![]()

Part 1

Creating

Business Value

through

Information

Technology

Part 1 of this book introduces the notion of the information technology portfolio and its four types of investment. We provide benchmarks for different information technology portfolios in different industries and examine the evidence to determine which investment strategies have worked and which have not. As more of a firm’s cash flow is on-line, it is the longer-term decisions about information technology infrastructure investments that will differentiate competitive capabilities.

Chapter 1 provides an overview of the challenges firms face in maximizing business value from the new infrastructure and illustrates how successful firms face these challenges. Changing competitive environments have significant implications for the management and uses of information technology. Emerging technologies present firms with new realities, and electronic commerce is shifting the locus of competition. However, few senior managers are well equipped to make confident and competent decisions to implement the new infrastructure in their business. We explore how shifts in business and customer demands require rethinking from many perspectives: rethinking value from the customer’s perspective, rethinking the nature of information technology investments, and rethinking the way a firm manages and governs that investment.

Chapter 2 introduces the investment portfolio as a new lens to rethink information technology management. In rethinking technology investments, we use concepts that are fundamentally those of business rather than of technology: portfolios, business value, investment, and alignment of resources with strategic goals. The objective of information technology investment is to provide business value through implementing current strategies and enabling new strategies. But, because several barriers exist, we need to rethink traditional alignment approaches. We explore new ways to drive business value through the notion of the information technology portfolio, balancing long- and short-term needs, as well as risk and return.

Generating business value from information technology infrastructure investments is a delicate balancing act. Chapter 3 provides the evidence for payoff from our research: which strategies have worked and the types of business value achieved in firms with different information technology portfolios. These patterns of business value identify the different risk-return characteristics of each type of information technology in the portfolio. The characteristics and actions of managers in firms that have achieved superior business value from their investments are also presented and analyzed. The evidence for payoff leads to a series of implications for maximizing value.

![]()

CHAPTER 1

Management Challenges

of the New Infrastructure

InvestCo is a large firm with a broad product range. It faces severe competition from smaller, more agile firms offering a limited range of products to select demographic groups. InvestCo sees its future as developing long-term relationships with increasingly sophisticated consumers and providing them with a broad range of products. However, InvestCo has found it difficult to respond quickly and is beginning to lose market share. A major part of the problem lies in the difficulties of developing new products that cross InvestCo’s traditional areas of responsibility and thus its business unit boundaries.

Until now the firm has operated as four largely independent business units whose senior managers are rewarded on business unit performance. The result has been very solid performance and a rising share price, but a high cost-to-income ratio relative to those of the firm’s traditional competitors. The cost-to-income differential is even worse when compared to those new entrants who are offering similar products, such as loans, investment accounts, checking accounts, and insurance policies, over the phone and without InvestCo’s large investment in a physical branch network.

One of the authors was asked to address InvestCo’s newly formed Information Technology Council on the theme of how to generate business value from information technology investments. The council comprises the chief executive officer (CEO), the chief financial officer (CFO), the chief information officer (CIO), the heads of the four business units, and the head of strategy. The CIO has worked, for two years, one on one with the senior executives to generate the necessary agreement to form this council, which will take a firmwide view of information technology.

Operating independently and entrepreneurially, each business unit has made large investments in information technology. To best meet its particular customers’ needs, each business unit has implemented different systems, which has resulted in much duplication and incompatibility across the firm. Until now the CIO has been unable to convince the business unit heads to agree on a common approach to information technology infrastructure.

The air was thick with tension after the presentation benchmarking InvestCo against other firms operating in similar markets around the world. The eight officers looked around the table, wondering where this meeting would lead. The CEO began to speak, identifying several major problems in the information technology area. First, he said, InvestCo was spending far more than its competitors based on the recent benchmarking study of both information technology costs and business value. Worse still, the firm wasn’t getting as much business value from its information technology investments as the average and far less than the leaders. The firm’s vision of providing integrated financial services and leveraging the customer base by cross-selling was fast becoming a mirage. The CEO stressed that the firm’s competitors were better at converting their information technology investments into business value. He gave a series of painful examples of competitors beating InvestCo to the market with new products at lower costs. Finally, he pointed out that the systems in each business unit were incompatible. For example, cross-selling an insurance policy to a customer with a mortgage was difficult. It was also almost impossible to determine the total business relationship that a customer had with the firm, certainly not while the customer was on the phone.

The CEO and CIO had come to the difficult realization that their approach to managing information technology was putting the firm’s future at risk. In short, they weren’t investing in information technology appropriately for their business objectives, and they weren’t getting enough business value from those investments. The duplication of information technology investments had raised costs, which went straight to the bottom line and reduced profits. Even worse, incompatible technology investments limited the firm’s strategic options. The CEO described the Executive Choice package recently released by a major competitor. This attractive package offered a wide range of financial services for a single fee and provided the customer with a consolidated report.

The CEO didn’t need to remind the group that InvestCo offered these same services, but that they were spread across the four business units. The cost of manually or electronically implementing this new offering to compete with Executive Choice was huge and probably would cause the firm to lose money on the package. However, without a similar offering, some customers were sure to defect to the competitor. InvestCo’s senior managers hadn’t realized that the value proposition they put to current and potential customers—a secure one-stop shop for financial services—was technically beyond their reach.

The CEO led several hours of tough discussion, during which the group agreed to a significant change in how InvestCo would invest and manage information technology. The heads of the business units left with mixed feelings. The logic of a shared information technology infrastructure made good business sense for the firm, but they didn’t want to give up control of information technology in their businesses. They realized, too, that these discussions had wider ramifications for the way InvestCo was managing its people, its organization, and its business.

