![]()

Chapter 1

Extractive Industry Finance and Mineral Economics

1.1Introduction

This book is a new edition of the original of the same title published in 2016 by World Scientific Publishing. Both cover the field of extractive industry finance, which is a specialist subset of economics. Chapters 2–9 have been revised with a contribution on Quantitative Finance written by Mark Davis added as Chapter 10. A set of three additional case studies has been included in Appendices.

The financial services sectors make little distinction between the mining and petroleum extractive industries, but it should be recognised that mining is just part of the extraction stages that include down-stream processing, while coal is as important a source of energy as petroleum. The choice of Metals and Energy Finance for the title of this book therefore allows for a broader treatment of both the technical and financial aspects of the extractive industries.

The concept of “mineral economics” has the connotation of supply and demand although it does incorporate elements of finance. The term “economic geology” is historical in its origin and is concerned mainly with the processes involved in the concentration of metals. The term “mineral deposits studies” is preferred in this book. The term “petroleum economics” tends to cover capital and cost estimates, whereas petroleum fiscal modelling provides the basis for investment decision-making. This book addresses petroleum fiscal modelling.

There are some notable similarities between mineral and petroleum projects. Both are based on depleting resources and therefore companies are under constant pressure to replace reserves. The products are commoditised and globally traded on both spot and futures markets as well as being based on long-term contracts (iron ore, coal and gas supplies). These are products that have low demand elasticity, are capital intensive, require long development lead times and are associated with high technical and commercial risk. There are also environmental compliance and regulatory burdens associated with the development of all natural resource projects.

The book identifies the investment opportunities that are being offered across the whole spectrum of the mining cycle by relating this to the various funding options in the progression from exploration through evaluation, pre-production development, development and, finally, into production. It also addresses the similarities of natural resource projects, whether minerals or petroleum, while identifying their key differences.

1.2Financial and Conventional Engineering

Fundamental to the approach used in this book is the contention that financial engineering should be considered equal to conventional engineering, as it has a design component. To ensure optimal investment return in natural resource projects, conventional engineering is blended with financial engineering. Timing is critical in optimising return on investment and innovative use of financial engineering can enhance returns to investors. Financial models can identify where sensitivities on investment performance indicators are a function of technical assumptions used in conventional engineering.

With many mining operations at the transition from open pit to underground mining where sub-level, panel and block caving methods are able to maintain the rate of production, the role of financial engineering has been enhanced. The tradition in the mining industry is to fund these types of projects from the cash flow generated by an existing operation. The alternative is to ring-fence the project as a discrete investment based on allocation of capital made up of a combination of debt and equity and then to demonstrate the level of return that can be generated. In any geared financial model, the use of debt in funding the capital expenditure permits discounting based on an equivalent to the corporate cost of capital which should further enhance Net Present Value. This results in much greater transparency in decision making which must enhance business development.

There is an important narrative around timing where delay in initiating development of the underground mining will result in a fall-off of ore to the plant which adversely impacts on cash flow. Some develop a shaft system based on cash flow generated from the open pit operation while others make use of debt in funding major programmes of capital expenditure. Where shaft sinking has been funded from equity this should allow treatment of this major cost as sunk capital that provides early access to the ore. As a consequence having vital pre-production infrastructure, such as shafts, in place during construction of the rest of the surface and underground facilities delays in bringing the operation into full production will be short and the ramp-up will be steep.

The book includes a section on the feasibility study. The traditional engineering approach will simply treat this as a study which determines if a project is technically possible. Any investment in a mining project needs, however, to generate a revenue stream that not only covers the cost of extraction but also an Internal Rate of Return (IRR) that exceeds the discount rate selected. In the case of a major mining company, this would be the corporate cost of capital. If the IRR does not exceed the corporate cost of capital, then it would not be feasible to proceed with the investment in the project as mining is not then a commercially viable option.

If debt is to be used and project finance arranged, then the investment banks and independent engineers will be involved in construction monitoring. Once the project is brought on stream, the independent engineers will again audit actual performance against design expectations. A major mining company with existing production capabilities would be in a better position to ensure economic completion tests which will be passed on time. Loans will then go non-recourse on schedule and future risk is then shared with the investment banks. Those elements are included in the book.

Where project finance is used and the lending goes non-recourse, the only remaining security for the investment bank is the ore reserve. The central role of ore resource evaluation in mining finance is also recognised.

The key theme emerging within the mining industry is the role of technical innovation needed to release value through replacing labour intensive mining methods with mechanisation. Before full productivity from the investment in equipment can be achieved, given the level of technical sophistication involved in a modern mechanised mining operation, skilled human resources are needed and these aspects are also covered. Significant technical risk is often associated with the performance of the processing plant and to reduce this the design must take into account the specific mineralogical characteristics of the ore. The book therefore includes an introduction to extractive metallurgy.

All deposits will eventually be mined out so the role of exploration and evaluation must be part of the narrative and the cycle of value creation is a theme that is addressed through detailed treatment of mineral and petroleum geoscience.

1.3Professional Development

Extractive industry finance recognises that major changes in the international mining and petroleum industries over the last decade have significantly increased the demand for professionals with skills that blend technical and financial engineering with a business perspective. It is now considered perfectly respectable for financial engineering to merit the UK’s Engineering Council’s Chartered Engineer (CEng) qualification, particularly where finance is combined with the technical aspects of mining, metals and petroleum. A poorly designed financial model can have as big an impact on a business as structural failure in construction. Financial models of case studies covered in this book demonstrate how financial engineering can be used to offset risk associated with operational issues that impact on the original financial performance indicators. An example would be the reduction in net present value as a consequence of unexpected delays in meeting production targets.

