eBook - ePub

The Passenger Has Gone Digital and Mobile

Accessing and Connecting Through Information and Technology

- 268 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The Passenger Has Gone Digital and Mobile

Accessing and Connecting Through Information and Technology

About this book

Technology is changing expectations in the airline industry. Passengers want to be in control, and they expect airlines to become solution providers and aggregators of value, to provide them with personalized services. Airline employees expect to be given the tools to do their jobs and to meet passenger expectations. Airline executives expect to make returns that are reasonable and relatively stable through business cycles. All of these expectations can be met by airlines through the effective and efficient leveraging of information and technology, to shift from being operations- and product-centric to becoming customer-centric and dramatically improving the overall passenger travel experience throughout the travel cycle. In this new book by world-renowned airline expert Nawal K. Taneja, the 7th in a series with Ashgate, the author explores and explains the game-changing opportunities presented to the industry by new-generation information and technology. He shows how information and technology can now drive, not just enable, an airline's strategy to become truly customer-centric at a personalized level, while at the same time enabling the operator to reduce costs, enhance revenues, reduce risks and become much more flexible and agile by better managing complexity.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access The Passenger Has Gone Digital and Mobile by Nawal K. Taneja in PDF and/or ePUB format, as well as other popular books in Technology & Engineering & Business General. We have over one million books available in our catalogue for you to explore.

Information

Chapter 1

Creating Information-Driven and Technology-Enabled Solutions for Airlines and Passengers

There is a game-changing shift taking place in the business sector worldwide in which firms are transforming the way they conduct their operations and the way they respond to their customers’ needs, at any time and at any place and in, as close to as possible, personalized ways. This game-changing shift is being driven by new-generation information incorporated in the business model and enabled technology, described in the next chapter (such as personalized search engines and mobile technology, including applications). Technology can now enable the collection and analyses of relevant, timely, and personalized information to become a key element of the business strategy, enabling a business to become truly customer centric and to provide solutions and aggregate value for the customer at a personalized level. At the same time, the new-generation technology is enabling firms to reduce their costs, enhance their revenues, reduce their business risks, and become much more flexible and agile by managing complexity. Moreover, new-generation technology is enabling firms to leverage their old and new sources of data to improve both their internal productivity and their strategic external collaboration to provide greater value for customers.

Mass Customization

Concepts such as customer centricity through mass customization and businesses becoming providers of solutions as well as value integrators have been around for many years. Take the concept of mass customization. It was discussed in books dating back to the 1990s.1 The idea was to explore if products and services could be customized and personalized for individual customers but produced at low costs, leading to low prices. Some businesses viewed the concept to be contradictory based on the supposition that mass production can lead to low prices, but only at the expense of the products and services being uniform. However, some businesses proved this assertion to be invalid by implementing the concept successfully, for example, the computer company, Dell, and the insurance company, USAA. Consequently, while neither the concept nor its implementation (despite on a limited basis) are new, it is the need for its mass market penetration that has become more essential, including within the airline industry, for at least five reasons:

• Passengers’ lives are becoming complex, time-constrained, and more diversified. Therefore, passengers are looking for easy solutions for their sometimes complex travel needs, not transactions (even if they are efficient), or even the lowest price.

• Competition is increasing among existing airlines as well as from new players, such as technology companies that are about to take distribution to new levels through intelligent market segmentation and personalized offers.

• The high-margin segment of the marketplace (premium travelers) is growing at a much lower rate than the lower-margin (leisure travelers) and it is becoming more discriminating. The lower-margin passengers, on the other hand, while benefiting from inflation-adjusted declining fares, are experiencing various levels of frustration relating to the services provided and lack of sufficient transparency. Middle classes are increasing in many emerging markets and their needs are different than the needs of the middle classes in developed markets. Populations are becoming older and living longer.

• Business is shifting from the West to the East with high growth rates expected in Asia Pacific and lower in North America and Europe.

• The airline business is becoming even more complex with the convergence of business models among the two main sectors within the airline industry (low cost airlines and full service airlines) and the increasing uncertainties and volatilities relating to the global economies and all sorts of other challenges (like volcanic ash, oil price fluctuations, or environmental restraints).

