eBook - ePub

The Savvy Investor's Guide to Pooled Investments

Mutual Funds, ETFs, and More

- 210 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The Savvy Investor's Guide to Pooled Investments

Mutual Funds, ETFs, and More

About this book

Do you only have a relatively small amount of money to invest?

Do you think this limitation give you only a few investment choices?

Well, it doesn't.

Investing experts H. Kent Baker, Greg Filbeck, and Halil Kiymaz offer an essential guide to one of the most common ways to invest: a pooled investment vehicle (PIV). A PIV is an investment fund that commingles the monies of many different investors to buy a portfolio that reflects a particular investment objective. – By using PIVs, you gain a diversified portfolio, which once was only available to large investors.

The Savvy Investor's Guide to Pooled Investments clearly explains the risks and advantages of investing in a PIV. This book introduces you to five PIVs – mutual funds, exchange-traded funds (ETFs), closed-end funds (CEFs), unit investment trusts (UITs), and real estate investment trusts (REITs) – with a unique Q&A format employed to delve into issues that investors want and need to know before choosing a PIV.

If you have ever felt limited by your investment choices, Baker, Filbeck, and Kiymaz explain your options to creating an investment portfolio, which is an initial step to becoming a savvy investor.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access The Savvy Investor's Guide to Pooled Investments by H. Kent Baker,Greg Filbeck,Halil Kiymaz in PDF and/or ePUB format, as well as other popular books in Commerce & Investissements et valeurs mobilières. We have over one million books available in our catalogue for you to explore.

Information

CHAPTER 1

MUTUAL FUNDS

Don’t look for the needle in the haystack. Just buy the haystack!

John C. “Jack” Bogle, Founder of the Vanguard Group, Inc.

Regulated open-end funds (OEFs), which include mutual funds, exchange-traded funds (ETFs), and institutional funds are exceedingly popular. According to the 2018 Investment Company Fact Book, there were 114,131 regulated funds worldwide in 2017. That’s a lot of choices! Mutual funds continue to provide investors with the chance to invest in many stocks, bonds, and other investments with a single transaction. By accumulating funds from numerous investors, mutual funds enable you to invest and take advantage of market opportunities with the help of professional management. For many investors, mutual funds are the pooled investment vehicle (PIV) of choice.

Dutch merchant Adriaan van Ketwitch formed the world’s first mutual fund in 1774 by pooling money from a limited number of investors. The fund diversified across European countries and the American colonies through the backing of income from plantations. The subscription to the fund was called “unity creates strength” and was limited to 2,000 units. The fund survived until 1824, but the concept of pooling money to create PIVs continues today. The first mutual fund in the United States, Massachusetts Investors Trust, was created in 1924. The fund grew from $50,000 to $392,000 in assets in one year. It became available to the public in 1928 and later became MFSA Investment Management. In 1940, the United States had 68 mutual funds, but this number had grown to 9,356 by 2017, with net assets under management (AUM) of almost $19 trillion.

The purpose of this chapter is to provide the necessary background to help you decide whether mutual funds should be part of your investment portfolio. Although mutual funds are extremely popular and investing in them appears straightforward, as a savvy investor, you should continue to educate yourself to stay at the top of your game and to obtain the most from your investments. The following questions and answers should help guide you to meet this challenge involving mutual funds.

1.1. WHAT IS A MUTUAL FUND AND HOW DOES IT WORK?

A mutual fund is an investment company that pools money from investors to buy securities and assets in financial markets according to the objectives specified in the fund’s prospectus. In finance, a prospectus is a formal legal document that provides details about an investment offering for sale to the public. With a mutual fund, you’re entrusting your savings to professional fund managers. The underlying securities and assets in a mutual fund represent its portfolio. Legally known as an “open-end” fund (OEF) or company, a mutual fund is one of three basic types of investment companies. The other two are “closed-end” funds (CEFs) and unit investment trusts (UITs), which are discussed in Chapters 3 and 4, respectively.

Mutual funds give people the sense that they’re investing with the big boys and that they’re really not at a disadvantage entering the stock market.

Ron Chernow

An important characteristic of a mutual fund is its ability to offer new shares to investors. A mutual fund stands ready to sell additional shares to investors and to buy and redeem shares from anyone who wants to sell. When you buy shares, the fund issues them, and then invests the money received. When you sell shares, the fund either uses existing cash or sells some of its assets and uses the cash to redeem your shares. As a result, the number of shares outstanding changes over time, and no limit exists on the number of shares that the fund can issue. Mutual funds price their shares each business day, typically after the major US exchanges close. The cost of each share is calculated as the fund’s net asset value (NAV) per share, which is computed by dividing the difference between the portfolio’s market value and any fund liabilities by the number of shares outstanding. You buy and sell shares based on a fund’s NAV per share. This price fluctuates based on the value of the securities held by the portfolio at the end of each business day. However, you don’t actually own the securities in which the fund invests; you only own shares in the fund itself.

