![]()

Part I

Approaches to Strategic Investment

![]()

Chapter 1

Corporate Finance and Strategic Planning: A Linkage

Life can be understood backward, but . . . it must be lived forward.

— Søren Kierkegaard (1813–1855)

1.1. Introduction

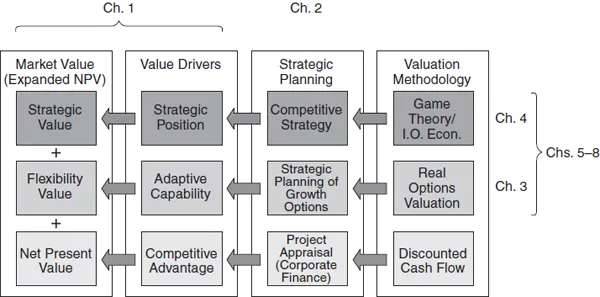

This chapter takes a first step toward closing the gap between traditional corporate finance theory and strategic planning. To put issues in a broad perspective, figure 1.1 summarizes three approaches to strategic planning and their impact on the market value of the firm. This conceptual framework aligns the design of an investment strategy with the value of the firm. Consider the various sources of economic or market value a firm can create. As shown in the left-hand column, the market value of a firm is not completely captured by the expected cash flow generated by the tangible assets that are currently in place (measured by NPV). Stock market prices partly reflect a firm’s strategic growth potential. This value derives from investment opportunities that the firm may undertake in the future under the right circumstances, and is sensitive to competitive moves. The strategic option value of a firm can be vulnerable not just to the actions of incumbents, but also to the unanticipated entry of new rivals with entirely new technologies that can modify the competitive landscape in which the firm operates.

Investment appraisal methods should capture the components of flexibility and strategic value, as they may contribute significantly to the firm’s market value in an uncertain competitive environment. The flexibility and strategic considerations of importance to practicing managers can now be brought into a rigorous analysis in a fashion consistent with the tenets of modern finance and the maximization of shareholder value. The right-hand column in figure 1.1 shows the valuation approach based on insights from real options and game theory, which captures additional flexibility and strategic value not measured by cash flow benefits per se. This approach considers growth opportunities to be a package of corporate real options that is actively managed by the firm and may be affected by competitors actions and by new technologies. If a firm’s investment decisions are contingent upon and sensitive to competitors’ moves, a game-theoretic treatment can be helpful. Competitive strategies should be analyzed using a combination of option valuation and game-theoretic industrial organization principles, as the two may interact.

FIGURE 1.1 IMPACT OF CORPORATE STRATEGIC PLANNING ON THE MARKET VALUE OF THE FIRM

The broader strategy framework recognizes three levels of planning that have an effect on the market value (expanded NPV) of investment opportunities. First (bottom row), project appraisal from corporate finance aims at determining the effect on the net present value of the projected cash flows resulting from establishing a competitive advantage. Second, strategic planning of growth opportunities aims at capturing the flexibility value resulting from the firm’s adaptive capabilities through real-options valuation. Third, competitive strategy aims at capturing the strategic value from establishing, enhancing, or defending a strategic position vis-à-vis competitors based on game theory analysis and industrial organization economics.

To link corporate strategy with the value creation of the firm, one should identify the investment opportunity’s value drivers. These value drivers provide an interface between the quantitative project valuation methodology and the qualitative strategic thinking process, focusing on the sources of value creation in strategic planning. The second column in figure 1.1 suggests that to understand total strategic value creation, one must examine, not only the traditional value drivers that focus on why a particular investment is more valuable for a company than for its competitors, but also the important value drivers for capitalizing on the firm’s future growth opportunities, and how strategic moves can appropriate the benefits of those growth opportunities, as well as limiting risk if unfavorable developments occur.

This broader framework provides deeper insights for competitive strategic planning. As the strategies of firms in a dynamic, high-tech environment confirm, adaptability is essential in capitalizing on future investment opportunities and in responding appropriately to competitive moves. Adapting to, or creating, changes in the industry or in technology is crucial for success in dynamic industries.

The rest of this chapter is organized as suggested by the columns of figure 1.1. Starting from the left with shareholders’ (market) value, and the components of this value observed from stock prices in financial markets, we reason back to the origins of this value in the real (product) markets and to corporate strategy. The market value components are discussed in section 1.2. Section 1.3 reviews the relevant valuation approaches, and the need for an expanded NPV criterion. Games are used to capture important competitive aspects of the strategy in a competitive environment. The value drivers of NPV, flexibility value, and strategic value, are discussed in section 1.4, relating the qualitative nature of competitive advantage and corporate strategy with quantifiable value creation measures for the firm. Section 1.5 discusses the options and games approach to capturing value creation in corporate strategy.

