![]() PART I

PART I

Production![]()

1

Corporate Transnationalism

The US Hispanic and Latin American Television Industries

JUAN PIÑÓN

The transnational as a concept has gained increasing attention from scholars to reflect the complex and hybrid flows of populations, finances, corporations, technologies, and cultures that provide the context for media expansion across borders. Such expansion results from the intensification of globalization processes in the last decades. The transnational, in contrast to the notion of “international,” was born out of the necessity to defy binary oppositions between the national and the foreign, the local and the global (Georgiou, 2006), by underscoring the porous character of national borders, borders that the notion of international seems to reify. The transnational also underscores the multispatial, multilayered, hybrid identities and cultures that coexist at cross-border, regional, and global levels. While a new set of media-related, differentiated socioeconomic-cultural processes is felt at global levels, upon an expanding financial, legal, communicational, and technological infrastructure worldwide, we can understand their articulations and speed only by taking into account the specific historical conditions of the geographies in which they are taking place.

In the case of the Americas, the relationship between the US media and Latin America has long been characterized by the increasing penetration of the US media, as a foreign corporate and cultural force, into the region (Schiller, 1991; Miller et al., 2005). At the same time, the increasing transnational relevance of evolving hybrid and complex corporate relationships between US Hispanic media and Latin American media requires us to pay attention to new institutional media modalities that are simultaneously shaping and blurring the notion of the national and forging a new industrial television character that rests mostly on the televisual constructed as culturally proximate for the region. The national broadcasting television industries in the Latin American region were born in a close relationship with US broadcasting technologies, media corporations, financial institutions, sponsors, and advertising companies. These relationships were rooted in the transnational corporate relationships that had been forged during the hemispheric expansion of the radio broadcasting industry (Fox, 1997; Sinclair, 1999). The launch of television in the region was made possible initially by imported technological flows, capital, programming, production schemes, and industrial television routines, mostly from the United States. Several Latin American nations, however, mainly the ones with the largest domestic markets, such as Brazil, Mexico, and Venezuela, were able to develop strong national television industries with very specific cultural and industrial characteristics. Brazilian TV Globo, Mexican Televisa, and Venezuelan Venevision benefited from both the relative sociopolitical stability enjoyed by these nations and the close relationship of these dominant corporations with their national governments, which favored these television networks through the establishment of monopolistic and duopolistic market structures (Fox and Waisbord, 2002). Due to these market conditions, these corporations were able to flourish as programming producers with regional impact and gain an important presence in the world television marketplace. Through their participation as owners and investors in US Hispanic-oriented media corporations, these Latin American corporations were able to make historically strong inroads into the US Latino television market with their programming and audience preferences.

The notion of programming counterflows revealed the robust and dynamic performance of the Latin American television industry and its penetration of the US and global markets (Straubhaar, 1991, 2007). But the new industrial US television landscape (Lotz, 2007) and the increasingly interwoven corporate relationship across the hemisphere require us to revisit the definition of these flows as interregional (Keane, 2006; Thussu, 2007). The purpose of this essay is to understand the new ways the transnational takes shape in the relationships between US and Latin American media corporations, particularly in the national broadcasting industries.

I argue that the line between the national and the foreign in US Hispanic and Latin American television has become blurry because of the increasing presence of transnational capital, productions, and formats. Further, the products passing as local/national are made possible through the strategic arrangement of these foreign media companies with national-local players. I complicate the well-established notion of cultural proximity, in which audiences tend “to prefer and select local or national cultural content that is more proximate and relevant to them” (Straubhaar, 1991: 43), by illuminating the industrial dynamics in which cultural proximity is pursued and constructed through television programming strategies devised by transnational corporations in order to succeed in national and regional markets. By examining some recent changes in transnational production arrangements, this essay reveals a manufactured condition of cultural proximity. Furthermore, the power of these manufactured televisual proximities is felt within a programming circuit of exhibition in which certain television networks establish programming agreements with other television networks across the whole hemisphere. These arrangements mirror domestic rivalries at transnational levels while also ensuring the visibility of their production styles and narrative strategies overseas. Structuring the programming offer within the region is an important outcome of this distribution strategy, by securing screens for exhibition for hegemonic players while cementing the familiarity of their particular foreign-produced content, marking it as culturally proximate at regional levels.