Ironically, just as the need for mass customization is becoming more imperative, the availability of a new-generation of information (for example, Web traffic and interactions through social media) and technologies (particularly, online, mobile, and social) now make information-based mass customization feasible, providing not only variety with a lower production cost, but also a higher quality. The higher quality feature can come from the delivery of services that meet individual needs and provide a better buying experience (enabled, for example, by the comparative shopping feature). At the same time, the successful implementation of cost-effective mass customization can enable airlines (now offering commoditized products/services) to be able to identify diverse segments and provide each one with a differentiated value proposition, thereby moving the focus away from buying on price.

The main thought to keep in mind is that new-generation information and enabling technology are now providing both passengers and airlines with an unprecedented number of choices. For passengers, new-generation information provides service options relating to airlines, airports, fares, alliances, and so forth. For airlines, there are options to use technology to cut costs, introduce new functionality, reduce time to market, or improve customer experience. The whole idea behind the airline business model transformation is for people in the airline organization at different levels to be able to obtain relevant and timely information and convert it into intelligent solutions for passenger-related or airline-related problems in a quest to become more customer centric.

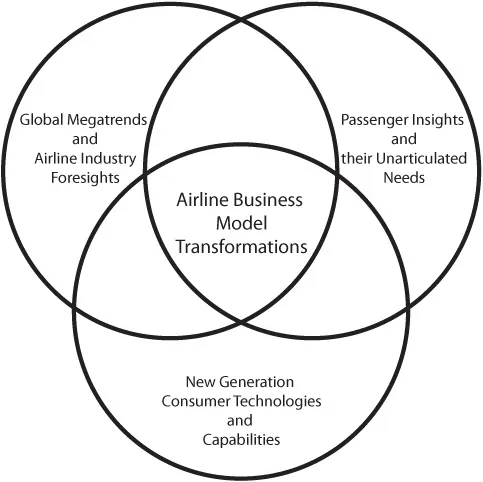

New business model opportunities can be explored from the intersection between three components: (a) global megatrends and airline industry foresights, (b) passenger insights and their unarticulated needs, and (c) new-generation consumer technologies and capabilities, as shown in Figure 1.1. First, there is competition between low cost carriers and the large network carriers. The latter group is coming to the conclusion that while it has reduced its operating costs, the cost levels are still too high to provide competitive services in short- and medium-haul markets. Within the low cost sector it is also becoming evident that there are limits to the future growth of airlines if they were to continue with their current business strategies. This point is addressed later in this chapter. Second, competition will increase at an unprecedented rate for the three major European carriers as the three major Gulf-based carriers in the Middle East increase their capacity. Emirates Airline has already become one of the top 10 carriers in terms of its size, operating to 65 countries with a fleet of 150 wide-body aircraft. More than 200 aircraft are still on order. Third, competition will also increase for the old world global airlines from the four major airline groups based in China—Air China, China Southern, China Eastern, and Hainan. According to the research conducted by the Centre for Asia Pacific Aviation, Air China is now the world’s top valued airline in the eyes of investors.2

Figure 1.1 Potential Framework for Airline Business Models

In terms of passenger insights, airlines can now include input from passengers not only in the development of new service offerings, but also in creating solutions to their current problems occurring at most touch points in the travel chain and improving the passenger travel experience. Most importantly, airlines can now implement ways of capturing both articulated and unarticulated needs by monitoring, for example, Web shopping behavior. These needs vary significantly by passenger and by situation for the same passenger. Even relating to a given need, such as greater transparency, there is much variation. One passenger wants greater transparency relating to the fare while another wants transparency relating to information that is sometimes inaccurate, untimely, or irrelevant from the point of view of the ability to take an action. Some airlines are beginning to offer passengers the ability to customize their travel experience. EasyJet in Europe was one of the early adapters of this concept. Figure 3.3 in Chapter 3 illustrates United Airlines’ initiatives in this area. Clearly, there are limitations relating to the size of the market segment desiring customization, the limitations of infrastructure to produce customized products, and the costs of providing customized products. Admittedly, infrastructure is also required for information and technology. And, this infrastructure is not trivial, as it requires planning, growth, and investment, just like any other kind of infrastructure. However, unlike traditional infrastructure, that becomes less useful over time, information and technology infrastructure, especially when it is centered around data collection, becomes more powerful and more broadly applicable over time.

