![]()

Part I

Organizing for Export and Import Operations

![]()

Chapter 1

Organizing for Export and Import Operations

When a company makes the decision to begin marketing its products outside the United States or to source raw materials from abroad, it generally assigns the compliance task to someone in the supply chain group with little to no background in the complexities of regulatory compliance. Very few people set out on a career path to develop an expertise in the import/export compliance field, but it is a highly necessary and valued position in today’s global environment.

Companies must have a smooth, efficient, and compliance-oriented (and, therefore, profitable) exporting and/or importing program and it requires that some personnel must have specialized knowledge. The personnel involved and their place in the business organization vary from company to company, and sometimes the same personnel have roles in both exporting/importing and other functions within the company. In small companies, one person may perform all of the relevant functions, while in large companies or companies with a large amount of exports or imports, the number of personnel dedicated to the compliance responsibilities may be large. In addition, as a company decides to perform in-house the work that it previously contracted with outside companies (such as customs brokers, freight forwarders, consultants, packing companies, and others) to perform, the export/import department may grow. As business increases, specialties may develop within the department, and the duties performed by any one person may become narrower.

A. Export Compliance Department

For a company to grow by marketing its products abroad, it must be compliant with both U.S. export controls and foreign import regulations. This compliance-first attitude must be driven from the top by the President or CEO. To be compliant, every employee must be aware of his own role in the process. Violations may result in penalties of $250,000 per violation, bad publicity and even a denial of export privileges. It is critical to the bottom line of any company to be compliant. One of the key responsibilities of an export compliance person is the ability to say “Stop the Shipment” and have the support of management to enforce that dictate. It is far better to stop a shipment than try to explain later when a subpoena arrives or when an enforcement agent shows up at your door why the company exported products in violation of the law.

