eBook - ePub

Return to Prosperity

How America Can Regain Its Economic Superpower Status

- 336 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Return to Prosperity

How America Can Regain Its Economic Superpower Status

About this book

In this vital economic roadmap, economist Arthur Laffe and journalist Stephen Moore lay out the essential components of a healthy economy: lower government spending, debt reduction, and the return of the investor class.

With the economy flat on its back, unemployment at a twenty-five-year high, and the housing default crisis still worsening, is it even possible to turn our financial problems around? Economic icon Arthur B. Laffer and journalist Stephen Moore believe America can once again become the land of economic opportunity, and this brilliant new book tells us exactly how.

In their rousing clarion call against the government’s current fiscal strategies, The End of Prosperity, the authors focused on how lowering taxes will promote economic growth. Now, they detail the other crucial components. Simply put, the keys to prosperity are low, flat-rate taxes; government spending restraint; sound and stable money; free trade; and minimal regulation. This book gives concrete proposals on how to return to prosperity using common sense principles of good economic behavior.

While most of the proposed solutions to our economic decline are fraught with peril, Return to Prosperity provides a refreshing counterbalance—a prescription for the fundamental tools America needs in order to set out on the road to recovery. It is essential reading for anyone who worries that the current economy is faltering, with no clear plan articulated to stop it.

With the economy flat on its back, unemployment at a twenty-five-year high, and the housing default crisis still worsening, is it even possible to turn our financial problems around? Economic icon Arthur B. Laffer and journalist Stephen Moore believe America can once again become the land of economic opportunity, and this brilliant new book tells us exactly how.

In their rousing clarion call against the government’s current fiscal strategies, The End of Prosperity, the authors focused on how lowering taxes will promote economic growth. Now, they detail the other crucial components. Simply put, the keys to prosperity are low, flat-rate taxes; government spending restraint; sound and stable money; free trade; and minimal regulation. This book gives concrete proposals on how to return to prosperity using common sense principles of good economic behavior.

While most of the proposed solutions to our economic decline are fraught with peril, Return to Prosperity provides a refreshing counterbalance—a prescription for the fundamental tools America needs in order to set out on the road to recovery. It is essential reading for anyone who worries that the current economy is faltering, with no clear plan articulated to stop it.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Return to Prosperity by Arthur B. Laffer,Stephen Moore in PDF and/or ePUB format, as well as other popular books in Economics & Taxation. We have over one million books available in our catalogue for you to explore.

Information

REACTIVE POLICIES

1

ENERGY INDEPENDENCE AND PROTECTIONISM

To illustrate this government’s inability to understand economics I’ll start my journey with the president’s environmental and energy policies. I was asked by Fox News to be a guest correspondent to discuss the appointment of President Obama’s Energy and Environment team along with the administration’s policies on energy and the environment. Berkeley Professor Steven Chu was chosen by the president to be the secretary of energy and to head Obama’s team.

Professor Chu is a Ph.D. physicist with a Nobel Laureate and formerly a professor and chairman of the department of physics at Stanford University, where I received my Ph.D. in economics. This man has a résumé a mile long. Nobody is more qualified or more highly recognized in his or her chosen field than is Professor Chu.

In the course of introducing Professor Chu, President Obama described his administration’s first priority for energy policy as securing U.S. energy independence. “It will be the policy of my administration to reverse our dependence on foreign oil while building a new energy economy that will create millions of jobs.”1 President Obama also emphasized, as he did in his inaugural address, that his administration will “restore science to its rightful place.”2 And when he said the word “science,” there was a slight hesitation, and the word was uttered with a bit of reverence, leaving the impression that his was the first administration in a long time that actually relied on science.3

When Professor Chu took the podium he reiterated the importance of energy independence for America and said that this administration would use science, and that he, by example, was literally a man of science.

Whenever people say that they want the United States to be energy independent they demonstrate that they simply don’t understand Econ 1. In fact, the notion of legislated or politically driven self-sufficiency with respect to any product—oil included—is one of the worst mistakes politicians can make, and yet they do it all the time.

When I look at this planet, I see one group of people that has lots and lots of oil, and they basically don’t know what to do with it. And then when I look at the United States I see another group of people that knows what to do with oil and could always use more. Venezuela, Russia, Canada, Nigeria, Mexico, and the Middle East selling oil to the United States is a win-win situation for both the United States and those oil-producing countries. Oil producers benefit by getting paid for selling their oil to us, which allows them to buy products they otherwise could not have acquired, and we benefit by purchasing that oil and using it better than they would use it.

The idea of politically motivated energy independence violates the precepts of David Ricardo’s concept of comparative advantage and the gains from trade.4 Ricardo was a late-eighteenth- and early-nineteenth-century English economist whose work is still revered today for showing that both countries involved in a trade arrangement can gain from trade even if one of the countries has an absolute advantage in production of all of the traded goods. Trade in oil is a classic example of Ricardo’s principle that gains from trade result from comparative advantage. The example of Ricardo’s comparative advantage that I was taught used cloth and wine, where Portugal had a comparative advantage in producing wine and Britain had a comparative advantage in producing cloth. In this example Britain can produce cloth more efficiently, comparatively, than can Portugal, and Portugal can produce wine more efficiently, again, relatively speaking, than can Britain. Both Portugal and Britain would be winners if Britain sold Portugal its cloth and in exchange bought wine from Portugal.

