![]()

CHAPTER 1

Survey Research Overview

Below, you will find Part I of the Infinity Insurance Case Study. This part of the Case Study includes several concepts from the current chapter, and is meant to provide a real-world example of the processes outlined in this text. As you read along, consider some of the “Food for Thought” questions and decide for yourself how one might answer these questions. If desired, you may compare your answers with the “Possible Answers” section at the end of the chapter that was developed while working with Infinity Property and Casualty Corporation (Infinity Insurance), keeping in mind there are multiple ways of answering each question.

Infinity Insurance—Case Exploring New Marketing Strategies

To provide a real-world example of how survey research can be utilized to inform business decisions, we have included a case study that will take you through the iterative process of designing, developing, and implementing a survey. Each section of the case study will correspond to information presented in each chapter; however, it is important to note that the case study is also meant to be conceptualized as a cohesive whole. We hope this real-world example will help cement your learning and understanding of each step in the survey design, development, and implementation process.

Part I—Infinity Case Study

Infinity Insurance, headquartered in Birmingham, Alabama, provides personal automobile insurance with a concentration on nonstandard auto insurance. Nonstandard insurance serves individuals unable to obtain coverage through standard insurance companies due to having a driving record with accidents and/or tickets, having a prior DUI, or the driver’s age, vehicle type, and so on. This top-performing Infinity brand distributes its products primarily through independent agencies and brokers and provides nonstandard car insurance through more than 12,500 independent agents. The company’s products include personal automobile insurance for individuals, commercial vehicle insurance for businesses, and classic collector insurance for individuals with classic and antique automobiles. Infinity Insurance utilizes Internet-based software applications to provide many of its agents with real-time underwriting, claims, and policy information, and is licensed to write insurance in all 50 states and the District of Columbia.

This company traces its roots back to 1955, doing business first as Dixie Insurance Company, and later, The Infinity Group. In 1991, The Infinity Group was purchased by Pennsylvania Company (sister company of American Premier Underwriters, Inc.); in 1995, they merged with the American Financial Corporation to become the American Financial Group (AFG). AFG transferred all common stock of The Infinity Group and its sister companies to Infinity Insurance in 2002, and in 2003, Infinity Insurance was officially listed on the NASDAQ as a registered public holding.

Since 2003, The Luca Group, an advertising and production company, has developed and implemented Infinity Insurance’s advertising campaigns, primarily on television, radio, and grassroots events. These efforts have significantly helped Infinity Insurance become a major auto insurance brand in the U.S. Hispanic market, where it primarily operates.

Food for Thought:

- Who are some of Infinity Insurance’s direct auto insurance competitors?

- How large (annual revenue) is the auto insurance industry?

- What type of customer might Infinity Insurance target?

- If you were a marketing consultant to Infinity Insurance, what market areas would you suggest targeting to access the customers identified above?

A survey is a system for collecting information to describe, compare, or explain the knowledge, attitudes, and/or behaviors of a particular group. All surveys involve setting some objective for information collection, designing research, preparing a reliable and valid data collection instrument, administering and scoring the instrument, analyzing the data, and reporting the results. The distinguishing features of surveys are the form of data collection and the method of analysis.

Surveys are administered to collect data on innumerable topics, from political preferences and consumer choices, to the use and preference of health services, the number of people in the labor force, and public opinion on just about any topic imaginable. Individuals, communities, schools, businesses, and researchers alike use surveys to uncover useful information by asking people (respondents) questions about their feelings, motivations, plans, beliefs, and personal backgrounds.

Surveys ask respondents for information by presenting them with a series of questions. Questions are presented as a questionnaire or interview, and answers are collected in verbal, written, or electronic form (i.e., electronically, through the mail, on the telephone, or face-to-face). These various methods for obtaining survey responses are intended to reach an audience that represents the population of interest. Because not every member of the target population can be reached for any one given survey, the more formal term, sample survey, describes the data collected as a “representative sample” of the target population. Thus, a survey is defined as a method of primary data collection based on communication with a representative sample of individuals.

