Chapter 1

Capital-Formation Strategies and Trends

After more than three decades of being an entrepreneur, serving as a legal and strategic advisor to entrepreneurs and growing companies, and speaking and writing on entrepreneurial finance, I have found one recurring theme running through all these businesses: Capital is the lifeblood of a growing business. In an environment in which cash is king, no entrepreneur I have ever met or worked with seems to have enough of it. The irony is that the creativity that entrepreneurs typically show when they are starting and building their businesses seems to fall apart when it comes to the business planning and capital-formation process. Most entrepreneurs start their search for capital without really understanding the process and, to paraphrase the old country song, waste a lot of time and resources “lookin’ for love [money] in all the wrong places.”

Not only is capital the lifeblood of a growing business, but it is also the lifeblood of our economy. When its flow stalls, our progress stalls. And when small and entrepreneurial companies cannot gain access to capital at affordable costs, we all suffer. According to recent Small Business Administration (SBA) statistics, smaller companies make up 99.7 percent of all employer firms, pay 44 percent of total U.S. payroll, and have generated 64 percent of net new jobs over the past 15 years. When small companies do not have the access to the resources they need in order to grow, our nation cannot grow. If entrepreneurial leaders are too concerned with what new crisis, burdensome regulation, budget deficit, tax hike, or economic downturn may await them to make any new hiring, growth, or capital investment decisions, we are destined to be in a perpetual recession. Healthy credit and equity markets are vital to our country’s ability to foster and commercialize innovation, penetrate new markets, seize new opportunities, create new jobs, offer raises and promotions, and compete on a global basis. The economic downturn of 2007 to 2009 put a dent in everyone’s pocketbook, but for smaller and entrepreneurial companies, it robbed them of the critical fuel that they needed to keep the engines of the economy moving forward. Payrolls were slashed, creativity was halted, inventories were reduced, capital investment decisions were delayed, and motivation in the workforce was virtually nonexistent.

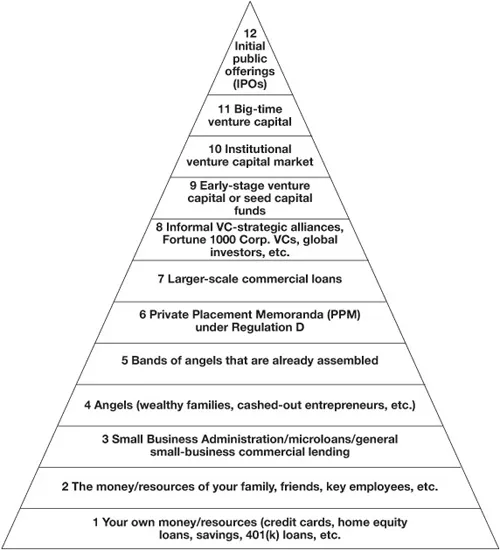

I wrote Raising Capital to help entrepreneurs and their advisors navigate the often murky waters of entrepreneurial finance and explore all of the traditional and nontraditional sources of capital that may be available to a growing business. I’m assuming that you, the reader, are the entrepreneur—the owner of a business that’s looking for new money. So, wherever possible, I’ll address you directly, as if you were a client sitting across the desk from me. My goal is to provide you with pragmatic guidance based on years of experience and a view from the trenches so that you’ll end up with a thorough understanding of how and where companies at various growth stages are successfully raising capital. This will include traditional sources of capital, such as “angels” and private placements; the narrower options of venture capital and initial public offerings; and the more aggressive and newer alternatives such as joint ventures, vendor financing, and raising capital via the Internet. The more likely the option, as demonstrated by the Capital-Formation “Reality Check” Strategic Pyramid in Figure 1-1, the more time I’ll devote to it. Look at the figure as an outline—it’ll make more sense as you read further.

Figure 1-1. The Capital-Formation “Reality Check” Strategic Pyramid.