This book addresses the issues facing InvestCo and many other firms trying to leverage information technology investments to fulfill the firm’s value proposition to customers. From our work with firms we have synthesized a practical management approach to the way market leaders leverage information technology. This approach draws on hard evidence of the market leaders’ business value generation and includes extensive benchmarks for comparison.

Facing a New Reality

In this new era of competition in which firms find themselves, opportunities and threats abound. The merging of the computing, telecommunications, publishing, and entertainment industries, as well as the pervasiveness of the Internet and other vehicles for electronic commerce, present strategic opportunities and threats for every firm. Business and technology managers are anxious to make smart use of this powerful combination of business unit, firm, industry, and public infrastructures. However, like InvestCo, many firms struggle with their information technology investments, grappling with a multitude of technical and business choices, working to find the optimal balance of capabilities at corporate and business unit levels. Concurrently, managers must consider how their firm’s technology infrastructure intersects with emerging industry and public infrastructures.

In the past there were fewer options and limited infrastructures providing channels to customers. Today there are many. As we move into the twenty-first century, when more and more of a firm’s cash flow is on-line, the longer-term decisions about information technology infrastructure investments will differentiate competitive capabilities. The opportunities of the new electronic infrastructures will test many organizational decision-making processes. People will still be a firm’s core asset, but the infrastructures they operate will be electronic. We will see the growing importance of the new electronic infrastructure and a declining importance of physical assets and location. Identifying how to benefit from the new infrastructures is a challenge for senior management, who must now take responsibility for these critical longer-term information technology decisions.

What Is the New Infrastructure?

Information technology has become pervasive within contemporary organizations, in order to do business electronically and to connect to customers, suppliers, regulators, and strategic partners. We define information technology as a firm’s total investment in computing and communications technology. This includes hardware, software, telecommunications, the myriad of devices for collecting and representing data (such as supermarket point-of-sale and bank automatic teller machines), all electronically stored data, and the people dedicated to providing these services. It includes the information technology investments implemented by internal groups (insourced) and those outsourced by other providers, such as IBM Global Services or EDS. We view the sum total of this investment as the information technology portfolio, which must be managed like a financial portfolio, balancing risk and return to meet management goals and strategies for customer and shareholder value.

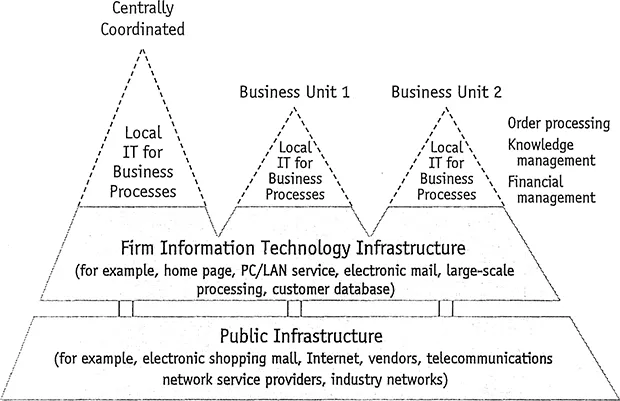

Figure 1.1The New Infrastructure

The foundation of the information technology portfolio is the firm’s longer-term information technology infrastructure, which is in turn linked to external industry infrastructures, such as bank payment systems, airline reservation systems, and automotive industry EDI networks, and to public infrastructures, such as the Internet and telecommunications providers. These infrastructures together enable firms to transact business by reaching customers and suppliers, and provide governments with cost-effective ways to deliver services to their communities. These technologies provide the basis for new organizational forms, new products, new markets, and many changed jobs. The combination of the firm’s internal information technology infrastructure and the external public infrastructures make up the new infrastructure illustrated in Figure 1.1. This new infrastructure (depicted in Figure 1.1 as the entire shaded section) will be as important for enabling business processes in the future as the traditional physical infrastructure of roads, store fronts, bank branches, share certificates, delivery services, and product catalogs. The new infrastructure, plus the information technology needed to perform business processes, make up the firm’s information technology portfolio. The entire information technology portfolio represented by Figure 1.1 must be managed by a partnership of business and technical management to create business value.

Why Is the New Infrastructure Important?

In many organizations, information technology is the single largest capital expense. In the United States, more than 50 percent of all capital spending goes into information technology, accounting for more than one-third of the growth of the entire U.S. economy.1 Senior managers clearly cannot afford to delegate or abdicate to technical personnel critical decisions about the new infrastructure. All managers need well-developed skills to deal confidently and competently with information technology issues so that these complex choices can take account of strategic, technical, competitive, financial, and organizational issues.

In the firms we studied over a five-year period, the average dollar investment in information technology rose by more than 12 percent each year (see Figure 1.2). The average firm invested 4.1 percent of revenues and 7.7 percent of expenses in information technology. Every year the ratio of information technology investment to expenses increased by 3 percent. So, every year, information technology accounted for over 3 percent more of the average firm’s resources. In many firms, this increase was accompanied by a reduction in labor costs. Investments in information technology account for an ever-increasing percentage of a firm’s discretionary investments and demand the attention of all senior managers.

The benchmarks in Figure 1.2 also illustrate variation by industry in the level of dependence on information technology. The finance industry (banking and insurance) depends most on information technology, followed by retail and process manufacturing. In service industries, such as banking, information technology is the engine that processes a huge number of transactions every day. Based on our study, a typical ban...