- 380 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

Setting out from an unapologetic Marxist perspective, The Long Depression argues that the global economy remains in the throes of a depression. Making the case that the profitability of capital is too low, and the debt built up before the Great Recession too high, leading radical economist Michael Roberts persuasively presents his case that this depression will persist until the profitability of capital is restored through yet another slump.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access The Long Depression by Michael Roberts in PDF and/or ePUB format, as well as other popular books in Economics & Economic History. We have over one million books available in our catalogue for you to explore.

Information

Chapter 1

The Cause of Depressions

The trigger for crisis can be any number of historical accidents such as the subprime mortgage swindle. It is necessary to deal with different levels of causation. The main point here is that capital is drawn into speculative activity when the rate of profit is low, so accident is the manifestation of necessity.

—Mick Brooks1

Those who choose to see each such episode as a singular event, as the random appearance of a “black swan” in a hitherto pristine flock, have forgotten the dynamics of the history they seek to explain. And in the process they also conveniently forget that it is the very logic of profit which condemns us to repeat this history.

—Anwar Shaikh2

The Nature of Depressions

There have been several depressions (as opposed to regular and recurring economic slumps or recessions) in modern capitalism. The first was in the late nineteenth century (1873–97); the second was in the mid twentieth century (1929–39); and now we have one in the early twenty-first century (2008–?).

Before the 1930s, all economic downturns were commonly called depressions. The term recession was coined later to avoid stirring up nasty memories. A recession is technically defined by mainstream economics as two consecutive quarters of contraction in real gross domestic product (GDP) in an economy. According to data compiled by the US National Bureau of Economic Research (NBER), recessions in the US economy on average have lasted about eleven months in the eleven official recessions since 1945. For the period recorded since 1859, recessions average about eighteen months. On average, the gap between each slump has averaged about six years in the postwar period and a little less over all thirty-three cycles, as defined by the NBER (see Table 1.1).3

Table 1.1

| Business cycle reference dates | Duration (months) | ||||

|---|---|---|---|---|---|

| Quarterly dates are in parentheses | Contraction | Expansion | Cycle | ||

| Peak | Trough | Peak to trough | Previous trough to this peak | Trough from previous trough | Peak from previous peak |

