- 172 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

The economy of Maldives faced two very challenging episodes traced to the 2004 tsunami and the 2008-2009 global financial crisis. To develop alternative sources of funding and to improve services delivery, the government, with the help of partners like the Asian Development Bank and others, succeeded in transforming the country's revenue system into a modern, e-enabled system for effective tax collection and development of a broader tax base. Find out more about Maldives' fast-track approach to tax reforms which can serve as a guide for other developing countries.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Fast-Track Tax Reform by in PDF and/or ePUB format, as well as other popular books in Business & Taxation. We have over one million books available in our catalogue for you to explore.

Information

CHAPTER 1

Introduction

BACKGROUND

The Republic of Maldives is a small island Islamic nation, which straddles the equator, in the Indian Ocean. It is located approximately 450 kilometers (km) southwest of mainland India. It is an archipelago made up of 26 natural atolls (divided into 20 administrative atolls), comprising around 1,190 islands, of which 188 are inhabited and 105 are tourist resort islands. Maldives is 820 km long and 120 km wide, and covers about 90,000 square kilometers (km2), of which only 298 km2 (or 0.3%) is land. Its highest point is a mere 2.4 meters above sea level.

The September 2014 Census revealed that the total resident population in Maldives was 402,071, of which 338,434 (84.2%) were Maldivians and 63,637 (15.8%) were foreigners. There were 227,749 males (56.6%) and 174,322 females (46.4%). The population has grown at an annual compound rate of 4.3% since the previous census in 2006. While the population is dispersed over the 188 inhabited islands, 153,904 people (or just over 38% of the total population) reside in the capital city, Male’.2 The archipelagic nature of the geography of Maldives, coupled with its small population scattered across distant atolls, results in high per capita service delivery costs. This situation poses challenges, which require extraordinary efforts to increase revenues to fund those services.

The Maldives economy began to develop during the presidency of Maumoon Abdul Gayoom (1978–2008). The average economic growth rate during 1980–2000 was 7.2% per annum, primarily on the back of development of the tourism industry and, to a lesser extent, fishing and construction. Real gross domestic product per capita has grown from $908 in 1989 to $5,036 in 2014, now the highest in South Asia. In 2011, Maldives was elevated from a least-developed country to a middle-income country under the United Nation’s classification of countries. However, although Maldives has one of the lowest poverty rates in South Asia, there are wide regional disparities, together with relatively high inequality in the distribution of income and wealth.

Despite Maldives, macroeconomic successes, the provision of public goods and services associated with its economic development has come at a cost to the government. Particularly as a consequence of the 2004 tsunami that severely impacted the country and the 2008–2009 global financial crisis (GFC), new sources of government finance needed to be found. These factors, together with a burgeoning tourism industry, provided an appropriate opportunity to introduce direct and indirect taxes into Maldives.

TOURISM DEPENDENCY

The largest contributor to the Maldives economy is the tourism sector. In 2015, the tourism industry accounted for approximately one-quarter of the country’s gross domestic product (GDP) and for more than 80% of its foreign exchange earnings.3 Tourism also drives much of the activity in other sectors of the economy, such as construction, distribution, and transportation. Therefore, the performance of the tourism sector has a significant impact across the whole economy.

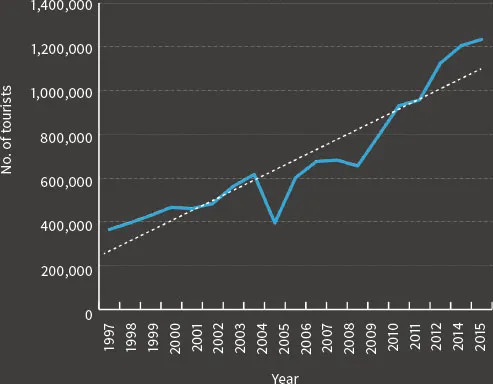

Since Maldives first opened its doors to tourists over 40 years ago, the tourism industry has experienced exceptional and continued growth. The annual compound growth rate in operational bed capacity during the last 2 decades has exceeded 5%.4 This growth has been driven by the long-term trend in tourist arrival numbers. Figure 1 illustrates the annual compound growth rate in tourist arrivals of 7%, during the period 1997–2015, when arrivals rose from 365,563 to 1,234,248.5

Figure 1: Annual Tourist Arrivals (1997–2015)

Source: Author.

TAX REFORM

For most countries, government expenditure, to the extent that it is not financed by borrowing, is funded through a broad range of taxes. But until 2011, the sourcing of government revenue in Maldives was far narrower than that adopted by other countries.

