![]()

Chapter 1

The Bond Market in Europe

(Marida Bertocchi, Rita L. D’Ecclesia)

1.1 Introduction

The word Eurobond was originally created by Julius Strauss. The first Eurobond was issued in 1963 by the Italian motorway network “Autostrade”. It was a ten years straight bond of USD 15 million underwritten by an international syndicate, the London bankers S. G. Warburg and listed on the Luxenbourg Stock Exchange. The term Eurobond has been used to define different instruments. Originally, the term was used to describe foreign currency denominated bonds. This means that the bond is issued by an individual country Central Bank in a foreign currency. Multinational companies and national governments, including governments of developing countries, use Eurobonds to raise capital in international markets. Eurobonds are issued by multinational corporations; for example, an Italian company may issue a USD eurobond in Germany for investors living in European countries. In this context, the term has nothing to do with the Euro, and the prefix “Euro” is used more generally for deposits made in a different currency and managed by the local Central Bank [Gallant (1988); Abaffy et al. (1988)]. Most Eurobonds are now owned in electronic rather than physical form. The bonds are held and traded within one of the clearing systems (Euroclear and Clearstream being the most common). Coupons are paid electronically via the clearing systems to the holder of the Eurobond (or their nominee account).

In recent times, the term Euro bond (or Euro-denominated bond) has been used for bonds that are issued in one of the European Union (EU) member states according to the European membership. In Fig. 1.1 a description of the European countries and their use of the Euro currency is provided.

Fig. 1.1 Map of European countries.

- the medium grey represents the common currency Euro area made of 17 countries (Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain);

- the light grey represents the EU members that do not use the Euro yet (Sweden, Latvia, Lithuania, Poland, Bulgaria, the Czech Republic, Romania, Hungary);

- the dark grey represents the two Euro countries with an option to leave the EU (United Kingdom and Denmark).

Note, Kosovo and Montenegro (the black ones) are not EU members but they accept Euro currency.

The European Union Bond (EUB) nowadays would be a securitized bond, backed by the European Central Bank (ECB), and guaranteed by the European countries, which is still a highly debated project aimed to foster a real monetary union. See Section 1.7 in this Chapter for more insights.

1.2 History and Development

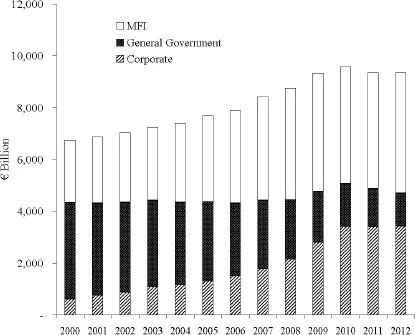

The Euro bond market has grown impressively since 2000. The importance of the Euro as an investment currency has made the market for Euro-denominated securities more attractive for investors and issuers. This market is better integrated and more liquid and provides a larger selection of innovative products, such as Index-Linked bonds, real-time bond indices, Fixed Income Exchange Traded Funds, Credit Derivatives and other Structured Products. The development of a relatively vast and yet homogenous financial market in the Euro area has attracted international investors, especially institutional investors, such as pension funds, insurance companies and banks. In 2000 the outstanding volume of Euro denominated debt was around €6.6 billion and reached €14.8 billion by the end of 2012 as shown in Table 1.1. The appeal of European bond markets for international investors has been further enhanced by reducing information asymmetry and improving transparency together with increased liquidity and declining transaction costs. In the last twelve years a large increase in private issuers of Euro-denominated bonds further contributed to the large growth of the market. The outstanding amounts of Euro-denominated debt securities by different issuers from 2000 to 2012 is reported in Fig. 1.2.

