![]()

CHAPTER 1

Chairman’s Introductory Remarks

TOMMY KOH

Your Excellencies, Governors, Sponsors, Corporate Associates and Friends of IPS, a very warm welcome to Perspectives 2007.

The response to this year’s conference has been overwhelming. We have a record number of 750 participants. Irene Lim, our Administration Manager, has had to turn away over 100 requests because of the lack of space. If the number keeps growing each year, we may have to consider moving to a bigger venue. I thank you for your support.

I would also like to thank our two principal sponsors, Temasek Holdings and the Standard Chartered Bank, as well as the other 15 sponsors, which are Asia Pacific Breweries, Housing & Development Board, Maritime and Port Authority of Singapore, Nanyang Polytechnic, Nanyang Technological University, National University of Singapore, Ngee Ann Polytechnic, OSIM International, Philips Electronics Singapore, Shell Companies in Singapore, Singapore Management University, Singapore Polytechnic, SMRT Corporation Ltd, Temasek Polytechnic and the Hongkong and Shanghai Banking Corporation. I congratulate Chang Li Lin, our Public Affairs Manager, for succeeding in increasing the number of sponsors each year.

It is the custom in IPS to have a different colleague from the research wing of the family and one from the administrative wing to take the lead in organising the annual Perspectives conference. This year, the two leaders are Senior Research Fellow Tan Tarn How and Administration Officer Claris Wang, and I wish to thank them for their outstanding jobs. I would also like to thank Acting Director Arun Mahizhnan and Irene Lim for overseeing the whole process.

The theme of this year’s Perspectives is “A New Singapore”. The conference will address four new trends and developments:

(i)How will the large influx of new immigrants and the increasing outflow of Singaporeans affect our social and political compact and our nation-building project?

(ii)How will the new technologies, such as the Internet and mobile phone, affect our civil society, our media and our political governance

(iii)How will the trend towards a dual economy — a robust globalised economy co-existing with a sluggish domestic economy — and the widening social divide, affect our social cohesion and harmony?

(iv)Will ASEAN, which will be 40 years old in August, succeed in seeking to re-invent itself by adopting a legal personality, a charter, embracing deeper integration and strengthening its institutions and effectiveness?

The Singapore government has appointed me to represent Singapore in the High-level Task Force to draft the ASEAN Charter. I will be leaving Singapore tomorrow morning for Cebu, the Philippines, to attend a joint meeting between the Task Force and the ASEAN Charter’s Eminent Persons Group (EPG). Our Deputy Prime Minister, Professor S. Jayakumar, represents Singapore in the EPG. I look forward to this endeavour and hope that my colleagues and I will succeed in drafting a good charter for adoption by the ASEAN Summit, when it convenes in Singapore in November this year.

Let me conclude by summarising the Institute’s main achievements in 2006:

(i)It co-organised, with the International Monetary Fund and the World Bank, the highly successful 2006 Programme of Seminars;

(ii)It commissioned a survey on the 2006 General Elections and organised a Post-Election Forum;

(iii)It launched with the Nanyang Technological University the inaugural annual index ranking the 10 ASEAN economies, 35 states and union territories of India, 31 provinces of China, Hong Kong, Macau and Taiwan;

(iv)It organised the 5th Young Singaporeans Conference;

(v)It organised three important public lectures for His Eminence Cardinal Renato Raffaele Martino, President of the Pontifical Council for Justice and Peace and Special Envoy of His Holiness Pope Benedict XVI; Professor Larry Diamond of the Hoover Institution, Stanford University; and Professor Rosabeth Moss Kanter of the Harvard Business School;

(vi)It co-published two books with the World Bank, one on the impact of China and India on the world economy and the other containing essays on Asia’s future by 17 Asian thinkers; published an important new book on madrasah education in Singapore and five other publications;

(vii)It continued to co-organise, with The Business Times, the Singapore Economic Roundtable twice a year; and

(viii)It organised 16 breakfast meetings, working lunches and dinners and other events for our 97 Corporate Associates. Our key performance indicator for 2007 is 110 members.

I will now request my colleague, Mr Yeoh Lam Keong, the Chairman of the first panel, to take over the proceedings.

Thank you.

![]()

S E C T I O N 1

The New and Dual Economy

![]()

CHAPTER 2

Singapore Economy: The New and The Dual

chua hak bin

There appears to be two faces to the current economic expansion: a new and a dual. The new economy thesis argues that Singapore is undergoing some form of Renaissance, with sustained and higher growth than the typical speed limit likely over the medium term. The dual economy thesis highlights that despite rosy headline growth, there appears to be divergent growth patterns persisting between different businesses, income groups and even within certain asset classes, particularly residential property (Chua and Lim, 2006). The two features need not necessarily be inconsistent, and on the contrary, may be part and parcel of globalisation.

THE NEW ECONOMY

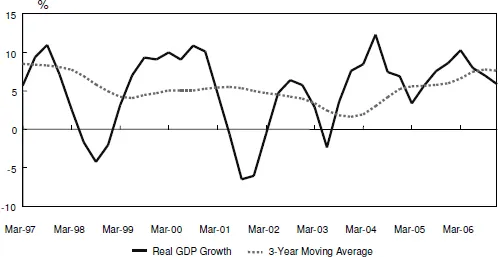

The conviction about a new economy comes from robust economic expansion over the last few years, since the Sars crisis, with GDP growth averaging 7.6 per cent over 2004–2006 (see Chart 1). Growth going forward will likely come in above the 3–5 per cent range, previously regarded as the long-term growth speed limit for a mature economy. The government has reiterated its confidence by forecasting a GDP growth range of 4–6 per cent in 2007, a departure from the last three years when the initial official forecast started at 3–5 per cent.

