![]()

CHAPTER 1

Introduction

THIS book is about the stock of money in the United States. It traces changes in the stock of money for nearly a century, from just after the Civil War to 1960, examines the factors that accounted for the changes, and analyzes the reflex influence that the stock of money exerted on the course of events.

We start with 1867 because that is the earliest date at which we can begin a continuous series of estimates of the stock of money in the United States. When the National Banking Act was passed during the Civil War, it was believed that state banks would shortly go out of existence. As a result, organized federal collection of statistics for state banks ceased, though, as it happens, state banks suffered only a temporary and never a complete eclipse. Accordingly, there is a serious hiatus in statistical data. Better data are available for the period before the Civil War than for the years from 1863 to 1867.

Money played an important role in economic and political developments in the United States during the period we cover—as it so often has in other periods and other places. We have therefore been led to examine some of these developments in considerable detail, so much so that this book may read in part like a general economic history. We warn the reader that it is not; it is highly selective. Throughout, we trace one thread, the stock of money, and our concern with that thread explains alike which episodes and events are examined in detail and which are slighted.

The estimates of the stock of money we have constructed give for the first time a continuous series covering more than nine decades.1 These estimates, graphed in Chart 1 (and given numerically in Table A-1), show clearly the impress of most of the major episodes in U.S. history since the Civil War.

The most notable feature of the stock of money is its sharp upward trend. In 1867, the first year for which we have an estimate, the public2 held about $585 million of currency—consisting at the time mostly of “greenbacks” issued to help finance the Civil War, plus national bank notes and subsidiary coinage3—and $729 million of deposits in commercial banks4 or a total of $1,314 million of what by one definition—and the one we use here—may be called money. In addition, the public held $276 million in deposits at mutual savings banks, or a total of $1,590 million of what, by a broader definition, may about as reasonably be called money. Our figures do not classify deposits in commercial banks at this early date into demand and time deposits, because this distinction had little meaning, either for banks or their customers. Reserve requirements for banks were levied against deposits, without distinction between demand and time. Demand deposits, like time deposits, frequently paid interest; and time deposits, like demand deposits, were frequently transferable by check. The distinction became of major importance to banks (and so reliable data became available on a continuous basis for the two categories separately) only after 1914, when the Federal Reserve Act introduced differential requirements for demand and time deposits. Accordingly, we have no estimate for 1867 for a third and narrower possible definition of money, namely, currency plus demand deposits alone.5

NOTE: Albert J. Hettinger, Jr., a Director of the National Bureau, has prepared a comment on this book which appears on pp. 809-814.

In mid-1960, the last year for which estimates are presented in Chart 1, the public held about $29 billion of currency (consisting mostly of Federal Reserve notes but with an appreciable residue of silver certificates and subsidiary coinage as well as a number of other relics of earlier monetary history), $110 billion of demand deposits, and $67 billion of time deposits in commercial banks, or a total of $206 billion of money by the terminology we use. In addition, it held some $35 billion of deposits in mutual savings banks and under $1 billion of postal savings deposits, or a total of $242 billion of money plus such deposits. The public held 50 times as many dollars of currency at the end of the 93 years spanned by our figures as at the beginning; 243 times as many dollars of commercial bank deposits; and 127 times as many dollars of mutual savings deposits.

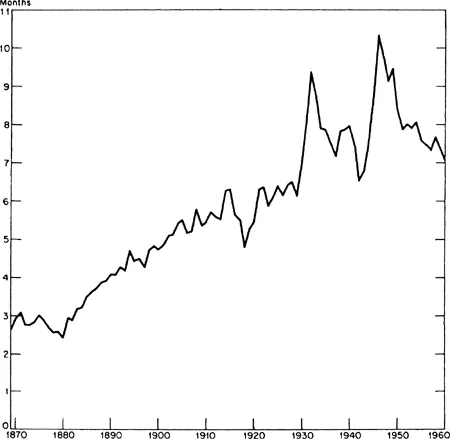

The total we designate as money multiplied 157-fold in the course of these more than nine decades, or at the annual rate of 5.4 per cent.6 Since the population of the United States nearly quintupled over the same period, the stock of money per capita multiplied some 32-fold, or at the annual rate of 3.7 per cent. We can break this total into three components: 1.9 percentage points, which is the rate of rise in output per capita; 0.9 percentage points, which is the rate of rise in prices; and a residual of 0.9 percentage points, which is the rate of rise in the amount of money balances, expressed as a fraction of income, that the public chose to hold.7 So great is the power of compound interest that this residual small rate of growth corresponds to a rise in the public’s holdings of money from a sum equal to less than 3 months’ income in 1869 to a sum equal to more than 7 months’ income in 1960. Of course, as Chart 2 shows, these developments did not proceed steadily; and it is with the vicissitudes along the way that this study is mostly concerned.

