- 256 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

How to Get a Business Loan

About this book

Joseph Mancuso means business. He takes you into your bank and into the offices of America's venture capitalists for an inside look at how they work and what they expect from prospective borrowers. He tells you exactly what actions to take every step of the way and how to distinguish yourself in the lender's eyes. How to Get a Business Loan will dramatically enhance your chances of putting together a deal you can live with and profit by.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access How to Get a Business Loan by Joseph R. Mancuso in PDF and/or ePUB format, as well as other popular books in Business & Small Business. We have over one million books available in our catalogue for you to explore.

Information

1. How to Write a Winning Business Plan

PREPARING YOUR PLAN

A business plan is commonly thought of as a document written to raise money for a growing company. In actuality, a business plan is a road map that gives a business direction. An entrepreneur visits his banker, or a venture capitalist, with his business plan, not his hat, in hand to attempt to raise money for his business. Attempting to raise money without a written business plan is pure folly, for your would-be backer undoubtedly will say, “Well, when your business plan is done . . . .”

The ideal business plan should really sing, so that you don’t have to raise money as the plan will do it for you. The problem for most entrepreneurs, though, is we hate to write business plans. We think of them as a form of punishment or as some species of cod-liver oil—we know they are good for us, but they taste awful going down. So we write adequate business plans because we’re too busy doing the real work of running our businesses. That work is more fun.

When you take your adequate business plan to your loan officer, what do you end up doing? You sit across from him, lean forward, and start compensating for the shortcomings of your plan with your forceful, charismatic, and persuasive personality. It’s called selling.

Well, guess what? Your banker has seen this scenario a hundred times. You’ve acted just like everyone else he’s turned down for a small-business loan in the last ten years. Everybody walks into his banker’s office with an average, adequate business plan. You can easily distinguish yourself in your banker’s eyes by taking the time to write a great business plan.

I’m going to show you the components of the ideal business plan, and then present to you the greatest business plan I think I’ve ever seen. (I’ve seen quite a few; in fact, I have probably the largest archive of business plans in the world).

My theory is if I show you the ideal business plan, you’ll be able to compare it with your own and make some practical improvements in yours. You’ll be one important step closer to getting your loan. I want you to bear two important things in mind, though.

First, most bankers and financiers don’t have emotional attachments to specific kinds of businesses. They don’t care if they invest in restaurants or computers, haberdasheries or medical devices. They have an emotional attachment to making money, and bankers are neurotic about the word risk.

Second, you cannot copy someone else’s business plan, you can only learn from it. If someone tries to tell you they have a computer program that writes a perfect business plan, don’t buy it! Each business plan is unique, like a work of art. In fact, it is a work of art in its own right. It expresses and personifies your company. You can no more write a business plan by following a format than you can paint the Mona Lisa using a paint-by-numbers kit.

WHY YOU NEED A PLAN

The need for a business plan is usually inversely proportional to the desire to write one. If you find you want to skip this chapter because you don’t think you need to write or improve your plan, you probably need to read this chapter more carefully than any other.

Let me ask you this: Have you ever been in a situation where you’re driving an automobile, but you don’t know the destination and your passenger is directing you? Doesn’t it make you crazy when your passenger gives you only short-term directions like “Turn left here” or “Take a right here.” How many short-term directions can a human being take without knowing where he’s going . . . before he blows up?

My limit is three; then I turn around and say, “Just tell me where the hell we’re going and I’ll get us there. I’m not stupid! Give me more than one direction at a time!”

Well, a business plan gives you your destination, and that’s tremendously important, not so much for you but for everyone involved in your business—your employees and investors, your customers, and your suppliers. They don’t want to just blindly follow your short-term directions, they want to know where the company is headed.

People have a great need for knowledge; in fact, many people are willing to take large risks for small amounts of information. I realized this while observing people waiting for a train at a New York City subway station. Now, I’m not a native New Yorker, so I tend to hug the wall while I wait for a train, for fear that some nut is going to shove me onto the third rail. But many people walk right up to the yellow line at the edge of the platform and lean over the third rail, placing themselves at the mercy of anyone who might be feeling a little testy—just to see if the train is coming. They aren’t going to make it come faster. The motorman isn’t going to get excited and speed up if they wave at him, but these people are all willing to risk their lives for a marginal level of information. They must need that bit of information badly, or feel that they do. I would like to get that information, too, but I stay glued to the back wall or a concrete pole. I choose, instead, to watch the faces of these data dummies. When they relax and smile, I move up to the yellow line.

Similarly, your employees, bankers, and investors crave every bit of information you can give them about your business. They need to know where the business is going.

DETERMINE YOUR READER

Now that I have you geared up to write your plan, there’s something very basic you must decide. For whom are you writing the plan?