1. Your own money and other resources (credit cards, home equity loans, savings, 401(k) loans, and so on). This is a necessary precursor for most venture investors. (Why should we give you money if you’re not taking a risk?)

2. The money and other resources of your family, friends, key employees, and other such people. This is based on trust and relationships.

3. Small Business Administration loans, microloans, or general small-business commercial lending. This is very common, but it requires collateral (something that is tough to provide in intangible-driven businesses).

4. Angels (wealthy families, cashed-out entrepreneurs, and other such people). These can be found by networking or by computer. You need to separate smaller angels from superangels. This is a rapidly growing sector of the venture-investment market.

5. Bands of angels that are already assembled. These include syndicates, investor groups, private investor networks, pledge funds, and so on. Find out what’s out there in your region and get busy networking.

6. Private placement memoranda (PPM) under Regulation D. This involves groups of angels that you assemble. You need to understand federal and/or state securities laws, have a good hit list, and know the needs of your targeted group.

7. Larger-scale commercial loans. To get these, you’ll need a track record, a good loan proposal, a banking relationship, and some collateral.

8. Informal venture capital (VC). This includes strategic alliances, Fortune 1000 corporate venture capital, global investors, and so on. These investors are synergy-driven; they are more patient and more strategic. Make sure you get what was promised.

9. Early-stage venture capital or seed capital funds. These make up a small portion (less than 15 percent) of all VC funds. It is a very competitive, very focused niche—the investors are typically more patient and have less aggressive return on investment (ROI) needs.

10. Institutional venture capital market. This is usually second- or third-round money. You’ll need a track record or to be in a very hot industry. These investors see hundreds of deals and make only a handful each year.

11. Big-time venture capital. Large-scale institutional VC deals (fourth- or fifth-round level—for a pre-IPO or merger and acquisition deal).

12. Initial public offerings (IPOs). The grand prize of capital formation.

Understanding the Natural Tension Between Investor and Entrepreneur

Virtually all capital-formation strategies (or, simply put, ways of raising money) revolve around balancing four critical factors: risk, reward, control, and capital. You and your sources of venture funds will each have your own ideas as to how these factors should be weighted and balanced, as shown in Figure 1-2. Once a meeting of the minds takes place on these key elements, you’ll be able to do the deal.

Risk. The venture investors want to mitigate their risk, which you can do with a strong management team, a well-written business plan, and the leadership to execute the plan.

Reward. Each type of venture investor may want a different reward. Your objective is to preserve your right to a significant share of the growth in your company’s value and any subsequent proceeds from the sale or public offering of your business.

Figure 1-2. Balancing Competing Interests in a Financial Transaction.

Control. It’s often said that the art of venture investing is “structuring the deal to have 20 percent of the equity with 80 percent of the control.” But control is an elusive goal that’s often overemphasized by entrepreneurs. Venture investors have many tools to help them exercise control and mitigate risk, depending on their philosophy and their lawyers’ creativity. Only you can dictate which levels and types of controls may be acceptable. Remember that higher-risk deals are likely to come with higher degrees of control.

Capital. Negotiations with venture investors often focus on how much capital will be provided, when it will be provided, what types of securities will be purchased and at what valuation, what special rights will attach to the securities, and what mandatory returns will be built into the securities. You need to think about how much capital you really need, when you really need it, and whether there are any alternative ways of obtaining these resources.

Another way to look at how these four components must be balanced is to consider the natural tension between investors and entrepreneurs in arriving at a mutually acceptable deal structure.

Virtually all equity and convertible-debt deals, regardless of the source of capital or stage of the company’s growth, require a balancing of this risk/reward/control/capital matrix. The better prepared you are by fully understanding this process and determining how to balance these four factors, the more likely it is that you will strike a balance that meets your needs and objectives.

Throughout this book, I’ll discuss the key characteristics that all investors look for before they commit their capital. Regardless of the state of the economy or what industries may be in or out of favor at any given time, there are certain key components of a company that must be in place and be demonstrated to the prospective source of capital in a clear and concise manner.