1.2. The Market Value of Growth Opportunities

In a dynamic environment, strategic adaptability is essential in capitalizing on favorable future investment opportunities or responding appropriately to competitive moves. A firm’s growth opportunities and its strategic position in the industry are eventually reflected in stock market prices. Of course, not all stocks generate the same earnings stream or have the same growth potential. Growth stocks (e.g., in biotech, pharmaceuticals, or information technology) typically yield high price-earnings and market-to-book ratios. In fact, it is precisely the intangible and strategic value of their growth opportunities that determines most of the market value of high-tech firms in a continuously changing environment. As box 1.1 suggests, a proper analysis of this strategic growth option value is more difficult than price-earnings ratios or other multiples might imply. An underlying theory that can explain this market valuation is now available if we consider the strategic option characteristics of a firm’s growth opportunities. There is indeed a clear appreciation in the market for a firm’s bundle of corporate real options (present value of growth opportunities, or PVGO).1

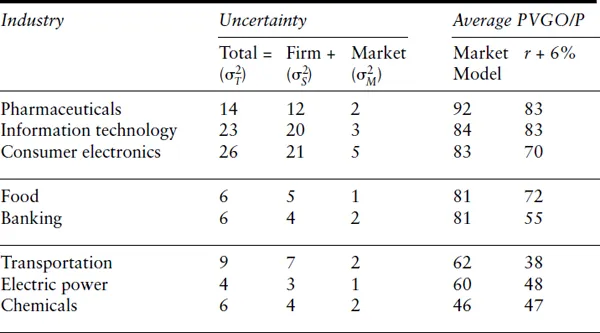

Table 1.1 shows that industries with higher volatility and (market, firm-specific, or total) risk (and as we will see, more option value) — such as information technology, pharmaceuticals, and consumer electronics — tend to have more valuable growth opportunities and a higher proportion of PVGO to price on average (above 80%) than other industries — such as transportation, chemicals, and electric power (below 60%). The former industries involve more unexpected technological changes and competitive moves; as the firm’s (or the industry’s) dynamic path unfolds, management must be better prepared to learn, adapt, and revise future investment decisions. The market appropriately rewards with higher market valuations those firms better able to cope with change, capitalizing on the upside potential while mitigating downside risk.

TABLE 1.1

Industry (average) Volatility (Market and Firm-Specific Uncertainty) and Proportion of PVGO to Price for a Number of Representative Industries, as of June 30, 1998

Note: Numbers are percentages. Averages per industry are equally weighted (to avoid excessive influence of large firms), based on monthly returns over the period 1988–98. Total risk (volatility), σ2 T, is estimated as the variance of monthly returns; market (or systematic) risk, σ2M,i,t, is estimated from σ2M,i,t = β2i,tσ2m,t, where σ2m,t is the volatility of the S&P 500 market index at time t, and βi,t is the beta or sensitivity of monthly returns of firm i to monthly market returns of the S&P 500 index estimated over a period of 10 years. The present value of growth opportunities (PVGO) for firm i is estimated by subtracting the discounted value (with the discount rate estimated from the market model or the risk-free rate (r) plus a 6% risk premium) of its perpetual stream of earnings (under a no-growth policy) from its market price.

Growth firms (e.g., leading firms in information technology, pharmaceuticals, and consumer electronics) tend to have a higher option value component (PVGO) than income stocks, for two reasons. First, they tend to operate in more volatile industries (characterized by more frequent technological innovations and a more intensely competitive environment), with the higher underlying volatility being translated into higher (simple) option value. Second, they tend to have a greater proportion of compound (multistage or growth) options as opposed to simple (cash-generating) options, which amplifies their option value (being options on options). This higher (growth) option value, in turn, is translated into higher market valuations, which may appear excessive from the perspective of standard DCF valuation methods.

BOX 1.1 REAL OPTIONS, GROWTH OPPORTUNITIES, AND MARKET VALUATION

Companies have all kinds of options: to raise production, to buy rivals, to move into related fields. Studying a company’s portfolio of options provides insight into its growth prospects and thus its market value.

“It’s an important way of thinking about businesses and their potential,” says Michael J. Mauboussin, a strategist at Credit Suisse First Boston (CSFB). “The thought process itself is very valuable.”

Real-options analysis is a big step beyond static valuation measures such as price-earnings and price-to-book ratios. Comparing two companies on the basis of their P/E ratios is valid only if they have the same expected earnings growth. They hardly ever do. Real-options analysis zeroes in on what really matters: the earnings growth itself. It values companies by studying the opportunities they have for growth and whether they can cash in on them. Management’s skill becomes a major focus. Take America Online Inc., whose P/E is stratospheric. AOI stock would be only about 4% of what it is today if the market expected it to maintain profits at the current level forever.

CSFB cable-TV analyst Laura Martin recently used real-options analysis to conclude that cable stocks are undervalued. Real-options analysis can also conclude that companies are overvalued. Coming up with a target price for a company by evaluating its real options is harder than lining up companies by their P/E’s of five-year sales growth. It means understanding the companies, their industries, and managers’ ability to take advantage of the options open to them. Then again, who said stock picking was supposed to be easy?

Source: excerpts from Coy 1999b...