eBook - ePub

The Corporate, Real Estate, Household, Government and Non-Bank Financial Sectors Under Financial Stability

- 236 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The Corporate, Real Estate, Household, Government and Non-Bank Financial Sectors Under Financial Stability

About this book

Sound financial stability assessments necessitate intensive analysis of different sectors, namely, the household sector, the corporate sector, the real estate sector, the government sector, and the non-bank financial sector.

This volume provides a complete analysis and risk assessment of each of these sectors which make up the subtle and intricate fabric which contribute to financial stability. The book considers:

• Micro-prudential and macro-prudential regulations and how they constitute core ingredients to ensure a sound and smooth functioning financial system.

• The role of household debt as a coveted economic indicator of the building up of financial instability pressures.

• The relation of the real estate sector to the prevalence of financial crises through asset price bubbles.

• The role of the corporate sector in financial stability risk analysis. In particular, the balance sheets of the corporate sector are widely examined to uncover feasible risks to financial stability.

• The role of the government sector, with particular emphasis being laid on public debt management.

This book will prove valuable to central bankers, economists, and policy-makers who are involved in the field of financial stability, as well as researchers studying the field.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access The Corporate, Real Estate, Household, Government and Non-Bank Financial Sectors Under Financial Stability by Indranarain Ramlall in PDF and/or ePUB format, as well as other popular books in Business & Finance. We have over one million books available in our catalogue for you to explore.

Information

Chapter 1

Household Sector

1.1. Household Debt

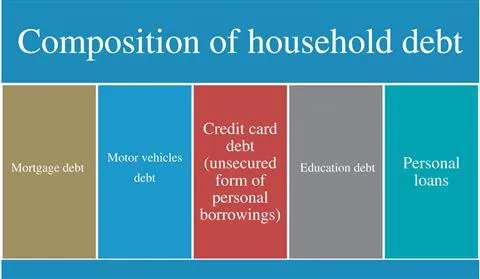

Over the last decades, household debt underwent substantial increases though results vary among countries. For instance, as per the BIS (2009), in 2007, household debt to GDP was merely of 7% in Indonesia but of 82% in Korea while for both the US and the UK, it was beyond 100%. Both demand and supply forces account for the burgeoning level of household debt. On the demand side, there exist different forces such as high economic growth, low and stable inflation, robust asset prices (such as asset price bubbles) and mortgages, declining interest rates and demographic changes. On the supply side, deregulation of financial markets, financial innovations, banks’ desire to diversify their loan portfolios, low demand for corporate loans, government policies (taxes or government support for household loans) and technological advancements spurred the demand for household debt. In most economies of the world, housing loan (mortgage debt) accounts for a lion’s share of the total level of household debt. The household sector acts as an intermediary sector in the economy as it links to other different sectors. The composition of household debt is depicted in Figure 1.1.

Figure 1.1: Composition of Household Debt. Source: Author’s illustration.

Household debt can consist of housing loan, motor vehicles loans, credit cards, educational loans and personal loans. Two main functions are attached to the use of credit cards, namely for payment purposes and to borrow regularly and pay interests accordingly. The credit card business model usually involves large fixed costs due to setting up of proper infrastructures so that once these investments are effected, the marginal cost of adding new accounts becomes low.

In Korea, the credit card business represents one of the fastest growing areas of unsecured retain finance with associated risks to financial stability. Indeed, Korean card issuers rely heavily on wholesale funding through securitisation to buttress their business activities so that they tend to package risky card loans off their balance sheets and to sell them to less informed third-party investors-a practice which resembles the US subprime crisis events. Such ‘originate-to-distribute’ model reduced incentives of Korean credit card companies to screen their borrowers. Alternatively stated, the Korean monocline credit card operations were same as those of the US subprime crisis ‘originate-to-distribute’ model.

The decomposition of household debt is useful as it helps to undertake specific boom–bust analysis of the various components which make up the total level of household debt. As per the permanent income hypothesis, the chief objective of savings is to smooth consumption; when current income falls below permanent income, this implies that households withdraw money from banks to be spent on consumption.

1.2. Drivers of Household Debt

- Debelle (2004) pointed out that low interest rates and less liquidity constraints helped to stimulate household debts worldwide. Abundant global and local liquidity conditions drive down the cost of borrowing.

