![]()

1

THE CONSUMER CREDIT MARKET

Credit is offered to consumers and businesses in a wide variety of forms, by a wide variety of entities, under a wide variety of terms. This chapter provides an overview of consumer credit, how it evolved, and how it is provided today. Some understanding of the history of consumer credit is helpful for understanding why such a wide variety of loans are offered today and why the predominant terms under which loans are offered vary from country to country. Following a brief survey of the history of consumer credit, we describe the major categories of consumer credit and the various processes by which loans are priced and the prices communicated to customers. Finally, we discuss the different types of regulation that apply to consumer lending and how they influence pricing.

BRIEF HISTORY

Debt and credit are older than recorded history—no one will ever be able to pinpoint the date at which one Homo sapiens (or was it Homo neanderthalensis?) provided another with something desired in that moment in return for future consideration. Anthropologists and sociologists remind us that our current concept of a loan—a sum of money received right now in return for a promise of future payments—is only a special case of the web of debts and obligations, both monetary and nonmonetary, that pervade any society.1 But even the more restricted idea of lending money at interest is ancient—a group of Babylonian tablets dating from 1800–1600 BC describe algorithms for computing compound interest, and in later centuries lending at interest was also a common practice in ancient Greece and Rome.

The early Christian church prohibited lending (but not borrowing) money at interest, a prohibition that was upheld by the Roman Catholic Church throughout the Middle Ages. As a result, for many centuries Jewish lenders were the primary source of loans to the nobility and great merchant houses. The formal prohibition against usury, or usuria (the Latin word for lending at interest), began to break down in England in the early sixteenth century, when Henry VIII broke from the Catholic Church, and on the European continent following the Protestant Reformation.

Notwithstanding this long history, in Europe up until the sixteenth century, borrowing and lending were the purview of kings, nobles, and merchants: there was little consumer credit, not to mention precious few consumers in the modern sense of the word. The only credit generally available to commoners was extended by tradespeople and shopkeepers who allowed their customers to run up purchase accounts. In England, records of trade debt date back to the first decades of the sixteenth century. Account books show that many of the debts were tiny—denominated in pennies—and were regularly paid off. However, the wealthy and the nobility were often allowed to amass substantial debts. In the eighteenth century disputes among tradespeople and debtors were common, and an elaborate infrastructure of debt courts and debtors’ prisons was established that lasted well into the nineteenth century. Defaults on shop credit were not uncommon; for example, Charles Dickens’s father was thrown into Marshalsea debtors’ prison for his inability to pay off a £40 debt to a local baker.2

Shop credit was typically interest-free: the borrower was expected to pay only the cumulative cost of purchased goods rather than as a source of profit itself. And, of course, merchants extended credit primarily as a way to move their goods. The first form of consumer credit to be offered by specialized institutional lenders in England was the mortgage. In the United States, mortgages were available from the late eighteenth century. However, well into the nineteenth century, the preferred method for buying a house was to save up for it, which meant a wait of ten years or more for the average wage earner. Following the Civil War, independent lenders and cooperative societies arose to provide mortgages to individuals. In this case, a typical approach to funding a house was for a prospective home owner to make a 50% down payment and borrow the rest from a savings bank, a building and loan association, or a private mortgage dealer. The borrower made interest payments semiannually for the following three to eight years, then paid the principal in a lump sum at the end of the term. Modern amortized loans—in which both principal and interest are paid off with equal monthly payments over the term of the loan—did not become popular until the 1920s.3

The late nineteenth century saw the rise of installment credit in the United States as a means to enable families to purchase the increasing number of expensive goods being brought to market. The first innovation to be widely sold on installment was the reaping machine. A new reaping machine enabled farmers to increase their productivity tenfold, but most farmers could not afford to purchase one. The industrialist Cyrus McCormick is credited with introducing an installment plan, and competing manufacturers quickly followed his lead. Many farming families were willing to take on the resulting debt in order to enjoy the benefits of increased productivity.

