- 160 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The Impact of International Debt Relief

About this book

International debt relief continues to be a highly controversial subject. Although many heavily indebted poor countries have received large amounts of debt relief over the past quarter of a century, it doesn't appear to be enough. This book examines the impact of international debt relief efforts since 1990. It assesses whether the various debt relief modalities have enhanced economic growth in eight highly indebted countries in Latin America and Africa.

Dijkstra argues that fundamental changes of the international aid and debt architecture are necessary to stop the flow of new multilateral loans and the possible perverse effects of conditionality.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access The Impact of International Debt Relief by A. Geske Dijkstra in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

Information

1

Introduction

The aim of this book is to evaluate the results of international debt relief efforts since 1990 and, in particular, their effects on the recipient countries. Debt relief continues to be a highly controversial subject. Although many heavily indebted poor countries (HIPCs) have received large amounts of debt relief over the past 25 years, they still seem to need more. Apparently, the effects have not always been favourable. From this, two contradictory conclusions can be drawn. Some argue that the international community has done far too little in alleviating the debt burden of poor countries. They have been given just sufficient relief to enable them to pay their primary creditors but not enough to allow their economies to grow, let alone to reduce poverty (Sachs 2002). International non-governmental organizations (NGOs), supported by several academic authors argue that more debt relief is necessary, especially in order to achieve the UN Millennium Development Goals1 by the year 2015 (Berlage et al. 2003; Hertz 2004; Sachs 2005). Others conclude that too much relief has already been given. They argue that the most heavily indebted countries are also countries with bad policies and weak institutions, so that in the past the greatest relief has gone to countries with bad policies or without good governance (Easterly 2002; Neumayer 2002; Asiedu 2003).

However, very few studies have explicitly examined the effectiveness of debt relief. There was an early boom in studies on sovereign debt and debt relief at the end of the 1980s and in the early 1990s, when most debts were owed to private creditors. These studies are only partially relevant for the current debt problems, which are principally a problem of poor countries that owe most of their debts to official creditors. The launch of the enhanced initiative for the HIPCs (HIPC initiative) in 1999 has given a new impetus to studies on debt and debt relief. These studies broadly fall apart in four groups.

First, there are econometric studies that investigate the relationship between high debts and economic growth. Although not focusing on debt relief directly, they are useful for the debt relief debate as they shed light on the potential relevance of debt relief for economic growth (Pattillo et al. 2002; Clements et al. 2003; Pattillo et al. 2004; Schclarek 2004; Imbs and Ranciere 2005; Presbitero 2005).2 Second, empirical studies have examined the allocation of debt relief (Easterly 2002; Neumayer 2002; Depetris Chauvin and Kraay 2006) and the extent of additionality of debt relief in relation to regular (other) aid flows (Powell 2003; Ndikumana 2004). Third, some evaluations have appeared of the effects of the HIPC initiative (OED 2003; Cohen et al. 2004; IEG 2006). Fourth, there is – to my knowledge – one econometric study of the effectiveness of debt relief (Depetris Chauvin and Kraay 2005).

This book contains elements of all four approaches but has a few distinct characteristics that add to the present knowledge. First, many recent studies and evaluations of debt relief tend to heavily focus on one aspect of debt relief, namely the reduction of the debt service and the possible benefits of the released resources for, especially, poverty reduction. In the terminology used in this book, this is known as the ‘flow effect’. This book also examines two other possible effects of debt relief: the effect of a reduction in the size of the debt, independently of whether debt service declines or not, and the effect of the conditions attached to debt relief. The former is called in this book the ‘stock effect’ of debt relief and the latter the ‘conditionality effect’. A reduction in the debt stock reduces the so-called ‘debt overhang’. As will be explained later in this chapter, this term indicates that the debt has become so large that the creditors no longer expect that it will be repaid in full. As debt overhang decreases, higher debt payments can be made on the remaining debt.