By the end of the first decade of the 21st century, the government was under considerable pressure to raise more revenue. By 2009, the government deficit had reached 20.5% of GDP.6 The government therefore implemented an ambitious tax reform agenda. Within a period of 9 months (from 1 January 2011 to 2 October 2011), Maldives introduced:

• a tourism goods and services tax (T-GST), which was repealed later in that period and replaced by a general goods and services tax (GST); and

• a business profit tax (BPT), a tax akin to an income tax on businesses.

These taxes were introduced as part of a wider economic recovery program led by the International Monetary Fund (IMF), which included specific support to tax reforms by the Asian Development Bank (ADB).

During the same year, the government also introduced into Parliament corporate profit tax (CPT) and personal income tax (PIT) bills, which were intended to replace the BPT.

No other country has embarked upon such wide-ranging tax reforms within such a short period and, in particular, implemented a general GST regime within only one month from the presidential ratification of the empowering law until its implementation, as Maldives did.

Prior to undertaking the reforms, Maldives had no central revenue-collecting authority. Instead, various government agencies were responsible for the collection of various fees, and many of these fees remained unpaid in full. Maldives Inland Revenue Authority (MIRA) was established in 2010 to implement the new T-GST, GST, and BPT laws, as well as take over the responsibility for collecting all nontax amounts payable to the government, other than customs duty (e.g., land lease rental payments, business permit fees, fines, etc.). Its broad mandate placed considerable pressure on the very limited resources available to MIRA. ADB technical assistance was able to provide expertise by way of tax specialists who, working closely with MIRA staff, were able to overcome capacity constraints.

Aside from the immediate revenue raising purpose of the imposition of new taxes, the introduction of BPT and general GST in the second half of 2011 were intended to broaden the tax base to reduce the government’s revenue dependence on the tourism sector. That objective has been achieved to a limited extent, by taxing nontourism sector businesses (through the BPT) and the Maldivian public (through the general—nontourism—GST).

2 National Bureau of Statistics, Maldives Population & Housing Census 2014—Statistical Release: 1 Population and Households, 2015, pp. 13, 30 and 31, at http://planning.gov.mv/nbs/wp-content/uploads/2015/10/Census-Summary-Tables.pdf

3 http://mma.gov.mv/Monthly%20Statistics/may16.pdf and http://mma.gov.mv/mmr/AR15.pdf

4 Derived from Maldives Monetary Authority, Monthly Statistics, Vol. 17, March 2016, p. 3, at http://www.mma.gov.mv/documents/Monthly%20Statistics/2016/MS-Mar-2016.pdf, and Maldives Monetary Authority, Annual Report 2015, pp. 68 and 75, at http://www.mma.gov.mv/documents/Annual%20Report/2015/AR-2015.pdf

5 Derived from Maldives Monetary Authority, Monthly Statistics, Vol. 7(7), July 2006, Table 4, at http://www.mma.gov.mv/documents/Monthly%20Statistics/2006/MS-Jul-2006.pdf and Maldives Monetary Authority, Monthly Statistics, Vol. 17(1), January 2016, p. 7, at http://www.mma.gov.mv/documents/Monthly%20Statistics/2016/MS-Jan-2016.pdf

6 Derived from Ministry of Tourism, Tourism Statistics 2001, 2001, p. 6, at http://www.tourism.gov.mv/downloads/tourism_statistics_2001.pdf and Ministry of Tourism, Monthly Updates, December 2016, p. 2, at http://www.tourism.gov.mv/downloads/arrival_updates/2016/December.pdf

CHAPTER 2

Government Revenues before 2011 and the Tax Reform Program

COMPOSITION REVENUE

Prior to 2011, the vast majority of public sector revenue in Maldives was generated by the two major indirect taxes—import duty and tourism tax—and land and resort rents. In addition, there were (and still are) several other imposts, such as bank profit tax, vehicle and vessel fees, and stamp duties. Additional public revenue was also generated through dividends from state-owned enterprises (SOEs), interest receipts, royalties, work permits and other administrative fees.

As Figur...

Table of contents

- Front Cover

- Title Page

- Copyright Page

- Contents

- Tables, Figures, and Boxes

- Abbreviations

- Currency Equivalents

- Preface

- Message from the Vice-President

- Foreword from the Vice-President

- Executive Summary

- Tax Reform Milestones

- Chapter 1. Introduction

- Chapter 2. Government Revenues before 2011 and the Tax Reform Program

- Chapter 3. Introduction of New Taxes

- Chapter 4. Establishment of the Tax Administration System

- Chapter 5. Some Unique Difficulties and Challenges of Implementation

- Chapter 6. Success Factors

- Chapter 7. Maintaining the Impetus

- Chapter 8. Learning from the Maldives Experience

- Back Cover