| December 1854 (IV) | — | — | — | — | |

| June 1857 (II) | December 1858 (IV) | 18 | 30 | 48 | — |

| October 1860 (III) | June 1861 (III) | 8 | 22 | 30 | 40 |

| April 1865 (I) | December 1867 (I) | 32 | 46 | 78 | 54 |

| June 1869 (II) | December 1870 (IV) | 18 | 18 | 36 | 50 |

| October 1873 (III) | March 1879 (I) | 65 | 34 | 99 | 52 |

| March 1882 (I) | May 1885 (II) | 38 | 36 | 74 | 101 |

| March 1887 (II) | April 1888 (I) | 13 | 22 | 35 | 60 |

| July 1890 (III) | May 1891 (II) | 10 | 27 | 37 | 40 |

| January 1893 (I) | June 1894 (II) | 17 | 20 | 37 | 30 |

| December 1895 (IV) | June 1897 (II) | 18 | 18 | 36 | 35 |

| June 1899 (III) | December 1900 (IV) | 18 | 24 | 42 | 42 |

| September 1902 (IV) | August 1904 (III) | 23 | 21 | 44 | 39 |

| May 1907 (II) | June 1908 (II) | 13 | 33 | 46 | 56 |

| January 1910 (I) | January 1912 (IV) | 24 | 19 | 43 | 32 |

| January 1913 (I) | December 1914 (IV) | 23 | 12 | 35 | 36 |

| August 1918 (III) | March 1919 (I) | 7 | 44 | 51 | 67 |

| January 1920 (I) | July 1921 (III) | 18 | 10 | 28 | 17 |

| May 1923 (II) | July 1924 (III) | 14 | 22 | 36 | 40 |

| October 1926 (III) | November 1927 (IV) | 13 | 27 | 40 | 41 |

| August 1929 (III) | March 1933 (I) | 43 | 21 | 64 | 34 |

| May 1937 (II) | June 1938 (II) | 13 | 50 | 63 | 93 |

| February 1945 (I) | October 1945 (IV) | 8 | 80 | 88 | 93 |

| November 1948 (IV) | October 1949 (IV) | 11 | 37 | 48 | 45 |

| July 1953 (II) | May 1954 (II) | 10 | 45 | 55 | 56 |

| August 1957 (III) | April 1958 (II) | 8 | 39 | 47 | 49 |

| April 1960 (II) | February 1961 (I) | 10 | 24 | 34 | 32 |

| December 1969 (IV) | November 1970 (IV) | 11 | 106 | 117 | 116 |

| November 1973 (IV) | March 1975 (I) | 16 | 36 | 52 | 47 |

| January 1980 (I) | July 1980 (III) | 6 | 58 | 64 | 74 |

| July 1981 (III) | November 1982 (IV) | 16 | 12 | 28 | 18 |

| July 1990 (III) | March 1991 (I) | 8 | 92 | 100 | 108 |

| March 2001 (I) | November 2001 (IV) | 8 | 120 | 128 | 128 |

| December 2007 (IV) | June 2009 (II) | 18 | 73 | 91 | 81 |

| Average, all cycles: | |||||

| 1854–2009 (33 cycles) | 17.5 | 38.7 | 56.2 | 56.4 | |

| 1854–1919 (16 cycles) | 21.6 | 26.6 | 48.2 | 48.9 | |

| 1919–1945 (6 cycles) | 18.2 | 35 | 53.2 | 53 | |

| 1945–2009 (11 cycles) | 11.1 | 58.4 | 69.5 | 68.5 | |

A depression has been defined by mainstream economics in two ways. The first is a rather formal rigid standard, namely, that an economy experiences a decline in real GDP that exceeds 10 percent, or suffers a decline that lasts more than three years. Both the late nineteenth-century depression and the Great Depression of the 1930s qualify on both counts, with a fall in real GDP of around 30 percent between 1929 and 1933. Output also fell 13 percent in 1937–38.

Second, it is argued that the difference between a recession and a depression is more than simply one of size or duration. The nature of the downturn matters as well. In the Great Depression, average prices in the United States fell by one-quarter and nominal GDP ended up shrinking by almost half. The worst US recessions before World War II were all associated with banking crises and falling prices. In both 1893–94 and 1907–8 real GDP declined by almost 10 percent; in 1919–21, it fell by 13 percent.

Neither of these definitions does justice to the reality of a depression. A more specific benchmark would be where an economy suffers a major contraction and any recovery is so weak that the trend growth path afterward is never reattained or at least takes several years or even a decade or more.

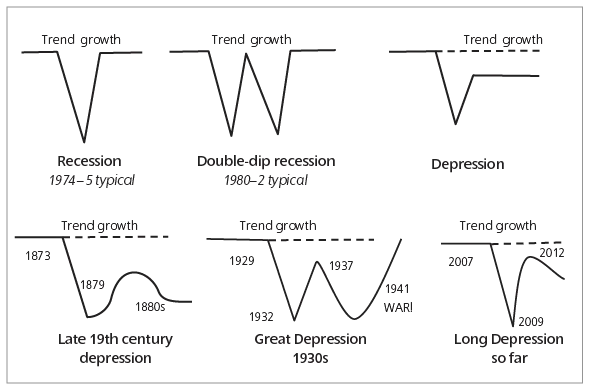

Think of it schematically. A recession and the ensuing recovery can be V-shaped, as typically in 1974–75; or maybe U-shaped; or even W-shaped as in the double-dip recession of 1980–82. But a depression is really more like a square root sign, which starts with a trend growth rate, drops in the initial deep slump, then makes what looks like a V-shaped recovery, but then levels off on a line that is below the previous trend line (see Figure 1.1). In a depression, precrisis trend growth is not restored for up to ten to fifteen or even twenty years.

With this definition, the Great Depression of the 1930s qualifies as a depression. Although the initial slump from 1929 to 1932 was the deepest in capitalist history so far, it was not the longest-lasting at forty-three months. The initial recession in the first long depression of the late nineteenth century was much longer at sixty-five months from 1873 to 1879. Recovery back to the trend growth rate in the United States was not achieved until 1940 after the Great Depression and not until the 1890s in the earlier depression. In the current Long Depression, the actual initial slump, the Great Recession, lasted only eighteen months, although this was the longest in the postwar period. Trend growth has not been achieved some eight years (ninety-six months) after the start of the Great Recession. So in that sense, it is a depression.

Figure 1.1

A Schematic View of Recessions and Depressions

A Schematic View of Recessions and Depressions

Source: Author

The Theory of Crises

What is the underlying cause of depressions in capitalist economies? I argue that it can be found in Marx’s law of the tendency of the rate of profit to fall. Marx reckoned that this law was the most important in political economy. I believe it is logical and consistent and proves the most compelling explanation of the cause of booms and slumps under capitalism and recurrent and regular...

Table of contents

- The Long Depression

- Introduction: Getting Depressed

- Chapter 1: The Cause of Depressions

- Chapter 2: The Long Depression of the Late Nineteenth Century

- Chapter 3: The Great Depression of the Mid-Twentieth Century

- Chapter 4: The Profitability Crisis and the Neoliberal Response

- Chapter 5: The Great Recession of the Twenty-First Century

- Chapter 6: Debt Matters

- Chapter 7: From Slump to Depression

- Chapter 8: America Crawls

- Chapter 9: The Failing Euro Project

- Chapter 10: Japan Stagnates

- Chapter 11: The Rest Cannot Escape

- Chapter 12: Cycles within Cycles

- Chapter 13: Past Its Use-By Date?

- Appendix 1: Measuring the Rate of Profit

- Appendix 2: The Failure of Keynesianism

- Bibliography

- Notes

- About the Author