eBook - ePub

Translating Strategy into Shareholder Value

A Company-Wide Approach to Value Creation

- 304 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Translating Strategy into Shareholder Value

A Company-Wide Approach to Value Creation

About this book

Too often there are serious missed signals between a company's stated goals and the methods employed to try to reach them. Translating Strategy into Shareholder Value is a unique look at how the planning process relates to the achievement of shareholder value, and ways to ensure that the two directly complement each other. Using tools and a special case study to analyze past, present, and future performance, the book takes readers through a host of steps, including:* Comparing existing strategy to the competition and the economy as a whole* Analyzing productive capabilities and costs* Bringing nonfinancial metrics to test how future strategy creates value* Selecting the right analytical tool and looking at strategic solutionsIf corporations are to truly maximize their success, managers need to understand how to translate corporate strategy to the bottom line -- and that means seeing the big picture.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Translating Strategy into Shareholder Value by Raymond J. TROTTA in PDF and/or ePUB format, as well as other popular books in Business & Leadership. We have over one million books available in our catalogue for you to explore.

Information

PART 1

Introduction to Strategic Alternatives

CHAPTER 1

Value and Value Proposition

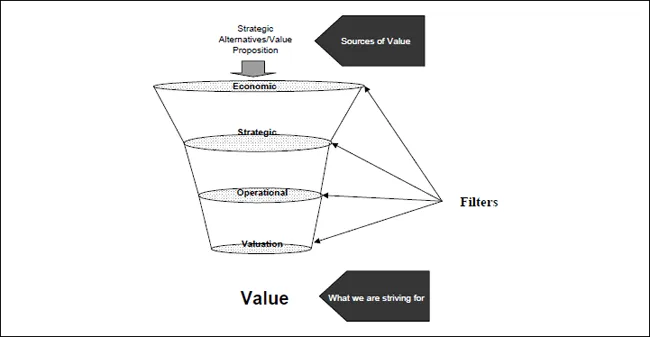

THE STEP-WISE Approach to Value (SWAV) is a method to assess the value derived from a Strategic Alternative (SA). Following the path illustrated in Exhibit 1-1, we need to understand what we are looking for (shareholder value) and how it is generated (value proposition) before discussing the value filters. This chapter will deal with the concept of value; more specifically, what it is and how it is derived.

Value has become a buzzword. We constantly hear executives say things like:

Exhibit 1-1. The Step-Wise Approach to Value.

Value seems to be an ubiquitous term, yet if you speak with a hundred executives, you will get a hundred different definitions. The major problem is that there is no clear definition with regard to the concept of value. If the objective of a business is to create value, then it needs to be clearly defined. We need to clear up this issue for the purposes of this work. This problem also exists in finance. This chapter will look at three concepts of value: book value, market value, and lastly the valuation concept upon which this book is based. Intrinsic value is the best form of value for our purposes because it is based on cash flow; it is forward-looking and can be quantitatively measured.

After establishing this concept, we will present a way to understand how value is created. More specifically, we will answer the question, “How are we adding value?” It is critical to understand the value proposition for an SA. The value proposition will be described in terms of three distinct sources of value: revenue increase and maintenance, competitive repositioning, and efficiency. It is important to clearly describe the value proposition so that it can be assessed using the filters of the SWAV. When it comes to creating intrinsic value, there are a limited number of ways to do it. Using this method of categorizing value propositions will help to eliminate confusion and will tend to eliminate value propositions that do not increase shareholder value. This keeps the company focused on Strategic Alternatives that will tend to increase shareholder value.

What Is Value?

The objective of this book is to link strategy to finance. Hence our concept of value will be driven by financial constructs. We will first discuss three concepts of shareholder value (book value, market value, and intrinsic value) and present their strengths and weaknesses.

