- 272 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

States and Firms is a study in the political economy of the multinational enterprise. It looks at the internationalisation in the 1980s of the twelve leading French and German-owned multinational enterprises in chemicals and electronics, who form part of a European Challenge in international competition in technology- intensive sectors. The book examines how and why the internationalisation of these MNEs has interacted with their embeddedness in the domestic structures of their home countries (France and Germany) particularly in terms of their power relationships with home governments and financial institutions. The primary themes are the MNEs' roles as political actors; domestic government policy vis-a-vis the MNEs; MNEs' financial relationships with banks in France and Germany; MNE political activity at the level of the European Union, especially evident in technology policy. The primary contribution of this book is an inclusion of a firm-level approach to put the spotlight on fundamental questions of political economy and international business.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access States and Firms by Razeen Sally in PDF and/or ePUB format, as well as other popular books in Economics & Economic Theory. We have over one million books available in our catalogue for you to explore.

Information

1

INTRODUCTION: POLITICAL ECONOMY AND THE MULTINATIONAL ENTERPRISE

This study has as its primary actor the multinational enterprise (MNE), which can be defined as an economic unit that operates across national boundaries, producing in at least one other foreign country as well as in its home market. International production, the value-adding activity (research, development, design, engineering, manufacturing, distribution, sales) owned, controlled and organised by a firm outside its national boundaries, is thus the essence of multinationality.1 The MNE can be studied from many different angles and perspectives, each with roots in one or a number of academic disciplines in the social sciences. Chief among them are international economics, management organisation, economic and business history, law and, last but not least, political science. The approach utilised here has its roots in the field of institutional political economy, much influenced by the concepts and tools of political science, and it is with such distinctive political economy lenses that the multinational enterprise is constantly viewed.

Political economy is intrinsically interdisciplinary, in so far as it represents a fusion of political science and economics. According to Robert Gilpin it is ‘the reciprocal and dynamic interaction between the realm of wealth and the realm of power’. Both Gilpin and Susan Strange see it as the interaction of the ‘state’ and the ‘market’. In Charles Lindblom’s influential work Politics and Markets, it is the interplay between ‘authority’ and ‘market’.2

At all events such political economy scholarship has continually focused on the role of government, that is, the ‘state’, in both domestic nation-state and international economic affairs. For analysts in the burgeoning field of international political economy, ‘what governments do’ is studied in terms of their roles in the international economic arena, that is, using the international system as the level of analysis. For political economists more concerned with the role of government within the nation-state, the focus is on the ‘state’s’ activity in the domestic economy. In the many corporatist, neo-corporatist and institutional writings within political economy the government’s relationships and linkages with other national aggregate units, such as industrial associations, trades unions and economic sectors (for example, steel, cars, electronics, chemicals), are analysed.

What all these approaches share in common is at worst a disregard, and at best a glaring underemphasis, of the individual firm; and in the context of international competition and global markets, of the MNE. Modern neoclassical economics also suffers from an analytic weakness with regard to firms: they are treated as atomistic actors judged on the basis of efficiency gains, without taking sufficient account of their institutional and policy settings which subsume, for example, bargaining relationships with governments over the distribution, as well as the generation, of wealth and power – the latter variable being largely disregarded in contemporary economic analysis.3 As Cawson et al. put it: ‘Firms are themselves systems of power, with constituent groups, challenging each other’s power, that to an important extent firms are involved in intermediating between society and state.’ Firms as social institutions are involved in power relationships in the domestic nation-state as well as in the international political economy; they shape the market in addition to being shaped by it.4

It is of course the function of management organisation studies, subsuming the ‘business school’ literature, to concentrate on the firm, but the imperative of intra-organisational analysis downgrades the need to observe the firm in its outer political economic environment, notably its power relationships with governments and other actors.

This study thus starts from the premise that it is of vital importance to study the firm as a political economic actor in the external environments in which it finds itself and in which it is embedded5 in a series of power relationships. Given that the frame of reference is of market and firm-level internationalisation, it is the MNE that assumes pride of place for the purposes of analysis. The global strategies of individual MNEs play an ever more crucial role in economic development, in shaping the world economy and in significantly influencing the direction, content and outcome of public policy choices.6 By constructing an interdisciplinary theoretical framework and subsequently conducting an empirical investigation into a selection of MNEs as political economic actors, one primary objective is at all times present: to contribute to the accumulation and enhancement of knowledge in ‘micro’ political economy in a key and timely area of research, at the level of the firm, in which the ‘state of the art’ is weak and insufficient.

THE EMPIRICAL FOCUS

The literature on institutional political economy in advanced industrial states focuses on the structural make-up and interconnections on economic policy issues within national political economies, and especially the linkages between the domains of the ‘state’, ‘industry’ and ‘finance’. A number of these studies specifically view national political economies in terms of their insertion in the international economy. The distinctive contribution of this study is the investigation of the process of economic internationalisation and its relation to the modern evolution of political economic structures and linkages in two advanced industrial states in Western Europe, France and Germany, during the 1980s. These countries have the two largest Gross National Products in Europe and are the third and fourth largest economies in the ‘First World’ OECD (Organisation of Economic Cooperation and Development) BLOC of advanced industrial states.