Urban families did not want reapers, but they did want sewing machines, which were marketed on a national scale starting in the 1850s. Like reapers, sewing machines were expensive, and installment sales were necessary to put them within reach of the average family. Unlike shop credit, installment sales of sewing machines usually involved an additional charge. In 1900 a Singer machine could be purchased for $30 cash up front or $40 on an installment plan. The additional charge was justified to the purchaser through the convenience of installment payments, but it also provided Singer with the opportunity to cover losses from defaults as well as the forgone returns from the capital advanced.

The first two decades of the twentieth century saw an explosion of installment credit in the United States. Mass production, mass marketing, and a growing middle class combined to create both supply and demand for an array of goods that many households could not afford to purchase from ready cash. Carriages, bicycles, pianos, furniture—even clothing—could all be purchased on installment during the early years of the twentieth century. But it was the arrival of the automobile that really initiated American consumers into the world of credit. In 1924 General Motors established the General Motors Acceptance Corporation (GMAC) to provide loans to help consumers purchase GM cars; the program was wildly successful and was soon imitated by other manufacturers. By 1929, 76% of new cars in the United States were sold on credit.

Commercial bankers were latecomers to consumer lending: banks began to establish consumer-lending departments only in the 1920s. The primary reason banks did not venture into personal lending earlier was the traditional sanctity of deposits—bankers were terrified that a large number of depositors would simultaneously demand their money, which they would be unable to supply because it was out on loan. (This is, of course, exactly what happened in 1929.) A secondary reason bankers were reluctant to extend credit to consumers was the common belief that consumer loans were highly risky. Bankers felt that business loans were “productive”—the money would be invested in ways that would generate income to repay the loan. In contrast, consumer loans were primarily for consumption, and there was no guarantee that a borrower would feel obligated (or have the wherewithal) to repay the loan after using the money for purchases. Furthermore, businesses—unlike many consumers—typically had valuable assets that could be seized if the loan was not repaid.

Banks had begun to experiment with consumer lending in the 1920s, but consumer-lending departments did not become commonplace until the mid-1930s. Perhaps surprisingly, it was the Great Depression that hastened the spread of consumer lending from a handful of urban banks in 1928 to a standard offering by 1939. During the Great Depression, the market for business loans essentially evaporated and bankers were forced to overcome their initial aversion and embrace consumer lending if they were to survive at all and, of course, many didn’t survive.

The most important innovation in consumer credit following World War II was the credit card. Although a few banks in the United States had issued charge cards that allowed favored customers to charge purchases directly to the bank as early as the 1930s, the first multipurpose credit card was issued by Diners Club in 1950. In the next few years Carte Blanche and American Express followed suit. Similar to today’s credit cards, these cards enabled revolving credit, but they were not backed by a bank and were accepted by only a few merchants. In 1958, Bank of America launched the BankAmericard (later known as Visa), the first widely accepted modern credit card. The first credit card introduced outside the United States was Barclaycard, which launched in the United Kingdom in 1966. Credit cards enjoyed explosive growth and are today one of the most important forms of consumer credit—and certainly the source of most credit transactions—around the world.

Throughout its history consumer lending has been characterized by spurts of innovation, such as securitized mortgage lending, installment purchases, auto lending, bank lending, and credit cards. In every case, each new innovation was able to take root and grow without entirely displacing previous forms. The most recent innovation in consumer credit is peer-to-peer lending, in which platforms such as Zopa in the United Kingdom and LendingClub in the United States connect borrowers and lenders on the Internet. Whether or not this new form of lending will thrive, and if so, the extent to which it will displace other forms, is yet to be determined. In any case, this history of innovation without complete displacement of earlier forms is a major reason so many different varieties of consumer credit are available from so many different sources.

