![]()

Chapter 1

The Six Points You Need to Know to Understand the Federal Budget Crisis

Finance Minister: Here is the Treasury Department’s report, sir. I hope you’ll find it clear.

Groucho Marx: Clear? Huh. Why, a four-year-old child could understand this report . . . Run out and find me a four-year-old child—I can’t make head or tail of it.

—Duck Soup, 1933

Open any newspaper, tune in to any newscast, and someone will be tossing around billion- and trillion-dollar estimates about government spending and squabbling about the nation’s finances. It certainly sounds important, but they don’t make it easy for people who aren’t policy wonks to understand. The numbers are mind-boggling, and the jargon is even worse. Unfunded liabilities, revenue neutral tax reform, entitlement spending, discretionary domestic programs, baseline assumptions, percentage of GDP. Faced with phrases like these, most of us reach for the remote to see what’s going on in TVLand. But this debate is crucial to our future. Deep inside, you know it matters; otherwise, you wouldn’t have opened this book.

For years, the budget issue was a sneaky, slow-boil kind of a problem, one that was easy for most of us to avoid. After all, politicians don’t like to talk about cutting programs or raising taxes—which we’ll no doubt need to do in some form or another in order to fix this budgetary mess. And yes, fellow Americans, we’ve earned our share of the blame, too.

Let’s be frank. When was the last time you cast your vote for a candidate who campaigned on getting the country’s finances back on the right track? What about one who wanted to cut government programs you like and raise taxes (which no one likes)? What do we talk about instead? Who had the most glittering celebrities at their fund-raiser. Who had the best zinger in the debate. Which candidate is making the cleverest use of YouTube. What a candidate did or did not do when he or she was twenty-something. No wonder so few people want to run for office these days—how would you like to have to defend everything you did and said in your twenties, or your thirties for that matter? And what about that pet question from the pre-pre-election polls: Which candidate would be more fun to have dinner with? How many Americans actually have dinner with presidential candidates, anyway? Go ahead, ask John McCain or Barack Obama to meet you at Chili’s sometime. See what happens. Is this what we really want from these people? Why do we spend time on this?

The truth is that those of us who aren’t in government or politics—those of us who generally watch from the sidelines trying to make sense of it all—had better start paying much more attention to the debate about the federal budget and the huge expenses we face in the coming decades. What’s decided (or not decided) over the next few years will spell big changes for the way we live our daily lives. How the country solves or doesn’t solve this problem will affect our paychecks, our investments, our mortgages, our kids’ prospects in life, what kind of health care we’ll get, our chances of ever getting to retire—even whether we live in a country that’s fair, stable, and prosperous. And let’s not kid ourselves. Right now, the savvy and well connected are already strolling the halls of Congress pushing for solutions that benefit them. So ignoring this debate is really not a very good option.

Fortunately, once you strip away all the confusing terms and unnecessary shouting, the budget problem isn’t as hard to understand as the people in charge would like you to think.

THE BUDGET DEBATE, PARKING LOT VERSION

If you missed this on Entertainment Tonight or Entourage, a “parking lot version” is what Hollywood producer types call the shortest, simplest description of a movie or TV idea. Basically, it’s what you can say to a studio exec if you’re lucky enough to meet one in the parking lot, and you have to pitch your idea in the time it takes to walk to your cars. In Manhattan, which is short on parking lots, it’s called the “elevator version.”

We’ve reduced the budget issue to six essential points. Get these, and you’re a long way to understanding what all the hoopla is about.

1. For thirty-one out of the last thirty-five years, the country has spent more on government programs and services than it has collected in taxes.

2. Every year the government comes up short, it borrows money to cover the difference. We’ve now built up a very big debt—approaching $15 trillion by the end of 2011, and yes, that is trillion with a t.

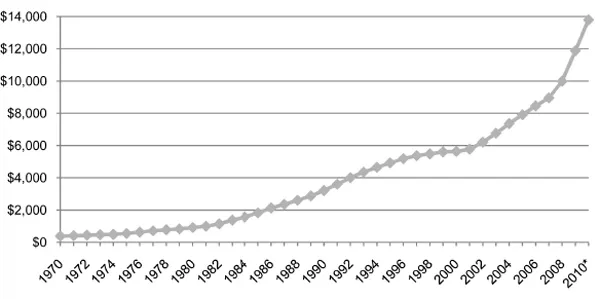

Gross National Debt (in billions of dollars)

* The national debt always tends to increase, but as you can see, over the past few years the debt has leaped up, to the point where the U.S. government is now roughly $14 trillion in debt. Source: Budget of the United States Government, FY 2011

3. The country will have humongous additional expenses over the next couple of decades as the baby boomers begin to retire and health care costs rise.

