- 163 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Understanding Financial Stability

About this book

Since the outbreak of the US subprime crisis in 2007, financial stability has become a pressing item in the agenda of governments and policy-makers worldwide. However, to date, there are no books that provide a comprehensive analysis of financial stability in all of its dimensions.

Understanding Financial Stability undertakes an in-depth analysis of all the concepts and issues related to financial stability. It establishes a general framework for a holistic assessment of financial stability, provides a comprehensive analysis pertaining to the genesis of financial crises, and offers key terms and elements embodied in financial stability. Posing the question of whether financial stability should rely only on resilience or predictability issues when it comes to handling crises, the book provides:

• Extensive coverage of all key issues involved in the field of financial stability.

• A consideration of the political economy.

• A complete and in-depth assessment of crises in the world based on full historical coverage; including a definition of crises, various theories of crises, costs related to crises, types of crises and policy responses to crises.

This book will prove valuable to central bankers, economists, and policy-makers who are involved in the field of financial stability, as well as researchers studying the field.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Chapter 1

Finance, Incentive Structures and the Financial System

1.1. Definition of Finance

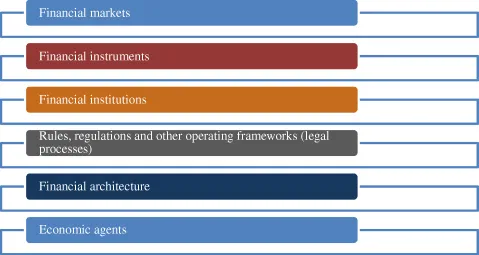

Finance can be defined as the management of money to enhance the value of wealth of different economic agents, which make up the financial system of a specific country. Finance encapsulates the process of saving, investing and recouping invested money to enshrine the value of the firm. Therefore, finance encompasses different spheres of economic activities in an economy, starting off from savers, lenders and governments to financial institutions such as banks and insurance companies, all geared towards wealth maximisation of different economic units in the financial system. Finance requires financial markets and financial instruments to ensure that different investors’ risk profiles are being catered, aligned with the notion of complete markets, widely cited in the case of innovative products. Risk-loving investors will cling to equities while risk-averse investors will prefer to go for bonds. These different sets of financial instruments enable portfolio diversification to effectively manifest. Figure 1.1 provides a snapshot of the key components, which make up a financial system.

Figure 1.1: Key Components of a Financial System. Source: Author’s illustration.

Since finance inherently touches all the subtle fabrics of a financial system in view of wealth maximisation, this leads to key tenets in financial theories such as the capital structure of firms, valuation of financial instruments accomplishable under asset pricing theories through Capital Asset Pricing Model (CAPM) or Arbitrage Pricing Theory (APT) or bond valuation methods, proper distinction between real and financial assets and firm synergies in terms of mergers and acquisitions. Intertemporal dimensions are embedded in finance as investment decisions overlap over different time periods, based on refraining current consumption to maximise future consumption.

A distinctive and critical element embedded in finance relates to the concept of information asymmetry, widely referenced through the classical chapter of Akerlof (1970). Such information asymmetry permeates most theories in finance, let alone the fact that it was recurrently cited in academic chapters as a major contributor to the Great Recession. For instance, the pecking order theory of capital structure borrows heavily from such information asymmetry to account for the fact that the cost of equity is always higher than the cost of debt so that a firm will first exhaust its own funds before using debt and finally equity as a last resort. In essence, the higher the information asymmetry level, the higher is the cost of external financing.

The single driving force that ensures that finance as a field works smoothly in an economy relates to trust and confidence which cannot be built in a single day but actually takes time to be nurtured. This explains the rationale as to why a crisis erupts on the back of shaken confidence or trust in the economy. Such a trust or confidence is highly fragile because once there is belief that trust in the financial system will be seeped out, such a trust will fade based on self-fulfilling actions of economic agents. Jerky economic and financial indicators usually herald that crisis conditions are nigh. To maintain trust and confidence, policy-makers adopt certain behaviour such as use of inflation targeting to properly anchor inflationary expectations in view of bolstering the credibility of monetary policy, financial stability reports not communicating problems but giving time for remedial actions, adherence to a sequential approach to liberalisation of capital accounts and gradual adjustments of interest rates, amongst others.

With finance being inextricably related to the real economy, this signifies that sound finance is highly needed to give a boost to economic activities. However, the relationship between finance and higher economic growth seems to be subject to increasing controversy. This can best be captured in the words of Turner et al. (2010) who state that ‘There is no clear evidence that the growth in the scale and complexity of the financial system in the rich developed world over the last 20 to 30 years has driven increased growth or stability, and it is possible for financial activity to extract rents from the real economy rather than to deliver economy value’. In essence, finance, per se, does not pose problems, it is a lacuna in the framework used in finance, which is problematic and prone to inciting crises.

