eBook - ePub

Improving Accessibility of Financial Services in the Border-Gate Areas to Facilitate Cross-Border Trade

The Case of Viet Nam and Implications for Greater Mekong Subregion Cooperation

- 33 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Improving Accessibility of Financial Services in the Border-Gate Areas to Facilitate Cross-Border Trade

The Case of Viet Nam and Implications for Greater Mekong Subregion Cooperation

About this book

This series features the scholarly works supported by the Phnom Penh Plan for Development Management, a region-wide capacity building program of the Asian Development Bank that supports knowledge products and services. It seeks to disseminate research results to a wider audience so that policy makers, implementers, and other stakeholders in the Greater Mekong Subregion can better appreciate and understand the breadth and depth of the region's development challenges.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Improving Accessibility of Financial Services in the Border-Gate Areas to Facilitate Cross-Border Trade by Nguyen Hong Son, Dang Duc Son in PDF and/or ePUB format, as well as other popular books in Economics & Development Economics. We have over one million books available in our catalogue for you to explore.

Information

1. Introduction

Since the early 2000s, cross-border trade has expanded rapidly among the countries in the Greater Mekong Subregion (GMS). Among other factors, the increase in cross-border trade has been stimulated by the application of a number of trade facilitation measures.

Facilitating cross-border trade is one of the five strategic thrusts of the 10-year Strategic Framework for the GMS Program that was endorsed in 2002 by the First GMS Summit. Its blueprint for action was set in the Strategic Framework for Action on Trade Facilitation and Investment which was approved by the Second GMS Summit in 2005. To support transport and trade facilitation, the GMS countries have also implemented since 1999 the Cross-Border Transport Agreement. Nevertheless, the important role of financial services as a cross-border trade facilitation factor has been so far overlooked in GMS cooperation. Although the strategic framework does not exclude financial services, at present it emphasizes customs procedures, inspection and quarantine measures, trade logistics, and mobility of business people as the four priority cross-border trade facilitating measures. Similarly, other trade facilitation measures, such as those incorporated in the Cross-Border Transport Agreement, have dealt merely with such border-crossing formalities and procedures as single-window and single-stop customs inspection; facilitation of the movement of goods, people and vehicles; and phytosanitary and veterinary inspection, and they have ignored the financial aspects of cross-border trade.

Inaccessibility is a major constraint to the use of financial services in the border areas of the GMS. The slow rate of expansion of financial services in the border-gate areas is out of step with the rapid growth of cross-border trade in the GMS. The dynamic border economy provides major opportunities for the growth of financial services in these areas, but banks are slow to tap this potential. As of 2010, only a few bank branches are established in the border areas, and only a small proportion of border trade in the GMS is financed through the commercial banks; the rest is through barter or cash. For example, settlement through banks accounts for a mere10% of the total cross-border trade volume between Viet Nam and the People’s Republic of China (PRC). In 2008, the value of trade between Viet Nam and Cambodia was $1.7 billion ($1.0 billion was the border trade value) and only $7.0 million (0.4%) of the cash was deposited into bank accounts by traders (Ministry of Industries and Trade [MOIT] 2009).

Even where banks are present in the border-gate areas, their services are still inaccessible to a large number of businesses. Banking services often stipulate restrictive criteria (e.g., a minimum deposit and evidence of good credit history) that disqualify small and informal businesses. The excessive paper work and high fees make getting a loan cumbersome and too costly for many borrowers seeking only small amounts. Banks may demand collateral, and pose other nonpecuniary challenges, such as requiring greater literacy, which poor borrowers lack (Claessens 2005: 12). Moreover, bank offices may have inconvenient location at the border gate or unsuitable working hours. The capability of banks to provide services needed by local businesses may also be limited. As a result, individuals, households, and firms have to rely on informal financial services, which appear to be a viable option in the less developed border areas.

In the most important border-gate areas of the GMS (e.g., Moc Bai, Bavet, Lao Bao, Densavan, Mong Cai, Dongxing, Lao Cai, and Hekou), there are black market currency exchange points with hundreds of money changers eagerly searching for clients. Compared to the banks, these informal financial service providers are more flexible with regard to customers’ needs and offer faster service. Nevertheless, informal services may be unreliable because they bear a high risk (e.g., exchange rate volatility, default, or transaction error), and easily become facilitators of illegal activities (e.g., tax evasion or money laundering). In addition, customers of informal services are easily subjected by service providers to unsympathetic behaviors, such as abuse and harassment. For most cross-border traders in the GMS, default on payment constitutes a big risk in the absence of payment guarantee services from banks (Nguyen and Cu 2005). Although informal financial services have an advantage in terms of number of providers and flexibility of conditions, concerns about reliability, assurance, and empathy may adversely affect customers’ decisions to use their services in the border-gate areas.

