![]()

1

Economic Freedom: Theory, Measurement and Concepts

1.1 Introduction

The capitalistic mode of production has successfully been adopted in all industrialized and advanced countries in North America and Western Europe. One can argue that these Western capitalist economies have become the “first generation” of capitalist economies that serve as models and references for other world economies. The key element in capitalism embraces economic freedom that allows voluntary participation of individuals in a free market and the establishment of various civic institutions that provide the rule of law and the protection of property rights.

After the Second World War and since the 1950s, there have been a number of world economies that have succeeded after taking up market capitalism. In East Asia, the “dragon” economies of Japan, Hong Kong, South Korea, Singapore and Chinese Taipei (Taiwan) have attracted world attention because of their rapid economic transformation in the second half of the 20th century. Although the extent of market capitalism may have differed from countries in Europe and North America, the economic success of these “dragon” economies have in turn served as “second generation” models and references of market capitalist economies for other emerging and transitional economies. Beginning from the 1980s in Asia, the “next tier” of Southeast Asian nations that comprise of Malaysia, Thailand, Indonesia and the Philippines have followed the path of the developed Asian economies. Similarly, Mainland China’s economic reform in 1978 has adopted pragmatic market economic principles and had attracted huge and continuous injection of capital from overseas Chinese. By the turn of the 21st century, the rapid growth of the Mainland China economy has led other emerging economies, such as India, Latin American and Eastern European countries, to examine the strength and virtues of market capitalism and have paid even closer and detailed attention to the post-World War II development of the Asia “dragon” economies as targets and references where development lessons can be learnt.

The post-World War II economic success of the Asia “dragon” economies and the increasing role they have in influencing other emerging world economies has led to the debate on the “Asia paradigm” of development. While capitalism has been the basic mode of production, the concerns include the various economic and non-economic ingredients, fabrics and textures that facilitated growth in these Asian economies. Among a large volume of studies that documented the successful growth in East Asia, Li (2002) has coined “economism” as the paradigm that explained how the success of Asian economies differed from the traditional “first generation” capitalist countries in North America and Western Europe.

The Hong Kong economy has been selected as the “freest” economy in the world for a number of consecutive years, and the Hong Kong economy has attracted large attention because its political sovereignty has reverted from Great Britain to the People’s Republic of China on July 1, 1997, ending the status of a British colony for 155 years. The concern is whether the established economic strength of Hong Kong will be challenged by the wave of economic convergence and integration with the Mainland China economy after 1997. The changing bilateral and mutual relationship with the Mainland China economy will be of great interest for the further development of the “freest” world economy. The mutual influence will form the dynamics of the bilateral relationship. Given its openness and the colonial connections, Hong Kong also has its other “leg” in the world economy. Although Hong Kong has constantly been influenced by the world market, changes in the Hong Kong market in turn have provided necessary information to international investors.

The Hong Kong economy in first decade of the 21st century has suffered from a number of regional and international crises. The Asian financial crisis in 1997 that brought different degrees of economic hardship to a number of Asian economies has subsided by the time the new century arrives, though some of the Asian economies were still struggling with economic recovery and were drafting a new path in their economic development. Health hazards occurred with the spread of the avian flu pandemic at regular intervals in a number of Asian economies since 1997, together with the outbreak of the severe acute respiratory syndrome (SARS) in 2003 in Hong Kong and Mainland China that have spread to the other parts of the world. In early 2009, the human swine flu that first discovered in Mexico has also quickly spread to the US and other parts of the world. In the US, the September 11, 2001, terrorist attacks on the World Trade Center in New York and the Pentagon in Washington DC have lifted the curtain for a prolonged war on terrorism that drained away much economic resources. One other unintended economic consequence includes the dramatic rise in the petroleum price that has in different manner hurt the world economy.

The showdown in the series of crises in the first decade of the 21st century came in September 2008 after a sequence of financial events and difficulties in the US that led to similar financial meltdown in different world regions. The 2008 financial crisis in the US has raised a number of interesting debates. One debate concerns whether the magnitude of the 2008 financial crisis is comparable to the “Great Depression” of the 1930s. The world economy in the 21st century, however, surely differs from the economic world of the 1930s, as the developed European and Asian countries have played a part in the world economy, suggesting that the cushion for economic hardship is now larger.

Another debate that arises from the 2008 financial crisis is whether there is an excessive application of economic freedom, especially in the financial world. One question is whether financial institutions have been given too much freedom to the extent of ignoring their moral, business conduct or ethic responsibilities. There have been two views in this debate. One view simply concerns that people have taken economic freedom to their own hands and unethically exploited it. Thus, anti-freedom advocates would call for a greater control, and introduce more economic restrictions and planning, typically to be exercised by the government or the state. Those who hold this view effectively suggest a rewinding of freedom, at least in the financial world, asking the government or the state to intervene and take over the economic decisions of individuals, businesses and institutions.