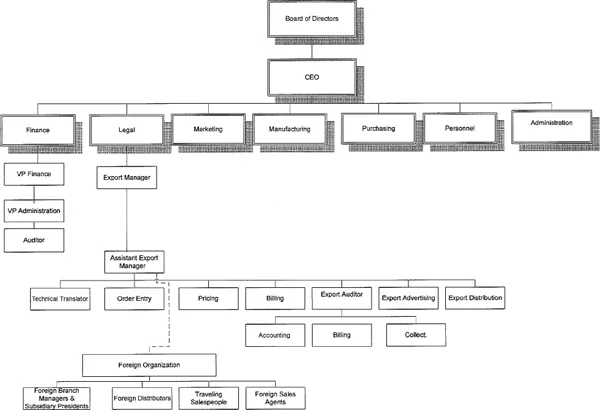

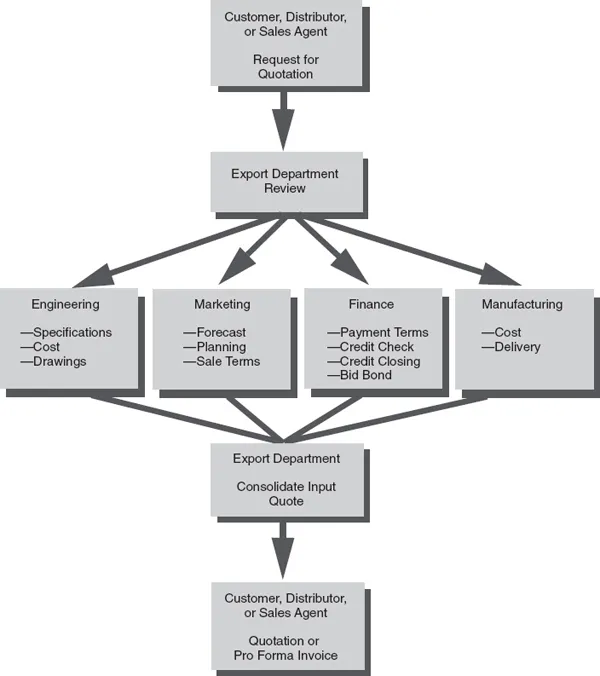

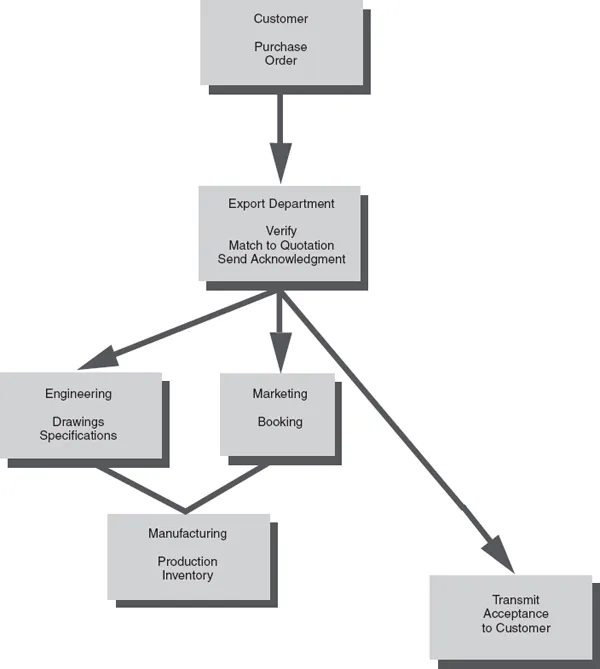

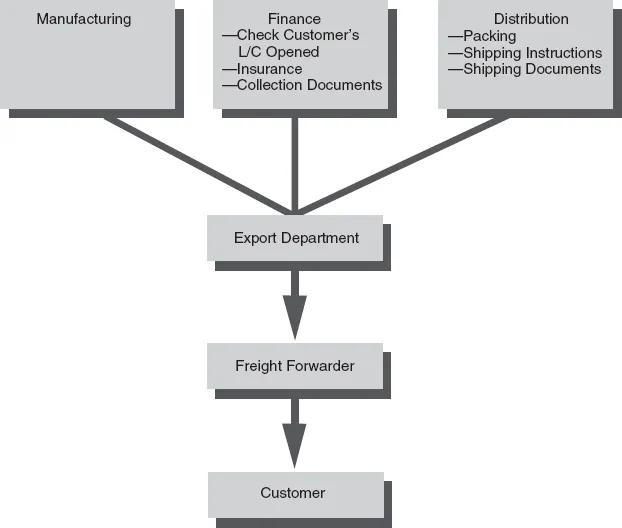

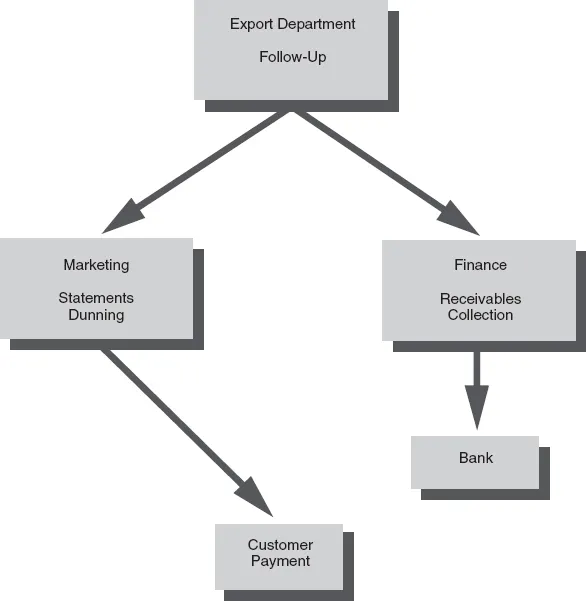

For many companies, the export department begins in the sales or marketing department. That department may develop leads or identify customers located in other countries. Inquiries or orders may come from potential customers through the company’s web site. When such orders come in, the salespeople need to determine what steps are different from its domestic sales in order to fill those export orders. For example, how do they arrange for the shipment; how will they guarantee payment; who is responsible for insurance; etc. Often the exporter’s first foreign sales are to Canada or Mexico. Because the export order may require special procedures in manufacturing, credit checking, insuring, packing, shipping, and collection, it is likely that a number of people within the company will have input on the appropriate way to fill the order. In addition, if the customer is expecting to take advantage of the North American Free Trade Agreement, the products must meet certain criteria to be eligible. Determining the eligibility should be done before marketing the product and the process can be complicated, but without ensuring the product is eligible, all duty-free privileges will be denied and the Company may lose a customer. As export orders increase (for example, as a result of an overseas distributor having been appointed or through an expansion of Internet sales), the handling of such orders should become more routine and the assignment of the special procedures related to an export sale should be given to specific personnel. It will be necessary to interface with freight forwarders, couriers, banks, packing companies, steamship lines, airlines, translators, government agencies, domestic transportation companies, and attorneys. Because most manufacturers have personnel who must interface with domestic transportation companies (traffic or logistics department), often additional personnel will be assigned to that department to manage export shipments and interface with other outside services. Some of this interface, such as with packing companies and steamship lines, and possibly government agencies and banks, may be handled by a freight forwarder, but the ultimate responsibility lies with the exporter, so knowledgeable oversight of the supply chain partnerships including, freight forwarder oversight is critical. The number of personnel needed and the assignment of responsibilities depend upon the size of the company and the volume of exports involved. A chart for a company with a large export department is shown in Figure 1–1. The way in which an export order is processed at the time of quotation, order entry, shipment, and collection is shown in Figures 1–2, 1–3, 1–4, and 1–5, respectively. Smaller companies will combine some of these functions into tasks for one or more persons.

B. Import Department

A manufacturer’s import department often grows out of the purchasing department, whose personnel have been assigned the responsibility of procuring raw materials or components for the manufacturing process or out of the supply chain department, because the responsibility of that group is managing the international transportation. It is important that the personnel responsible for the import compliance receive proper training.

