- 400 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The Advisor’s Guide to Commercial Real Estate Investment

About this book

The Advisor's Guide to Commercial Real Estate Investment is the only single volume A-Z guide to commercial real estate investment available today. It is an invaluable resource for anyone advising investors as well as for those seeking to increase their knowledge of real estate finance. As investors (and advisors) search everywhere for yield, commercial real estate has proven itself to be the best alternative investment around. Commercial real estate is relatively transparent, able to produce a steady yield, not easily subject to financial fraud, and—thanks to this all-new guide—very easy to understand. Written and edited by an all-start team of experts, The Advisor's Guide to Commercial Real Estate Investment stands out as your how-to resource into investing in the largest asset class in the world. It is a hands-on guide for advisors and the perfect primer for anyone starting out in real estate finance. This is the only guide that fully covers: » Property Types » Portfolio Management » Portfolio Returns and Volatilities » Private Real Estate » Private Equity Funds » Investing in International Real Estate » REITs (listed and non-listed) » International Real Estate Equity Markets » General Risk Considerations » Advanced Strategies » And much, much more!

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access The Advisor’s Guide to Commercial Real Estate Investment by David J. Lynn in PDF and/or ePUB format, as well as other popular books in Business & Finance. We have over one million books available in our catalogue for you to explore.

Information

Chapter | 1 |

Why Real Estate as an Investment

David Lynn, Ph.D; Kevin White, CFA; Dan Occhionero, CFA; and Ross W. Tieken

Introduction

Chapter 1 underscores that there are several different ways of investing in commercial real estate and that each method is unique in terms of the method of investment and advantages and disadvantages. Commercial real estate (CRE) investing as a whole provides five primary benefits:

1. Large investable universe: In the United States, CRE composes a large share of the investable universe which makes it accessible for a variety of investors.

2. Relatively high income returns: CRE has provided high levels of current income relative to cash or government bonds.

3. Lower volatility: CRE has been less volatile than stocks.

4. Diversification: Real estate generally exhibits low correlations with other asset classes, creating opportunities to increase portfolio returns for a given level of risk.

5. Potential inflation hedging: CRE is a tangible asset that can partially hedge inflation risks.

Later in this chapter, we apply commercial real estate investing principles into the context of a diversified investment portfolio to show how risk-adjusted returns can be improved.

Finally, we discuss determining suitability based on an investor’s investment policy statement and two examples of investors accessing commercial real estate.

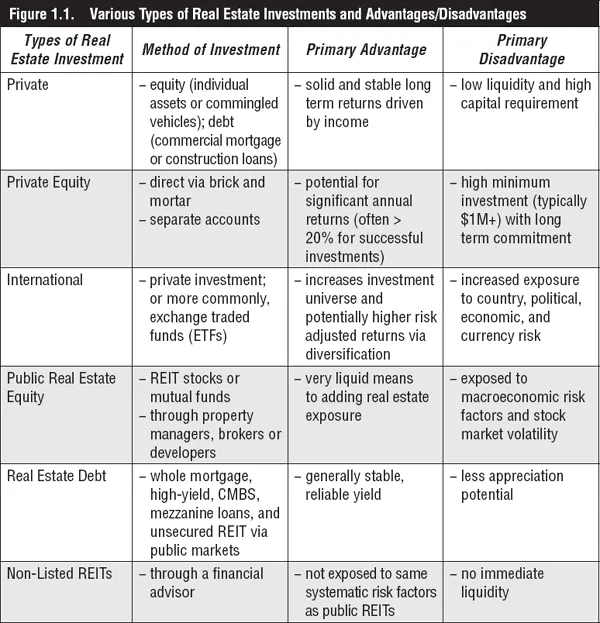

In this book, we will discuss several methods of investing in real estate, including private, private equity, international, public, debt, and nonlisted. Each type of investment comes with its own expected return, risk profile, advantages, and disadvantages (Figure 1.1).

Private Investment

Private investment is done through equity interest in individual or groups of assets or via debt such as a commercial mortgage or construction loan. The return profile is generally solid over the long term and is driven mostly by income. Private real estate investment faces the constraints of high initial capital requirements and low liquidity.

