- 94 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

Explains the essential concepts of finance—budgeting, forecasting, and planning—to managers who are not financial managers. Understanding Finance contains relevant information on how to: understand what the three basic financial statements and ratio analysis tell about a company's financial health; develop and track a budget; and assess an investment opportunity.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Understanding Finance by in PDF and/or ePUB format, as well as other popular books in Business & Management. We have over one million books available in our catalogue for you to explore.

Information

Understanding Finance: The Basics

Understanding Financial Statements

But it is pretty to see what money can do.

—Samuel Pepys

COMPANIES DO many things: build cars, process data, provide services, and even launch satellites. But the underlying purpose of all for-profit companies is to make money. As a for-profit manager, your job is to help the company make money—preferably, more money each year. Even if you work in the nonprofit or government sectors, where net income is neither the only nor the most important bottom line, it is still vital that you carefully monitor how much money comes in and where it gets spent.

You can help your company make money by reducing costs, increasing revenues, or both. You can also help the organization be financially successful by making good investments and using its assets to their fullest extent. The best managers don’t just mind the budget—they look for the right combination of controlling costs, improving sales, and utilizing assets.

How’s your company’s financial health? Where does its revenue come from, and where does it spend its money? How much profit is it making? Where is its cash coming from, and where is it going to? Companies provide answers to such questions in three documents, called financial statements: the income statement, the balance sheet, and the cash flow statement. Publicly traded companies make these statements available to everyone—shareholders, industry analysts, and competitors as well. As a result, they are not as detailed as the company’s internal financial statements.

Accounting methods

Financial statements follow the same general format from company to company. Depending on the nature of the company’s business, however, specific line items may vary. Still, the statements are usually similar enough to allow you to compare one business’s performance against another’s. The reason for this similarity is that accountants abide by generally accepted accounting principles, or GAAP.

Most companies use accrual accounting: revenue and expenses are booked when they are incurred, regardless of when they are actually received or paid. This system relies on the matching principle, which helps companies understand the true causes and effects of business activities. Accordingly:

- Revenues are recognized during the period in which the sales activity occurred.

- Expenses are recognized in the same period as their associated revenues.

For example, at Amalgamated Hat Rack Company, which manufactures hat racks from imitation moose antlers, the revenue for a customer order is booked when each hat rack is sold—even if payment is made on account and the cash is not received immediately. Similarly, if Amalgamated receives two thousand brass hooks from a contracted supply company, those hooks are not all expensed at once. Rather, they are expensed on a per-unit basis: if it takes five brass hooks to make one hat rack, then the brass hooks are expensed five at a time as each hat rack is sold.

Occasionally, a very small company will begin its existence using cash-basis accounting, which counts transactions when cash actually changes hands. This practice is less conservative when it comes to expense recognition, but sometimes more conservative when it comes to revenue recognition. But as companies increase in size and complexity, it becomes more important to match revenues and expenses in the appropriate time periods, so they tend to switch over to accrual accounting.

The income statement

You might want to invest in a company for many reasons. Perhaps it’s a leader in the industry. Or its CEO has a great record of turning companies around. Or its products are on the cutting edge of technology. But if the company is not turning a profit (otherwise known as net income or earnings), or it doesn’t show strong potential to become profitable over the medium term, you probably wouldn’t want to invest in it.

The income statement tells you whether the company is making a profit—that is, whether it has positive net income. (This is why the income statement is also called a profit and loss statement.) It shows a company’s profitability for a specific period of time—typically, monthly, quarterly, and annually.

How does an income statement present this profitability picture? It starts with a company’s revenue: how much money has come in the door from its operations. Various costs—from the costs of making and storing its goods, to depreciation of plant and equipment, to interest and taxes—are then subtracted from the revenue. The bottom line—what’s left over—is the net income or profit.

Consider the example shown in the table “Income statement for Amalgamated Hat Rack.” (Explanations for key terms follow.)