The region’s integration into the global economy has resulted in increased forms of transnational presence within a television industry that needs capital flows to be competitive at national and regional levels, but is still tied to the legal limitations on foreign ownership imposed by specific broadcasting media regulations. Frequently the legal framework that limits foreign ownership has been defied by legal loopholes, corporate joint ventures, partial investments, stock market shares, and the increasing push of ownership deregulation. Also, transnational capital and global media are gaining more of a presence in national settings, not as foreign cultural forces, but through the faces of local-national production houses with access to distribution screens in national networks. As a result, transnational corporate agreements have not only secured the transnational circulation of programming in specific screens, but also cemented the power of certain media players to become the main sources of production and distribution across the hemisphere, reinforcing the privileged position of media corporations with transnational reach.

The main questions guiding my analysis are the following: How has the new industrial television landscape reshaped the relationship between US Hispanic television corporations and Latin American television industries? What are the specific ways the transnational is deployed within the industrial space of the US Hispanic and Latin American television landscape? Finally, how is a new form of foreign presence and participation changing common ways of thinking about transnationalism within the region?

For that purpose, I underscore two dimensions that uniquely reveal the new transnational configuration of the broadcasting television industry: transnational media ownership and investment and corporate agreements for hemispheric programming flows. First, I trace media ownership and the kind of transnational production strategies that resulted from the specific legal-industrial configuration that allows the production of a manufactured cultural proximity. Second, I highlight the programming flows that resulted from corporate hemispheric programming agreements. These particular programming flows, which I call circuits of exhibition, reveal the hidden dynamics that fuel distribution flows.

Television Corporate Ownership and Investment within a New Media Landscape

Through the combined processes of deregulation, privatization, and liberalization, the landscape of US Latino and Latin American television industries has dramatically changed (Fox and Waisbord, 2002). These industrial changes have resulted in the rising visibility of new television network competitors, the growing relevance of national independent house productions, the intensifying financial processes of foreign investments, and the active participation of global media players through the launching of localized television networks within the region. These developments have allowed the number of national media players to increase while also creating heightened production-programming-distribution relationships with regional and global media counterparts.

In contrast to the sweeping trend of deregulation in telecommunications, cable, and satellite television, the broadcasting industry is still widely protected from transnational participation, mainly on the basis of its strategic character, expressed by “the idea of ‘home,’ of a bond between the nation and broadcasting” (Monroe, 2000: 12). In the United States, for instance, the 310 provision mandates that television station licenses be granted only to US citizens while also imposing a 25 percent limit on foreign ownership and investment in broadcasting TV stations (Carter, 2000, 431). This scheme of limited foreign participation in media ownership is practiced in Argentina with up to 30 percent foreign ownership, Brazil with 30 percent, and Colombia with 40 percent. In Mexico, Venezuela, and Uruguay, however, foreign participation in this sector is explicitly excluded. Chile is the only country with a major media industry in the region with no limits on foreign participation and ownership (Investment Development Agency, n.d.). Yet media industries require capital for growth, so applying strict limits to foreign ownership seems to pose particular challenges to an industry that wants to benefit from access to global financial flows through stock markets. For instance, in the case of Mexico, where the law explicitly forbids foreign ownership in broadcasting media, since 1989 new regulations from the National Commission of Foreign Investment classified foreign investment originating from the Mexican Stock Market as “neutral” (Robles, 1999). Such neutral investments are not considered “ownership” and do not count in defining foreign investment (38). In the case of Argentina, the 30 percent limit on foreign ownership can be lifted in a reciprocal relationship with other nations offering more opportunities for foreign investment in media communication corporations. For Colombia, control of the company should remain in national hands, and the nation from where the foreign investment originates should offer the same opportunities to Colombian investors (Investment Development Agency, n.d.).

