![]()

Part I

Pricing theory

![]()

1 The optimality of pure competition in the capacity problem*

The problem of optimum (‘efficient’) pricing under conditions of complementary demands (the ‘capacity’ problem) has been formulated in its most essential form by Steiner, and the solution has been presented.1 However, neither Steiner nor the discussants2 of his article have pointed out that complementary demand functions in no way vitiate the general rule that a purely competitive market structure yields optimum prices. Yet this fact is of substantial interest. It demonstrates the pervasiveness of pure competition as an optimum situation. Joint use of capacity in no way gives rise to a market failure! Indeed it is surprising that Steiner himself did not perceive this because he discusses various pricing schemes which might attain the optimum, even without knowledge of demand conditions on the part of the price-maker. He concludes that such measures cannot be guaranteed to achieve the efficient prices.

The purpose of the present note is to demonstrate the success of one measure, on the proviso that Steiner’s implicit assumption of monopoly in supply is dropped. The conventional theorem that ‘under constant costs pure competition maximizes consumers surplus subject to the constraint that producers suffer no monetary loss’ is applicable to the capacity problem, at least in its Steiner version. Indeed this constrained maximization is Steiner’s criterion of optimality.

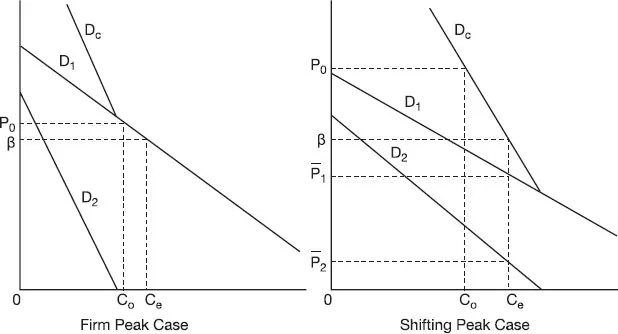

The argument applies equally to the ‘firm peak’ and ‘shifting peak’ cases. Consider Figure 1.1 (Figure I in Steiner’s article).

D1 and

D2 are the demand curves for capacity and

β is the (joint) unit cost of capacity.

Dc is the vertical sum of

D1 and

D2. Prices are defined net of operating costs. Optimum prices are:

P1 =

β, P2 = 0 in the firm peak case,

in the shifting peak case.

3 It may be wondered why the demand functions D1 and D2 are designated as ‘complementary.’ Actually, no complementarity as usually defined is involved. Each demand depends only on its own price, and not on the other price. Demands are complementary or joint with respect to supply, not from the point of view of the consumers. In calling such demands complementary I am continuing a solecism apparently started by Steiner.4

Now suppose that the market structure is one of pure competition. What does pure competition imply for the behavior of suppliers of capacity? Each firm acts as if it cannot affect prices (P1 and P2) and firms act alone, collusion and cartellization being incompatible with pure competition. Therefore each firm offers its existing capacity to the limit at the going rates, if it offers capacity at all, i.e., if it is in the market. Firms do this for each of the complementary markets. If total revenue is greater than or equal to total cost, firms offer all their capacity. If total cost is less than total revenue, profits are negative and some firms (plants) will leave the market (capacity will decrease). There is also free entry (expansion of capacity) into the market, which will occur if total revenue exceeds total cost, that is, if observed profits are positive.

Figure 1.1 Firm-peak case and shifting-peak case: continuous capacity.

Suppose Co is the amount of capacity in the market. Then a profit of (Po – β) is earned per unit of capacity. The number of firms (plants) increases until capacity equals Ce. Beyond Ce a loss per unit of capacity is incurred and the number of firms (plants) decreases until Ce is reached. Therefore the efficient prices are obtained.

It is obvious that the effective value of β is constant over all firms. The reason for this procedure is that it exactly corresponds to Steiner’s assumption of a unitary homogeneous production function (β independent of output). Such a production function under monopoly is precisely analogous to the production conditions of a purely competitive industry of identical firms, irrespective of the actual technology of the firms.5 Were it to be assumed that firms differ in efficiency, this would correspond to a monopolist that faces decreasing rather than constant returns to scale.

The nature of supply under pure competition requires re-emphasis. The amount of capacity supplied or offered is identical in the two markets and is offered to the limit irrespective of prices. This is the meaning of price-taking: going rates are accepted. Changes in supply take the form of bodily shifting this inelastic offering. In other...