![]()

1. A brief history of EU policies for financial integration

Financial integration in the European Union has been a long-term process, begun in 1957, which has involved a complex interaction of economic, social and political factors. Financial integration is the process through which different regions or countries become more financially interconnected, ultimately producing private risk sharing to withstand asymmetric shocks and a convergence of prices and returns for financial assets and services. An increase in cross-border asset holdings would be a proxy of private risk sharing.

Three waves of financial integration

The history of EU policies to promote financial integration can perhaps be summarised in three main waves, led by different political and economic events. The first wave was led by the post-world war reconstruction phase. The European stagnation following the two oil crises and the end of the Bretton Woods system led the second wave. The effects of the financial and sovereign crises of 2008 and 2010 currently lead the third wave.

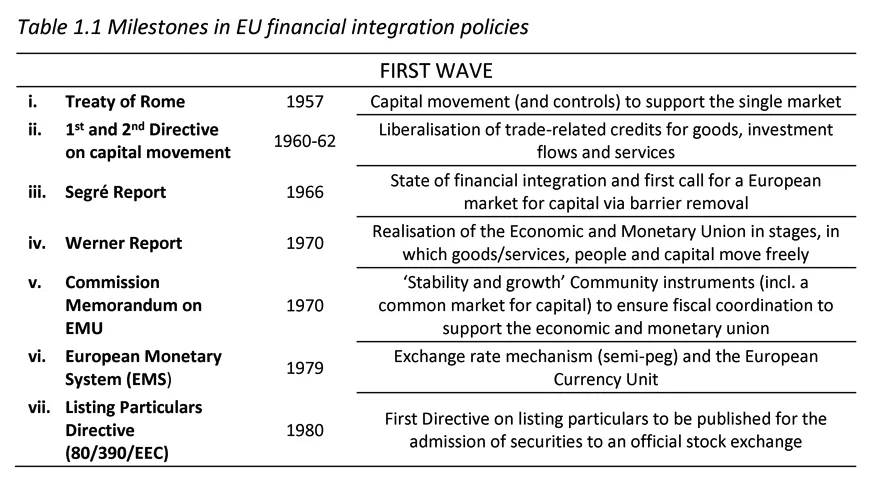

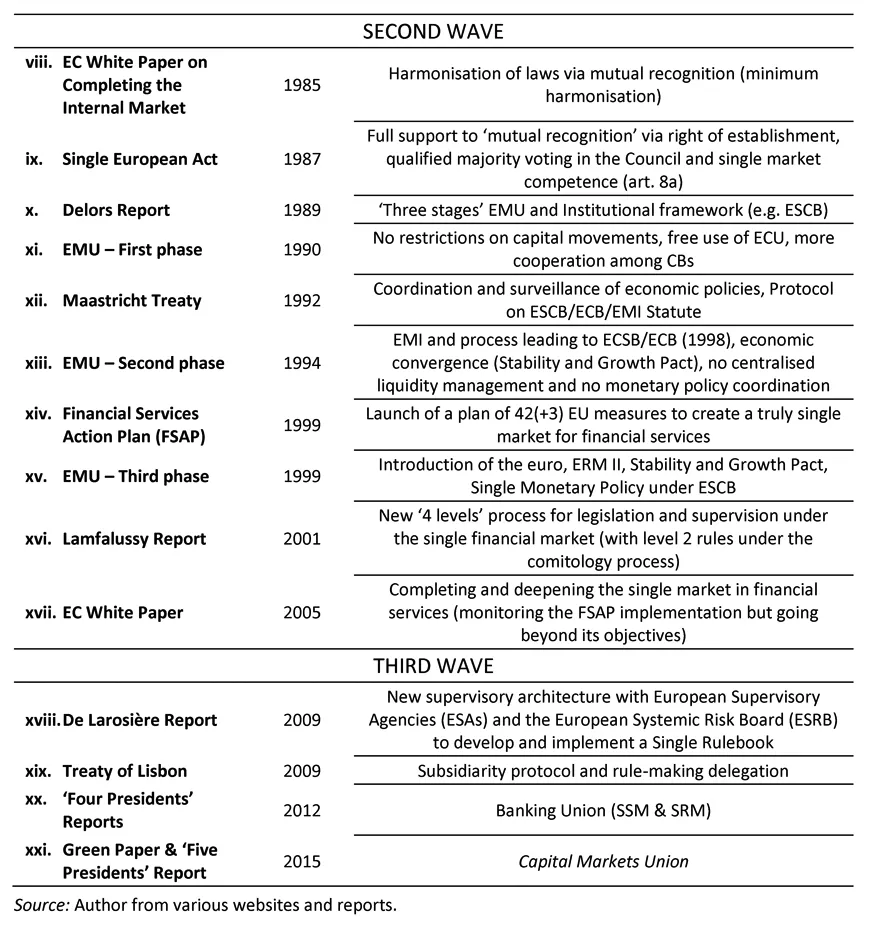

It took on average about 20 years each to complete the first two waves of financial integration and most likely it will take a comparable amount of time to complete the last one. Table 1.1 summarises the key steps of this integration process. The following section will discuss in detail some of these steps to set the stage for the CMU action plan in the European financial integration process.