To bring Ricardo’s example of comparative advantage to the present, we Americans make some things comparatively better than foreigners, and foreigners, in turn, make other things comparatively better than Americans. We and foreigners would both be foolish in the extreme if we didn’t sell to foreigners those things we make better than they do, and they sell to us, in return, those things they make better than we do. It’s a win-win relationship.

The proceeds from U.S. purchases of products from foreigners provide foreigners with the wherewithal to buy goods from us. Our exports are their imports. This administration simply doesn’t get it. U.S. imports don’t mean job losses for Americans. U.S. imports are the means by which foreigners earn the income to buy products from us. Without U.S. imports there are no U.S. exports.5

And while I use energy independence and oil as the example of this administration’s isolationist and protectionist tendencies, it’s by no means an isolated example. President Obama’s policies are riddled with protectionism. It was after all candidate Barack Obama who denounced NAFTA, and he has not changed that position.

In April 2009, Congress effectively banned Mexican trucks from U.S. highways, and the Mexican government responded with tariffs on roughly $2 billion worth of American exports to Mexico. Similarly, Paragraph (a) of Section 1605 of the stimulus package states:

None of the funds appropriated or otherwise made available by this Act may be used for a project for the construction, alteration, maintenance, or repair of a public building or public work unless all of the iron, steel, and manufactured goods used in the project are produced in the United States.6

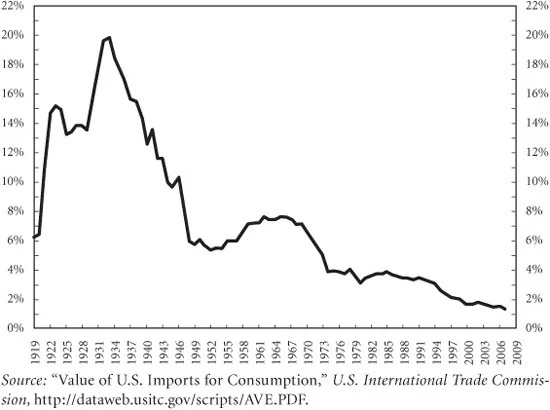

In 1929 and 1930 the United States passed a trade bill called the Smoot-Hawley tariff, named after the chief Senate sponsor and the chief House sponsor. The bill was signed into law by President Herbert Hoover, and in my opinion was the catalyst for what we now call the Great Depression.7 The Smoot-Hawley tariff raised duties (read taxes) on imported products to levels rarely seen in modern economies. Since the imposition of the Smoot-Hawley tariff, the United States has systematically been lowering tariffs and duties on imports. In Figure 1-1, a straightforward measure of the bipartisan progress is readily apparent. It is my fear that the Obama administration and its hostility toward NAFTA and free trade in general will reverse this trend.

The idea of the United States being energy independent, or independent with respect to any other product, for that matter, makes no sense whatsoever. Imagine if Minnesota tried to ban the importation of bananas into the state to achieve “banana independence.” If Minnesota refused to buy bananas from Costa Rica, it wouldn’t be able to sell Costa Rica iron ore. In fact, Minnesotans would have to build greenhouses in the frozen tundra to grow bananas in the winter. Ignoring the gains from trade is absolutely foolish.

Figure 1-1 Average U.S. Tariffs, Duties Collected as a % of All Imports

(through 2008)

(through 2008)

Prohibiting banana imports makes Minnesota worse off, and the United States’ prohibiting imports of oil also makes the United States worse off. In the Minnesota example, Costa Rica will be worse off as well, because it has less iron ore than it needs and too many bananas. If they don’t sell us their oil, oil-producing nations will also be worse off. While Professor Chu may be very good at high-energy physics and manipulating Feynman diagrams and all of that, both he and President Obama clearly don’t understand Econ 1 when it comes to the gains from trade.

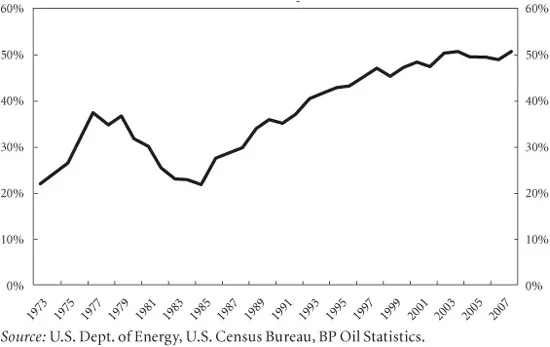

The economic consequences of energy independence for the United States would be catastrophic for us and the rest of the world. The United States is the world’s third-largest producer of oil.8 We fall slightly behind Saudi Arabia and Russia. The number-four producer is way below the United States. But in spite of being a major producer of oil, the United States is the number-one consumer of oil. We import about 50 percent of the oil we use currently in the United States (see Figure 1-2).