These components (discussed in later chapters) include a focused and realistic business plan (which is based on a viable, defensible business and revenue model); a strong and balanced management team that has an impressive individual and group track record; wide and deep targeted markets that are rich with customers who want and need (and can afford) the company’s products and services; and some sustainable competitive advantage that can be supported by real barriers to entry, particularly barriers that are created by proprietary products or brands owned exclusively by the company. Finally, there should be some sizzle to go with the steak; this may include excited and loyal customers and employees, favorable media coverage, nervous competitors who are genuinely concerned that you may be changing the industry, and a clearly defined exit strategy that allows your investors to be rewarded within a reasonable period of time for taking the risks of investment.

Understanding the Private Equity Markets

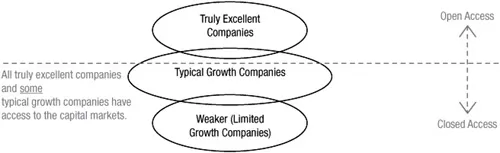

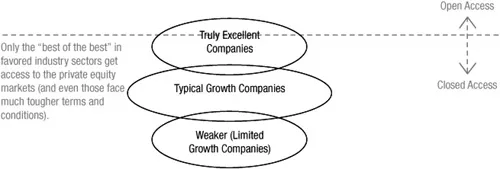

In many ways, the private equity markets mimic the conditions of the public stock market, much the way a little brother copies the mannerisms of an admired big brother. When the public markets have raised the bar to access, as they have done pretty consistently since the dot-com meltdown, the private equity markets also raise the bar to access. When the bar is raised, Darwinian principles begin to apply strongly. It is survival of the fittest. The “fittest” companies are those with the strongest management teams, the largest potential markets, the most loyal and established customers, the most defendable market positions, and the clearest path to profitability. It has often been explained as the “state of the capital markets” snowman, as diagrammed in Figure 1-3.

Understanding the Different Types of Investors

Most investors fall into at least one of three categories: emotional investors, who invest in you out of love or because they have a relationship with you; strategic investors, who invest in the synergies offered by your business (based primarily on some nonfinancial objective, such as access to research and development, or a vendor-customer relationship, although financial return may still be a factor); and financial investors, whose primary or exclusive motivation is a return on capital and who invest in the financial rewards that your business plan (if properly executed) will produce. Your approach, plan, and deal terms may vary depending on the type of investor you’re dealing with, so it’s important for you to understand the investor and his objectives well in advance. Then your goal is to meet those objectives without compromising the long-term best interests of your company and its current shareholders. Achieving that goal is challenging, but it can be easier than you might think if your team of advisors has extensive experience in meeting everyone’s objectives to get deals done properly and fairly. The more preparation, creativity, and pragmatism your team shows, the more likely it is that the deal will get done on a timely and affordable basis.

Figure 1-3. The State of the Capital Markets Snowman.

Normal Private Equity Conditions

(Ex. 1994 to1997, 2004)

Weak Capital Market Conditions

(Ex. 2000 to 2002)

Abnormally Exuberant Market Conditions

(Ex. 1998 to 2000)

Understanding the Different Sources of Capital

There are many different sources of capital—each with its own requirements and investment goals—discussed in this book. They fall into two main categories: debt financing, which essentially means that you borrow money and repay it with interest; and equity financing, where money is invested in your business in exchange for part ownership.

Sources of Debt Financing

Commercial Banks. Smaller companies are much more likely to obtain an attentive audience from a commercial loan officer after the start-up phase has been completed. In determining whether to “extend debt financing” (essentially, make a loan), bankers look first at your general credit rating, your collateral, and your ability to repay. Bankers also closely examine the nature of your business, your management team, your competition, industry trends, and the way you plan to use the proceeds. A well-drafted loan proposal and business plan will go a long way toward demonstrating your company’s creditworthiness to a prospective lender.

Commercial Finance Companies. Many companies t...