1.2. Why Finance is Different from the Provision of Goods and Services?

The demand for goods and services is based on the consumption and affordability ability of consumers. Greater consumption of goods in a specific period will leverage on the demand for that good-for example, during festive seasons, there is higher demand for chocolates. However, only high net worth households will be able to afford more expensive chocolates. Unfortunately, when it comes to finance, the demand for financial products and services differs from conventional demand for goods and services on ground of not being subject to consumption issues but being fed on by positions over positions. This can be best explained by an investment in a foreign currency that is subject to currency risk. To curb such a risk, the investor can have recourse to a forward contract. Thus, the absolute value of positions consists of the initial investment position coupled with the forward contract position. Such a state of affairs accounts for the substantial increase in the value of global derivatives positions in the world, being significantly higher relative to the US GDP. Based on positions creating new positions in the case of financial products and services, it becomes glaring the financial products and services tend to create a burgeoning level of artificial economy relative to the real economy – herein lies the reason as to why financial stability gains a prominent role worldwide. Risks to financial stability usually manifest when the wedge between the real economy and the artificial economy is too large relative to the fundamentals.

Securitisation, hedge funds activities, myopic and herd behaviour of traders, all further contribute to an even larger artificial economy. Turner et al. (2010) point out that ‘The essential reason why the 2007–2008 crisis was so extreme was the interaction of the specific features of bank credit and the specific features of securitised credit’. Ironically, such a large artificial economy is based on the fragile component of trust, which once broken, unleashes substantial squeeze on the real economy.

1.3. Some Unique Features in Finance

Compared to the demand for goods and services which is limited by the value of resources possessed by economic agents who hail from the demand side, the demand for finance has no such limitations. For instance, the demand for banking account services can be accommodated easily without any problem.

Another distinctive feature of finance is that capital markets are running above 100 % of GDP in their respective economies. For example, most equity market capitalisation happens to hover above 100% of GDP in it country.

Keeping abreast with the latest updates in finance, it becomes clear that Fintech is gaining momentum so much so that the role of the banking sector may soon become questionable if people start to heavily practise peer-to-peer lending.

Certain economic agents in finance exhibit high levels of rent extraction as it is the case for hedge funds, which pay a flat fee of 2% based on value of assets and an exorbitant performance fee of 20% for upside performance without being subject to any penalty fee for underperformance.

Regulation of financial sector has been more in terms of a pragmatic approach in terms of setting in place new measures to curb the forces which drove the most recent crisis, making financial regulation a heavily a-theoretical subject of focus.

1.4. Self-Interest of Bank Managers: Hammering on Information Asymmetry

Three main actors determine the road of actions to be taken by a bank, namely bank managers, regulators and the shareholders, as argued by Jeitschko and Jeung (2005). Bank managers are imbued with their own self-interests. Gorton and Rosen (1995) differentiate between good managers and bad managers. While good managers tend to perform profitable risky or profitable safe loans, bad managers tend to carry out unprofitable risky (excessive risk-taking) or unprofitable safe loans (excessive entrenchment). The greater the proportion of bad managers, the higher is the level of agency conflicts. Managers strive to maximise their own private benefits. Regulators attempt to scale down bank default risk. Shareholders want actions to be initiated as to maximise the equity value of the bank. Thus, strong agency conflicts arise out of these different actors which permeate the banking industry. Hughes and Mester (1994) argue that due to internal agency problem, bank’s managers do not maximise shareholders value. Deposit insurance may spur excessive risk-taking on behalf of bank managers as they know that in the case of difficulties, the government will always be there to protect the banks. Saunders, Strock, and Travlos (1990) state that ‘stockholder controlled’ banks took on more risk than their ‘managerial controlled’ counterpart.

The incentives structures may also be damaging to the health of the financial system chiefly when bank managers’ variable component of remuneration emanates from growth performance in total credit facilities provided by the bank. Bank managers will thereby attempt to increase credit facilities more during boom periods by being lenient in their credit processing mechanisms. Ironically, it is during such time periods that pressures build up in the economy as encapsulated under the paradox of financial instability.

1.5. Efficient Market Hypothesis Back in the Limelight as a Discredited Theory in Finance

The efficient market hypothesis assets that financial markets are efficient so that asset pricing models such as CAPM, APT and Fama-French three-factor models become highly useful. The key message underpinned under such a theory is that any investor can beat the market but not consistently. Unfortunately, the tug of war between academicians and practitioners that has been going on for decades appears to often miss out one key component embedded under the Efficient Market Hypothesis. Testing of the Efficient Market Hypothesis implies that a proper model is being used, but, in practice, it is impossible to ensure that this is the best model to test the theory. Therefore, if it is impossible to know what the best model is, the best we can say is that the theory is not testable in reality. Following the Great Recession, many economists began to discredit the Efficient Market Hypothesis so much so that the theory is now being relegated to a special case. Such a disparaged view of the Efficient Market Hypothesis signifies that markets do not really behave in such a way as to self-regulate themselves. Thus, relying on the subtle forces of the markets to rectify any anomaly may ironically make things worse and this was glaringly witnessed during the Great Recession when the financial sector destabilised the real sector.

