eBook - ePub

Securitization in India

Managing Capital Constraints and Creating Liquidity to Fund Infrastructure Assets

- 108 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Securitization in India

Managing Capital Constraints and Creating Liquidity to Fund Infrastructure Assets

About this book

India needs to spend close to Rs43 trillion (about $646 billion) on infrastructure through to 2022. Such a staggering requirement cannot be met though traditional sources such as public sector bank loans. India must immediately explore and quickly ramp up financing from alternative investment sources. This report provides an overview of infrastructure financing in India, sheds light on the challenges faced by the country's banking sector, suggests an optimal mechanism for securitizing the infrastructure assets of public sector banks, and outlines a range of scenarios and factors that must be in place for this mechanism to be successfully realized.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Securitization in India by Jennifer Romero-Torres, Sameer Bhatia, Sural Sudip in PDF and/or ePUB format, as well as other popular books in Economics & Banks & Banking. We have over one million books available in our catalogue for you to explore.

Information

Appendix 1

Criteria for Securitization in India

Reserve Bank of India’s Guidelines on Securitisation of Standard Assets

Criteria to be met by SPV

| “8. | [Special-purpose vehicle (SPV)] is set up during the process of securitisation to which the beneficial interest in the securitised assets are sold or transferred on a without recourse basis. The SPV may be a partnership firm, a trust or a company. Any reference to SPV in these guidelines would also refer to the trust settled or declared by the SPV as a part of the process of securitisation. The SPV should meet the following criteria to enable the originator to treat the assets transferred by it to the SPV as a true sale and apply the prudential guidelines on capital adequacy and other aspects with regard to the securitisation exposures assumed by it.

|

Appendix 2

Basel III Risk Weights

Table A2.1: Basel III risk Weights

Asset | Risk Weight | ||||

Investments in government securities | 0% | ||||

Claims on foreign sovereigns | 0%–100%, depending on credit rating | ||||

Claims on public sector entities | 20%–100%, depending on credit rating | ||||

Claims on commercial banks:

| 125% 250% | ||||

Investment in bank bonds | 20% | ||||

Claims on foreign banks | 20%–50%, depending on credit rating | ||||

Claims on corporates | 20%–100%, depending on credit rating | ||||

Individual housing loans | 50%–75%, depending on the book value | ||||

Commercial real estate loans | 100% | ||||

Claims on venture capital funds, which are considered high-risk exposures | 150% | ||||

Treatment of securitization exposures | |||||

Credit enhancements with first-loss positions | 1,111% | ||||

Exposure of “B+” rating and below, unrated exposures | 1,111% | ||||

Securitization exposures that do not meet the Reserve Bank of India’s securitization guidelines | 1,111% | ||||

Source: Reserve Bank of India.

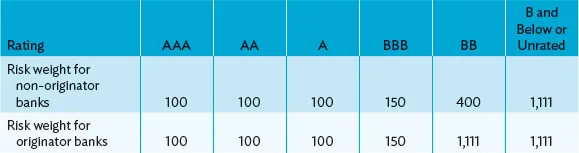

Table A2.2: risk Weights for Securitization Exposures (%)

Source: Reserve Bank of India.

Table A2.3: risk Weights for commercial real Estate Securitization Exposures (%)

Source: Reserve Bank of India.

Appendix 3

Detailed Analysis of the Regulatory Framework

An overview of the regulations studied under this exercise is provided in Table A3.1.

Table A3.1: regulatory Framework Overview

Participant | Regulatory Authority | Regulations or Guidelines |

Originators | ||

Banks or nonbanking financial companies (NBFCs) | Reserve Bank of India (RBI) | Guidelines on securitization transactions: section A on 7 May 2012, pursuant to paragraph 107 of the Monetary Policy Statement 2012–2013 |

Investors | ||

Banks | RBI | Master circular: Cash reserve ratio and statutory liquidity ratio, 2014 |

Insurance funds | Insurance Regulatory Development Authority (IRDA) | Insurance Regulatory and Development (Investment) (Fifth Amendm... |

Table of contents

- Front Cover

- Title Page

- Copyright Page

- Contents

- Figures and Tables

- Foreword

- Acknowledgments

- Abbreviations

- I. Introduction

- II. Infrastructure Financing in India

- III. Banking Sector in India

- IV. The Securitization Market in India

- V. Securitization of Infrastructure Assets in India

- VI. Value Analysis and Success Factors

- Conclusion

- Appendixes

- About the Authors

- Back Cover