- 588 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Investing in the Modern Age

About this book

This book discusses many key topics in investment and risk management, the global economic situation and the shift in global investment strategies. It was largely written during the period of 2007-12, one of the most tumultuous times in global financial markets which called into question not only tenets of economic forecasting and also asset allocation and return strategies. It contains studies of how investors lose money in derivative markets, examples of those who did not and how these disasters could have been prevented. The authors draw some conclusions on the impact of the structural shifts currently underway in the global economy as well as how cyclical trends will affect these industries, the globe and key sectors. The authors zoom in on key growth areas, including emerging markets, their interlinkages and financial trends.

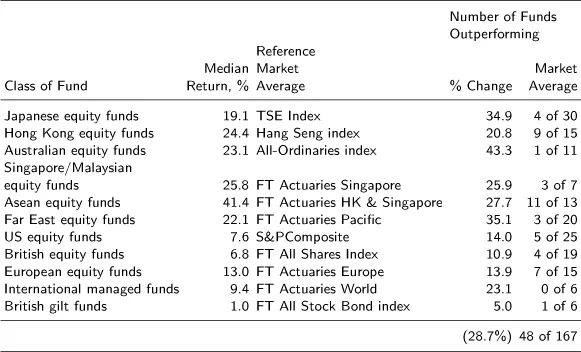

The book also covers risk arbitrage and mean reversion strategies in financial and sports betting markets, plus incentives, volatility aspects, risk taking and investments strategies used by hedge funds and university endowments. Topics such as stock market crash predictions, asset liability planning models, various players in financial markets and the evaluation of the greatest investors are also discussed.

The book presents tools and case studies of real applications for analyzing a wide variety of investment returns and better assessing the risks which many investors have preferred to ignore in the search of returns. Many security market regularities or anomalies are discussed including political party and January effects as is the process of building scenarios and using Kelly and fractional Kelly strategies to optimize returns.

Contents:

- Key Concepts:

- Arbitrage, Risk Arbitrage and the Favorite-Longshot Bias

- The Bond Stock Earnings Yield Differential Model

- Investor Camps

- Hedge Funds, Sovereign Wealth Funds and Other Investment Agglomerations:

- Average Hedge Funds and Their Evaluation

- Incentives and Risk Taking in Hedge Funds

- Evaluating Superior Hedge Funds

- Investment in Own-Company Stock

- Cutting Through the Hype on Sovereign Wealth Funds

- A New Age for Liquidity

- Government Owned Pensions: Asset Allocation and Governance Issues

- Update on Yale's Approach to Endowment Investing

- A Risk Arbitrage Convergence Trade: The Nikkei Put Warrant Market of 1989–90

- Kelly Capital Growth Investing

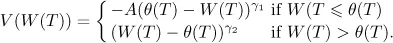

- InnoALM, the Innovest Austrian Pension Fund Financial Planning Model

- Seasonal Effects and Other Anomalies:

- Investing in the January Turn-of-the-Year Effect with Index Futures

- The January Barometer

- Sell-in-May-and-Go-Away and the Effect of the Fed

- 60–40 Pension Fund Mixes and Presidential Party Effects

- Volatility, Correlation and Liquidity:

- Thoughts on the VIX Fear Index

- Changing Correlations: Rising VIX and Violent Market Moves

- Can We Predict Stock Market Crashes?:

- Stock Market Crashes in 2006–2009: Were We Able to Predict Them?

- Three Mini Crashes in US and World Equity Markets

- What Signals Worked and What Did Not, 1980–2009

- What Signals Worked and What Did Not, 1980–2009, Part II

- What Signals Worked and What Did Not, 1980–2009, Part III

- How to Lose Money in Derivatives and Examples of Those Who Did

- Bubbles and Debt:

- Understanding the Financial Markets in the Subprime Era: The 2007/9 Crisis

- Bubbles

- China: Navigating the Olympic Risks

- Turkey's Juggling Act: Can It Live Up to Potential?

- Testing Resiliency: Protest and Natural Disasters

- It's a Gas, Gas, Gas!

- Thoughts on the Current Market Environment, Risks and Returns

- What's Wrong with The US?

- Investing Around the World

- Investing and Arbitrage in NFL Football and Horse Racing:

- Blunder or Correct Decision? The Belichick Decision to Go for It on 4th Down

- The 2010 and 2011 Super Bowls and the Elo Ranking System

- Risk Arbitrage in the NFL 2012 Playoffs and the Super Bowl

- The One That Got Away: The Hitable $2 Million Pick 6 at the Breeders' Cup

- Two Super Horses

- Farewell to the Queen and to the Princess of US Thoroughbred Racing

- The Dr Z Place and Show Racetrack Betting Systems Past and Present

Readership: Hedge fund managers, insurance managers, pension fund managers, mutual fund managers and other investment professionals and investors; students and researchers interested in risk management and investment management; investment strategies.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

Funds and Other Investment

Agglomerations

Table of contents

- Front Cover

- Half Title

- Title Page

- Copyright

- Dedication

- Acknowledgements

- Content

- Preface

- I Key Concepts

- II Hedge Funds, Sovereign Wealth Funds and Other Investment Agglomerations

- III Seasonal Effects and Other Anomalies

- IV Volatility, Correlation and Liquidity

- V Can We Predict Stock Market Crashes?

- VI Bubbles and Debt

- VII Investing and Arbitrage in NFL Football and Horse Racing

- Bibliography

- About the Authors

- Index