The MNE lies at the heart of an interaction between the process of internationalisation – the expansion of cross-border production activities for global market coverage – and the structure and workings of national political economies. It is the MNE which engages in foreign direct investment (FDI), which grew four times as fast as international trade between 1983 and 1988 at a rate of 20 per cent growth annually; and has outpaced the growth in world output in this period. The worldwide stock of FDI has tripled during the 1980s to approximately $1500 billion, more than 80 per cent of capital flows being within the US–EC–Japan ‘Triad’. The five leading FDI source countries, the US, UK, Japan, Germany and France, account for 75 per cent of FDI, and over 90 per cent of technology agreements are made between firms with Triad home bases. MNEs’ share of world production and trade is far greater than that suggested even by their significant equity bases and shares of capital transfers. MNEs control over a quarter of the world’s economic activity outside their home countries. Over a half of international trade in manufactured goods, and a greater share of the growing trade in services, takes place intrafirm, that is, between different national subsidiaries of the same MNEs.7

On the other hand the MNE itself is deeply embedded in its country of origin, where it retains its headquarters as well as the core of its research, development, design, engineering, manufacturing, sales and distribution activities. It is in its home market that the MNE, as an institution in its own right, is linked in a myriad of historically conditioned power relationships with external actors such as local, regional and national governments, financial institutions, trades unions, small and medium-sized firms, and industrial associations. Once an MNE expands its production networks abroad, it puts down roots in foreign markets and begins to build up a series of similar linkages in those host markets, with suppliers, customers, governments, and labour and financial institutions. But it is in the home market that the MNE has its history – its initial inception, expansion and consolidation – before beginning to cross over its national boundaries. It is there that the MNE is most strongly anchored, both in its commercial coverage of the market and in its relations with other actors. And only on the strength of its position in the home market does the MNE expand abroad in the first place. Indeed the argument in chapter 2 will show that, corresponding with their internationalisation, French and German MNEs are still crucially dependent on their home bases in France and Germany, in so far as these remain quite the most important markets in their cross-border networks of production and sales. Whether it concerns governments, banks or trades unions, the relations MNEs have with external actors are strongest in their home markets. Most political science-based studies of the MNE concentrate on MNE activity and government policy in host countries, but from an institutional perspective the home base is more important in highlighting the national characteristics and differences in the conditioning of the firm within its operating environment, as well as the role of the multinational firm in influencing its most proximate public policy setting.

Hence this interaction, between the internationalisation of the MNE on the one hand, and its embeddedness in its home political economy with its government-finance-industry linkages on the other, forms the central connecting thread of this study. For internationalisation does provide a variable of change that impacts on the MNE’s pre-existing and historically evolving relations with external actors at home. Conversely it is also argued in this study that the MNE’s long-standing linkages with other actors in their home bases do impact on the manner in which the MNEs themselves internationalise.

The concentration on a carefully chosen selection of individual MNEs in addressing a political economy problematique thus places this study at a microscopic level of aggregation, with the intention of drawing qualified, middle-range interpretations in a French-German comparative context.

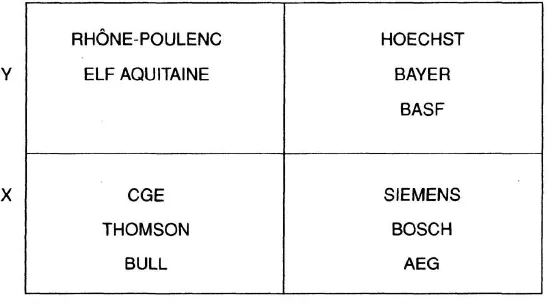

Figure 1.1 Matrix: French and German chemical and electronics MNEs

Note: X = chemical sector; Y = electronics sector.

Note: X = chemical sector; Y = electronics sector.

The empirical focus consists of eleven selected French and German-owned MNEs in the chemical and electronics sectors (see Figure 1.1): their individual strategies and experiences of internationalisation during a specific time-frame, the decade of the 1980s; and their embeddedness in the French and German political economies during that time, particularly configured in terms of their power relationships with external actors such as the home governments and financial institutions. The interaction between internationalisation and the home political economies is reciprocal: MNE internationalisation impacts on the nature of the government-finance-industry relationships in which the MNEs are rooted in the French and German political economies; conversely such MNE embeddedness in French and German domestic structures colours the process of their internationalisation. A key objective throughout is to draw French-German comparisons based on this empirical focus. The particular selection of these firms for analysis has nevertheless to be justified. Four pertinent questions arise.

Why French- and German-owned MNEs?

