- 484 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

An Undergraduate Introduction to Financial Mathematics

About this book

This textbook provides an introduction to financial mathematics and financial engineering for undergraduate students who have completed a three- or four-semester sequence of calculus courses. It introduces the theory of interest, discrete and continuous random variables and probability, stochastic processes, linear programming, the Fundamental Theorem of Finance, option pricing, hedging, and portfolio optimization. This third edition expands on the second by including a new chapter on the extensions of the Black-Scholes model of option pricing and a greater number of exercises at the end of each chapter. More background material and exercises added, with solutions provided to the other chapters, allowing the textbook to better stand alone as an introduction to financial mathematics. The reader progresses from a solid grounding in multivariable calculus through a derivation of the Black-Scholes equation, its solution, properties, and applications. The text attempts to be as self-contained as possible without relying on advanced mathematical and statistical topics. The material presented in this book will adequately prepare the reader for graduate-level study in mathematical finance.

Contents:

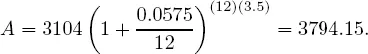

- The Theory of Interest

- Discrete Probability

- Normal Random Variables and Probability

- The Arbitrage Theorem

- Random Walks and Brownian Motion

- Forwards and Futures

- Options

- Solution of the Black-Scholes Equation

- Derivatives of Black-Scholes Option Prices

- Hedging

- Extensions of the Black-Scholes Model

- Optimizing Portfolios

- American Options

Readership: Undergraduate students in finance, economics, and applied mathematics; professionals in banking, insurance and finance.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

Chapter 1

The Theory of Interest

1.1 Simple Interest

1.2 Compound Interest

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Dedication Page

- Contents

- Preface

- Preface to the Second Edition

- Preface to the First Edition

- 1. The Theory of Interest

- 2. Discrete Probability

- 3. Normal Random Variables and Probability

- 4. The Arbitrage Theorem

- 5. Random Walks and Brownian Motion

- 6. Forwards and Futures

- 7. Options

- 8. Solution of the Black-Scholes Equation

- 9. Derivatives of Black-Scholes Option Prices

- 10. Hedging

- 11. Extensions of the Black-Scholes Model

- 12. Optimizing Portfolios

- 13. American Options

- Appendix A: Sample Stock Market Data

- Appendix B: Solutions to Chapter Exercises

- Bibliography

- Index

- About the Author