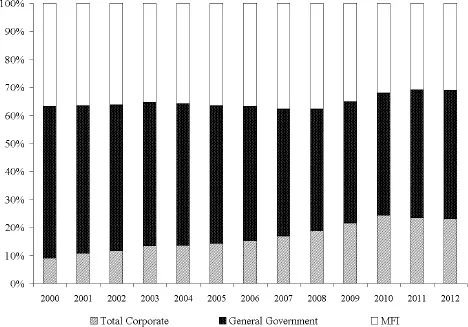

Euro Governments and Central Banks, classified as General Government, represent the largest issuers in the market, see Fig. 1.3. However, General Governments have shown a constant reduction in their outstanding volume during the decade, with an average yearly reduction rate of 8%, while Monetary and Financial Institutions have reported an average growth rate equal to 5% and Corporate companies a steady yearly increase at an average rate over the decade equal to 16%.

At the beginning of the European Monetary Union (EMU) in 2000, corporate bonds represented only 9.6% of outstanding bonds. By the end of 2003 they had grown to 14% and by 2012 reached 23% (see Table 1.1), largely due to the growing uncertainty experienced by sovereign government bond markets. In the last five years the corporate bond markets have continued to grow and develop although recent market volatility has slowed the growth.

Frequent efforts have been made to move towards an effective integration of European financial services. The Financial Services Action Plan (FSAP) was adopted by the European Commission in 1999 and endorsed by the Lisbon European Council in March 2000. It represents the most ambitious initiative to foster the integration of capital markets and to strive for a single market for financial services in the EU, [European Central Bank (2004)]. The degree of integration of Euro bonds is still low and in the last 5 years, after the 2008 financial crisis, many differences between the bond market across the various Euro countries emerged. At present investors show different perception of the financial credibility and stability of the various Euro countries, [Lojsch et al. (2011)].

Fig. 1.2 Euro-denominated debt by issuers.

1.3 The Main Features of Euro Bonds

The introduction of the Euro currency created one of the world’s biggest markets for bond issuance. According to Bank of International Settlements (BIS) data, the European bond market ranks third (USD 14 trillion) after the United States (USD 26 trillion) and Japan (USD 15 trillion), and the three together account for almost 80% of world bonds outstanding today. Although the market may be comparable in size to the US or Japanese markets, both the sheer number of issuers and differences in issuer credit-worthiness distinguish the Euro area bond market from its competitors.

Fig. 1.3 Share of Euro-denominated debt by issuers.

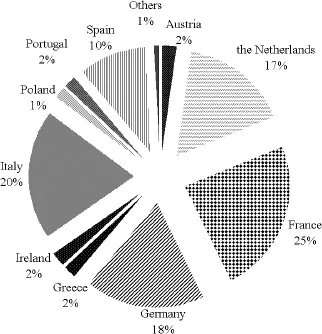

The outstanding volumes of domestic debt securities for the entire Euro area amount to about half that of the US market volume. However, national debt markets are of different sizes: 63% of the entire debt market is made up by Italy (20%), France (25%) and Germany (18%), Spain and the Netherlands represent another 27%, while Austria, Poland, Portugal, Greece, and Ireland and the others account for the remaining 10% of the sovereign issues outstanding, as reported in Fig. 1.4.

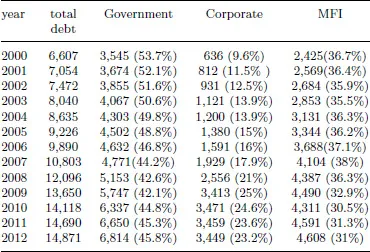

In Table 1.1 the dynamic of Euro denominated outstanding debt securities, in billions of Euro, by issuer is reported.

The European bond market can be broadly categorised into three bond market sectors: General Government, Corporate and Monetary Financial Institutions. Within each market sector bonds with different credit ratings, coupon rates, maturities, yields and other features appear.

The volume of Euro debt securities more than doubled in the last decade from €6.6 trillion to €14.9 trillion. The impressive growth, however, can be noticed in the Euro Corporate debt volumes which grew from €636 billion to €3.5 trillion, showing an average annual growth of 17% for the 6 years up to 2007, surging in 2008 and 2009 when it grew by 20% annually. After 2009 the amount of corporate debt volume grew at a slower pace. In 2000 54% of the total outstanding volume was represented by Government debt while the Corporate debt represented only the 9.6% and the MFIs the 36%. By 2011 the percentage of Government debt had declined to 45% while Corporate had risen to 24% and MFIs to 31%, see Fig. 1.3. In the last decade European market investors have shown increased interests in corporate debt securities with respect to the traditional Government securities, providing liquidity to the corporate sectors.