Book Value

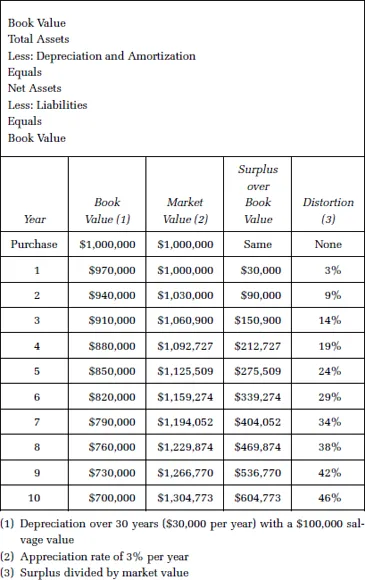

This form of value is the worth of a company based on its financial statements. This means the net asset value of a company, as illustrated in Exhibit 1-2.

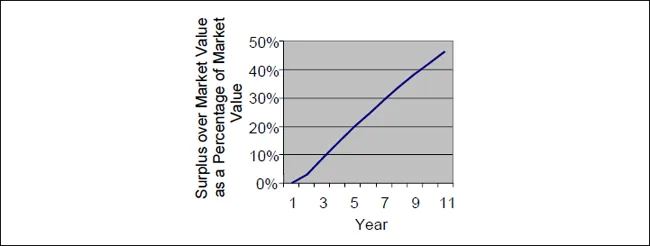

There are some major problems with this definition as presented in Exhibit 1-2. First, it uses accounting principles that do not necessarily reflect realistic conditions. Total assets are adjusted for deprecation and amortization, which are allowances taken to adjust for the decline of the price of an asset. Depreciation is an adjustment of the book value of an asset to allow for wear and tear. For example, assume you had a commercial building that was purchased for $1 million and it was depreciated over a thirty-year period, a salvage value of $100,000. Now suppose that the market price of the building increases at a rate of 3 percent per year. The amount of cash the property could be sold for may be rising, and the book value could be falling, as also illustrated in Exhibit 1-2. Over a ten-year period the distortion in value (surplus over book value divided by market value) grows to 46 percent of market value (Exhibit 1-3).

Exhibit 1-2. Book value.

The next issue is that the book value method is based on historic transactions. The value of the building on the books is determined by what the company paid for the property less depreciation (adjustments may be made for improvements over time). The problem is that book value does not look at future growth in value based on changes in demand and the receipt of future cash streams.

Market Value

Market value is the price at which buyers and sellers trade similar items in an open marketplace. In the absence of a market price, market value is the estimated highest price a buyer would be warranted in paying and a seller justified in accepting, provided both parties were fully informed and acting intelligently and voluntarily. This is the price that a willing buyer and a willing seller would pay if the transaction would be consummated today or in the near future. The market value of a stock is what it is trading for today. The problem with this form of value is that it may be based on a “market bubble.” Market bubbles are overvaluations in assets based on irrational behaviors of investors. For example, many Internet stocks in the late 1990s were overvalued based on hype in the business community. Technology analysts saw great growth in market demand for the Internet by consumers and businesses. The bubble did burst as the hype did not transform itself into reality. The ability of the Internet companies to generate cash was in many cases nonexistent.

Exhibit 1-3. Value distortion.

Analysts have created ways to rationalize the future growth in terms of market price by using the earnings multipliers. They use the following formula to understand value:

Market Value = Earnings × Price/Earnings Multiplier

This equates the value of a company with its earnings and a multiplier. Another way to think about this formula is that the multiplier represents some premium that a buyer will pay over current earnings. The premium is in many respects an adjustment for the ability of a company to produce earnings and future growth. The major issue with the multiplier approach is that earnings are not a strong indicator of value and cash generation.

Intrinsic Value

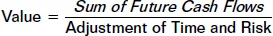

We mentioned that intrinsic value is an estimate of value based on the present value of cash flows. In its simplest form an equation for intrinsic value is:

We will discuss the math behind intrinsic value in Chapter 11. Why is this superior to market and book value? Most importantly, the intrinsic value model is cash flow–based. Cash flow is defined as benefits less costs and taxes. Research has shown that the value of companies has a strong correlation to value.1 This method is more conducive to analyzing SAs. Alternatives that involve changes to the way companies do business are difficult to value, based on market and book value concepts. Reengineering, for example, would most likely be accounted for as an operating expense and not an asset. Hence, a book value calculation could not be used. It would be difficult to find a market for a reengineering initiative because of the specialized and proprietary nature of this alternative. In addition, the intrinsic value model is forward-looking. It focuses on future cash flows.