The airline industry foresights component relates to a comprehensive understanding of emerging megatrends and monitoring their continuous shifts to develop new competitive strategies. These foresights relate to various forms of consolidation and various forms of cooperation and competition among carriers within alliances and between different sectors of airlines. New-generation consumer technologies and capabilities (such as personalized search engines and digital travel concierges) relate to the acquisition of appropriate information for the first two components and for airlines to act accordingly with proactive, dynamic, and agile passenger-centric and competitor-centric strategies.

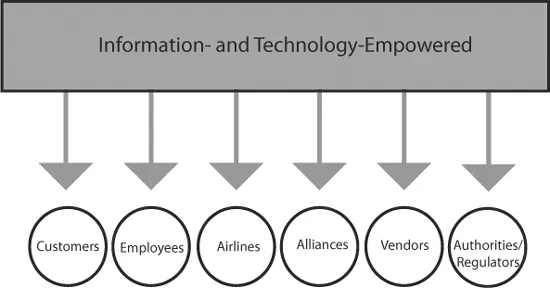

Information-based mass customization, assuming it is one way to transform airline business models, requires not just the acquisition of new-generation information and technology, but it will also require a clear articulation of vision, a fitting organization structure, an enabling corporate culture, adaptive supportive systems, and expediting processes. Vision relates to how an information-savvy airline might see a creative mass customization technology platform to achieve profitable growth that is sustainable. Organization structure refers to not just where the technology group sits but also how it facilitates communications, coordination, and collaboration among closely related groups such as those shown in Figure 1.2. Systems refer not just to technology but also to how employees are selected, trained, empowered (provided with business intelligence tools), kept motivated, and rewarded. Processes relate to how customer profiles are built using behavioral data, how they are kept updated, and how they are used to provide solutions to passengers.

In the final analysis, information-based mass customization would depend on the availability of relevant and timely information that must be available to passenger-facing employees at each touch point (at check-in or in flight) on a consistent, personalized, and actionable basis. This information must also be available through a wide array of devices and channels (websites, kiosks, call centers, mobile devices, and so on) and at different locations, including in the aircraft itself, while in flight, so as to be able to engage with an individual passenger, and provide meaningful solutions to problems as they occur, or even better, before they occur.

In addition to the passenger-facing staff, executives also need to have access to technology and information to test new mass customization ideas themselves, and quickly, rather than depend entirely on the centralized technology department. Given the importance of this capability, it is the responsibility of the technology department not just to acquire and implement new-generation technologies but also to support the development and assessment of new, including ambiguous, concepts on an ongoing basis. Information-based mass customization clearly requires on an ongoing basis business intelligence (including the functionality to integrate and synthesize unstructured data) on internal operations as well as external parties such as passengers, competitors, and vendors as well as authorities and regulators (as shown in Figure 1.2). Therefore, planning processes need to change dramatically in all departments to achieve mass customization, enabled by information and technology, to take a deep dive into the purchase behavior of passengers and their expectations for solutions when problems arise. While such a deep dive can easily be achieved by mining information through the use of such technologies as Web crawling and text mining, the achievement of mass customization requires also a change in corporate culture to break down the internal and external silo systems, typified in Figure 1.2.

Figure 1.2 Information- and Technology-Empowered Holistic Framework

Solution Orientation

Just as with mass customization, the story is similar in the case of companies becoming solution providers. One famous case study relates to the leadership of Louis Gerstner Jr. when he was able to turn IBM around, in part, by repositioning a company that sold computer hardware, software, and information and technology services to a company that provided solutions to its customers’ problems. While the concept itself is fairly straightforward, its implementation is complex as it involves changing the culture of the corporation. Going back to the case of IBM, it was a strong-willed outsider who was able to change the culture. For example, insiders were not willing to accept defeat with the marketing of some products, such as, the OS/2 software and the IBM desktop computers. At the same time, the three major internal divisions remained focused more on internal competition than on the needs of external customers. It was Lou Gerstner’s success in changing the culture of the corporation that enabled the successful implementation of the concept of a solution provider.3

Can such a cultural change be implemented in many large “old world” airlines to build a stronger relationship with their passengers to become proactive even in creating solutions, let alone creating customized solutions that are innovative? The time to make the step-changing culture shift is now given that passengers are demanding new service value propositions, and information and technology are now becoming available for airlines to interact with passengers in real time to learn about their real problems and provide meaningful solutions, even if it means recommending and selling the services offered by competitors. Should an airline sell a seat of its competitor on its website if it solved the critical need of a passenger (even one of its top-tier passengers, let alone a new passenger)? Ironically, there are some airlines that are reluctant to even sell seats on their alliance partners if it is possible to keep the passengers flying on their own aircraft even if their own flights are less convenient. This predicament is an example of some airlines’ lack of passenger-solution perspective.

