Chapter One

The Origins of the AREA Method

There’s an alternative. There’s always a third way, and it’s not a combination of the other two ways. It’s a different way.

—David Carradine

Every day, people around the world make financial decisions. They choose to invest in a stock, sell their holdings in a mutual fund, or buy a condominium. These decisions are complex and financially tricky—even for financial professionals. But the literature available on financial research is dated and either focuses narrowly on only one aspect of financial sleuthing, such as earnings quality, or provides a bird’s-eye view without any real practical application. Until now there’s been a gap in the literature: a book that shows you how to conduct a step-by-step comprehensive financial investigation that ends in a decision.

This book gives you that how.

Investing in Financial Research: A Decision-Making System for Better Results is a guidebook for conducting financial investigations. The book lays out my AREA Method—a research and decision-making system that uniquely controls for bias, focuses on the incentives of others, and expands knowledge while improving judgment—and applies it to investigating financial situations. AREA is applicable to all sorts of financial sleuthing, whether for investment analysis or investigative journalism.

I first laid out my AREA Method in a general interest book about how to make complex personal and professional decisions. That book is titled Problem Solved: A Powerful System for Making Complex Decisions With Confidence and Conviction. For my Problem Solved readers the basic AREA roadmap is largely the same. However, this book uses financial case studies, drills down deeper into company financials, has an in-depth discussion of fraud and deception, and includes many more financially focused Cheetah Sheets.

If you are new to the AREA Method: Welcome aboard! The AREA Method helps you make smarter, better decisions by improving upon classic research and decision-making pedagogy.

How does it do that? First, AREA recognizes that research is a fundamental part of decision-making. Second, AREA organizes your research process based on the perspective of the source of your information. Third, it addresses the critical component of timing head-on, incorporating calculated and directed reflections that promote insight, slowing down to speed up the efficacy of your work. And fourth, AREA provides a clear, concise, and repeatable process that works as a feedback loop in part or in its entirety. Result: AREA is the first decision-making system to control for bias, focus on the incentives of others, and expand knowledge while improving judgment

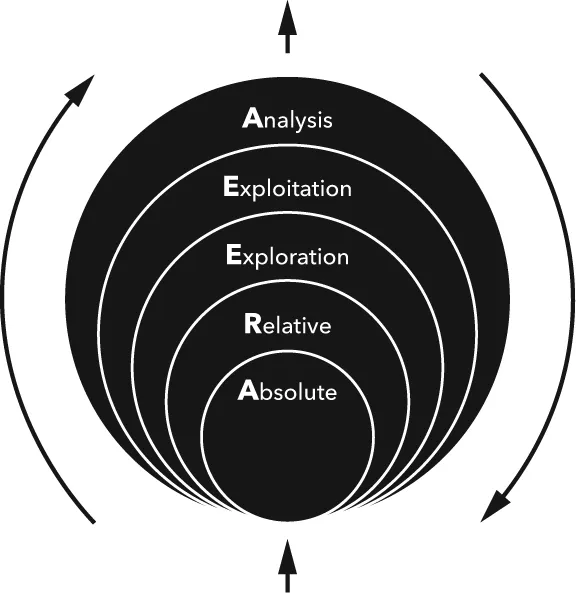

My research process is called the AREA Method because of the different perspectives it addresses. AREA is an acronym for these perspectives: Absolute, Relative, Exploration and Exploitation, and Analysis.

The first “A,” or “Absolute,” refers to primary, uninfluenced information from the source or sources at the center of your financial research. “R,” or “Relative,” refers to the perspectives of outsiders around your research subject. It is secondary information, or information that has been filtered through sources connected to your subject. “E,” or “Exploration” and “Exploitation,” represents the twin engines of creativity, one being about expanding your research breadth and the other about depth. Exploration moves your research beyond written documents to teach you to listen to other peoples’ perspectives by developing sources and interviewing. Exploitation asks you to focus inward, on you as the decision-maker, to examine how you process information, exploring and challenging your own assumptions and judgment. The second “A,” “Analysis,” synthesizes all of these perspectives, processing and interpreting the information you’ve collected. Each of these steps will be explained in detail in the chapters that follow.

Together the “A” and the “R” provide you with the tools necessary to create a framework for gathering and evaluating information. The latter part of the AREA process, the “E” and the “A,” provide detailed examination tools gleaned from experts in other fields such as investigative journalism, intelligence gathering, psychology, and medicine. They help you make some of your mistakes before you make them.

Figure 1.1.

Cycling through the AREA Method. AREA is a step-by-step decision-making process focused on mining the insights and incentives of others to help you manage for mental shortcuts. The steps build on one another, radiating out from the center but also serving as a feedback loop. The views and insights of other stakeholders are separated until you, the decision maker, fit them all together.

The AREA Method’s ability to address perspectives makes the process and this book unique. It teaches you to isolate and categorize information based upon its source. By inhabiting one perspective at a time you can attempt to control for and counteract some of your cognitive shortcuts while also building empathy and understanding with the other stakeholders involved in your research decision.

The idea for AREA initially came to me during the decade when I worked as a columnist and editor at Barron’s, the business magazine. There I ended up specializing in what was called the “bearish” company story, one that takes a skeptical look at a company’s financials or strategy.

When my stories were published, there was often a large share-price reaction. At times, an exchange might halt trading in the stock or regulators might get involved. In a few cases, the companies I investigated and wrote about went out of business. In one case, the chief executive was sentenced to ten years in jail.

I became concerned about the human toll of my stories. They were not only affecting people’s investment portfolios or retirement accounts; they were also impacting the employees of the companies I investigated, as well as the customers. When I wrote a series of investigative stories about a company called PolyMedica, then one of the largest diabetic test-kit makers, I recounted how the company was raided by the FBI, a story that ended up adversely affecting both customers and employees. At the same time, customers who had bought used car batteries thinking they were new from Exide—the subject of another series of investigative pieces—received important information from my stories.

I wanted to write these important stories but I also wanted to ensure that I was conducting sound research, that I was taking into account the incentives and motives of my sources, that I was thinking about having evidence to back all my assertions, and that I was considering where I might be biased and judgmental in how I looked at and interpreted the data. In essence, I needed a way to control for and catch some of my thinking errors and, given my background in research, I wondered if I could set up a construct to do that, something that would push me out of my mindset, focus me on others, and give me distance to critically assess the validity of my viewpoint. That’s how I came to the idea of the perspective-taking that frames my AREA Method.

I also recognized that I needed my perspective-taking research steps to sit inside a broader operating system, so that I could clear my mind before settling in to work. That mental preparation is what follows in the next four chapters, which cover Cheetah Pauses, the AREA journal, thesis statements, cognitive biases, edges and pitfalls, and Critical Concepts.

These chapters are important spadework. Anyone can do research, and many of us do dive right in without thinking about the outcome, but that’s like building a house without a plan. To effectively build a sturdy house, or conduct meaningful research, you need to have a blueprint: a clear picture of a successful outcome. And the plan alone isn’t enough; you need the right tools—the hammers, nails, drills, etc.—to get it done. Once you have that blueprint, you’ll have the mental map for the problem solving you’re about to do and be better able to effectively use the A, R, E&E, and A tools of the AREA Method.

Let’s start by meeting the cheetah.