eBook - ePub

Models.Behaving.Badly.

Why Confusing Illusion with Reality Can Lead to Disaster, on Wall Street and in Life

- 240 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Models.Behaving.Badly.

Why Confusing Illusion with Reality Can Lead to Disaster, on Wall Street and in Life

About this book

Now in paperback, “a compelling, accessible, and provocative piece of work that forces us to question many of our assumptions” (Gillian Tett, author of Fool’s Gold).

Quants, physicists working on Wall Street as quantitative analysts, have been widely blamed for triggering financial crises with their complex mathematical models. Their formulas were meant to allow Wall Street to prosper without risk. But in this penetrating insider’s look at the recent economic collapse, Emanuel Derman—former head quant at Goldman Sachs—explains the collision between mathematical modeling and economics and what makes financial models so dangerous. Though such models imitate the style of physics and employ the language of mathematics, theories in physics aim for a description of reality—but in finance, models can shoot only for a very limited approximation of reality. Derman uses his firsthand experience in financial theory and practice to explain the complicated tangles that have paralyzed the economy. Models.Behaving.Badly. exposes Wall Street’s love affair with models, and shows us why nobody will ever be able to write a model that can encapsulate human behavior.

Quants, physicists working on Wall Street as quantitative analysts, have been widely blamed for triggering financial crises with their complex mathematical models. Their formulas were meant to allow Wall Street to prosper without risk. But in this penetrating insider’s look at the recent economic collapse, Emanuel Derman—former head quant at Goldman Sachs—explains the collision between mathematical modeling and economics and what makes financial models so dangerous. Though such models imitate the style of physics and employ the language of mathematics, theories in physics aim for a description of reality—but in finance, models can shoot only for a very limited approximation of reality. Derman uses his firsthand experience in financial theory and practice to explain the complicated tangles that have paralyzed the economy. Models.Behaving.Badly. exposes Wall Street’s love affair with models, and shows us why nobody will ever be able to write a model that can encapsulate human behavior.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Models.Behaving.Badly. by Emanuel Derman in PDF and/or ePUB format, as well as other popular books in Business & Finance. We have over one million books available in our catalogue for you to explore.

Information

CHAPTER 1

A FOOLISH CONSISTENCY

Models that failed • Capitalism and the great financial crisis • Divining the future via models, theories, and intuition • Time causes desire • Disappointment is inevitable • To be disappointed requires time, desire, and a model • Living under apartheid • Growing up in “the movement” • Tat tvam asi

Pragmatism always beats principles. . . . Comedy is what you get when principles bump into reality.

—J. M. Coetzee, Summertime

MODELS THAT FAILED I: ECONOMICS

“All that is solid melts into air, all that is holy is profaned, and man is at last compelled to face, with sober senses, his real conditions of life, and his relations with his kind,” wrote Marx and Engels in The Communist Manifesto in 1848. They were referring to modern capitalism, a way of life in which all the standards of the past are supposedly subservient to the goal of efficient, timely production.

With the phrase “melts into air” Marx and Engels were evoking sublimation, the chemists’ name for the process by which a solid transmutes directly into a gas without passing through an intermediate liquid phase. They used sublimation as a metaphor to describe the way capitalism’s endless urge for new sources of profits results in the destruction of traditional values. Solid-to-vapor is an apt summary of the evanescence of value, financial and ethical, that has taken place throughout the great and ongoing financial crisis that commenced in 2007.

The United States, the global evangelist for the benefits of creative destruction, has favored its own church. When governments of emerging markets complained that foreign investors were fearfully yanking capital from their markets during the Asian financial crisis of 1997, liberal democrats in the West told them that this was the way free markets worked. Now we prop up our own markets because it suits us to do so.

The great financial crisis has been marked by the failure of models both qualitative and quantitative. During the past two decades the United States has suffered the decline of manufacturing; the ballooning of the financial sector; that sector’s capture of the regulatory system; ceaseless stimulus whenever the economy has wavered; taxpayer-funded bailouts of large capitalist corporations; crony capitalism; private profits and public losses; the redemption of the rich and powerful by the poor and weak; companies that shorted stock for a living being legally protected from the shorting of their own stock; compromised yet unpunished ratings agencies; government policies that tried to cure insolvency by branding it as illiquidity; and, on the quantitative side, the widespread use of obviously poor quantitative security valuation models for the purpose of marketing.

