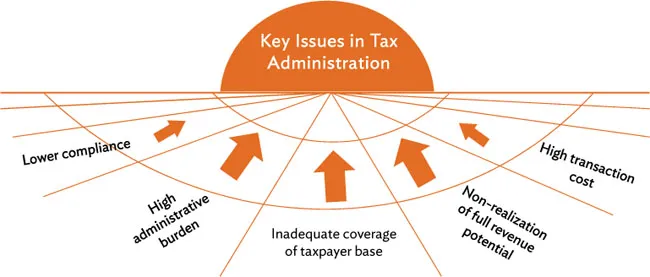

Tax authorities worldwide are presented with certain common and country-specific challenges that have a bearing on the performance of the tax authorities in service provision, revenue collection, and compliance monitoring. Different internal and external environmental factors pose challenges to tax administration—such as redundant activities, weak service delivery capacities, and an insufficient enabling legal environment—that can lead to sub-optimal revenue realization by the tax agency. Many of these and other challenges affect overall tax administration as depicted in Figure 1. Meanwhile, Table 1 summarizes such key issues faced by the tax authorities in a number of countries worldwide.

Figure 1: Key Issues in Tax Administration

Table 1: Key Issues in Tax Aministration

Key Issues | Description |

Inadequate coverage of taxpayer base | • Disparate and redundant data sources, within and outside the public sector, on potential taxpayers with inadequate and untimely data exchange between tax authorities • Data received and available in manual records and documents leading to difficulties in enforcing and tracking compliance in registration |

Non-realization of full revenue potential from existing taxpayer base | • Lack of integrated coverage of taxpayer base among tax agencies and related institutions and/or partners • Limited or no access by the tax authorities on revenue and business performance records of taxpayers • Inaccurate or incomplete data on taxpayers • Legislative hurdles in accessing taxpayer-related records and transactions (e.g., bank secrecy laws in a few countries restricting access on taxpayers banking and financial transactions to the tax authorities) • Large volume of records and manual operations making it complex and difficult to monitor revenue realization and initiate and conclude recovery measures in a timely manner |

Low level of compliance | • Large numbers of taxpayers, associated records, documents, and transactions, making it complex to monitor compliance • Manual operations providing limited scope for monitoring and ensuring full compliance of tax obligations by taxpayers and leading to delays and inefficiencies in service delivery to taxpayers, monitoring compliance, and initiating assessments and collection recovery • Lack of data exchange within and between tax units leading to inefficiencies in compliance monitoring • Lower compliance monitoring leading to delayed and inadequate realization of revenue • Higher priority given to processing the returns filed or claims made by taxpayers and inadequate focus on compliance monitoring |

Higher transaction costs | • Large number of taxpayers, documents, and manual operations leading to higher administrative costs for tax authorities and higher compliance costs for taxpayers • Printing, distribution, and exchange of physical documents • Lack of self-services for taxpayers, which requires a greater administrative burden and higher costs for tax authorities and taxpayers • Low rate of recovery per dollar spent on tax collection |

Significant administrative burden | • Complex business rules and compliance requirements compounded by manual systems and processes • Physical verification of monitoring of registration, compliance, payments, and recovery • Minimal or no self-services options for taxpayers • Tax agencies relying on both automated and manual systems in parallel, leading to more operational costs • Operational procedures consuming employee time at tax agencies, leaving minimal scope for planning, monitoring, and analysis |

2.2. Can ICT Help Streamline Tax Administration?

The administrative activities related to tax administration are largely governed by the relevant regulatory framework, while tax agencies play a significant role in the practical operation and delivery of services to taxpayers. Tax authorities are in a strong position to influence the overall level of the administrative burden on businesses and citizens by undertaking dif...

Table of contents

- Front Cover

- Title Page

- Copyright Page

- Contents

- Tables and Figures

- 1. The Tax MIS Tool Kit

- 2. The Business Case for Tax MIS

- 3. Overview of Tax MIS

- 4. Diagnostic Assessment of ICT Status

- 5. From Diagnostic Assessment to Prioritization of Taxes and Services

- 6. Tax MIS Implementation Approach: Stakeholders and Cost Estimate

- 7. Commercial Off-the-Shelf versus Custom-Developed Tax MIS Solutions

- 8. Monitoring and Evaluation Framework

- 9. Key Barriers to Tax MIS Implementation

- References

- Back Cover