4. There is no realistic way government can lower taxes (or even keep them at current levels), spend money on everything people want the government to do (at least according to the polls), and still end up with a balanced budget.

5. If we keep on going the way we’re going, the debt will get bigger and begin to endanger the U.S. economy and our own personal finances and plans. And the government won’t have enough money to pay for Social Security and Medicare for the boomers and still do what most of us expect government to do.

6. A substantial portion of the country’s debt is held in foreign countries. Right now, these foreign investors consider U.S. government bonds one of the safest places in the world to put their money, but they could decide at some point that China or some other place is a better bet. This would be the global equivalent of a store clerk seizing your credit card and cutting it up.

If the country’s state of financial affairs reminds you of people who spend more money than they make nearly every month, while cheerfully adding on to their credit card debt hoping that nothing will go wrong, you’re not that far wrong. Obviously, government finances and family finances are different. For one thing, the government can probably raise taxes a lot more easily than most of us could just suddenly raise our own salaries substantially. The worst-case scenario is also much different. The president isn’t going to walk out of the White House one morning and find out someone’s repossessed the armor-plated limousine. But the concept is pretty similar. You can live beyond your means for quite a while without too much fuss (as long as nothing goes wrong). But at some point, the amount you owe begins to take its toll on the way you live.

SO WHY DO THEY KEEP DOING IT?

Given the dangers and the fact that everyone knows that the huge baby-boom generation is coming up for retirement now, why does the government keep on spending more than it takes in, you may ask in your best Cindy Lou Who voice. After all, politicians talk about balancing the budget and cutting the deficit all the time. The simple answer is there’s always something people want more, whether it’s tax cuts or better benefits or a stronger military. In some cases, that can be a perfectly reasonable choice. The country ran large deficits during World War II, for example.

DEFICITS BEGIN TO FEEL NORMAL

There are good reasons for the country to run a deficit every so often, but if you do it long enough (thirty-one out of thirty-five years, for example), it starts to feel normal. It’s nearly always easier for politicians to add to the debt than raise taxes or cut popular programs. In fact, in Washington these days, they don’t even seem able to cut unpopular programs—if some politically connected someone somewhere likes it, it stays in the budget. And like a slow-growing tumor in the national economy, the debt just keeps on growing until it becomes really dangerous—dangerous enough to affect the livelihood and lifestyle of nearly every single American.

What would actually happen if the country keeps on spending more than it takes in, and the debt continues to mount?

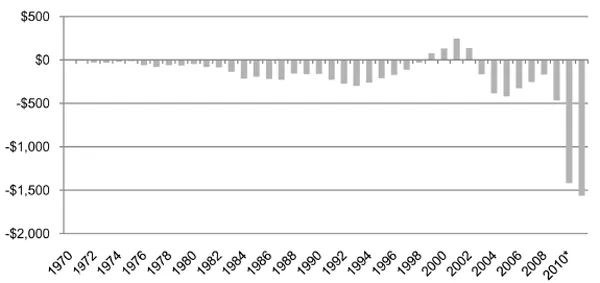

Federal Budget Deficits/Surpluses

* Deficit spending has become routine for the U.S. government, with the government running in the red for thirty-one of the last thirty-five years. Source: Budget of the United States Government, FY 2011

When we wrote about the country’s budget problems a couple of years ago, there were some optimistic experts who didn’t think much would happen at all. They just didn’t think the country’s debt was so serious given how large our economy is. Many believed that in the new global economy, there would always be people in other countries with money to lend to the U.S. government (by buying government bonds). To them, that meant that the United States could carry a fairly hefty amount of debt without much fuss.

Not much good came out of the global economic meltdown of 2008 and 2009, but it did give us a really unpleasant preview of what it’s like to be carrying a huge debt and suddenly hit economic bad times. That was true for a lot of us personally, and it was certainly true for the country as a whole.

When the recession hit, the U.S government was suddenly getting much less money coming in from taxes. Fewer people were working, and many of those who were working weren’t making as much money. Businesses weren’t making much money either, so tax revenues plummeted more than $400 billion from 2008 to 2009.

At the same time, there was a very long line of people wanting the U.S. government’s help getting through the tough times. Maybe your mind has immediately flown to the gigantic banks that were deemed “too big to fail” despite their risky bets on subprime mortgages, or AIG, the high-flying insurance company that underwrote those crazy risks and had to be bailed out by the government. Yes, they were there with their hands out, complete with pinstripes, tasseled loafers, and limo driver waiting outside. No, we don’t feel sorry for them either. But there were plenty of other people who needed and got government help: people collecting unemployment insurance who needed extended benefits because the job market was so terrible; states and cities who wanted the federal government’s help so they wouldn’t have to lay off teachers and police officers during the downturn.

And finally, there was the very grim possibility ...