This valuation concept is not without weaknesses. If assumptions are performed incorrectly, such as in estimation of cash flows and time/risk adjustments, the quality of the analysis is just as flawed as the market and book value models. We will deal with the weaknesses and how to offset them in the section dedicated to discounted cash flow in Chapter 11. On the other hand, the intrinsic value model has the best fit for our purposes.

Understanding the Value Proposition: How Is Value Created?

With our objective defined (intrinsic value), we must focus on how to get there (value creation). Based on the SWAV, adding value would be increasing intrinsic value, which is increasing future cash flows. In the introduction to this chapter we mentioned hackneyed expressions like “adding value.” The way SAs increase value is called the value proposition. The SWAV will test whether value propositions are increasing or adding value using the successively more stringent filters. There are three types of value propositions:

1. Revenue increase and maintenance (RIM)

2. Competitive repositioning

3. Efficiency

The goal is to turn these value propositions into a stream of cash. The objective of the SWAV is to increase the probability of creating a cash stream that will increase intrinsic value. Let’s explore these value propositions in detail.

Revenue Increase and Maintenance

One aspect of this value proposition is in many respects self-explanatory. A Strategic Alternative will increase value if it generates cash from increasing revenue. The relationship is that rising revenue will drive increasing cash flow. The assumption here is that costs and taxes do not exceed the revenue boost. Increasing revenue becomes more difficult in established industries. This occurs because there is greater competition for the same dollar of revenue. This intense competition tends to drive down cash flow because of pricing pressures (see the Porter Model in Chapter 5). This value proposition is normally associated with mergers and acquisitions.

The maintenance aspect of the RIM value proposition is less intuitive. Revenue maintenance is thwarting the loss of revenue driven by market conditions. A company may invest in a technology initiative to improve customer retention. For example, computer telephony interface (CTI) technology improves the flow of information from core systems to the point of contact with the customer. The benefit is improved customer service through improved access to account information and less wait time. The key assumption here is that a Strategic Alternative will protect the existing stream of cash flow. The underlying premise is that revenue and hence cash flow will be lost if the investment is not made. Revenue maintenance investments are normally made if companies feel that they are catching up to their competition. In the CTI instance, the other competitors would already have this technology. The evaluating company would consider a CTI investment as a “strategic necessity.” In the past, managers would use the strategic necessity argument to move forward with SAs that did not have strong quantitative support. With the analytical rigor of the SWAV, SAs will need to be validated through the generation of intrinsic value.

Competitive Repositioning

This is an increase in competitive position that results in increased intrinsic value. Competitive repositioning increases value through:

Increasing or Maintaining Market Share

The underlying assumption is that there is a direct relationship between market share and cash flow similar to RIM and cash flow. This assumption requires rigorous testing through the SWAV. There have been many mergers that were justified on increased market share that have destroyed value. Integration expenses reeled out of control and resulted in a future cash drain as opposed to an increase.

Improving Competitive Intelligence

Competitive intelligence is knowledge and/or information that gives a business a competitive advantage over its rivals. A competitive advantage is obtained by acquiring information about customers, suppliers, markets, and channels. (For instance, a point of sale capability that collects information on customer buying behaviors.) This type of information gives a company the ability to stock shelves with products that customers want. This type of intelligence gives a company an advantage over its...

Table of contents

- Cover

- Half title

- Title

- Dedication

- Contents

- Preface

- Acknowledgments

- Introduction

- Part 1: Introduction to Strategic Alternatives

- Part 2: The Macro View

- Part 3: The Operational Filter

- Part 4: The Valuation Filter

- Bibliography

- Index

- Copyright