Figure 1-2 Oil Imports as a % of Total Oil Consumption (annual, through 2008)

Can you imagine what the U.S. economy would look like today if President Obama were to successfully stop the importation of oil? The U.S. economy would be in even worse shape than it already is. If we had to make do with only half the oil we currently use, what would be the price of a gallon of gas or an airplane ticket? People would have to suffer the cold in the winter and heat in the summer. The economic results would be catastrophic, pure and simple. And yet the words “energy independent” roll off the lips of the physicist and the Harvard-educated lawyer with ease.

Oil Imports/Total Oil Consumption

Now, President Obama is not alone among today’s politicians in espousing energy independence, and the concept of energy independence is surely not unique to this day and age. The espoused goal of U.S. energy independence was alive and well when Dwight David Eisenhower was president of the United States. Eisenhower was elected way back in 1952. In 1959, in the never-ending quest for energy independence, President Eisenhower imposed strict oil import quotas, which remained in force for many years, until 1973.9 As a result of those quotas and other targeted taxes, regulations, and restrictions, crude oil prices, as received by U.S. oil suppliers, deviated substantially from their rest-of-world counterparts even though wholesale prices of retail products were roughly similar.

But the idea of energy independence was just as silly back in Eisenhower’s day as it is today. Since the days of President Eisenhower, every president has at least paid lip service to the idea of energy independence. But frankly, year after year the United States has become more and more dependent on foreign oil (see Figure 1-2). Economics has until now triumphed over nonsensical politics. However, with his proposed “cap and trade” legislation, President Obama intends to change all of that. Cap-and-trade legislation not only entails a $600 billion–plus tax increase but also is about as protectionist a piece of legislation as can be found.

As drafted, the “Clean Energy and Security Act” (the “Waxman-Markey” Cap and Trade bill) would subsidize companies that pay higher costs than their international competitors. This subsidy is currently considered an “illegal state aid” program and violates our commitments under World Trade Organization (WTO) rules. Waxman-Markey also empowers the president to impose a border adjustment that is essentially a tariff on foreign companies to pay for the cost of carbon.

My final point on the follies of protectionism has to do with retaliation. While one restrictive measure by itself may not do all that much harm, what a protectionist move by the United States does do is incite foreign governments to retaliate against U.S. exports into their countries. The aforementioned recent example of Mexico’s putting tariffs on some imports from the United States in retaliation for U.S. prohibitions on Mexican trucks entering the U.S. is a case in point. Perhaps more ominously, this is exactly what happened in the 1930s after the United States began the protectionist war with the Smoot-Hawley tariff. In my opinion, it was in part the trade war brought on by the Smoot-Hawley tariff legislation that created the preconditions for World War II.

2

ENERGY INDEPENDENCE AND FOREIGN POLICY

When confronted by the obvious economic lunacy of the concept of energy independence, proponents of energy independence respond that in fact, while David Ricardo’s concept of the gains from trade (which we cover shortly) is all well and good, it doesn’t apply today in the United States. The leaders of the oil-producing countries are really just one step removed from being declared enemies of the United States. They are truly terrible people and we cannot allow the U.S. economy to be held hostage by them. Putin, Chavez, Ahmadinejad, and the like hate us and at the same time control the market for oil. They can’t be trusted, because in times of great need they just might cut us off from their oil.

On the face of it, such an argument for protectionism is ridiculous. The people who advocate enforced U.S. energy independence want us to stop importing oil from foreigners because these foreigners might stop selling oil to us. Huh? This is the perfect example of the old saying “Cut off your nose to spite your face.”

We stop buying because we’re afraid that they might stop selling! Now, there’s an example of why logic should be a required course at every law school. It’s like the person who at age twenty-two realizes he, like everyone else, will someday die and as a result becomes so depressed that he commits suicide.

Now let me stipulate at this juncture that I agree that the leaders of many of the oil-producing countries are not good guys. In fact, they really are bad guys. There are, however, a number of major exceptions to the bad-guy rule when it comes to oil suppliers—Canada, Mexico, the United Kingdom, Norway, and Denmark to mention just a few.

But that a leader of a foreign country is a bad guy does not mean that we should not trade with that country. Far from it.

Refusing to buy products from countries run by bad guys does not convince those countries or their leaders to become good guys. If embargoes caused people to rethink their politics and see the light, then North Korea sixty years ago would have become a free-market, progrowth, democratic, capitalist nation. We have embargoed North Korea for sixty years, since the Korean War, and as you can see, not only does it not see the light, it is as bad, if not worse, than ever.1 Just picture Kim Jong Il in your mind’s eye and you can see the product of economic embargoes and isolation.

The same lesson is equally true for Cuba. Shortly after Fidel Castro took over Cuba, the United States put an embargo on virtually all U.S.-Cuban trade. The Cuban embargo has not changed Cuban minds one iota....

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Dedication Page

- Contents

- Introduction

- Part One: Reactive Policies

- Part Two: Fiscal Policy

- Part Three: Monetary and Trade Policies: Interest Rates, Exchange Rates, and Inflation

- Summary: A Prescription for America

- Appendix: The Laffer Curve

- Acknowledgments

- Index

- Footnotes