- 496 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

This new book uses advanced signal processing technology to measure and analyze risk phenomena of the financial markets. It explains how to scientifically measure, analyze and manage non-stationarity and long-term time dependence (long memory) of financial market returns. It studies, in particular, financial crises in persistent financial markets,

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Financial Market Risk by Cornelis Los in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

Information

Part I

Financial risk processes

1 Risk — asset class, horizon and time

1.1 Introduction

1.1.1 Classical market returns assumptions

Most investors, portfolio managers, corporate financial analysts, investment bankers, commercial bank loan officers, security analysts and bond-rating agencies are concerned about the uncertainty of the returns on their investment assets, caused by the variability in speculative market prices (market risk) and the instability of business performance (credit risk) (Alexander, 1999).1

Derivative instruments have made hedging of such risks possible. Hedging allows the selling of such risks by the hedgers, or suppliers of risk, to the speculators, or buyers of risk, but only when such risks are systematic, i.e., when they show a certain form of inertia or stability. Indeed, the current derivative markets are regular markets where “stable,” i.e., systematic risk is bought and sold.

Unfortunately, all these financial markets suffer from three major deficiencies:

(1) Risk is insufficiently measured by the conventional second-order moments (variances and standard deviations). Often one thinks it to be sufficient to measure risk by only second-order moments, because of the facile, but erroneous, assumption of normality (or Gaussianness) of the price distributions produced by the market processes of shifting demand and supply curves.

(2) Risk is assumed to be stable and all distribution moments are assumed to be invariant, i.e., the distributions are assumed to be stationary.

(3) Pricing observations are assumed to exhibit only serial dependencies, which can be simply removed by appropriate transformations, like the well-known Random Walk, Markov and ARIMA, or (G)ARCH models.

Based on these simplifying assumptions, investment analysis and portfolio theory have conventionally described financial market risk as a function of asset class only (Greer, 1997; Haugen, 2001, pp. 178–184). In a simplifying representation:

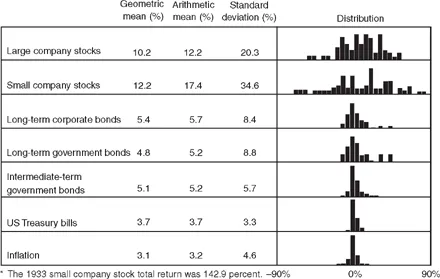

Figure 1.1 shows the familiar presentation of risk as a function of asset class by Ibbotson and Sinquefield, who have collected annual rates of return as far back

Figure 1.1 Historical average annual returns and return volatility, 1926–1995.

Source: Stocks, Bonds, Bills and Inflation 1996 Yearbook,™ Ibbotson Associates, Chicago (annually updates work by Roger G. Ibbotson and Rex A. Sinquefield). Used with permission. All rights reserved.

as 1926 (Ibbotson and Sinquefield, 1999). The dispersion of the return distributions, measured by the respective standard deviations, differs by six different asset classes:

(1) common stocks of large companies;

(2) common stocks of small firms;

(3) long-term corporate bonds;

(4) long-term US government bonds;

(5) intermediate-term US government bonds;

(6) US Treasury bills.

When an investor wants a higher return combined with more risk, he invests in small stocks. When he wants less risk and accepts a lower return, he is advised to invest in cash.

For example, Tobin (1958) made two strong assumptions, which were believed to be true by many followers: first, that the distributions of portfolio returns are all normally distributed and, second, that the relationship between the investors' portfolio wealth and the utility they derive it from is quadratic of form.2 Under these two conditions, Tobin proves that investors were allowed to choose between portfolios solely on the basis of expected return and variance. Moreover, his liquidity preference theory, shows that any investment risk level (as defined by the second moment of asset returns) can be attained by a linear combination of the market portfolio and cash, combined with the ability to hold short (borrow) and to hold long (invest). The market portfolio contains all the non-diversifiable systematic risk, while the cash represents the “risk-free” asset, of which the return compensates for depreciation of value caused by inflation. The linear combination of the market portfolio and cash can create any average return and any risk-premium one wants or needs, under the assumption that the distributions of these investment returns are mutually independent over time.

1.1.2 What's empirically wrong?

Regrettably, there are many things wrong with this oversimplified conceptualization and modeling of the financial markets and one has now become alarmingly obvious. Financial disasters are much more common and occur with much higher frequencies than they should be according to the classical assumptions. An incomplete but rather convincing listing of financial disasters can be found in Kindleberger (1996). Bernstein (1996) and Bassi et al. (1998) mention many additional instances.

The world's financial markets exhibit longer term pricing dependencies, which show, in aggregated and low frequency tra...

Table of contents

- Cover

- Half Title

- Routledge International Studies in Money and Banking

- Full Title

- Copyright

- Dedication

- Contents

- List of figures

- List of tables

- Preface

- Introduction

- PART I Financial risk processes

- PART II Financial risk measurement

- PART III Term structure dynamics

- PART IV Financial risk management

- Appendix A: original scaling in financial economics

- Appendix B: S&P500 daily closing prices for 1988

- Index