Second, this book applies a relatively long time perspective. It examines the origin and causes of debt problems in general and then assesses the efficiency, effectiveness and relevance of debt relief received as from 1990s and up to and including the effects of the HIPC initiative thus far. This means it has a longer time horizon than the studies and evaluations of the HIPC initiative, which means that more can be learnt from past experiences. Third, in analysing the origins and causes of debt problems, it recognizes that loan and debt contracts originate from two parties. Too high debts are not just the result of irresponsible borrowing but may also be due to irresponsible lending. This book continues to examine the creditor side in analysing the effectiveness of debt relief. While most authors tend to focus on the possible moral hazard among the receivers of debt relief, i.e. the prospect of relief will encourage short time horizons and irresponsible borrowing (Easterly 2002; Moss and Chiang 2003) and together with defensive lending and defensive granting may induce adverse selection (Birdsall et al. 2003; Marchesi and Missale 2004), this book also examines possible moral hazard and causes of adverse selection on the part of the suppliers of debt relief or in the system of conditionality that has been set up for international debt relief efforts.

Fourth, this book follows eight debtor countries in particular. The detailed case study approach allows examining different effects of different modalities of debt relief as well as different effects of debt relief under different circumstances. The effects of debt relief vary according to the type of debt (concessional and non-concessional) and the type of creditor (private, official multilateral and official bilateral), according to whether debt relief concerns rescheduling (postponement) of obligations or forgiveness and to whether the relief is given on debt stocks or on debt service. The effect also varies according to the circumstances of the recipient. For example, a reduction of principal or of debt service that so far has not been paid does not increase the amount of resources in the debtor country. On the contrary, a precondition for an agreement on debt reduction is usually that the remaining debt will be serviced in the future; in the years following such a ‘relief operation’, therefore, actual debt service paid may be higher than before.

These different effects are impossible to capture in an econometric analysis. Depetris Chauvin and Kraay (2005), for example, lump together all forms of debt relief by looking at the reduction in the net present value (NPV) of the debt.3 However, the effects of debt relief may vary not only by their effect on the NPV of the debt, with rescheduling generally leading to a lower effect on the NPV than forgiveness and relief on concessional debts leading to a lower effect on the NPV than relief on commercial debts, but also by whether a debt would be paid in the absence of debt relief. This means that relief on multilateral debts, though only causing a small reduction in the NPV of debt due to their concessionality, implies a large reduction in actual debt service paid. Moreover, a rescheduling of a debt service flow, even if it does not reduce the NPV at all, may have a positive flow effect if debt service would have been paid in the absence of rescheduling. In sum, the reduction in the NPV of debt is mainly important for the stock effect of debt relief in the sense that a reduction in the NPV reduces expected payments in the future but says nothing on the possible flow effect of debt relief. Most of the outcome variables examined in their study, however, deal with flow effects: government expenditure, expenditure for health and education, etc. Not surprisingly, they conclude on limited effectiveness of debt relief.

The eight countries examined in this book are Bolivia, Jamaica, Nicaragua and Peru in Latin America and Mozambique, Tanzania, Uganda and Zambia in Africa. These eight countries have received large amounts of debt relief during the 1990s, and together they represent a wide variety of debt relief modalities and circumstances. Two of them are middle-income countries (Jamaica and Peru), while the other six proved to find themselves eligible as HIPCs at the end of the 1990s. Four of these, Bolivia, Mozambique, Tanzania and Uganda, were among the first to complete the requirements of the HIPC initiative and achieved completion point in 2001, and the other two (Nicaragua and Zambia) reached the completion point in 2004 and 2005, respectively. The eight case studies are, of course, not representative of all the debtor countries in a statistical sense, but they do reflect a fairly broad variety of debt situations and external conditions.