- IT or technological innovations which trigger strong productivity tend to contribute towards lower levels of interest rates.

- Low interest rates in advanced economies also act as a base for low interest rates in other countries based on the interest rate parity conditions.

- Demographic changes such as ageing of the baby boom generation also drive up household debt.

- Securitisation helps banks to reduce their credit risk as to stimulate them to engage more into household debt which can then be used to push for mortgage-backed securities. In a parallel manner, a vibrant secondary market for loans enable banks to have higher levels of loanable funds which can be used to provide more and more loans to the household sector.

1.2.1. Benefits of Higher Household Debt

- Stimulates a better standard of living.

- Enables households to smooth consumption patterns over time.

- Enables bank to diversify their loans portfolio.

- Stronger household debt can in the long-run incite the local demand function as to rely less on external trade to boost the economy. Indeed, household debt constitutes a core driving force which propels the economic activities of an economy.

- The actions of households following interest rate changes consolidate the interest rate channel of the monetary policy transmission mechanism.

- Households via their loans encourage securitisation under mortgage-backed securities which exist in Europe, Asia and Australia, thus helping banks to diversify their credit risk level.

1.2.2. Drawbacks of Household Debt

- Generates contagion risks in the case of mortgage-backed securities along with collateralised debt obligations. Securitisation spurred by higher household debts act as a strong channel for transmission of contagion risks. In fact, if the securities are sold abroad, local problems will impact on both the local and foreign economies as witnessed in the case of the US subprime crisis.

- Increases financial stability risks to the economy-defaulted households on loans may significantly scale up the non-performing loans levels of banks.

- The margin of manoeuvre in consumption by households should be larger to ensure a potent monetary policy changes in interest rates do elicit changes in consumption. However, if there is already high level of household indebtedness in an economy, this automatically gnaws at such a margin of manoeuvre. In a nutshell, the structure of the mortgage market helps to determine the effectiveness of monetary policy in an economy. In the same vein, variable-rate mortgage loans help to ensure a fluid interest rate transmission channel for monetary policy.

- Adverse shocks in the economy can trigger high levels of financial casualties by households as to incite financial stability risks.

1.2.3. Channels via which Household Debt Impacts on Different Components of Aggregate Demand

- Consumption is affected via debt servicing costs as interest rates alter.

- Borrowing constraints imposed by financial institutions gnaw at the consumption patterns of households.

- Household debt acts as the cross-roads of consumption and savings.

- Higher household debts exert strains on the level of net worth of households to thereby increase the cost of borrowing as to negatively impact on consumption and on the business cycle dynamics.

1.3. Country Features Pertaining to Household Debt

In this section, focus is laid on the country features with respect to household debt. As a matter of fact, household debt is never the same for different countries, mainly explained by the fact that different countries exhibit different structural economic conditions.

Australia and Japan have higher levels of household debts while China, India and Indonesia have lower levels of household debts and Korea, Malaysia, Taiwan and Thailand have in middle levels of household debts. The driving force pertaining to the growth in housing loans in China relates to the development of the housing market and improved standard of living of the Chinese people. The government also undertook measures to increase the supply of affordable housing and low-cost rentals.

In Australia, the majority of Australian asset-backed securities comes from prime (not subprime) residential mortgage-backed securities so that the Australian housing market stayed healthy despite the presence of the US subprime crisis. High levels of household debts in Australia are mainly propelled by mortgage debt. Drivers for high household debts in Australia are low interest rates, increased availability of house funding and strong demand for debt from investors. Davies (2009) pointed out that ‘Several factors have contributed to the strong growth in housing debt over recent years, the principal one being that lower interest rates in Australia allow households to borrow more when they take out their housing loan’. The increase in funding for household debt emanated from the entry of specialist mortgage originators (non-bank lenders who do not accept deposits and thus rely heavily on securitisation to fund their housing lending) into the Australian housing loan market. Household debt to disposal income hovered around 157% in 2007 in Australia. The household disposable income is computed as income after tax but before the deduction of interest payments. The Australian household debt is dominated by housing debt. Nonetheless, for the same time period, the level of non-performing loans (loans past due 90 days (nearing default mode) plus impaired loans (default mode) over total value of loans outstanding) was below 0.4%. Strong pass-through mechanism for interest rate channel of monetary policy manifests in the case of a larger chunk of household housing loans being held at variable rates. For instance, around 85% (see Davies, 2009) of outstanding Australian housing loans were at variable rates.