Private Equity Investment

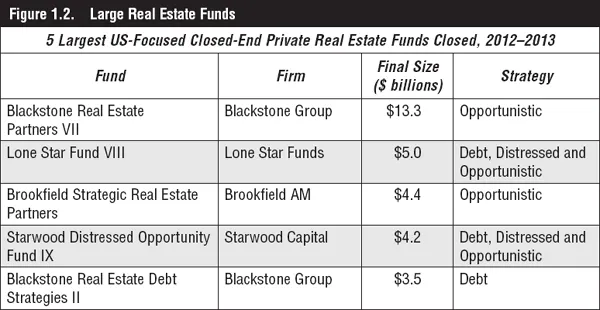

Private equity investment also entails equity and debt investments in property done via a fund that pools capital from investors. Funds are actively managed over a ten-year horizon at which point properties are liquidated. Private equity investors tend to be institutions or high-net-worth investors due to high capital requirements and long-term commitments. Because of these limitations, returns can often be very lucrative—in excess of 20 percent annually for well-run funds. Examples of large real estate funds include entities such as Blackstone, Lone Star, Brookfield, and Starwood (Figure 1.2).

International Investing

International investing is done through private investment, or more often, via an exchange-traded fund (ETF). ETFs trade on an exchange much like a stock and track the performance of a variety of asset classes and indices. International investment increases the investment universe for domestic investors, therefore offering higher risk-adjusted returns via diversification. The primary disadvantage of international investing is exposure to a variety of risk factors including exposure to country, political, economic, and currency risk. Investing in international REIT stocks and ETFs will also carry exposure to systematic risk associated with publicly traded markets. Some of the large international real estate ETFs include SPDR Dow Jones Global Real Estate ETF, Vanguard Global ex-US Real Estate ETF, SPDR Dow Jones International Real Estate ETF, WisdomTree Global ex-US Real Estate Fund and several others. ETF data is readily available from Morningstar, Inc., a leading provider of independent investment research in North America, Europe, Australia, and Asia.

Public Real Estate Investing

Public real estate investing is done through individual REIT stocks and REIT mutual funds, or through property managers, brokers, or developers. Investing in public real estate offers the unique advantage of high liquidity, which allows investors with a low capital base to enter the space. The primary disadvantage of public real estate investment is high exposure to macroeconomic risk factors, which create general stock market volatility. Some of the large REIT mutual fund managers include Cohen & Steers, Fidelity, TIAA-CREF, Invesco, T. Rowe Price, and several others. ETFs have also gained in popularity. An ETF is an investment fund that trades similar to a stock. It holds assets such as stocks, commodities, or bonds and generally trades close to net asset value. Many of them track broader stock indices or more narrow sectors such as real estate. Large real estate ETFs include Schwab US REIT ETF, SPDR Dow Jones REIT ETF, Vanguard REIT ETF, iShares Cohen & Steers REIT ETF, and several others. Real estate mutual fund and ETF data is readily available from Morningstar.®

Real Estate Debt Investments

Real estate debt investments include whole mortgage, high-yield, CMBS, mezzanine loans, and unsecured REIT debt via public markets. Returns are generally stable (compared to other methods of real estate investments) but appreciation potential is also limited.

Nonlisted REITs are purchased through a financial advisor. The primary advantage of nonlisted REITs is that investments are not exposed to the same systematic risk factors as public REITs. However, nonlisted REITs require a lock-up period, which means that investments offer no immediate liquidity.

The ways in which different types of commercial real estate are accessed (essentially, the investment products) creates varying investment return characteristics. For example, a portfolio of retail net-lease buildings offered in a private, commingled vehicle uses appraisal-based pricing to contribute to coming up with a net asset value per share of ownership in the portfolio. This is typically done on a quarterly basis when investors are allowed to invest and redeem. Meanwhile the same portfolio offered through a publicly listed REIT will have its shares priced throughout trading sessions in the public market. The same investment in underlying buildings would never have the same return profile because of the way in which they are packaged into products.

Five ‘Whys’ for Commercial Real Estate Investing

Commercial real estate (CRE) is a unique asset class that warrants consideration by investors given the many benefits. Five of the key benefits of CRE investment, as discussed in the following sections, are:

(1) A large investable universe,

(2) Income returns,

(3) Lower volatility,

(4) Diversification, and

(5) Inflation hedging.

Large Investable Universe

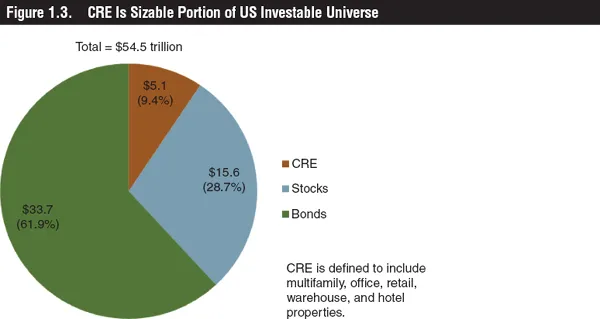

After bonds (61.9 percent) and stocks (28.7 percent), CRE is the third largest asset class in the United States representing approximately $5.1 trillion, or 9.4 percent, of the $54.5 trillion investable universe, as shown in Figure 1.3. Accordingly, an investor that excludes it from a portfolio is significantly narrowing the universe of potential investment opportunities.