Methodology and data sources

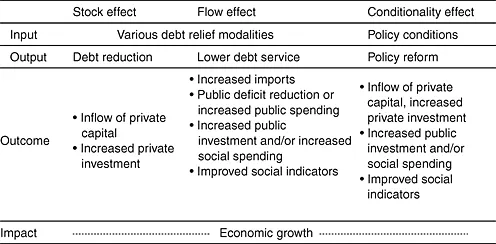

The methodology for assessing the impact of debt relief is deduced from a theory-based evaluation framework. The aim is to examine whether debt relief has been (1) efficient, (2) effective and (3) relevant. In order to systematically analyse the relations between inputs, outputs, outcomes and impact, a so-called logical framework has been elaborated. Figure 1.1 shows the most important aspects of this framework and of the underlying intervention theory.

The main impact variable is economic growth (Figure 1.1). Given that many recent studies consider poverty reduction the most important goal of debt relief, this choice for economic growth as the central impact variable must be explained. Basically, there are three reasons for this. First, the relation between debt relief and the ultimate poverty reduction is very difficult to ascertain. This is already true for the flow effect of debt relief but holds even more for its stock effect. A second and more formal reason is

|

Figure 1.1 Logical framework and intervention theory.

that poverty reduction has only become the objective for debt relief with the introduction of the enhanced HIPC initiative in 1999. Since this study begins examining the effects of debt relief as from 1990, it is not very logical to assess these efforts against a policy objective that did not exist yet. Third, it is now generally accepted that economic growth is a necessary, though not sufficient, condition for lasting (sustainable) poverty reduction. If debt relief proves to have a positive effect on economic growth, it may be assumed that it has also furthered the objective of sustainable poverty reduction. Despite its main focus on economic growth as objective variable, this book does explore possible effects on the non-income dimensions of poverty such as higher literacy rates and reduced infant mortality.

The inputs of debt relief comprise the different financial modalities of debt relief, so debt forgiveness, debt restructuring, relief on debt service flows and on outstanding debt stocks and relief on debts from different creditors: bilateral, multilateral and commercial. Many combinations of these three classifications are possible. Debt relief is usually granted if certain policy conditions are fulfilled, so the conditions also form part of the inputs.

The intervention theory of the possible effects of debt relief is the following. If debt relief is to promote economic growth, this can in principle occur in three ways. First, debt relief can lead to a reduction of the debt stock (output) and thus of the debt overhang, which stimulates private investment and enables the country to regain access to international private capital (outcomes), which in turn may lead to economic growth (impact). This is the stock effect. Second, debt relief can result in a fall in the debt service (output); funds released in this way may lead to additional imports and public expenditure in physical and social infrastructure (outcomes), which also may further economic growth: the flow effect. Third, conditions attached to debt relief may induce policy improvements (output); if the correct conditions have been set, this can lead, for example, via higher public investment and social expenditure (outcomes) to increased economic growth and poverty reduction (impact). This is the conditionality effect of debt relief.

This theory is developed on the basis of what is known in the academic literature on the reverse relationship, namely on the two ways in which a large and unsustainable debt may affect economic growth: a debt overhang effect and a liquidity effect.4 The third effect examined is in keeping with earlier insights in the effectiveness of policy-based loans and grants (programme aid) (White 1996; White and Dijkstra 2003).

In order to analyse efficiency, inputs are compared with outputs. The outputs include the direct effects of the different financial debt relief modalities: a reduction of the debt service (a decrease in the flow of outgoing payments) and of the debt stock (a decrease in the size of the outstanding debt). A third output considered here is the implementation of policy conditions that are attached to debt relief...

Table of contents

- Routledge studies in development economics

- Contents

- Illustrations

- About the author

- Preface

- Abbreviations

- 1 Introduction

- 2 The origins of debt and an overview of debt relief

- 3 The efficiency of debt relief

- 4 The effectiveness of debt relief

- 5 The relevance of debt relief

- 6 The impact of debt relief since 2000 and prospects for the future

- Notes

- Bibliography

- Index