An investment company organizes a mutual fund as a corporation that relies upon third parties or service providers, either fund sponsor affiliates or independent contractors, to manage the fund’s portfolio and carry out other operational activities. The fund sponsor raises money from the investing public, who become fund shareholders. It then invests the proceeds in various securities and assets following the fund’s investment objective. A portfolio manager manages the investments in a mutual fund. The manager oversees the fund on a daily basis, deciding when to buy and sell various securities. For these services, the fund sponsor charges fees and incurs expenses for operating the fund. Fund shareholders bear their proportional share of these fees.

Many financial innovations such as increased availability of low-cost mutual funds have improved opportunities for households to participate in asset markets and diversify their holdings.

Janet Yellen

1.2. HOW DOES A MUTUAL FUND DIFFER FROM A SEPARATELY MANAGED ACCOUNT (SMA)?

Similar to a mutual fund, a separately managed account (SMA) is a basket of individual securities owned directly by the client and managed by a professional money manager to achieve a specific objective. Both mutual funds and SMAs invest pools of money over a range of investments and are run by professional managers.

Mutual funds and SMAs have many differences.

- Ownership. Buying a mutual fund share represents ownership of a certain percentage of the fund’s value, but with an SMA, you actually own the securities in the account. The standard way of classifying mutual funds is by their investment objective and risk tolerance. Each investor owns the same assets as every other investor in the fund. With an SMA, your portfolio may be unique.

- Tax liability. As a mutual fund investor, you may incur a tax liability as a result of a fund paying out income and capital gains to you. For example, if fund managers sell winning stocks and hold losing stocks, the fund may decrease in value, but you may incur capital gains, which are defined as the difference between a security’s selling price and purchase price. With an SMA, you have more flexibility to optimize a tax liability by trying to offset gains and losses in the account, potentially leaving you with no tax liability.

- Transparency. Mutual funds report their holdings quarterly, and many investor services track mutual fund performance. SMAs have no requirement for publicly reporting the holding’s performance and style consistency.

- Regulation. Mutual funds are subject to the 1940 Securities Act that is enforced by the Securities and Exchange Commission (SEC), but SMAs have no specific regulation. This Act requires investment companies to register and regulate the product offerings issued to the public by investment companies.

- Fee structure. With mutual funds, you pay trading commissions directly and financial advisors and brokers who sell mutual funds charge management fees. Furthermore, you can sell mutual fund shares on any day. Closing an SMA requires moving the individual securities to another manager, which is a potentially complicated and time-consuming task.

- Voting. In mutual funds, shareholders elect the board of directors, which has a fiduciary responsibility to the fund’s shareholders. No such board structure exists for SMAs.

1.3. WHAT IS THE DEMAND FOR MUTUAL FUNDS AND WHO OWNS THEM?

According to the Investment Company Institute, the US mutual fund market had $18.7 trillion in AUM at the end of 2017. Although mutual funds had more than 83% of total net assets in 2017, representing a decline from 96.1% in 2000, the overall mutual fund segment experienced a compounded annual growth of 8.4% between 2002 and 2017. Mutual funds recorded $174 billion in net inflows in 2017, while other US registered investment companies also attracted new investments such as ETFs with a net inflow of $471 billion in 2017. Households make up the largest group of investors in funds, and registered investment companies managed 24% of household financial assets at year-end 2017, an increase from 3% in 1980. The increase of individual retirement accounts (IRAs) and defined contribution (DC) plans mainly explains this growth. The proportion of mutual funds in household retirement accounts increased from 32% in 1997 to 59% in 2017. Mutual funds also manage accounts outside of retirement accounts, including $1.3 trillion in variable annuities, as well as $8.6 trillion of other assets. A variable annuity is a contract sold by an insurance company that provides the holder with future payments based on the performance of the contract’s underlying securities. Besides households, business and other institutional investors also invest in money market funds to manage their cash holdings. A money market fund is a type of fixed income mutual fund that invests in short-term debt securities such as US Treasury bills and commercial paper. These investments are highly liquid and have a high credit quality. For example, the firms operating outside the financial sector had 16% of their short-term assets in money market funds at the end of 2017, with an increase from 6% in 1990.

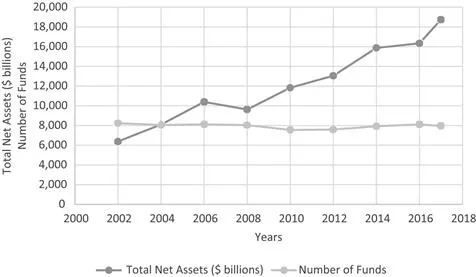

Figure 1 shows the total net assets and number of mutual funds between 2002 and 2017. Of particular importance is the positive compound annual growth rate (CAGR) of 8.4% for the total net assets during this period with no significant change in the number of funds.