For importers or trading companies that deal in finished goods, the import department may begin as the result of being appointed as the U.S. distributor for a foreign manufacturer or from purchasing a product produced by a foreign manufacturer that has U.S. sales potential. Because foreign manufacturers often sell their products ex-factory or FOB plant, a U.S. company that intends to import such products must familiarize itself with ocean shipping, insurance, U.S. Customs clearance, and other procedural matters. Increasingly, a number of U.S. manufacturers are moving their manufacturing operations overseas to cheaper labor regions and importing products they formerly manufactured in the United States. That activity will also put them in contact with foreign freight forwarders, U.S. customs brokers, banks, the U.S. Customs and Border Protection, marine insurance companies, and other service companies.

Once again, import compliance is key to ensuring a smooth import process and all parties in an organization must be aware of the compliance role they play in meeting those requirements. Compliance begins at the time a product is in the design stages for manufacture either abroad or in the U.S. in order to be able to take advantage of import opportunities for finished goods or components and to ensure that there is no misunderstanding regarding the classification, duty rate, availability of certain free trade agreements duty reduction programs, proper valuation, county of origin marking, etc. There are potential penalties and seizures available to the U.S. Customs and Border Protection, so compliance must be first and foremost at all times.

Figure 1–1. Export organization chart.

Figure 1–2. Export order processing—quotation.

Figure 1–3. Export order processing—order entry.

Figure 1–4. Export order processing—shipment.

C. Combined Export and Import Departments

In many companies, some or all of the functions of the export and import departments are combined in some way. In smaller companies, where the volume of exports or imports does not justify more personnel, one or two persons may have responsibility for both export and import procedures and documentation. As companies grow larger or the volume of export/import business increases, these functions tend to be separated more into export departments and import departments as each develops a specialized expertise in their areas. A diagram of the interrelationships between the export and import personnel in the company and outside service providers is shown in Figure 1–6.

Figure 1–5. Export order processing—collection.

D. Manuals of Procedures and Documentation

It is often very helpful for companies to have a manual of procedures and documentation for their export and import departments particularly as personnel changes. Such manuals serve as a reference tool for smooth operation and as a training tool for new employees. Moreover, since the Customs Modernization Act, such manuals are required to establish that the importer is using “reasonable care” in its importing operations, and they have become essential in the mitigation of penalties for violations of the import and export laws administered by the U.S. Customs and Border Protection; the Bureau of Industry & Security, Department of Commerce; and the Office of Foreign Assets Control, Department of Treasury and Directorate of Defense Trade Control, Department of State. Such manuals should be customized to the particular company and kept up-to-date. A good manual should describe the company’s export and import processes. It should contain names, telephone numbers, and contact persons at the freight forwarders and customs brokers, steamship companies, packing companies, and other services that the company has chosen to utilize as well as government agencies required for the import or export of the company’s commodities. It should contain copies of the forms that the company has developed or chosen to use in export sales and import purchases and transportation, identify the internal routing of forms and documentation within the company for proper review and authorization, and contain job descripti...