Chart 1 GDP growth trending up since 2003 Sars crisis: Renaissance or luck?

SOURCE CEIC Data Company Limited.

Luck may have certainly been a factor, given the relatively benign global environment over the last few years since 2003. But there are nevertheless structural developments supporting the Renaissance thesis. The relative out-performance of the Singapore economy against its regional peers suggests more fundamental forces at work, some of which are policy-induced. We believe the new economy is a result of (1) enhanced competitiveness arising from an aggressive tax and Central Provident Fund (CPF) restructuring; (2) a more liberal immigration policy; (3) a more diversified economy with new growth drivers, and (4) a pro-growth approach.

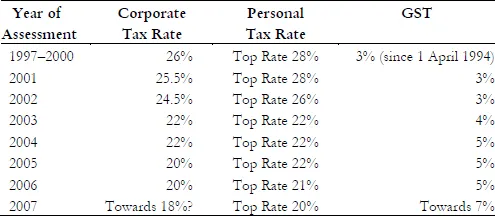

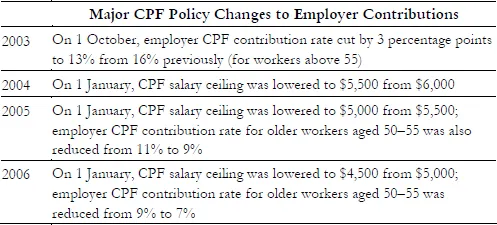

Enhanced Competitiveness from Tax and CPF Restructuring

Tax and CPF restructuring may have increased economic competitiveness, unleashing new growth drivers and wider domestic investment opportunities. Aggressive tax and CPF cuts from 2001 have significantly reduced costs for employers. Corporate tax rates have been cut from 26 per cent to 20 per cent over 2001–2006 (see Table 1). Prime Minister Lee Hsien Loong has indicated that, alongside a further Goods and Services Tax (GST) increase, more income tax cuts could be possible going forward (Lee, 13 November 2006). Employer CPF contribution has also been cut, with the contribution rate cut by 3 percentage points to 13 per cent from 16 per cent and the salary ceiling gradually reduced from S$6,000 to S$4,500 over three years (see Table 2).

Table 1 The grand tax restructuring: More to come?

SOURCE www.iras.gov.sg; Citigroup estimates. See Chua, 20 November 2006.

Table 2 CPF restructuring 2003–2006

SOURCE www.cpf.gov.sg. See Chua, August 2006.

Verdict on the economic restructuring is probably best reflected in the strong job growth figures and rising foreign investment over the last few years. Job creation has gradually risen from a contraction of 12,950 in 2003 to 71,400 in 2004 and 113,300 in 2005. For the first nine months of 2006, job growth at 123,000 has already beaten the whole of 2005. Overall unemployment rate has slid back from a high of 4.8 per cent in September 2003 to 2.7 per cent in September 2006.

Such strong job growth figures are spectacular and may not have been possible without the generous tax and CPF cuts, which helped to lift corporate profitability and attract fresh investments. Net manufacturing investment commitments recovered from S$7.5 billion in 2003 to S$8.3 billion in 2004 and S$8.5 billion in 2005. For the first nine months of 2006, net manufacturing investment commitments are holding up at about the same levels, of about S$6 billion. Figures on the number of newly registered companies are probably more representative, as they include services. Newly registered companies have risen to 19,501 in 2005 and 17,153 in 2004 from the low point of 13,544 in 2003. The figure for 2006 should come in slightly above the 2005 level and almost double the 2000–2002 levels. About 90 per cent of the new companies are in services.

More Liberal Immigration Policy

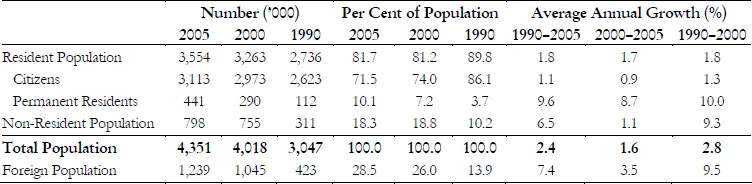

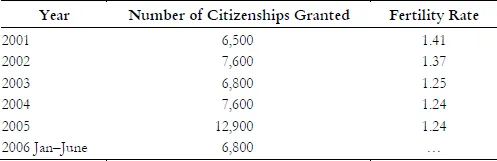

A liberal immigration policy, even more relaxed than during the early 1990s boom, is increasing the influx of foreign talent, making higher potential growth possible. Permanent residents, for example, grew 8.7 per cent in 2000–2005, ten times the growth rate of citizens. The government is studying its population policies and more relaxation may be in store to increase the citizenship take-up rate. The number of new citizenships granted in 2005, at 12,900, is almost double the rate of previous years (see Table 3). Preliminary figures for 2006 and government policy direction suggest that this trend will continue.

The more relaxed immigration policy has made the current economic boom possible, as a large fraction of the strong job demand is satisfied by foreign workers. Labour force growth, currently running at 6 per cent, is significantly higher and about double the pace even compared to the boom during the early 1990s (Chua, 7 November 2006). About half of the new jobs created are going to non-residents.

Table 3 Demographic trends, 1990–2005

SOURCE Singapore Department of Statistics, Demographic Trends, General Household Survey 2005; Koh et al., 2002; Citigroup estimates. See Chua, September 2006.

NOTE Full time series for permanent residents and citizens are not available.

Table 4 New citizens in Singapore: Sharp jump in 2005 and 2006

SOURCE New Straits Times, 24 August 2006; Singapore Departmen...