- 384 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

This new 12th edition contains some of the most important updates ever made to this highly popular publication. This edition of Building a Financial Services Clientele brings the proven One Card System ("OCS") to life in a contemporary, high-tech context—penetrating the mechanics of the system itself to expose why the approach works and how you can take advantage of today's tools and technology while still employing the remarkably effective OCS system. This edition provides step-by-step instructions on how to: Understand the client-building philosophy Use Social Media for improved prospecting Conduct an effective fact-finding interview Use Activity and Efficiency Points to Stay on Track Use the CAM System Understand the consultative sales cycle Enhancements to the 12th Edition: New Chapter: Understanding the Science of Building a Clientele New discussion of the importance of – and how to – stay focused Complete update of the relationship of technology and the One Card System including discussion of technological tools, benefits of technology, networking and social media Increased emphasis on "soft skills" including client research and physiological value of new clients, client guidance and loyalty Enhanced treatment of Client Acquisition Process Enhanced treatment of managing time and relationships CAM (Career Activity Management) System chapter entirely updated Mastering the Client Acquisition Process Expanded instruction in identification of "Qualified Suspects" and turning them to Clients Updating of useful tools for increasing industry knowledge and skills Scripts for the six-step prospecting approach to gaining more clients Tips and scripts for use of the telephone, mail and email Effective communication techniques for today's producer Tools for customer-relationship management and practice management Setting goals and refining work plans Analyzing and managing activity and production Handling the fact-finding interview Effective closing techniques Maximizing the value of delivery and post-sale contacts Whether you're a beginner or an established professional, there is only one proven system that will bring you true success...that's the One Card System, and this is the book that will help you master these proven techniques.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Building A Financial Services Clientele, 12th Edition by Al Granum,Al Granum in PDF and/or ePUB format, as well as other popular books in Personal Development & Finance. We have over one million books available in our catalogue for you to explore.

Information

Part 1

Why the Research and Original Approach Are Valid Today

Chapter 1

Building a Long-Term Career

You’re in Control

What is it about a sales career in financial services that attracts people? The magnitude and range of skills required to succeed are clearly daunting. Yet, the career continues to attract a steady stream of energetic, entrepreneurial people. What is the appeal? The answer is the unique combination of rewards the career offers, such as:

• Potential of financial rewards

• Independence

• An opportunity to truly help people in a significant way

• Intellectual stimulation

Rewards and Opportunities

Financial Potential

Many believe the financial potential of this career is “unlimited.” Perhaps this is a bit of a stretch, but it is clear that a financial service professional can earn compensation in direct proportion to his or her talent and effort. Think about it. Most career opportunities have clear limits on what someone can earn in a given time period. How many other careers are as free from the restrictions of internal corporate politics? In most financial services companies the territories, markets, and types of accounts are open to every producer. It’s really you and the world – you’re in control! The opportunity to achieve is truly exceptional.

Earnings Commensurate with Your Talent and Effort

Personal Independence

The American essayist Christopher Morley once wrote, “There is only one success…to be able to spend your life in your own way.” It appears that most people who are attracted to the financial services industry have a strong desire to be self-directed and captain of their own ship. Experienced, successful financial service professionals have an unusual amount of independence in the structuring of their professional lives. They control their own calendars and time schedules. They have the luxury of being able to choose their own travel commitments. They can schedule around family events and, to a large extent, control their own destiny.

The initial relationship between you and your company is one of interdependence.

As success is earned, so is increased independence. Perhaps it would be more accurate to describe the initial relationship between new financial service professionals and their companies as one of interdependence. Nonetheless, the combination of earning potential and independence creates an opportunity for personal freedom that few careers can match.

An Opportunity to Be of Service to Others

Another appealing feature of a financial services career is the genuine opportunity to help other people in a significant way. It is difficult to overstate the human benefit that flows from your work. Programs providing an intelligent mix of insurance and investments provide both peace of mind and personal confidence. Knowing that the financial well being of one’s family and business is protected is both satisfying and enormously important. Furthermore, your contribution to your clients’ future doesn’t stop with the immediate family. It flows through generations and has a lasting mark on the course of the lives of children and grandchildren. Communities also benefit through capital accumulation and business longevity. The financial service professional truly makes a substantial and lasting difference in many, many lives.

Your contribution to your Clients’ financial security will flow through generations.

Continual Intellectual Stimulation and Challenge

Finally, the ever-changing nature of the economy, tax laws, and the industry offer continual intellectual stimulation. While this career choice is not without its challenges, it is never boring.

The Client Building Philosophy

The Profit Is in the Relationship, Not in the Sale

The key to achieving this combination of compensation, individual freedom, and service to others centers around the process of obtaining and sustaining a client base. Clients – not just sales – bring both freedom and the opportunity to be of genuine service.

Who, then, is a Client? A Client is a person, household or business that has purchased insurance or other financial products as a result of an in-depth Fact Finding Interview. In other words, a Client is a paying entity in which the decision maker has a relationship with you that is based upon a thorough discussion of his or her situation. A Client is probably best defined not by what he or she has bought, but by the process that was used to determine the appropriate purchase. Simply put, a Client is someone who has shared personal and financial information with you and feels a sense of trust and continuity into the future. A Client is considered to be active when he or she is likely to buy from you again as his or her situation changes over time.

You know you have a true Client when, if asked whether they have a trusted financial professional, they name you!

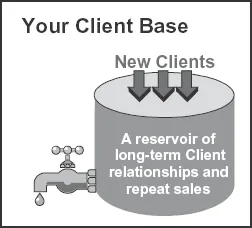

What is a client base? Since Active Clients are people or businesses that will continue to buy from you in the future, a client base is best viewed as a reservoir of long-term relationships and repeat sales. Unfortunately, the reservoir is somewhat leaky. That is, Clients die, move, divorce or are lured away. Some just become satisfied and saturated, so steady but slow attrition is inevitable. The goal is to fill the reservoir with new Clients faster than the reservoir drains.

Client vs. Policyholder or Investment Account Holder

A Client, in One Card System (OCS) terminology, is not the same as a policyholder or investment account owner. A policyholder or account owner is a person who has engaged in a sales transaction with a producer but feels no particular sense of trust or loyalty. This person often buys a product focusing on cost or ...

Table of contents

- Cover

- Title Page

- Copyright Page

- Table of Contents

- About Our Organization

- Preface

- Introduction

- About the Authors

- The Touch of the Master’s Hand

- Part 1: Why the Research and Original Approach Are Valid Today

- Part 2: Using OCS with Today’s Tools and Technology

- Part 3: Critical Soft Skills for Client Building

- Appendix A: Converting to the One Card System

- Appendix B: Staying Focused – Getting Things Done with a Quiet Mind

- Appendix C: The Psychology of Establishing and Maintaining Trusting Professional Relationships

- Index