In discussing these vicissitudes, we frequently find it convenient to mark off periods by dates at which business activity reached a cyclical peak or trough. We use for this purpose the reference cycle chronology established by the National Bureau of Economic Research. Our extensive use of this chronology perhaps justifies an explicit caveat that we do not present a comprehensive history of cyclical movements in economic activity in the United States. Monetary factors played a major role in these movements, and conversely, nonmonetary developments frequently had a major influence on monetary developments; yet even together the matters that concern the historian of money do not exhaust those that are relevant to the historian of cyclical movements.

CHART 2

Number of Months’ Income Held as Money in Each Year, 1869-1960

SOURCE: Money stock was multiplied by 12 and divided by money income.

Money stock, figures in col. 8 of Table A-l were averaged to center on June 30; before 1908, annual averages were obtained from that source, interpolated by the step method (see Table 25, col. 1, for description).

Money income, same as for Chart 62.

The years from 1867 to 1879 were dominated by the financial aftermath of the Civil War. Early in 1862, convertibility of Union currency into specie was suspended as a result of money creation in the North to help finance the Civil War, disturbances in foreign trade, the general financial uncertainty arising out of the war, and the borrowing techniques of the Treasury. From then until resumption of specie payments on January 1, 1879, the United States was legally on a fiduciary standard—the greenback standard as it has come to be called. The dollar was linked with other currencies through exchange rates determined in the market and fluctuating from day to day. The dollar was inconvertible in the older sense of not being exchangeable at fixed parity for specie; it was not inconvertible in the modern sense of being subject to legal restrictions on its purchase or sale. For domestic payments, gold was in the main simply a commodity like any other, with a variable market price. For foreign payments, gold was equivalent to foreign exchange, since Great Britain maintained a gold standard throughout the period, and several other important countries did so during the latter part of the period.

Despite support for inconvertible currency by many business groups both during and after the war, and growing farm support after the war, as agricultural prices fell, suspension of payments was generally regarded as temporary. The major announced aim of financial policy was a resumption of specie payments at the prewar parity. This aim was finally achieved on January 1, 1879. The whole episode, discussed in detail in Chapter 2, is clearly reflected in the series in Chart 1. The decline in the stock of money from 1875 to 1878—one of the few absolute declines in the whole history of the series and next to the largest—was a necessary prelude to successful resumption. The extremely sharp rise thereafter was partly a reaction to success.

Another aftermath of the Civil War was an extremely rapid growth in banking institutions, which produced a sharp rise in the ratio of deposits to currency. The financial measures of the war included establishment of the National Banking System and, effective July 1, 1866, a prohibitive tax on state bank notes. Initially, few national banks were created, while the prospective tax measure was a strong deterrent to state banks. The result was that the major effect of the National Banking Act came after the end of the war, and, along with a revival of state hanks, helped to produce the sharp rise in deposits recorded in Chart 1.

The success of resumption did not end uncertainty about the monetary standard. For nearly two decades thereafter, the U.S. financial scene was dominated by controversy, which had started in the seventies, over the place of silver in the monetary system.

The rapid expansion of output in the Western world during those decades and the adoption of a gold standard over an area far wider than before added substantially to the demand for gold for monetary purposes at any given price level in terms of gold. That expansion in demand more than offset a contemporary expansion in supply, as a result both of increased production of gold and improvement of financial techniques for erecting a larger superstructure of money on a given base of gold. The result was a slow but rather steady downward tendency in product prices that prolonged and exacerbated the political discontent initiated by the rapid decline in prices after the end of the Civil War. “Greenbackism” and “free silver” became the rallying cries. The silver forces were strong enough to obtain concessions that shook confidence in the maintenance of the gold standard, yet they were not strong enough to obtain the substitution of silver for gold as the monetary standard. The monetary history of this period is therefore one of repeated crises and of legislative backing and filling. The defeat of William Jennings Bryan in the Presidential election of 1896 marks in retrospect the end of the period (Chapter 3).