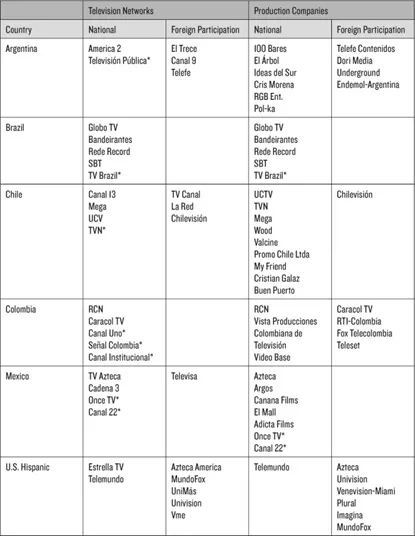

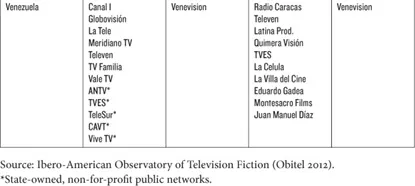

Table 1.1. Ownership of National Television Broadcasting Networks and Production Houses

Due to this regulation, the broadcasting television industry remains largely a national endeavor with very few exceptions, while foreign participation through partial investment or as neutral investments seems to be rising. In 2011, there were forty-seven national broadcasting television networks in the seven main Latin American markets of Argentina, Brazil, Chile, Colombia, Mexico, Venezuela, and the US Hispanic market (table 1.1). There are thirty-four national private broadcasting networks and thirteen nonprofit public national broadcasting networks (Obitel, 2012). Out of the forty-seven national television networks, twelve have a foreign presence. Some of these television networks have foreign participation through the stock exchange market (SEM) or from direct investment, and a few from takeovers by foreign entities. In Argentina, El Trece, owned by the Clarín Group Argentina, with a presence in the Argentinean and London SEMs, has 8.75 percent ownership by the Booth American Company. Twenty percent of Canal 9 is owned by the Argentinean Daniel Haddad and 80 percent by Mexican-owned Albavisión. Telefe is 100 percent owned by Spanish-owned Telefónica. In Chile, where there is no restriction on foreign ownership, Telecanal was sold to the Mexican entrepreneur Guillermo Cañedo (a former Televisa executive). La Red was sold to Mexican-owned Albavisión. Chilevisión was sold to Turner Broadcasting System (United States). In the case of Colombia, the Santo Domingo family, owners of Caracol, sold 60 percent of its shares of Caracol Radio to Prisa in 2002; however, the family retained full ownership of Caracol TV (Arango-Forero et al., 2010). In Mexico, 43 percent of Televisa is owned by the Mexican Azcárraga family. Present in both the Mexican SEM and the NYSE, Bill Gates holds 8 percent of Televisa’s stock, protected as neutral investments. Dog & Cox, First Eagle Global, Bank Morgan, and Cascada Investment also have a presence in Televisa with minor participation (Institut für Medien- und Kommunikationspolitik, n.d.). In the case of the United States, the law allows partial foreign ownership up to 25 percent. Mexican Televisa owns 5 percent of Univision Corporation, with options to grow to 30 percent (Fontevecchia, 2010). The public-oriented Vme has 42 percent of shares owned by the Spanish Group Prisa (“VMe,” n.d.). Azteca America, a US corporation, is 100 percent owned by Mexican TV Azteca, but does not break US law because TV Azteca has no ownership of its television stations, since they are the corporation’s independent affiliates (“Azteca America,” n.d.).

In spite of provisions that allow partial foreign ownership in countries such as Colombia and Brazil, in both countries there is a lack of foreign ownership in national television networks, and the main media corporations in Latin America have been held by...