People and models and theories have been behaving badly, and there has been a frantic attempt to prevent loss, to restore the status quo ante at all costs.

THEORIES, MODELS, AND INTUITION

For better or worse, humans worry about what’s ahead. Deep inside, everyone recognizes that the purpose of building models and creating theories is divination: foretelling the future, and controlling it.

When I began to study physics at university and first experienced the joy and power of using my mind to understand matter, I was fatally attracted. I spent the first part of my professional life doing research in elementary particle physics, a field whose theories are capable of making predictions so accurate as to defy belief. I spent the second part as a professional analyst and participant in financial markets, a field in which sophisticated but often ill-founded models abound. And all the while I observed myself and the people around me and the assumptions we made in dealing with our lives.

What makes a model or theory good or bad? In physics it’s fairly easy to tell the crackpots from the experts by the content of their writings, without having to know their academic pedigrees. In finance it’s not easy at all. Sometimes it looks as though anything goes. Anyone who intends to rely on theories or models must first understand how they work and what their limits are. Yet few people have the practical experience to understand those limits or whence they originate. In the wake of the financial crisis naïve extremists want to do away with financial models completely, imagining that humans can proceed on purely empirical grounds. Conversely, naïve idealists pin their faith on the belief that somewhere just offstage there is a model that will capture the nuances of markets, a model that will do away with the need for common sense. The truth is somewhere in between.

In this book I will argue that there are three distinct ways of understanding the world: theories, models, and intuition. This book is about these modes and the distinctions and overlaps between them. Widespread shock at the failure of quantitative models in the mortgage crisis of 2007 results from a misunderstanding of the difference between models and theories. Though their syntax is often similar, their semantics is very different.

Theories are attempts to discover the principles that drive the world; they need confirmation, but no justification for their existence. Theories describe and deal with the world on its own terms and must stand on their own two feet. Models stand on someone else’s feet. They are metaphors that compare the object of their attention to something else that it resembles. Resemblance is always partial, and so models necessarily simplify things and reduce the dimensions of the world. Models try to squeeze the blooming, buzzing confusion into a miniature Joseph Cornell box, and then, if it more or less fits, assume that the box is the world itself. In a nutshell, theories tell you what something is; models tell you merely what something is like.

Intuition is more comprehensive. It unifies the subject with the object, the understander with the understood, the archer with the bow. Intuition isn’t easy to come by, but is the result of arduous struggle.

What can we reasonably expect from theories and models, and why? This book explains why some theories behave astonishingly well, while some models behave very badly, and it suggests methods for coping with this bad behavior.

OF TIME AND DESIRE

In “Ducks’ Ditty,” the little song composed by Rat in Kenneth Grahame’s The Wind in the Willows, Rat sings of the ducks’ carefree pond life:

Everyone for what he likes!

We like to be

Heads down, tails up,

Dabbling free!

Doubtless the best way to live is in the present, head down and tail up, looking at what’s right in front of you. Yet our nature is to desire, and then to plan to fulfill those desires. As long as we give in to the planning, we try to understand the world and its evolution by theories and models. If the world were stationary, if time didn’t pass and nothing changed, there would be no desire and no need to plan. Theories and models are attempts to eliminate time and its consequences, to make the world invariant, so that present and future become one. We need models and theories because of time.

Like most people, when I was young I couldn’t imagine that life wouldn’t live up to my desires. Once, watching a TV dramatization of Chekhov’s “Lady with a Lapdog,” I was irritated at the obtuse ending. Why, if Dmitri Gurov and Anna Sergeyevna were so in love, didn’t they simply divorce their spouses and go off with each other?

Years later I bought a copy of Schopenhauer’s Essays and Aphorisms. There I read an eloquent description of time’s weary way of dealing with human aspirations. In his 1850 essay “On the Suffering of the World” Schopenhauer wrote:

If two men who were friends in their youth meet again when they are old, after being separated for a life-time, the chief feeling they will have at the sight of each other will be one of complete disappointment at life as a whole, because their thoughts will be carried back to that earlier time when life seemed so fair as it lay spread out before them in the rosy light of dawn, promised so much—and then performed so little. This feeling will so completely predominate over every other that they will not even consider it necessary to give it words, but on either side it will be silently assumed, and form the ground-work of all they have to talk about.