If Efficient Market Hypothesis is invalidated, then the other channels relating to finance also become subject to a major blow. For instance, in portfolio theory, it is presumed that all investors will first cling to the market portfolio to then decide as to whether to become a borrower or a lender, hinging on their respective risk profiles. But, if the market portfolio is itself wrong, everything which is based on this will also become flawed. In that respect, all risk analyses and risk metrics will also become flawed. This is akin to the Garbage In Garbage Out (GIGO) concept. Most interestingly, if the Efficient Market Hypothesis is wrong, then other markets which are derived from equity markets will also be priced wrongly such as in the case of the derivatives markets which thereby invalidate the social utility of derivatives.

Woolley (2010) points out momentum and reversals to be the two main forces which driving mispricing with its extreme forms leading to bubbles and crashes. Discrediting the Efficient Market Hypothesis also implies discrediting the use of indices for both passive and active investment strategies because indices represent efficient portfolios.

1.6. Shortcomings Embedded in the Financial System

This section discusses some of the shortcomings which permeated or still permeate the financial sector in the world.

- Two key features describe financial markets in the last three decades, namely growth in both scale and complexity so much so that at the end of the day, a big question arises as to whether financial markets really contributed to higher economic growth worldwide.

- Financial markets which form part of any financial system are deemed to be fragile components being highly affected by substantial divergences from equilibrium values.

- Due to limited liability structures, this leads to a call option on banks’ assets with shareholders desiring higher risk activities during boom periods to harness maximum benefits possible. This explains the rationale as to why banks endowed with friendly governance structures did worst during the Great Recession as pointed out by Beltratti and Stulz (2009).

- Stated functions of financial systems: providing savings for real investment, risk transfer, maturity transformation, making payments and ensuring complete markets. But in reality, things do not move as per these stated functions.

- Risk migrates to where regulation is weakest.

- Private equity is adversely affected by opacity which involves strategies to benefit parties which are non-shareholders.

- Commodities investment should be avoided as they offer a long-run return which is no better than zero after inflation and after fees.

- Opacity and asymmetric information. Highly complex financial products and services related to securitised credit and derivatives generated false beliefs that they were enhancing economic growth by bringing in efficiency and enhanced risk management possibilities.

- Rating agencies adversely impacted by conflicts of interest.

- Short-term performance-related pay.

- Turner (2010) in the first chapter of the book The Future of Finance comments that ‘only a fraction of credit extension relates to capital formation process’. Such a statement implies that the whole process of credit provision to borrowers to enhance growth of the economy was not really working in practice because credit was not linked to real investment. Authorities should admit that they fail to properly carry out their roles. Turner (2010) comments that ‘it is possible for financial activity to extract rents from the real economy rather than to deliver economy value’.

- Scale of financial activities is substantially very high relative to the real economy. Can we even say that it is extremely very high? For instance, the total outstanding amount of derivative contracts is many times higher than the US GDP. Are we moving too much to a financial system which is imbued with illusionary powers as to gnaw at the level of real economic activities.

- Proprietary trading is considered to be a source of instability instead of stability in financial markets.

- Failure of credit provision to be related to increase in real investments in developed economies because such credit was used principally to either smooth out consumption patterns of households across life cycle via residential mortgages or to increase the level of ‘skin in the game’ of borrowers who invest in real estate either through residential or commercial real estates. Credit provision to spur real investments was not a common feature in developed economies for years prior to the Great Recession to the plain effect that it became questionable as to whether higher credit provision by the banking or non-banking sector do elicit higher economic growth.

- Turner (2010) argues for an increasing role of the non-banking sector to induce an enhanced financial system. He clearly states, ‘Less maturity transformation in aggregate and a reduced role for bank credit in the economy, compared with that which emerged pre-crisis in several developed economies, may in the long run be optimal’. Leverage and maturity transformation issues directly impact on the volatility of credit furnished by banks when crisis conditions manifest. Two other forces also increase the volatility of credit and which are related to the market price of credit, namely securitised credit and mark to market accounting.

1.7. Solutions to the Identified Shortcomings

Based on the identified shortcomings, so...

Table of contents

- Cover

- Praise for The Theory and Practice of Financial Stability

- Chapter 1 Finance, Incentive Structures and the Financial System

- Chapter 2 Concept of Financial Stability Demystified

- Chapter 3 Financial Stability Reports

- Chapter 4 Country Experiences with Respect to Financial Stability

- Chapter 5 FinTech and the Financial Stability Board

- Chapter 6 Financial Crises

- Appendix 1: Working Mechanism of Asset-backed Securities

- Appendix 2: Required Reserve Ratios for Different Central Banks in the World

- Appendix 3: List of Some Important Websites and Databases

- Glossary

- References

- Index

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Understanding Financial Stability by Indranarain Ramlall in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.