The most common types of surveys include:

- Employee Satisfaction/Opinion

- Customer Feedback/Opinion

- Mystery Shopper

- Communication format preferences

- 360° Feedback/Multirater

- Compensation/Benefits

- Public Opinion

Organizations survey their employees on a semiregular basis, with the goal of better understanding employee attitudes, knowledge, and intentions as they change over time. The measurement tools used to collect this type of data usually include employee interviews and/or some form of standardized questionnaire. These questionnaires may include items on specific content areas (e.g., program implementation effectiveness, change in payroll system) or general feedback on employee satisfaction with the company (e.g., “I would recommend this company to a friend,” “I am generally content when I’m at work”). For example, an employee satisfaction survey might include survey items in the content areas of pay, benefits, rewards, supervision, coworkers, communication, work location, training, performance evaluation, feedback systems, promotion opportunities and process, policies, and procedures. These questions are often framed for standard responses on a sliding scale, or for free format, written responses.

Organizations use surveys to benchmark current employees (i.e., cross-sectional surveys), but they may also want to collect data over time (i.e., longitudinal surveys). Surveys can provide both strategic and tactical information which, in turn, is useful when implementing organizational changes. To conduct a successful employee survey, it is important to bolster the support of management, and ideally, involve management in some capacity, throughout the survey design process. Employees are often hesitant to provide honest answers because they are skeptical of the level of true confidentiality and/or anonymity of their responses; thus, it is important for management to clearly articulate how the information will be used, who will have access to the raw and potentially identifying data, and if possible, articulate the level of true anonymity or confidentiality of the respondents. Throughout the entire survey process, management should also be held to some level of accountability.

Keeping track of your survey process—from start to finish—is a key element to ensuring others can replicate your survey in the future, repeat your survey to perform longitudinal analysis (or benchmarking), and in turn, see changes in people’s responses over time.

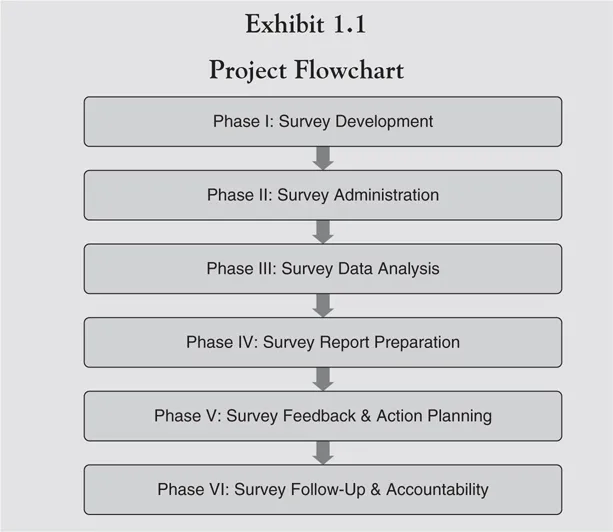

The survey design process is summarized in six phases, as shown in the project flowchart in Exhibit 1.1.

The Survey Development section (Phase I) has three steps, as summarized in Exhibit 1.2.

Exhibit 1.2

Phase I: Survey Development

Step 1: Define the purpose, goals, and objectives of the survey.

Step 2: Design the survey study. Include departments, jobs, the sampling plan, feedback procedures, type and number of feedback reports, and the number of statistical analyses to be conducted.

Step 3: Develop the survey questionnaire, including content areas, items, and demographic information. Then pilot test the survey, and revise accordingly.

The Survey Administration section (Phase II) involves the distribution of the survey to the identified respondents. Phase II is summarized in Exhibit 1.3.

Exhibit 1.3

Phase II: Survey Administration

Step 5: Determine sample to be surveyed.

Step 6: Determine method of survey administration (e.g., mail, electronic, etc.).

Step 7: Train survey administrators (if necessary).

Step 8: Send out survey administration materials.

Step 9: Administer and return surveys to XYZ Corporation.

The Survey Data Analysis section (Phase III) involves three steps, as summarized in Exhibit 1.4.

Exhibit 1.4

Phase III: Survey Data Analysis

Step 10: Collect data and prepare for input.

Step 11: Input all survey data and verify accuracy.

Step 12: Analyze survey data.

There are two steps involved in Phase IV, Survey Report Preparation (Exhibit 1.5).

Exhibit 1.5

Phase IV: Survey Report Preparation

Step 13: Decide on the types of reports to share to present survey data in a meaningfulway. Consider norms, bar graphs, pie charts, key organizational issues, comparison groups, etc.