Bryan’s defeat marks the end of the period, rather than simply a minor setback on the road to ultimate success, because it happened to follow gold discoveries in South Africa and Alaska and the perfection of the cyanide process for extracting gold. These developments doomed Bryan to political failure, far more than any waning in the effectiveness of his oratory or any shortcomings in his political organization. They produced a rapid expansion of the world’s production of gold, sufficiently large to force an upward price movement over the next two decades despite a continued growth in world output. In the United States, the stock of money was approximately constant from 1890 to 1896. During those years, uncertainty about the monetary standard and associated banking and international payment difficulties prevented any expansion in the U.S. stock of gold despite a moderate acceleration in the growth of the world’s stock of gold. The money stock then rose over the next two decades at a rate decidedly above that from 1881 to 1896 (Chart 1). The accompanying gradual rise in prices rendered the gold standard secure and unquestioned in the United States until World War I.

The elimination of controversy about the monetary standard shifted the financial and political spotlight to the banking structure. Dissatisfaction had been generated by recurrent banking difficulties. The most severe of these occurred in 1873, 1884, 1890, and 1893, when bank failures, runs on banks, and widespread fears of further failures produced banking crises and, on several occasions, most notably 1893, suspension by most banks of convertibility of deposits into currency. The 1893 episode is reflected in Chart 1 in the concomitant rise in currency and decline in deposits, as well as in the decline in total currency and deposits. The dissatisfaction with the banking structure was brought to a head by the banking panic of 1907. That panic was a repetition of earlier episodes, including the suspension of convertibility of deposits into currency. It is marked in Chart 1 by the only decline in the stock of money during the period 1897-1914, accompanied as in 1893 by a rise in currency and hence a still sharper decline in deposits. The result was the enactment by Congress of the Aldrich-Vreeland Act in 1908 as a temporary measure, a searching examination of the monetary and banking structure by a National Monetary Commission in 1910, the publication by the Commission of some notable scholarly works on money and banking, and the adoption by Congress of the Federal Reserve Act of 1913 as a permanent measure (Chapter 4).

The Federal Reserve System began operations in 1914. This far-reaching internal change in the monetary structure of the United States happened to coincide with an equally significant external change—the loosening of links between external conditions and the internal supply of money which followed the outbreak of World War I—destined to become permanent. Taken together, the two changes make 1914 a major watershed in American monetary history.

Important as they were, both changes were changes of degree. The Treasury had long exercised central banking powers that were no less potent because they were not so labeled, and, as Chapter 4 documents, it had been doing so to an increasing extent. The growing size of the U.S. economy relative to the world economy and the declining importance of U.S. foreign trade relative to domestic trade had long been increasing the importance of internal changes in the United States for world monetary conditions and introducing ever greater play in the links between the two.

Though independent in their inception, the two changes were destined to become closely related. The weakening of the international gold standard gave the Federal Reserve System both greater freedom of action and wider responsibilities. In turn, the manner in which the Federal Reserve System exercised its powers had an important effect on the fate of the gold standard. One who did not know the subsequent history of money in the United States would very likely conjecture that the two changes reinforced one another in reducing the instability in the stock of money. The weakening of external links offered the possibility of insulating the domestic stock of money from external shocks. And the Reserve System, established in response to monetary instability, had the power to exercise deliberate control over the stock of money and so could take advantage of this possibility to promote monetary stability.

That conjecture is not in accord with what actually happened. As is clear to the naked eye in Chart 1, the stock of money shows larger fluctuations after 1914 than before 1914 and this is true even if the large wartime increases in the stock of money are excluded. The blind, undesigned, and quasi-automatic working of the gold standard turned out to produce a greater measure of predictability and regularity—perhaps because its discipline was impersonal and inescapable—than did deliberate and conscious control exercised within institutional arrangements intended to promote monetary stability. Here is a striking example of the deceptiveness of appearances, of the frequently dominant importance of forces operating beneath the surface.

The rapid rise in the stock of money during World War I, when the Federal Reserve System served as an engine for the inflationary financing of government expenditures, continued for some eighteen months after the end of the war, at first as a con...