Income statement for Amalgamated Hat Rack

| Retail sales | $2,200,000 |

| Corporate sales | $1,000,000 |

| Total revenue | $3,200,000 |

| Cost of goods sold | $(1,600,000) |

| Gross profit | $1,600,000 |

| Operating expenses | $(800,000) |

| Depreciation expense | $(42,500) |

| Operating income | |

| (also called earnings before interest and taxes) | $ 757,500 |

| Interest expense | $(110,000) |

| Earnings before income tax | $647,500 |

| Income tax | $(300,000) |

| Net income | $347,500 |

Source: Harvard ManageMentor® on Finance Essentials, adapted with permission.

The cost of goods sold is what it cost Amalgamated to manufacture the hat racks. It includes raw materials, such as fiberglass, as well as direct labor costs.

By subtracting the cost of goods sold from revenue, you get a company’s gross profit—the profitability of the company’s products or services.

Operating expenses include administrative employee salaries, rents, sales and marketing costs, as well as other costs of business not directly attributed to manufacturing a product. The fiberglass for making hat racks would not be included here; the cost of the advertising would.

Depreciation is a way of estimating the “consumption” of an asset over time. A computer, for example, might have a useful life of three years. Thus, according to the matching principle, the company would not expense the full value of the computer all in the first year of its purchase, but as it is actually used over a span of three years.

By subtracting operating expenses and depreciation from gross profit, you get operating income—often called earnings before interest and taxes, or EBIT.

Interest expense refers to the interest charged on loans a company takes out.

Income tax is levied by the government on corporate income.

BOTTOM LINE n 1: net income (or profit), as shown on a company’s income statement

The balance sheet

Most people go to a doctor once a year to get a checkup—a snapshot of their physical well-being at a particular time. Similarly, companies prepare balance sheets as a means of summarizing their financial positions at a given point in time.

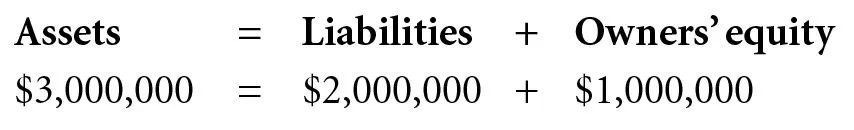

Assets = liabilities + owners’ equity

Assets are the things a company invests in so that it can conduct business—examples include financial instruments, land, buildings, and equipment. In order to acquire necessary assets, a company often borrows money from others or makes promises to pay others. That money, which is owed to creditors, is called liabilities. Owners’ equity, also known as shareholders’ equity, includes the capital that investors have provided and the profits retained by the company over time. If a company has $3 million in assets and $2 million in liabilities, it would have owners’ equity of $1 million.

By contrast, a company with $3 million in assets and $4 million in liabilities would have negative equity of $1 million—and serious problems as well.

Thus, the balance sheet provides a description of how much, and where, the company has invested (its assets)—broken down into how much of this money comes from creditors (liabilities) and how much comes from stockholders (equity). Moreover, the balance sheet gives you an idea of how efficiently your company is utilizing its assets and how well it is managing its liabilities.

Balance sheet data is most helpful when it’s compared with information from a previous year. In the table “Amalgamated Hat Rack balance sheet as of December 31, 2004,” a comparison of the figures for 2004 against those for 2003 shows that Amalgamated has increased its total liabilities by $38,000 and increased its total assets by $38,000, thus resulting in no change in owners’ equity. (Explanations for key terms follow.)

The balance sheet begins by listing the assets that are most easily converted to cash: cash on hand, receivables, and inventory. These are called current assets.

Next, the balance sheet tallies other ass...

Table of contents

- Pocket Mentor Series

- Title Page

- Copyright Page

- Table of Contents

- Mentors’ Message: Why Understand Finance?

- Understanding Finance: The Basics

- Tips and Tools

- Key Terms

- To Learn More

- Sources for Understanding Finance

- How to Order