History also explains why the most popular forms of loans and pricing processes vary from country to country. For example, the 30-year fixed-rate mortgage is the most popular form of mortgage in the United States, but it is relatively rare in other countries. In Canada the most popular mortgage has a 5-year term and a 20-year amortization period. The prevalence of the 30-year fixed-rate mortgage in the American market can be traced to the efforts of the Federal Housing Administration (FHA) to stimulate housing sales during the Great Depression. The FHA simplified the mortgage market by establishing a standardized system with 25- and 30-year amortized mortgages that required a down payment of 10 percent based on a standardized appraisal. This system, which was created to support and encourage home ownership during the Great Depression, set the template for mortgages that has persisted to this day.4

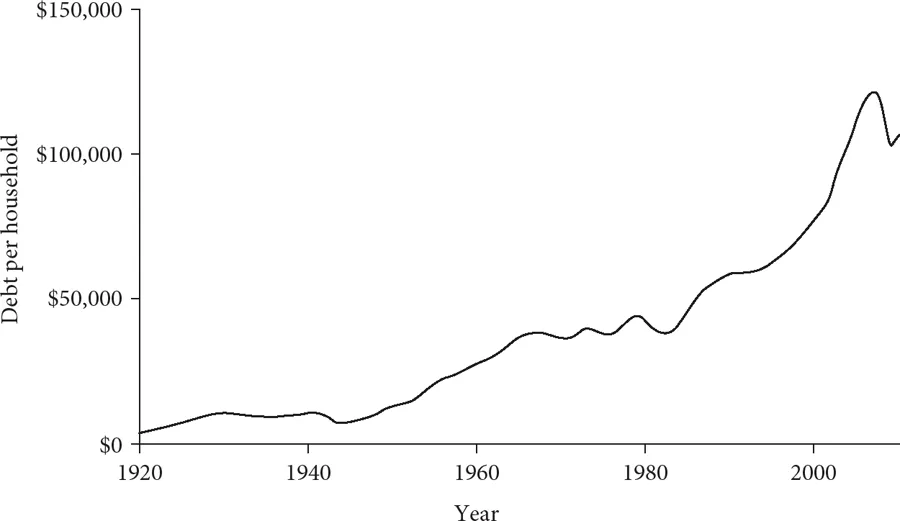

Consumer debt has been growing across the United States and the developed world for more than a century. Figure 1.1 shows the levels of debt per household in the United States from 1920 to 2010. While the general trend has been upward, three periods of particularly rapid growth are apparent. The first, during the 1920s, coincided with the increasing popularity of installment sales (including auto loans) and the entry of banks into the consumer credit market. This phase of growth came to an end with the onset of the Great Depression: household debt did not increase again until after World War II. Post–World War II debt growth was fueled primarily by rapidly expanding home ownership, encouraged by government programs such as the Veterans Administration and the creation of Fannie Mae and Freddie Mac. This phase of growth came to an end in the 1970s when the growth of debt was tempered by both recession and high interest rates: the prime rate hit its all-time high of 21.5% in December 1980. Household debt began to grow again with the return of economic growth in the 1980s and grew rapidly until the financial crisis of 2008–2009. Some of the growth in consumer debt during this period was due to the increased availability of credit cards and a rapid expansion of student loans, but, as in previous periods of debt growth, the primary driver of consumer debt was the rapid growth of mortgages.

Figure 1.1 Real debt per household in the United States from 1920 through 2010

SOURCE: Federal Reserve Bank of New York (2017).

Over the past fifty years, consumer debt per household has been increasing in all developed countries. In most countries, the ratio of household debt to household wealth has lagged that of the United States. A notable exception is Canada, where the ratio of household debt to wealth surpassed that of the United States in 2014. Mortgages are by far the largest component of consumer debt in most developed countries. Table 1.1 shows the components of total household debt in the United States as of Q1 2017.

CREDIT PRODUCTS

Some of the important characteristics that differentiate credit products are the following:

• The payment period is the time interval between payments. A lender will typically charge a late fee if a minimum payment is not made when due at the end of each payment period.

• The compounding period defines the intervals when interest is computed on the outstanding balance. At the end of a compounding period, the corresponding interest rate will be applied to the current balance (including any accrued and unpaid interest) to determine additional interest due. Typically, the compounding period is less than or equal to the payment period.

• The amortization period is the total “life” of the loan used to calculate payments. For a simple loan with a fixed balance, a borrower who made the periodic payment each period would exactly pay off the loan in the last p...