The recognition of the importance of these concepts has resulted in a demand for both postgraduate training and professional development courses. The earlier version of the book is used to support the delivery of the MSc in Metals and Energy Finance degree at Imperial College which is a joint Faculty of Engineering and Business School programme. The book also supports a range of courses delivered through the Imperial College Centre for Continuing Professional Development as well as by Vancouver-based Edumine who also provide the platform from which Excel financial models used in the book can be downloaded.

The fundamental basis for the interest in metals and energy is that the assets are tangible and produce commodity-based products that are an integral part of the natural geological environment. The products are traded internationally and generate cash in hard currency in countries in which the resources are located. It follows, however, from this that no matter how smart the financial engineering associated with investment structures, if basic estimates of grade, tonnage and recoveries for metals or the volumetrics and recovery assumptions for hydrocarbons are wrong because of a flawed understanding of mineral or petroleum geosciences, then the whole basis for a valuation and investment decision will also be flawed.

1.4Hydrocarbons

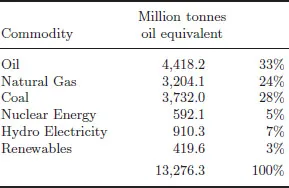

The emphasis of this book is not only on metals but also on energy, and is not confined to conventional oil and gas associated with petroleum systems. Part of the book is devoted to coal, which in 2016 supplied 28% of world energy needs (see Table 1.1). As will be noted, oil, natural gas and coal, which are collectively described as fossil fuels, provide 85% of energy needs.

Upstream extraction techniques for petroleum and coal are normally different, with the former recovered from wells while the latter is associated with mining, but the Athabasca tar sands operations in Canada are essentially mining operations although classified as petroleum projects.

Table 1.1.Consumption by fuel type in 2016.

Source: BP Statistical Review of World Energy, 2017. http://www.bp.com.

There is also a convergence between petroleum and coal in the downstream processing stage of Sasol’s Secunda plant in South Africa where the Fischer–Tropsch (F–T) process is used to convert coal to petroleum products. This includes the development of conventional petroleum gas resources to enhance the gas-to-liquid capabilities of the F–T process. Theoretically, carbon dioxide generated by the process could be cooled and liquefied and then utilised to recover residual hydrocarbons from mature oil reservoirs.

Pilot projects are being linked to coal mining, carbon sequestration and methane production. Carbon capture and storage, and the utilisation of methane emissions permits operators to attract carbon credits and participate in active carbon trading.

For these reasons, the investment community often makes little distinction between petroleum and coal mining, as both sectors are energy-related and commodity-based. The book covers the detailed financial modelling of coal projects and an in-depth treatment of hydrocarbon fiscal regimes based on both tax and royalty and production sharing contracts. The interplay between gas (and liquefied natural gas (LNG)) prices and oil prices only adds to the mix.

![]() Management and Business

Management and Business![]()

Chapter 2

Cash Flow Modelling and Financial Accounting

2.1Introduction

This chapter considers the links between the “accounting model” (potentially net profit, earnings per share, price to earnings ratio, even return on investment %) and the “economic model” (present value of the project’s expected future cash flow). It outlines the way in which cash flow information is constructed from basic project details and then represents that information as a set of accounts, as this is widely used for presentation and reporting of financial information. It could be argued, however, that cash flow information is much more useful.

The accounting model includes provision for funding to ensure cash flows never go negative while the economic model is prefunding. Capital costs and the delay involved during development and before production starts generating revenue means that the initial net cash flow will be negative. In general petroleum fiscal models, with the complexity of provision for production sharing contracts, are essentially economic models usually discounted by the corporate cost of capital of the major petroleum company developing the project.

For mineral projects, particular attention has to be paid to the treatment of the key independent variables such as grade, and dependent variables, such as grade-tonnage relationships, and the way these influence the rate of mining, associated costs and optimisation of the value of a project. Petroleum projects are based on initial volumetries, segment production and annual production profiles, revenue, operating costs, and capital costs.

The distinction between technical appraisal and financial factors will also be addressed and the reason why discounted cash flow (DCF) models need to be integrated correctly into financial accounts explained. This will be linked to concepts of shareholder value and the role of gearing to maintain an efficient balance sheet.

2.2Principles of DCF Modelling

As a starting point in building a DCF model for a mineral project, it is often assumed that the projects are at the pre-production and preinvestment stages. The principle of DCF is based on the logic that money received in the future is worth less than that same amount received today, due to the opportunity for earning additional revenue on that sum if it were to be invested elsewhere. Suppose there is a choice of receiving $1,000 today and investing it or receiving $2,000 in 10 years’ time. Which is the most valuable outcome? The answer clearly depends on the prevailing interest rate. If it happens to be 5%, the money would be worth $1,629 at the end of 10 years and so it would be better to wait. On the other hand, if the current rate happens to be 10%, the sum would be worth $2,594 in 10 years’ time and so it would be preferable to take the money now and invest it. The breakeven interest rate in this scenario is about 7.2%.

Modelling incremental DCF analyses the financial viability of a project by not only testing that generated revenues are substantially greater than costs and debt service requirements, but also by measuring the present value of those profits. The und...