Overview – The 12 Reasons You Need to Plan

Forty years ago, the financial planning profession did not even exist, yet today, hundreds of thousands of people claim to be financial planners (and some of them actually are!). But is financial planning really necessary?

Well, yes. Here are 12 reasons why you need to plan.

Reason #1: To Protect Yourself and Your Family Against Financial Risks

Notice the word financial. As a financial planner, I cannot protect you from the risks you face in life — no planner can — but I can protect you from suffering the financial loss that may result when any of those risks become reality. What are those risks? The five major ones are job loss, injury, illness, death, and lawsuits, and you’ll learn how to manage and reduce the adverse financial impact of those risks in Parts VII and XI.

Lawsuits? You bet! For perspective, the odds that your house will burn down are 1 in 1,200 — yet according to Forbesmagazine, the odds are just 1 in 200 that you will be sued at some point in your lifetime. (To learn how to protect yourself from the financial threat of a lawsuit, see Chapter 75.)

Reason #2: To Eliminate Personal Debt

For some people, a proper goal is to become worthless. If you owe lots of money to credit cards, auto loans, and student loans, becoming worthless would be a real improvement. You must move from owing money to owning money.

Indeed, total consumer debt in this country (excluding mortgages) exceeds $2.5 trillion, according to the Federal Reserve. A 2008 survey from Gallup Research reveals that Americans hold an average of four credit cards each, with an average total balance of $3,848.

You’ve heard the joke about “running out of money before you run out of month,” but it’s not so funny to run out of money before the end of your life! You must make sure you don’t outlive your income, and that means you’ve got to accumulate assets so you can support yourself for a lifetime. That’s impossible to do if you have credit card debt and personal loans, so you must eliminate them. Chapter 49 will show you how.

Reason #3: Because You’re Going to Live a Long, Long Time

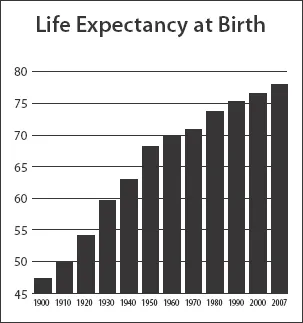

At the time of the American Revolution, life expectancy at birth was 23 years. Even by 1900, Americans were expected to live only to age 47. Thus, throughout most of our nation’s history, if you were alive, you worked; there was no such thing as retirement.

How Old Will You Be in 2110?

The ridiculous part of all those life expectancy tables is that they all assume that life expectancies will remain at current levels. But that is not likely to be the case. Indeed, research suggests that people will continue to live longer and longer. In fact, even those as old as 45 today might be alive in the 22nd Century.

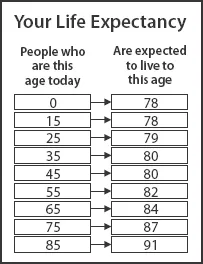

Why are these figures important? Well, to determine how much money you’ll need in retirement, you need to project how long that retirement might last. Based on the actuarial data provided by various government agencies, most financial planners assume their clients will live to age 90, and conservative planners (my firm included) use age 95 (because the longer you live, the more money you’ll need). We’re now even considering boosting the life expectancy for our younger clients to 100.

You’ll Have Multiple Marriages

First, you might have four or five spouses during your lifetime. Like all the other futurisms to follow, this one is not as far-fetched as it may first appear. After all, we’ve all heard the oft-quoted statistic that half of all marriages end in divorce. And U.S. Census research shows that 58% of women over 70 have been widows at some point — with a great many of them remarrying. Thus, we’re already a multiple-marriage society. It’ll just become more so. (After all, can you imagine marrying someone at age 20 and living with that same person for the next 120 years!? Honey, I love you, but ...)

You’ll Have Multiple Careers

Second, you will have five or six careers. You’ll go to school, get a degree, develop expertise in a given field, devote yourself to it for 20 or 30 years, then quit and start again, doing something entirely different. Think that’s crazy? Millions of military retirees, police officers, firefighters, and schoolteachers already do this. They “retire” at 40 or 50 with 20 or 30 years of service and, with their monthly pension checks in the mail, they head off to new challenges. This strategy will become more common during this century and the phrase “double- dipper” will give way to “quintuple-dipper” as people have five or six 20-year careers in their lifetime. The notion of “retirement” as we know it today will fade away. For more on this, read Rule 88 of The New Rules of Money.

You’ll Extend Your Rites of Passage

As our lifetimes become extended, so too will our rites of passage. As recently as 1960, marrying in your late teens was common; the phrase “old maid” applied to women who failed to marry by age 20. You were expected to have children (plural) before you were 25, Jerry Rubin told us not to trust anyone over 30, middle age and mid-life crises hit at 45, and the “elderly” were 65.1

As I bet yours does, my own life provides examples of this brave new world: My former college roommate didn’t get married until he was nearly 50; my oldest brother will be 72 when his youngest daughter graduates from medical school; one of my nieces has three daddies (one biological, one marital, and one legal); my father renounced retirement four times before he passed away; and my grandmother buried four of her doctors before she died at age 101.

If today’s trends continue unabated, the year 2050 will find people marrying (for the first time) at age 50, having kids in their 60s (in France, they already are), facing middle age in their 80s, retiring in their 120s, and dying in their 140s.

These prognostications remind us that financial planning is a process, not a product. A financial plan must be periodically reviewed, with its assumptions challenged and altered based on changes in the economy and in your circumstances. One key circumstance is the fact that you may live much longer than you envision. If you plan to retire at 65 and are assuming a life expectancy of age 90, you’re assuming a 25-year retirement. But what if you live to 140? Will you have enough income for a 75-year retirement?

Finally, who’s going to pay for it all?

This question suggests that the most politically explosive social issue in America today — the right to life — will evolve into a new debate. In the 21st Century, with people living for so many years beyond their resources and soc...