The MNEs, six of them German (Hoechst, Bayer, BASF, Siemens, Bosch, AEG) and five French (Rhône-Poulenc, Elf Aquitaine, CGE,8 Thomson, Bull), are headquartered in the third and fourth largest economies in the industrialised world; and furthermore, in national economies that have internationalised their economic structures considerably in recent decades. These MNEs are also leading participants among a number of European-owned MNEs that have internationalised significantly within the last two decades, and have emerged to take their places alongside US and Japanese-owned MNEs as the main commercial actors in international competition. Companies headquartered in the European Community increased their share of total international investment stock to 34 per cent by 1989, roughly equal to that of the US.9 The défi americain (the American Challenge) – the term coined by Jean-Jacques Servan Schreiber to describe the expansion of US MNEs abroad in the 1960s – has been supplemented in subsequent decades not only by a défi japonais but also by a défi européen.

Furthermore French and German MNEs are belated internationalisers, only expanding and deepening their production networks in quite a major fashion within the last two decades. This stands in contrast, most prominently, to US and British MNEs, who have postwar histories of international presence. Within this context of relatively recent internationalisation, there are distinctive French and German differences: the German MNEs have relied more on exporting, whereas the French ones have been more dependent on home market sales.

In addition the French and German political economies are differently structured, which leads to French-German differences in MNE relations with external actors at home. For example the role of the government and the structure of financial systems differ between the two countries. MNE–government relations are far stronger in France than they are in Germany, whereas MNE-bank relations are much stronger in Germany than they are in France.

Given such French-German differences, internationalisation is a uniting factor among the French and German MNEs which induces certain common effects in MNE relations with external actors in France and Germany, that is, certain common effects in the French and German political economies. Thus the rationale for this French-German comparison: to portray the mix of national similarities and differences on a canvas of continuity and change.

What is distinctive about these MNEs?

These firms are the biggest French and German companies in terms of sales, productive capacity, capital and R&D investment, employment levels and global reach, in their respective sectors of chemicals and electronics, and are among the largest companies in France, Germany and indeed in Europe. The question of how these MNEs became multinational does not loom large, for they are well-established multinationals. Rather it is the extending, deepening and restructuring of pre-existing networks of international production as part of a 1980s internationalisation process that is relevant.

Hence the selection of these companies in order to make up a manageably small sample of individual MNEs. Other French and German MNEs, including some in the chemical and electronics sectors, are excluded because they are smaller and less internationalised. In France the ‘second rung’ of indigenous chemical and electronics firms are very much smaller than the five French firms chosen here, and have very little international exposure. In Germany there is a backbone of reasonably large companies in these sectors who also have significant international presence (for example, Bohringer-Ingelheim, Merck, Degussa, Hüls and Schering in chemicals, and Mannesmann in electronics). But their size and global reach is still far behind that of the six German companies chosen.

Why chemical and electronics MNEs?

These MNEs are active on a worldwide scale in the chemical and electronics sectors. These sectors account for a large chunk of world output and are deeply integrated in the tissue of the international manufacturing economy: they not only supply end-products to consumers but also provide a whole range of components and intermediate products to other manufacturing sectors as well as to the service economy. Many areas within these sectors in which the selected firms are heavily involved are characterised by technology-intensiveness, increasingly utilising the late twentieth-century core technologies of biotechnology, microelectronics and advanced materials, together with the internationalisation of production to cater for global markets. Therefore broad swathes of these sectors are at the forefront of internationalisation. A later section in this chapter discusses the distinctive technology-intensive-cum-internationalising characteristics of these two sectors.

Why internationalisation during the 1980s?

This study is intended to contribute to scholarship on contemporary issues in micropolitical economy. Hence the importance of tracking the most recent period of internationalisation – which also happens to be the period of greatest international expansion for the MNEs concerned – and relating that to the modern evolution of French and German domestic structures. Nevertheless, it is felt that a certain distance in time is required to aid the analytical process, one step removed from the hurly-burly of the here-and-now in the mid-1990s. A critical and cool perspective on events in the recent past would not, arguably, be aided by taking the narrative up to the present. The period covered is both short enough and recent enough for contemporary relevance; and yet it is sufficiently ‘in the past’ to allow for marginally greater reflection and consideration without falling into the trap of providing hasty and over-speculative interpretations of current events. It is hoped that the argument developed will have currency for general debates in political economy and international business studies in the 1990s, and serve the additional objective of being a statement on the political economy of the MNE during the chosen period of the 1980s.

These then are the four criteria used to select this particular mixture of firms for analysis during the aforementioned time-scale. The internationalisatio...

Table of contents

- Cover

- Halftitle

- Title

- Copyright

- Dedication

- Contents

- List of figures

- List of tables

- Acknowledgements

- 1 Introduction: Political Economy and the Multinational Enterprise

- 2 The Internationalisation of French and German MNEs

- 3 MNEs in Domestic Structures

- 4 Government Policy and MNE-Government Relations: MNEs as Political Actors

- 5 The Financial Function and the Power of the Purse: Government-Firm, Bank-Firm Relations

- 6 Europe and Technology: Cross-Border Dimensions of Political Economy

- 7 Conclusion: Micropolitical Economy, the 1980s, the 1990s and the Way Ahead

- Notes

- Bibliography

- Name index

- Subject index