Step 14: Prepare reports for each organizational unit as necessary.

The Survey Feedback and Action Planning section (Phase 5) involves two steps, as summarized in Exhibit 1.6.

Exhibit 1.6

Phase V: Survey Feedback and Action Planning

Step 15: Train managers to facilitate survey feedback and develop action plans to improve organizational unit.

Step 16: Provide survey feedback and develop action plans.

The Survey Follow-Up and Accountability section includes the final two steps, shown in Exhibit 1.7.

Exhibit 1.7

Phase VI: Survey Follow-Up and Accountability

Step 17: Organizational units submit action plans to Steering Commitee (i.e., a group that decides on the priorities of an organization and determines next steps).

Step 18: Steering Comittee makes policy decisions regarding survey results and action plan results.

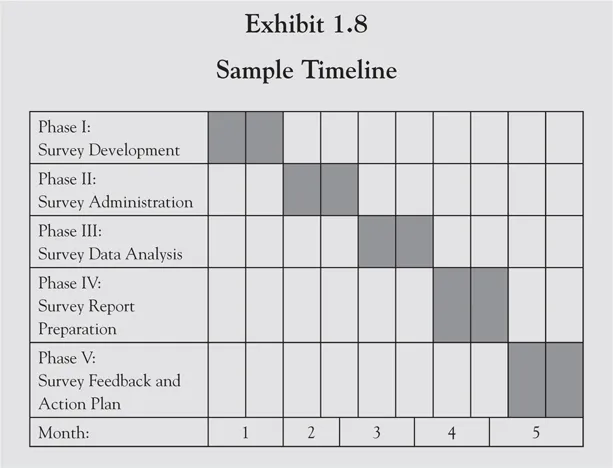

The timely integration of each phase is critical to ensuring the survey process is finished according to schedule. An overview of a sample timeline is provided in Exhibit 1.8.

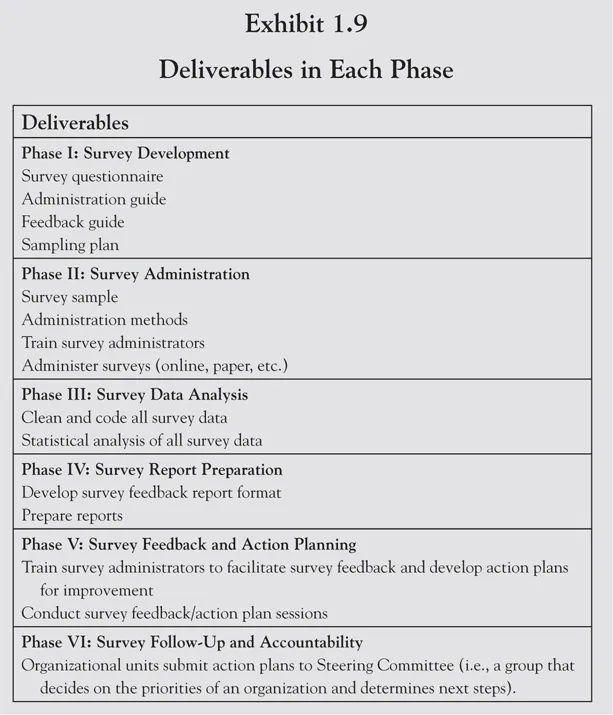

The deliverables are summarized in each of the associated phases (Exhibit 1.9).

Errors in Survey Research

There are many potential sources of errors and biases in surveys that can influence the results of the data. Some of these biases are measurable and can therefore be accounted for; however, many others creep into our survey results unnoticed. As previously mentioned, a survey is defined as a method of primary data collection based on communication with a representative sample of individuals. Because we are working with only a sample, rather than the entire population of respondents, there are certain limitations to the data, and sources of error we need to be aware of and attempt to manage. Even the methodology used to collect the survey responses can invite opportunities for error, which, if not managed, can render a survey unusable. Many of the errors in surveys can be introduced unintentionally. For example, fatigue bias can result from a question involving a long list of items to be assessed. The survey respondent may tire of reading all the items and miss something, or they may simply stop completing the survey. These various sources of error are described in detail in the next section; however, a tree diagram summarizing each type of error is provided in Exhibit 1.10.

Total survey error includes random sampling error and systematic error. Rand...