![]()

1 Theory of financial integration and achievements in the European Union

Daniel Stavárek, Iveta Řepková and Katarína Gajdošová

Financial integration in Europe began several decades ago, in 1957, with the Treaty of Rome, which already contained the basic principles for the creation of single European market for financial services. The adoption of the common currency in 1999 was a major impetus for further financial integration in the European Union (Liebscher et al., 2006). With all the theoretical and empirical evidences, the issue of the euro undoubtedly offered a strong motivation for the procedure because a single currency is an important component of a common financial system and a strong promoter of financial integration (Jikang and Xinhui, 2004).

The aim of this chapter is to describe the concept of financial integration, compare the benefits and risks of financial integration and summarize the progress in financial integration in the European Union. The chapter is structured as follows. The first section defines financial integration, in the second section we introduce types of financial integration, the third section describes benefits and the fourth section the risks of financial integration. The fifth section presents measures of financial integration and the sixth section reports and discusses progress in financial integration in the EU.

Definition of financial integration

The literature provides various alternative definitions of financial integration. Here, we present and discuss only definitions that have attracted attention in the subsequent research. Baele et al. (2004) assume that the market for a given set of financial instruments and/or services is fully integrated if all potential market participants have the same relevant characteristics:

1 They face a single set of rules when they decide to deal with those financial instruments and/or services.

2 They have equal access to the same set of financial instruments and/or services.

3 They are treated equally when they are active in the market.

This definition of financial market integration contains three important features. First, it is independent of the financial structures within regions. Financial structures encompass all financial intermediaries – institutions or markets – and how they relate to each other with respect to the flow of funds to and from households, governments and corporations. Second, frictions in the process of intermediation – i.e. the access to or investment of capital either through institutions or markets – can persist after financial integration is completed. Financial integration is concerned with the symmetric or asymmetric effects of existing frictions on different areas. Even in the presence of frictions, several areas can be financially integrated as long as frictions affect these areas symmetrically. However, if the frictions have asymmetric effects on the areas, the process of financial integration cannot reach the completion point. Third, definition of financial integration separates the two constituents of a financial market, namely the supply of and the demand for investment opportunities. Full integration requires the same access to banks or trading, clearing and settlement platforms both for investors (demand for investment opportunities) and firms (supply of investment opportunities, e.g. listings), regardless of their region of origin. In addition, once access has been granted, full integration requires that there is no discrimination among comparable market participants based solely on their location of origin. When a structure systematically discriminates against foreign investment opportunities due to national legal restrictions, then the area is not financially integrated. An area can also be partially financially integrated.

The definition of financial market integration is closely linked to the law of one price. The law of one price states that if assets have identical risks and returns, then they should be priced identically regardless of where they are transacted. In other words, if a firm issues bonds in two countries or regions, it must pay the same interest rate to both sets of bondholders (Jappelli and Pagano, 2008). If the law of one price does not hold, then there is room for arbitrage opportunities. However, if the investment of capital is non-discriminatory, then any investors will be free to exploit any arbitrage opportunities, which will then cease to exist, thereby restoring the validity of the law of one price.

Baltzer et al. (2008) show it is easy to see that the law of one price is in fact an implication of the above definition. If all agents face the same rules, have equal access and are treated equally, any price difference between two identical assets will be immediately arbitraged away. Still, there are cases where the law of one price is not directly applicable. For instance, an asset may not be allowed to be listed on another region’s exchange, which according to our definition would constitute an obstacle to financial integration. Another example is represented by assets such as equities or corporate bonds. These securities are characterized by different cash flows and very heterogeneous sources of risk, and as such their prices are not directly comparable. Therefore, alternative measures based on stocks and flows of assets (quantity-based measures) as well as those investigating the impact of common shocks on prices (news-based measures) may usefully complement measures relying on price comparisons (price-based measures). All the approaches to the financial integration measurement are described in detail in the fifth section of this chapter.

Brouwer (2005) argues that financial market integration is the process through which financial markets in an economy become more closely integrated with those in other economies or with those in the rest of the world. This implies an increase in capital flows and a tendency for prices and returns on traded financial assets in different countries to equalize. The Economic Commission for Africa (2008) confirms that this requires the elimination of some or all restrictions on foreign financial institutions from some (or all) countries. Ideally, financial institutions would be able to operate or offer cross-border financial services, as well as establish links between banking, equity and other types of financial markets. Financial integration could also arise even in the absence of explicit agreements. Such forms of integration could include entry of foreign banks into domestic markets, foreign participation in insurance markets and pension funds, securities trading abroad and direct borrowing by domestic firms in international markets.

Ho (2009) shows that financial market integration could proceed with enforcement of a formal international treaty. This refers to two distinct elements. One is the provision for concerted or cooperative policy responses to financial disturbances. The other is the elimination of restrictions on cross-border financial operations by member economies including harmonization of regulations of financial systems. Both elements are necessary to achieve full unification of regional financial markets, and taxes and regulations between member economies.