1.1 The first wave of financial integration

The history of European financial integration goes back to the founding Treaty of the European Communities in 1957.2 Article 67 established the free movement of capital, but only when necessary to the functioning of the single market. The subordination of capital liberalisation to what was needed for the single market did not allow direct application of this article, but it nonetheless helped to approve two Capital Directives in 1960 and 1963, which opened up the common market for capital around trade-related credits.3 It was a great advance, but it was still limited to some banking transactions and ignored capital markets in the broad sense (including securities). Capital markets integration was described not much later on as a pre-condition for the monetary union by the Segré Report (CEEC, 1966).

Treaty of Rome and Capital Directives

Taking stock of fragmented capital markets at that stage, the Segré Report reviewed the status quo and proposed a list of areas to which to direct more attention, such as regulation of the financial sector and market funding for public authorities. Most importantly, the report dwelled for the first time on the role of a more integrated securities market as a source of funding for firms and a way to better allocate savings and argued that:

Segré Report

“[...]there can be no monetary union in the Community without such a market” (CEEC, 1966, p. 15).4

The report also stated that focusing only on primary markets is insufficient. The efficiency of secondary markets is as important for price discovery. Equity/debt tax bias (CEEC, 1966, p. 214), double taxation and discrimination against host service providers, fragmentation of the investment management industry (i.e. the absence of a pan-European pool of institutional investors) were crucial issues already at that time. Insufficient information flow was instead crucial for secondary markets, which were much smaller in the 1960s.

“Lack of information by which the comparative merits of different types of investment can be assessed, especially from the point of view of their yield and soundness, induces savers to stick to the simplest forms, like sight deposits and savings deposits, because they are not in a position to assess the advantages of other forms of investment, such as securities” (CEEC, 1966, p. 226, para. 5).

Ongoing mandatory corporate disclosure and other company information, which can promote more equity investments and cross-border listings, were missing at that time and their implementation under EU rules is still today a source of concern on a pan-European scale (see Chapter 4 for more details). The report also called for more cross-border trading in bonds for savers to reap the benefits of risk diversification.

The gradual collapse of the Bretton Woods system, between 1968 and 1973 (see, among others, Garber, 1993), raised concerns about the stability of the European internal market as currency volatility rose across Europe. To ensure the stability required for the a development of the internal market, in 1969, heads of state or government gave a mandate to a group of experts,5 chaired by Pierre Werner, to explore the idea of an economic and monetary union (EMU) in the European Community (Council and Commission of the European Communities, 1970). Due to unfavourable market conditions and political pressures, however, the report postponed a strict timetable and focused instead on cooperative systems to ensure irreversible convertibility of exchange rates. This work also led to a memorandum of the European Commission (CEC, 1970), calling for greater coordination of economic policies and putting a common capital market on the same level of the common market for goods. It also proposed the completion of the economic and monetary union by 1976-78, but this attempt also failed, as market conditions did not favour member states’ political support to give up control over foreign exchange policies.

Werner Report and Commission Memorandum

1.2 The second wave of financial integration

Despite the spectacular failure of the Werner Report and of the Commission memorandum, these reports sowed the seeds for the European Monetary System (EMS) in 1979, in a highly volatile post-Bretton Woods monetary system. The EMS was an exchange rate mechanism through which currencies were semi-pegged to the European Currency Unit (ECU), i.e. a basket of European currencies weighted by a pre-determined value that later became what we call today the euro currency. Not much more than that concretely happened in the field of financial integration since the second capital directive was approved in 1963. The Casati case6 in 1980 confirmed the non-direct applicability and subordination to the single market of the freedom of movement of capital enshrined in Article 67.1 of the Treaty of Rome (see Louis, 1982). Nonetheless, the instability of the global financial system and important political events, after the end of Bretton Woods, led to two major financial crises in 1973 and 1979 (also called the ‘oil shocks’ because they were triggered by a sudden and sharp rise in oil prices). The slow recovery from the shocks raised concerns that the gradual elimination of tariff barriers and the stabilisation of the exchange rates in the area were insufficient to bring Europe back to growth and unleash the single market (Key, 1989). Non-tariff barriers, together with the complete removal of capital controls,7 then came to the attention of European policy-makers as the next step for the financial integration process. Financial integration was again considered (as the Segré Report had done) as a tool to support the exchange rate stabilisation.