Figure 1. Total Net Assets and Number of Mutual Funds.

Note: This figure shows the total net assets in billions of dollars and the total number of mutual funds between 2002 and 2017.

Source: Investment Company Institute (2018) (https://www.ici.org/pdf/2018_factbook.pdf).

Source: Investment Company Institute (2018) (https://www.ici.org/pdf/2018_factbook.pdf).

1.4. WHY SHOULD INVESTORS CONSIDER OWNING MUTUAL FUNDS?

Owning mutual funds offers the following advantages:

- Professional management. A major benefit of investing in a mutual fund is professional management. Full-time, high-level investment professionals can manage and monitor a fund better than the typical individual investor. A team of experienced professionals supports a fund manager, and investment decisions are based on rigorous research and analysis. Mutual funds were created to make investing easy, so consumers wouldn’t have to be burdened with picking individual stocks.Scott Cook

- Simplicity and convenience. Investing in mutual funds is simple and convenient. You don’t have to research stocks or other assets, monitor the market, and conduct the transaction. You can easily move funds from one fund to another, allowing them to alter your portfolio to respond to fund management or economic changes.

- Cost effectiveness. The managers have real-time access to crucial market information and can execute trades on an extensive and cost-effective scale. They have the knowledge and experience to trade in markets that retail investors may not possess. A retail investor is as a nonprofessional investor who invests in securities through a brokerage firm. Mutual funds provide professional management at a fraction of the cost of making such investments independently. The ‘know-nothing’ investor should practice diversification, but it is crazy if you are an expert.Charlie Munger

- Diversification. Diversification is a great strategy for investors who may not know exactly how to manage associated risks. When you first start investing, diversifying can help you avoid major losses from poor investments. For example, investing in a number of different companies may reduce company-specific risks, such as declining profits, and protect against the effects of adverse issues related to a single firm. A mutual fund enables you to participate in a diversified portfolio with many markets and sectors and usually with a small investment. Because consistently predicting superior performing firms and industries is very difficult, diversification is the best way to balance a portfolio, especially for nonprofessional investors.

- Liquidity. With mutual funds, you can redeem shares to get your money back at the fund’s prevailing NAV. Compared to other investments such as fixed deposits, mutual funds are highly liquid. A fixed deposit is a financial instrument provided by banks that affords investors a higher rate of interest than a regular savings account until the given maturity date. Mutual funds have historically offered safety and diversification. And they spare you the responsibility of picking individual stocks.Ron Chernow

- Variety. Mutual funds offer a wide range of options regarding asset classes and objectives. You have many mutual fund types from which to choose involving a range of industries and sectors, different kinds of assets, and so on. Mutual funds provide an opportunity for a manager to apply various investment strategies. Some funds focus on blue-chip stocks, which are stocks of well-established firms, while others specialize in technology stocks, bonds, or a mix of stocks, bonds, and other assets.

- Investor protection. In the United States, the SEC regulates the mutual fund industry. Hence, all funds must disclose information to both current and potential investors and follow operating standards. The intent of regulation is to protect investors from fraud and abuse. Similar types of government regulation exist in many other countries. However, the Federal Deposit Insurance Corporation (FDIC) doesn’t insure mutual funds.

1.5. WHAT ARE THE DISADVANTAGES OR DRAWBACKS OF OWNING MUTUAL FUNDS?

Several disadvantages are associated with owning mutual funds.

- Costs. You incur costs and fees regardless of the fund’s performance. You pay several types of costs, including sales charges (loads), annual fees, and others, which add up over time and reduce overall investment returns. Thus, simple outperformance isn’t enough to justify buying a mutual fund; you need outperformance after costs.

- Professional management. Although professional management is an advantage, some contend that professional managers aren’t any better than the average investor at selecting stocks and timing the market to buy and sell securities in their portfolios. The academic evidence on beating the market is clear: the hurdles are typically too great to consistently achieve outperformance.

- Taxes. You may have little room to optimize taxes paid. When a fund manager sells a security in the portfolio that has increased in price, this sale creates a tax on capital gains even if the fund’s NAV decreases. For example, stock A in an equity fund may experience a 20% price increase while the value of the overall fund may be down by 5%. By selling stock A, the fund incurs a capital gain...

Table of contents

- Cover

- Title Page

- Chapter 1 Mutual Funds

- Chapter 2 Exchange-traded Funds

- Chapter 3 Closed-end Funds

- Chapter 4 Unit Investment Trusts

- Chapter 5 Real Estate Investment Trusts

- Index