Types of financial integration

The literature, e.g. Oxelheim (1990) or Guha et al. (2004), distinguishes between total, direct and indirect financial integration. The total financial integration thus embraces direct and indirect integration. Total (perfect) integration means that expected real interest rates are the same on the markets concerned. Where total financial integration is not perfect, the reason may be imperfect direct and/or indirect financial integration.

Direct financial integration, which is also called capital market integration, is expressed in deviations from the law of one price for financial securities. Under perfect direct financial integration this law obtains, and an investor can expect, the same return on investments from different markets (and borrower the same loan costs), after the requisite adjustment has been made for risk. If the differential in expected risk-adjusted returns is greater than zero but less than or the same as the transaction cost, we can say that markets are disintegrated but are nonetheless efficient.

Financial integration can also vary in strength from perfect integration to perfect disintegration or segmentation (Oxelheim, 1990). When expected real interest rates are not the same in the markets in question (not perfect integration), then the markets are said to be segmented. Segmentation is a result of lack of integration and this can happen due to high transaction costs involved in arbitrage or market inefficiency (Guha et al., 2004).

Financial integration includes not only integration of financial markets or services but can take other forms as well. These forms need not be interconnected nor are they advanced forms (stages) of the integration process. Liebscher et al. (2006) show that integration can take many forms and present various aspects:

• monetary integration, either through currency unions (Europe, Western and Central Africa) or through dollarization, such as in Latin America and the Caribbean;

• liberalization of the capital account;

• subcontracting abroad of financial services or infrastructure, such as in the case of listing of securities on foreign stock exchanges;

• foreign entry;

• regulatory convergence and harmonization.

Benefits of financial integration

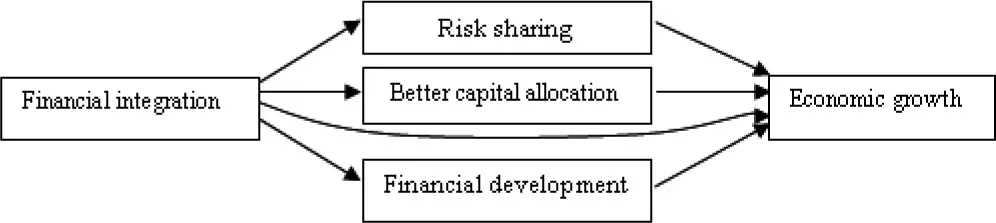

Baele et al. (2004) or Economic Commission for Africa (2008) consider three widely accepted interrelated benefits of financial integration: more opportunities for risk sharing and risk diversification, better allocation of capital among investment opportunities and potential for higher growth. Some studies also consider financial development as a beneficial consequence of financial integration (Figure 1.1).

Figure 1.1 Benefits of financial integration (source: authors’ compilation).

Risk sharing

Economic theory predicts that financial integration should have an effect on facilitating risk sharing (Jappelli and Pagano, 2008). The integration into larger markets or even the formation of larger markets is beneficial both to firms and to financial markets and institutions.

According to Baele et al. (2004) financial integration provides additional opportunities for firms and households to share financial risk and to smooth out consumption inter-temporally. Financial integration allows project owners with low initial capital to turn to an intermediary that can mobilize savings so as to cover the initial costs. These avenues indicate a strong link between financial institutions and economic growth (Levine, 1997). The exploitation of economies-of-scale can allow firms, in particular those small and medium-sized ones that face credit constraints, to have better access to broader financial or capital markets.

Risk-sharing opportunities make it possible to finance highly risky projects with potentially very high returns, as the availability of risk-sharing opportunities enhances financial markets and permits risk-averse investors to hedge against negative shocks. Because financial markets and institutions can handle credit risk better, integration could also remove certain forms of credit constraints faced by investors. The law of large numbers guarantees less exposure to credit risk as the number of clients increases. Individual risks could also be minimized by integrating into a larger market and, at the same time, enhancing portfolio diversification.

Through the sharing of risk, financial integration leads to specialization in production across the regions. Furthermore, financial integration promotes portfolio diversification and the sharing of idiosyncratic risk across regions due to the availability of additional financial instruments. It allows households to hold more diversified equity portfolios, and in particular to diversify the portion of risk that arises from country-specific shocks. Similarly, it allows banks to diversify their loan portfolios internationally. This diversification should help euro-area households to buffer country-specific income shocks, so that shocks to domestic income should not affect domestic consumption, but be diversified away by borrowing or investing abroad (Jappelli and Pagano, 2008). Kalemli-Ozcan et al. (2003) provide empirical evidence that sharing risk across regions enhances specialisation in production, thereby resulting in well-known benefits.

Kalemli-Ozcan and Manganelli (2008) analysed banking integration since the banking system, especially in the euro area, is the main financial channel for both the corporate sector and households. They find that higher cross-border banking integration increases consumption risk sharing. Their findings have important policy implications for the euro. Asymmetric shocks in a currency union generate output and inflation differentials. The impact of such shocks is considerably reduced if cross-country risk sharing is significant. To the extent that risk sharing allows hedging of consumption, it represents a key counteracting mechanism against output asymmetric shocks among members of a currency union. This mechanism reduces the need for policy intervention in dealing with such asymmetries.

Improved capital allocation

It is a generall...