SOURCES: BEA, IMF, Cole Real Estate Investments, Inc.

NOTE: Data as of December 2011.

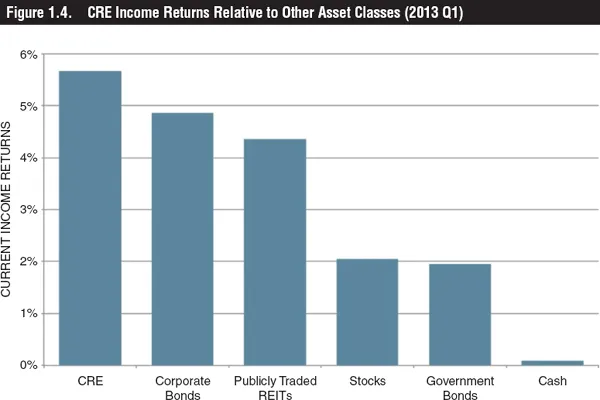

Income Returns

Investments in general produce two kinds of returns: cash yields (income returns) and value changes (capital gains or losses). In the case of CRE, income returns (generated from tenants’ rental payments) have historically accounted for more than 90 percent of total returns (compared with 23 percent in the case of stocks). Real estate’s healthy income component is attractive to investors seeking stable cash flow. Stable income is also safer during periods of financial-market stress when liquidating assets may prove problematic.

Income returns on commercial property have been particularly attractive in recent times relative to other investment alternatives. Aggressive Federal Reserve policies aimed at promoting economic recovery (close to 0 percent short-term interest rates and several rounds of asset purchases) have pushed cash and Treasury bond yields down to near-record lows. Although corporate bond and equity dividend yields are attractive, they still do not match those available from CRE (see Figure 1.4).

Past performance is no guarantee of future results.

SOURCES: National Council of Real Estate Property Index (NCREIF NPI) (CRE); Moody's Baa Corporate (Corporate Bonds); National Association of Real Estate Investment Trusts (NAREIT) All Equity REITs (Publicly Traded REITs); S&P 500 (Stocks); 10-Yr US Treasury (Government Bonds); 3-Month US Treasury (Cash).

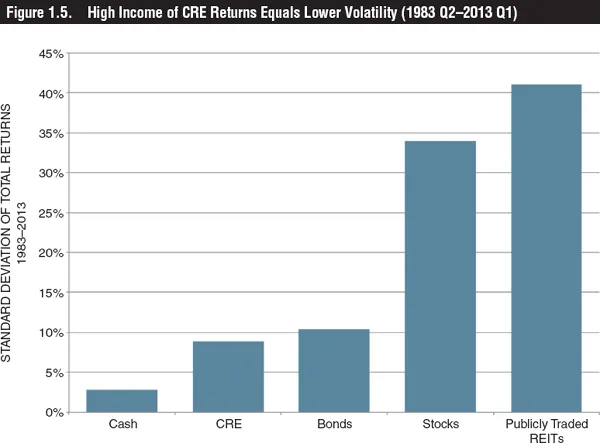

Lower Volatility

Real estate’s substantial income component helps to temper its volatility relative to asset classes that derive a higher proportion of returns from price movement. Additionally, longer rental lease terms help to mitigate the impact economic fluctuations have on rental income. CRE as an investment has historically exhibited stability similar to bonds while being much less volatile than equities, whose prices are more sensitive to systematic risk factors and overall sentiment (see Figure 1.5). This relative stability may be especially alluring in today’s uncertain financial climate.

Past performance is no guarantee of future results.

SOURCES: NCREIF NPI (CRE); Barclay's US Aggregate (Bonds); NAREIT All Equity REITs (Publicly Traded REITs); S&P 500 (Stocks); 10-Yr US Treasury (Government Bonds); 3-Month US Treasury (Cash).

Note: Volatility is measured from quarterly annualized data.

Diversification

On a stand-alone basis, CRE may offer compelling value as a source of current income. Yet its capacity to reduce volatility is enhanced when it is included in a balanced portfolio. Like stocks and bonds, real estate is influenced by economic and financial drivers, such as economic output and interest rates. But it also has unique characteristics, including extended lease terms, sensitivity to development activity (currently near an all-ti...

Table of contents

- Cover

- Title Page

- Copyright Page

- About Summit Professional Networks

- Acknowledgments

- About the Authors

- Contents

- Introduction

- Section 1: Why and How to Invest in Commercial Real Estate

- Section 2: Private Real Estate

- Section 3: Public Real Estate

- Section 4: Advanced Topics and Risks

- Index