Schopenhauer believed that both mind and matter are manifestations of the Will, his name for the substance of which all things are made, that thing-in-itself whose blind and only desire is to endure. Both the world outside us and we ourselves are made of it. But though we experience other objects from the outside as mere matter, we experience ourselves from both outside and inside, as flesh and soul. In matter external to us, the Will manifests itself in resilience. In our own flesh, the Will subjects us to endless and unquenchable desires that, fulfilled or unfulfilled, inevitably lead to disappointments over time.

You can be disappointed only if you had hoped and desired. To have hoped means to have had preconceptions—models, in short—for how the world should evolve. To have had preconceptions means to have expected a particular future. To be disappointed therefore requires time, desire, and a model.

I want to begin by recounting my earliest experiences with models that disappoint.

MODELS THAT FAILED II: POLITICS

I grew up in Cape Town, South Africa, in a society where most white people had Coloured servants, sometimes even several of them. Their maids or “boys” lived in miserably small rooms attached to the outside of the “master’s” house. Early in my childhood the Afrikaner Nationalist Party government that had just come to power passed the Prohibition of Mixed Marriages Act of 1949. The name speaks for itself. Next came the Immorality Act of 1950, which prohibited not just marriage but also adultery, attempted adultery, and other “immoral” acts between whites and blacks, thereby trying to deny, annul, or undo 300 years of the miscegenation that was flagrantly visible. In South Africa there were millions of “Cape Coloureds,” people of mixed European and African ancestry, who lived in the southern part of the country, their skin tone ranging from indistinguishable-from-white to indistinguishable-from-black and including everything in between.

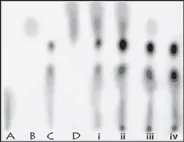

In South Africa we all became expert at a social version of chromatography, a technique chemists use to separate the colors within a mixture. I learned how to do it in my freshman chemistry course at the University of Cape Town. You place a drop of black ink on a strip of blotting paper and then dip the end of the strip into water. As the water seeps through the paper, it transports each of the different dyes that compose black through a different distance, and, as if by magic, you can see the colors separate. How convenient it would have been for the government to put each person into a device that could have reported his or her racial composition scientifically. But the authorities came as close to that as they could: the Population Registration Act of 1950 created a catalogue in which every individual’s race was recorded. South Africa didn’t just categorize people into simple black and white; there were whites, natives (blacks), Coloureds, and Indians. Racial classification was a tortuous attempt to impose a flawed model on unruly reality:

A white person is one who in appearance is, or who is generally accepted as, a white person, but does not include a person who, although in appearance obviously a white person, is generally accepted as a Coloured person.

A native is a person who is in fact or is generally accepted as a member of any aboriginal race or tribe of Africa.

A Coloured person is a person who is not a white person nor a native.

Note the pragmatic combination of objectivity and subjectivity: if you are objectively white but accepted as Coloured, then you’re not white.

In disputed cases a board made decisions that determined not only who you could sleep with but which beaches you could swim at, where you could work and live, which buses you could take, and which cinemas you could attend. Given South Africa’s history of miscegenation, it was not uncommon for members of the same family to end up with different chromatography profiles. Some Coloureds attempted to be reclassified as white, and some blacks applied to be reclassified as Coloured. Evidence involved keen discussions of texture of bodily hair, nose shape, diet, and ways of earning a living, the latter two being taken as racial characteristics rather than matters of socialization or opportunity. Most Chinese, who were difficult for officials to define or even to distinguish from other Asians, were classified as nonwhite, but Chinese from Taiwan and all Japanese, for trade and economic reasons, were declared honorary whites.

The Group Areas Act of 1950 institutionalized apartheid by specifying the regions in which each race could live and do business. Nonwhites were forcibly removed from living in the “wrong” areas, thereby superimposing a legal separation over the less formal physical separation of the races that had already existed.1 Those domestics who didn’t “live in” had to commute long distances to work. In Cape Town the government razed District 6, its Coloured Harlem, and moved the entire community of inhabitants to the Cape Flats, a desolate sandy region outside the city, well described by its name. When I was at university I trekked out there several times as a volunteer on behalf of the Cape Flats Development Association to help persuade poor Coloured families to feed their children milk rather than the cheaper mashed-up squash that, though stomach-filling, had virtually n...

Table of contents

- Cover

- Description

- Title Page

- Copyright

- Part I: Models

- Part II: Models Behaving

- Part III: Models Behaving Badly

- Appendix: Escaping Bondage

- Acknowledgments

- Notes

- Index

- Endnote

- About the Author