Household debt in Korea rose from KRW 200 trillion in 2000 to KRW 450 trillion in 2002, a substantial increase. The reasons behind such an increase comprise of financial institutions enlarging their businesses aggressively to the household sector, low interest rates and increasing housing prices.

Nakagawa and Yasui (2009) stated that Japanese households were inclined to put about half of their financial assets in cash and deposits while US and European households tended to put merely 16% and 25% to 33% of their financial assets in safe and liquid products. They argued that cultural features such as saving constituted a virtue in Japan along with the existence of considerable level of down payment in the case of a house purchase in Japan.

1.4. Balance Sheet Approach to Household Financial Stability Assessment

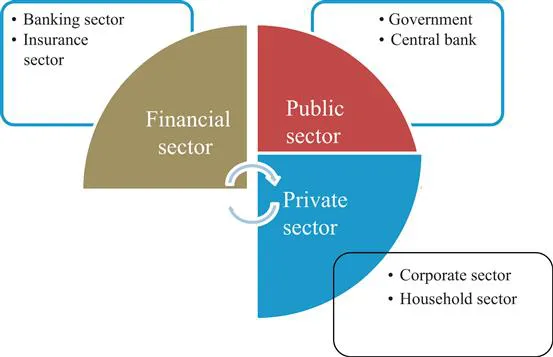

The aim of the balance sheet approach to gauge on financial stability risks is to focus on stock variables (see Allen, Rosenberg, Keller, Setser, & Roubini, 2002) of key sectors in the economy such as the banking sector, the corporate sector, the public sector (government and central bank) and the household sector. In essence, national balance sheets can be employed to undertake a holistic approach to financial stability risk assessment in an economy. The national balance sheets can be split into three broad categories as illustrated in Figure 1.2.

Figure 1.2: Three-pronged Classification of National Balance Sheets. Source: Author’s illustration.

Allen et al. (2002) pointed out four specific cases of balance sheet mismatches which can assist in determining the repayment capacity of an economy when it is buffeted by a shock. These four cases comprise of maturity mismatches, currency mismatches, capital structure problems and solvency problems. Maturity mismatches manifest when a sector is not able to cover its short-term liabilities on the back of insufficiency of liquid assets. Currency mismatches occur whenever there are net positive or net negative exposures (long over short) to distinct types of currencies. Capital structure problems emanate from over-reliance on debt in the funding structure of the sector so that this increases the probability of the sector being subject to financial distress costs. Finally, solvency problems occur when the present value of assets is not enough to cover the present value of liabilities (all assessed under cash inflows/outflows) so that there is an erosion in equity value of the sector.

Table 1 provides a snapshot of the balance sheet for the Indonesian’s household sector. The main shortcoming related to household’s balance sheet is that data are still not available for many economies.

Table 1.1: Balance Sheet of Indonesia’s Household Sector.

Assets | Liabilities |

|---|---|

Financial assets | Bank loans |

Cash | Loans from non-bank financial institutions |

Bank deposits | Other loans |

Insurance, cooperatives, post-office deposits | |

Accounts receivable | |

Stock, bond, mutual fund investments | |

Pension funds and other investments | |

Non-financial assets | |

Gold and jewellery | |

Vehicles | |

Houses and buildings | |

Land | Net worth (assets minus liabilities) |

Source: BIS (2009): Household debt: implications for monetary policy and financial stability, p. 63.

The ultimate focus under household balance sheet assessment is to ensure that households have assets in excess of their liabilities. It came out that in Indonesia (see Santoso & Sukada, 20091), households put their money in banks in form of bank deposits2 in spite of a decline in interest rates. Above all, Indonesian households had low exposure to financial assets so that they tended to be mainly involved with the banking sector. Thus, there are strong relationships between the household sector and the banking sector in Indonesia.

1.5....

Table of contents

- Cover

- Praise for The Theory and Practice of Financial Stability

- Chapter 1 Household Sector

- Chapter 2 Corporate Sector

- Chapter 3 Real Estate Sector

- Chapter 4 Government Sector

- Chapter 5 Non-bank Financial Sector

- References

- Index