Inadequate policy attention to financial service development does not mean that there is little demand for financial services in the border-gate areas. Rather, it may reveal the mismatch between policy priorities and the needs of the local business community and residents. Using the case study of Viet Nam to draw implications for GMS cooperation, this paper investigates how users and providers of financial services in the border-gate areas see financial services as a factor of cross-border trade facilitation. It also examines how users and providers of financial services evaluate different dimensions of financial service accessibility and how these dimensions of accessibility affect customers’ decisions to use financial services in the border-gate areas.

2. Financial Services in Cross-Border Trade of Viet Nam

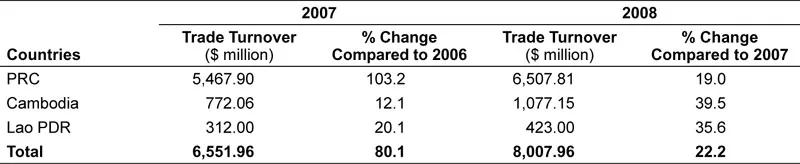

Cross-border trade between Viet Nam and Cambodia, the PRC, and the Lao People’s Democratic Republic (Lao PDR) has grown rapidly (Table 1). Border trade turnover between Viet Nam and Cambodia was $1.1 billion in 2008. It increased by 39.5% compared with 2007, and accounted for 65.7% of total bilateral trade between Viet Nam and Cambodia in 2008. Viet Nam had border trade surplus with Cambodia of $252.7 million in 2007 and $415.1 million in 2008. Viet Nam had a border trade deficit with the Lao PDR of $103.5 million in 2007 and $123.3 million in 2008. During 2002–2008, the border trade turnover of Viet Nam’s seven border provinces with the PRC grew at an annual rate of 46.3%. Viet Nam had a large trade deficit with the PRC but it had a border trade surplus of $1,056.0 million in 2007 and $639.2 million in 2008 (MOIT 2009).

Table 1 Cross-Border Trade among Cambodia, People’s Republic of China, Lao People’s Democratic Republic, and Viet Nam

PRC = People’s Republic of China, Lao PDR = Lao People’s Democratic Republic.

Source: Department of Trade Statistics, Ministry of Industries and Trade of Viet Nam (MOIT), 2009.

Along the border of Viet Nam, cross-border trade is concentrated in 26 border-gate economic zones (BEZs) where major border gates are located.1 Of the 26 BEZs, there are 9 major BEZs which are accorded priority in the development policy of the Government of Viet Nam: Mong Cai, Lao Cai, and Lang Son (in the north); Cau Treo, Bo Y, and Lao Bao (in the center); and Moc Bai, Dong Thap, and An Giang (in the south). These are the areas where cross-border trade is most active.

1 A BEZ is defined in the Decree 29/2008/ND-CP in 2008 by the government as the economic zone located in the land border region where there is an international or main checkpoint or more, and encompassing not only the border gate(s) but also the contiguous administrative areas that are spatially inseparable. The BEZs are granted with special administrative and regulatory status suited to the local conditions to ensure their rapid socioeconomic development which has strong spillover effects on the surrounding areas.

It is difficult to provide an adequate assessment of financial services in the border areas of Viet Nam. There is a lack of data due to the low accessibility of border traders to formal financial services and virtually non-existent data on informal financial providers.

Few attempts have been made to redress the undersupply of formal financial services in the border areas of Viet Nam. The State Bank of Viet Nam has signed bilateral settlement agreements with the People’s Bank of China (1993), the Bank of the Lao PDR (1998), and the National Bank of Cambodia (2005). These financial settlements allow the commercial banks to exploit the potential of the border financial market. This includes the agreements between the Viet Nam Joint Stock Commercial Bank for Industry and Trade (VietinBank), the Bank for Agriculture and Rural Development (Agribank), and the Viet Nam Technological and Commercial Joint-Stock Bank (Techcombank) of Viet Nam with the Industry and Commercial Bank of China, the Agricultural Bank of China, the China Construction Bank, Bank of China, and some banks in Cambodia and the Lao PDR.

Despite these efforts, there remains a “current financial service problem” as evidenced by the scarcity of commercial banks and other formal financial institutions in the border-gate areas. Some major banks opened more branches and improved their services in the border-gate areas. For example, Techcombank and the Mekong Housing Bank reached an agreement with the Industry and Commercial Bank of China in Guangxi Zhuang Autonomous Region to provide border trade settlement services at ...

Table of contents

- Front Cover

- Title Page

- Copyright Page

- Contents

- List of Tables

- Acknowledgments

- Abbreviations

- Foreword

- Abstract

- 1. Introduction

- 2. Financial Services in Cross-Border Trade of Viet Nam

- 3. Access Dimensions of Financial Services

- 4. Study Sites

- 5. Sample Profile

- 6. Discussion of Findings

- 7. Policy Recommendations

- References

- Back Cover