As with the case of mass customization and provision of solutions, the concept of companies becoming value integrators is not new either. In fact, within the aviation industry itself, Pan American World Airways was the first airline to exploit this concept. The legendary airline entrepreneur and founder of Pan American, Juan Trippe, made transatlantic and transpacific travel possible when there were no viable airplanes, no qualified crews or crew bases, no navigational aids, no en-route landing fields, not even bilateral agreements between governments. Even if some of these products, facilities, services, and regulations had existed, true value could not have been achieved by simply integrating them. He was a true value integrator in that he created the missing elements, coupled them with the existing elements, and then operationalized the entire combination at the point of integration, and that is how he made money and made Pan Am a global brand. Decades later, FedEx succeeded in creating a highly demanded value proposition (door-to-door delivery of small packages) by starting with the integration of the services provided by trucking companies with those provided by airlines. However, real value was provided not simply by combining the services of two different transportation businesses, or even by utilizing the hub-and-spoke system (that had previously been used by airlines such as Delta and Eastern in Atlanta), but by integrating the combination of the three with a fourth component, the creation and deployment of information and technology, first to operationalize the door-to-door concept, and later to provide even more value by enabling shippers to track their packages.

Accordingly, application of the aforementioned concepts (while not new to businesses, including the airline sector) can now be taken to new heights through the use of new-generation information and enabling technologies. Admittedly, in the case of the airline industry, their implementation has been somewhat difficult because of the need to accommodate on one airplane a very broad spectrum of passengers (with an equally broad spectrum of needs and sensitivities to price) and a wide array of operational constraints, with many outside the control of the airline industry. Despite such difficulties, some airlines have already proven (to a limited extent, given the operational constraints) that they can become value integrators and solution providers.

Let us first consider some historical examples of airlines being solution providers for passengers:

• Passengers wanted to travel from their points of origin to their points of destination on multiple airlines (flying in multiple segments) using one ticket issued by one organization (an airline or an agent) and paid for through one transaction (say a credit card) and in one currency. Airlines developed interline agreements, bank settlement payments, and a single ticket for multi-segment travel.

• Passengers living in smaller cities wanted higher frequency service in a broad spectrum of markets and at reasonable fares. Airlines developed hub-and-spoke systems that connected thinner markets among themselves as well as with higher density markets and with a broad spe...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Contents

- List of Figures

- Preface

- Foreword by Akbar Al Baker, Chief Executive Officer, Qatar Airways

- Foreword by Eric R. Conrad, IBM Travel & Transportation Global Industry Leader, Global Business Services

- Foreword by Constantino de Oliveira Jr., Chief Executive Officer, GOL Linhas Aéreas Intelgentes

- Foreword by Tewolde GebreMariam, Chief Executive Officer, Ethiopian Airlines

- Foreword by Henry H. Harteveldt, Vice President, Principal Analyst, Airline and Travel Research, Forrester Research, inc.

- Foreword by Peter Hartman, Chief Executive Officer, KLM, Royal Dutch Airlines

- Foreword by Dr. Christoph Klingenberg, Senior Vice President, Information Management and Chief Information Officer, Lufthansa German Airlines

- Foreword by Tan Sri Dr. Munir Majid, Chairman, Malaysia Airlines

- Foreword by David Neeleman, Chairman, Azul Brazilian Airlines

- Foreword by Azran Osman-Rani, Chief Executive Officer, AirAsia X

- Foreword by Greg Schulze, Senior Vice President, Global Tour and Transport, Expedia Inc.

- Foreword by Francesco Violante, Chief Executive Officer, SITA

- Acknowledgements

- Introduction

- 1 Creating Information-Driven and Technology-Enabled Solutions for Airlines and Passengers

- 2 Game-Changing Technologies for Airline Business Models

- 3 Current Information- and Technology-Enabled Initiatives

- 4 Potential Information- and Technology-Driven Initiatives

- 5 Hurdles in Implementing New Enabling Technologies

- 6 Opportunities for Overcoming Hurdles

- 7 Preparing for Competitive Renewal Opportunities

- Appendix: BSI: Teradata Webisode: The Case of the Mis-Connecting Passengers

- Index

- About the Author