Table 1.1 Euro 17 domestic debt outstanding.

Fiscal performance has had a significant impact on the issuance activity of the Euro area governments. As a consequence, the borrowing requirements of Euro area countries have increased. For example, the borrowing of each of the biggest debt issuers, Italy, Germany and France, was equal to the outstanding debt volume of the seven “small” Euro area countries combined.

Governments represent the largest issuers in the Euro area. Governments issue bonds to borrow money to cover the gap between the amount they receive in taxes and the amount they spend, to re-fund existing debt and/or to raise capital. Government bonds are usually considered the highest quality bonds in the market because they are backed by central governments (not the case for emerging market bonds where defaults can represent a serious risk). Within the Central Government bond sector, the Sub-Sovereign bond sector is defined as any level of government below the national or central government, which includes regions, provinces, states, municipalities. In Europe, the Sub-Sovereign bond market is primarily dominated by agencies and supranational institutions such as the World Bank, Kreditanstalt für Wiederaufbau (KfW) and the European Investment Bank (EIB). The market for Sub-Sovereign bonds in Europe has less individual participation than in the US; individual investors in the US municipal bond market enjoy significant tax advantages for their investments. As European countries have increasingly become a single market, the growth of the Sub-Sovereign bond market has been significant as well. It represents in 2012 9% of the general government outstanding volume (3% in 2001), from a €99 billion notional in 2001 to €609 billion in 2012. Growth in the number of Sub-Sovereign entities issuing debt has been related to changes in the structure and function of government entities below the national or sovereign level. Re-examination and reorganisation of sources of revenue for Sub-Sovereign entities and access to capital for new infrastructure are important in Europe. The European Union continues to expand and develop rules on which categories of Sub-Sovereign government borrowing are included in the national debt ceilings and which are excluded. Sub-Sovereign participation in the bond markets is expanding because local governments need to finance day to day operations of public services and capital infrastructure investments (i.e roads, hospitals, bridges, reservoirs) and the central governments have debt ceiling limits. In addition, a decentralization process is ongoing in most European countries. Government and Sub-Sovereign bond markets exist side by side and serve as independent sources of financing for the national or central government and local governments.

Fig. 1.4 Euro-denominated bond market by country in 2011.

The second largest Euro-denominated bond market is the Monetary and Financial Institution (MFI) whose issuances grew from €2.4 trillion in 2000 (37% of total outstanding) to €4.6 trillion in 2012 (31% of total outstanding). The MFI represents the credit institutions (6,180 institutions in the Euro area in 2012) and financial institutions (1,088 money market fund institutions in 2012). They issue Bonds, Asset-Backed Securities and other collateralized Mortgage Debt Obligations enriching the set of debt securities suitable for different kind of investors. Collateralized debt has been one of the fastest developing investment vehicle in the last decade based on the idea that credit can be advanced on the basis of which collateral, security, or compensation a borrower can use to repay the loan in the case of default. The collateral or security can come from one or more sources such as mortgages, loans, bonds/debt or asset-backed securities. Collateralized debt instrument is therefore a kind of promissory note backed by collateral, security or other compensation in the event of a default by a borrower. The subject is further discussed in the following Chapters.

The corporate bond market sector is the sector which has reported the most impressive growth. Nearly 23% of outstanding bonds globally are corporate bonds. In Europe the corporate bond markets has been shown a steady increase even if the recent high market volatility has caused some decline. The assessment of corporate credit quality requires the collection, on a regular basis, of a substantial set of reliable data. It is impressive that the non banking sector has taken this responsibility on board. There are two categories of corporate bonds for investors: investment-grade bonds and speculative-grade (also known as high-yield and sub-investment grade). Investment-grade bonds are characterized by high credit quality, speculative-grade bonds are issued by corporations that are per...