Post-oil shocks environment

At the beginning of the 1980s, as the European economy was struggling compared to that of the United States and Japan, integration policies for the single market were seen as a key driver for the economic and political stabilisation of the area. The important Cassis de Dijon ruling of the European Court of Justice in 19798 established the equivalence of home-country standards applied to goods in a host member state. The principle of the ruling was somehow confirmed by the ‘insurance undertakings’ case (European Commission v. Germany, Case C-205/84), in which the ECJ denied Germany the possibility of obliging foreign insurance companies to be permanently established and authorised by the German state. Building on these two important rulings, the European Commission released the 1985 White Paper on completing the internal market by 1992 (also called the Single Market Programme), which argued for the first time that the establishment of a single financial market would require both free movement of capital and free movement of financial services (CEC, 1985, p. 6). Financial integration would thus be based on a combination of right of establishment, i.e. the ability of a financial institution to set up a permanent activity in any member state, free movement of capital and free movement of services across the European Union. It de facto put goods, services and capital on the same level, thus leaving legal space for the use of the Cassis de Dijon (‘mutual recognition’ for goods) also in the area of cross-border provision of financial services. Mutual recognition would then be combined with a minimum set of European rules (minimum harmonisation) to be more effective and create a minimum level of trust among member states.

Completing the internal market

Mutual recognition was a great legal innovation, which ultimately pushed the single market project forward, after full harmonisation attempts never really gained momentum. The 1985 White Paper, therefore, called for a renewed commitment to the complete the internal market via the removal of physical, technical and fiscal barriers by 1992 (“The time for talk has now passed. The time for action has come”, CEC, 1985, p. 7; see also Oliver & Baché, 1989, and Key, 1989). The Single European Act, which entered into force in 1987,9 reiterated the importance of completing the single market by the end of 1992 (Article 8a). Most important, though, it indirectly enshrined the mutual recognition principle in the Treaty (to support the ECJ ruling) via the strengthening of the right of establishment (Article 52), which limited local additional restrictions on top of the home-country regime (Article 53) and imposed a principle of equality between foreigners and nationals (Article 58). Most notably, the Single European Act also removed unanimity in the Council for single market matters in financial regulation, introducing the qualified majority voting, which facilitated the approval of key financial reforms over the years.

Mutual recognition

At the end of the 1980s, closer European integration was indeed the main political project emerging from the ashes of the Cold War, even before the Berlin Wall collapsed in 1989. This macro-political momentum building around the Single European Act of 1987,10 together with a renewed attempt to stabilise exchange rates for good this time, led the European Council in 198811 to restate the “objective of progressive realisation of economic and monetary union”, which originally came out in the Werner Report but had not found enough political support (Council and Commission of the European Communities, 1970). A Committee, chaired by the European Commission President Jacques Delors, was entrusted the task of “studying and proposing concrete stages leading towards this union.” The report stated (CSEMU, 1989, pp. 14-15) that there were:

Delors Report and EMU

“three necessary conditions for a monetary Union:

- The assurance of total and irreversible convertibility of currencies;

- The complete liberalization of capital transactions and full integration of banking and other financial markets; and

- The elimination of margins of fluctuation and the irrevocable locking of exchange rate parities.”

The introduction of the single currency, therefore, was only part of the economic and monetary union project, including the “full integration of banking and other financial markets”, which we call today banking and capital markets (or financial) unions. The EMU plan was then partially enacted in three phases:

1. From 1 July 1990, complete freedom of capital transactions, free use of the ECU and greater coordination among central banks and among governments;

2. From 1 January 1994, greater convergence of economic policies12 and launch of the European Monetary Institute (predecessor of the European Central Bank, ECB);

3. From 1 January 1999, introduction of the euro and single monetary policy via the European System of Central Banks (ESCB) led by the ECB and entry into force of the Stability and Growth Pact.

From 1989 to 1999, most EU countries decided to undertake a fundamental project of financial integration that was a catalyst for other reforms and further financial integration beyond the EMU boundaries.

The Single Market Programme (SMP) discussed above and the acceleration of political momentum, led by the phasing-in of the EMU, were able to reinvigorate the financial integration process for the whole European Union with concrete actions, especially in the market for services (CEC, 1994, 1996; Allen et al., 1998). The implementation of the SMP led to at least five key directives in financial services, which are still today (in their revised version) milestones of the liberalisation and integration process of financial services in Europe. These five directives are: the Second Banking Directive,13 the Undertakings for Collective Investments in Transferable Securities (hereinafter “UCITS”),14 the Investment Services Directive (hereinafter “ISD”),15 the Life and Non-Life Insurance Directives.16 The Second Banking Directive is by far the most important because it was the first real application of mutual recognition to financial service p...