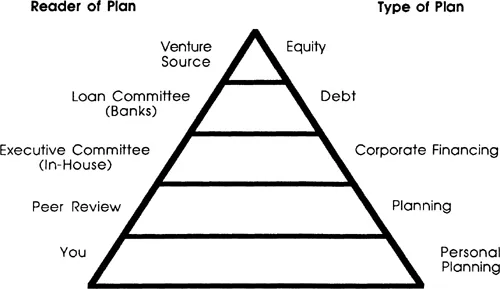

As you can see from the pyramid chart, business plans are written for different readers and for different purposes. First, there’s the plan you write for yourself. That plan is useful because it will show you the bugs of your business on paper. Because if you can work them out on paper, you can save yourself some time and money. That plan doesn’t receive much peer review, though, and since you worked so darn hard on it, you won’t be good at catching its flaws or at criticizing it.

The second kind of plan is the one written for a corporation, such as the plan an IBM executive might write for his operating division. The peer review of these plans has a great deal to do with upper management’s perception of the writer of the plan. For example, if GE’s brass thinks the new president of their light bulb division is a golden boy based on the last thing he did, they are likely to be thrilled by the next plan he sends them for a project and will probably blindly approve the funding. That’s why so many divisions of large companies fail to follow up their first success with another—they become enamored of a hero.

The third type of plan is the kind you write for a bank to get a loan. You give your banker the plan and tell him you want to borrow $100,000. He calls you a couple of days later and says he really likes your plan and will lend you the money if you can deposit $150,000 in CDs to secure the loan.

I’ve often wondered, What if he didn’t like the plan? Would he ask for $350,000 in CDs? Bankers aren’t initially moved by business plans to fork over cash—they’re moved by collateral because all they stand to make on their deal with you is interest. Even if your business does extremely well, all the bank will get back is interest and its principal, so all the banker wants is to make sure that the bank gets that interest and principal. Period.

The most fun and valuable people to write business plans for are venture capitalists. Unlike corporations or banks, they aren’t looking for heroes or collateral; rather, they are looking for exciting new enterprises in which to invest. They are looking for a dream that can become a reality with their financial assistance. The business plan you write for a venture capitalist will be the toughest one you write, because in it you will have to show exactly how you plan to realize your dream.

Even though this book is about getting money from a bank for your small business, I’m going to spend some time talking about how to write a winning business plan for venture capitalists, because if you can write a great business plan for venture capitalists, the other plans—for banks, corporations, or yourself—will be easy to write.

STRIVE FOR AN ELEVEN

One day you make the big decision. You quit your job and go home to write the great American novel, the new Love Story or Godfather. You walk over to Simon & Schuster to collect your advance. How much money could you get? A hundred thousand? How about when the book is done? Let’s say the publisher loves it and gives you $2 million. That’s respectable.

The great thing about a business plan is you can spend the same amount of time it would take you to write a novel and, if you write a plan as good as the one I’m going to describe . . . well, that plan attracted 250 million of today’s dollars up front on day one! The sequel to the greatest movie of all time, Gone with the Wind, fetched $5 million up front in 1988. You can get several orders of magnitude more in up-front money by writing a business plan than by writing a novel, and, in many ways, a business plan is easier to write.

Most entrepreneurs are capable of writing a business plan that on a scale of one to ten would rate from five to nine. The problem is that to raise money from a venture capitalist or to get a loan from your bank you need an eleven. Average is not acceptable. Too many entrepreneurs shoot for a business plan that rates a five. You have to shoot for an eleven because you’ll never write one accidentally. A plan has to be a ten just to attract any money. A nine is a bridesmaid who is very sweet and attractive but doesn’t get married. An eight is also a bridesmaid, but she’s not quite as attractive . . . and so on.

So what’s an eleven? An eleven is a plan that attracts so many investors that you’re up all night trying to decide who you’re going to have to cut out of the deal. To be good is not enough when you dream of being great.

THE DIFFERENCES BETWEEN BUSINESS PLANS FOR BANKERS AND FOR VENTURE CAPITALISTS

The first thing to decide on before starting your business plan is what the reader needs to know. In each business plan you write, you should emphasize the figures that are important to the reader—the banker or venture capitalist.

We’ve already determined that a banker needs to know about collateral. He wants to know how the loan is going to be repaid. The venture capitalist, on the other hand, wants to know different things: Is the product going to sell l...

Table of contents

- Cover

- Chapter 1: How to Write a Winning Business Plan

- Chapter 2: The Components of a Successful Business Plan

- Chapter 3: Befriending Your Banker

- Chapter 4: Investigate Your Bank and Your Banker

- Chapter 5: Dealing with Your Banker

- Chapter 6: How to Stay Off Personal Loan Guarantees and Get Off Them If You’re Already On (Ditto for Your Spouse)

- Chapter 7: Small Business Administration Loans

- Chapter 8: The Ethics of Banking

- Appendix I: Glossary

- Appendix II: The Entrepreneur’s Reference Library

- Appendix III: Sample Application for a Business Plan Loan

- Appendix IV: Sample Business Plan

- Appendix V: Ingredients of a Real Estate Loan Submission

- Endnotes

- Index

- Copyright