- 173 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Welcome to My Trading Room, Volume III

About this book

This third volume sets out more advanced trading techniques; starting with a breakdown of easy to use analytical tools, then building more complex knowledge of portfolio strategies and how to calculate a fair value of shares. This is followed by a breakdown of technical triggers and how to apply them in equities, futures, and forex trading.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Welcome to My Trading Room, Volume III by Jacques Magliolo in PDF and/or ePUB format, as well as other popular books in Business & Finance. We have over one million books available in our catalogue for you to explore.

Information

PART I

Professional Analytical Tools

CHAPTER 1

Portfolios of Professional Traders

We must free ourselves of the hope that the sea will ever rest. We must learn to sail in high winds.

—Aristotle Onassis (1906–1975)

Shipping magnate

Shipping magnate

Strategy to Professional Status: Part I

Aim

To establish your Various Portfolios Before you start to Trade

Three Specific Portfolios

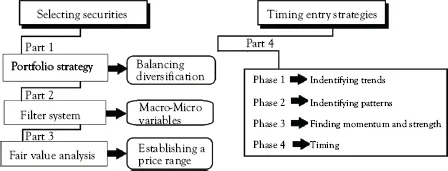

The preceding figure sets the scene for building a set of portfolios that should replace any speculation, specific shares influencing the overall portfolio, and more importantly, enables emotion to be largely removed from the equation.

Portfolio 1: Foundation of Wealth

Nearly all novice traders who come to me to join my share mentoring program want to make instant wealth. This is not a very solid foundation to build your long-term wealth. In the same breath, many say that they want to learn to trade because “I believe I can change careers and retire on more wealth than my current pension.”

Then they say that they do not want to save for their retirement—or, stated differently, they have no “trading pension plan.”

How can you build wealth and financial independence without first having sound foundational principles to build upon? I have found that many people simply have not thought about their trading plans in a logical or thoroughly enough manner. In fact, many novices start on the premise that they do not need a trading plan.

To protect your profits and maximize wealth, you need to have a plan and a strategy. Without a logical or disciplined approach, novice traders are destined to experience elation and panic all the time. This is the cycle that has to be broken if you want to build a foundation of wealth for your future.

The irony is that even skilled traders think that all gains are theirs to spend; what about costs of trading, living expenses, or retirement funds? The answer is that such traders and investors start to lose their future earning power and end up with no long-term wealth. As such, certainly, there is no foundation on which to build even more wealth.

Bottom line is that you need:

• To have a long-term portfolio to earn dividends as a retirement income.

• You need to have a salary while you build that long-term wealth. This is achieved by developing day trading strategies.

• In addition, you need a trading strategy to protect your long-term wealth, by taking advantage of short-term market anomalies.

Take the following true example:

Ken Smith came to me some seven years ago. His contention was that he could successfully trade the single-stock futures with a few well-placed technical indicators.

His aim: To turn his $2 million into $20 million within three years.

My recommendation: It would be easier to make his target by gambling at the casino.

The result: He decided to go for it alone and—within three weeks—had panicked and lost all his capital in three quick trades.

More to come ….

So, before you can start, have a plan, think about wealth and how much you really want to spend time in building that wealth. Once you have created a basic trading plan to achieve long-term wealth, start by taking a step back: think about a retirement free of financial stress—one in which you can enjoy life in a relaxed manner due to the income streams you have created through a disciplined and long-term approach.

The first portfolio is admittedly boring and not the excitement many novice traders expect when they start out in stockbroking. This is the basic equity portfolio that enables you to invest your funds in longer-term blue-chip shares, but it does give you a number of very important benefits over other portfolios:

• You own the stock, so there is no close out or geared effect over the growth of the share, as in futures positions.

• A long-term benefit is that you have time to build wealth through compounding.

• The time also gives you building blocks to learn how more complex risk management techniques work when you move to the second phase of portfolio management.

• Any related emotion is removed if you have well-thought-out strategies to enter and exit shares.

Recommendation

Methods | Portfolio strategy |

Balancing | • You should have a maximum of 12 shares in your long-term portfolio. • The shares should be evenly balanced. • Timeframe: more than three years. |

Diversification | • These should be diversified across at least three sectors. • Risk profile: The shares should be split as follows:    |

Overall portfolio cash to be invested in Portfolio 1 = 70 percent of the total funds.

Portfolio 2: Trade Market Anomalies

Once you get bored, it is time to start thinking about the second form of portfolio. Take a step back—my definition of being bored does not equate to the boring task of setting up Portf...

Table of contents

- Cover

- Half-title Page

- Title Page

- Copyright

- Contents

- Preface: How This Volume Works

- Acknowledgments

- Part I Professional Analytical Tools

- Part II Sentiment, Timing, and Alternative Triggers

- Part III Futures and Forex

- Part IV The Global Trader

- Appendixes

- Index

- Backcover