The pro-freedom advocates treasure the virtues of individual freedom, but point to the importance of needed regulations in the financial world. The needed and transparent financial regulations are meant to protect, nurture and strengthen economic freedom and provide a “level playing field” platform through which market participants can rely, participate, transact and engage effectively. Economic freedom does not operate in a vacuum; and individuals and businesses in a free economy need to be protected from illegal or faulty transactions and abuse. A more open, standardized and transparent set of financial and banking regulations should be seen as a complement to the operation of financial transactions and the functioning of economic freedom.

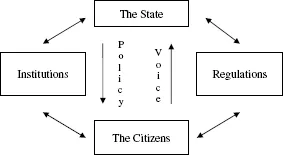

Economic freedom is not a “free good”. The exercise of economic freedom comes with the presence of a high level of civilized behaviors and manners governed by the presence of specialized and professional institutions and the presence of regulations that specify how activities are conducted equitably, transparently and openly. A somewhat simplified structure that gives the relationship between the state representing the government or the ruler and the citizens representing the public is shown in Figure 1.1. The state or the government exercises and implements appropriate policies in a timely manner, while the citizens express and voice their opinions and needs through different channels.

In Figure 1.1, institutions on the one hand and regulations on the other hand act like two arms in a free economy. Institutions represent numerous civic establishments that specify various standard practices and an extent and coverage of activities and transactions, while regulations specify how standard practices are maintained and how activities and transactions are conducted in a manner that applies to all citizens indiscriminately. In short, the exercise of freedom itself needs to be protected from coercion and abuse, and the form of protection is embedded in the presence of relevant institutions guided by comprehensive regulations.

The 2008 financial crisis has actually highlighted the relevance and importance of economic freedom. In the first instance, freedom in financial, investment, information and monetary transactions are crucial elements in civic societies. For example, the knowledge about the financial products, the method used to calculate investment returns, the agent that handles the invested amount, the risk level of individual business entities and financial products, and the use and flow of private information between bankers and investment agents are equally important in order to ensure that all parties in financial transactions are fully aware of the size of monetary involvement and the responsibility of each and every individual and agent. As the financial sector involves changes and innovations constantly, it would be appropriate to establish new and timely regulations that counterbalance possible mishaps, abuse and poor governance by individuals and business entities in the financial world.

FIGURE 1.1 A simplified structure in a free economy

The next two sections summarize the key arguments of economic freedom, pointing out its virtues, and elaborate conceptually on its intuition and strength to show how an individual and the society can benefit and progress with it. Section 1.4 examines the way economic freedom is measured. Section 1.5 illustrates some of the key empirical studies that relate economic freedom to its causes and consequences, providing comparisons across different world economies. Most empirical studies come to the conclusion that economic freedom is surely a virtue and not a vice to humanity.

Hong Kong has been the freest economy for a number of consecutive years. Section 1.6 considers the elements that Hong Kong has performed in the Index of Economic Freedom. The various elements are then grouped into three headings so that other economies aim to pursue and improve their economic freedom can draft their own paths by examining the content and performance of the three economic freedom pillars.

Before concluding the chapter, the discussion in Section 1.7 looks deeper into the foundation of economic freedom. The result of economic freedom rests with the different economic outcomes experienced by individuals and enterprises. But the difference in outcome should not be contradictory or conflicting because all outcomes depend on efforts and resource endowments. Economic relativity is the ultimate accepted outcome in a free society where individuals can conduct their activities according to their resource endowments. There is no doubt inequality emerges, but inequality can be viewed dynamically because the difference can change overtime, can get larger or shrink according to individuals’ effort and adjustment in endowment and business cycles.

The chapter concludes that being the freest economy in the world, Hong Kong economy is worth to be studied and documented, so that lessons can be drawn and learned by other economies. One is not projecting a perfect economy, and there are always economic faults and drawbacks. By openly studying the various components of the freest economy, one can have an insight on how a free economy operates and how different components function, complement and interact with each other. The lesson is to know how activities are being conducted successfully, and at the same time observe the continued or dynamic performance of the Hong Kong economy. Lacking natural resources of its own, Hong Kong seems to face different economic challenges at different times. Economic vibrancy seems to be a good and successful alternative to the shortage in natural resources.

1.2 Economic Freedom Advocates: Smith, Hayek and Friedman

Scholars in economic thoughts have provided a detailed sequence and classification on the contribution by different economic philosophers. The early economic philosophers of mercantilists in the 18th century gave way to the development of the classical economists in the 19th century. Economic liberalism in the form of laissez-faire emphasized on the pursuit of individual economic interests, and coupled with the necessary institutional setup, formed the basis of classical economic theories and arguments.

The two diverging political economy views that emerged after the classical economists are the Marxian school and the neo-classical school. Contrary to the classical school were the Marxists, whom preached for collectivism, communism and concentration of economic power in the hands of the state. Under communism, resource allocation and output would come under the monopoly of the state. According to the Marxists, imperialism and the dependency theory argue that underdevelopment in developing countries was the result of economic exploitation. The marginalist school extends the classical school by incorporating a discussion on economic efficiency, and has formed the main stream of the neo-classical school in the early 20th century. Since the end of the Second World War in 1945, the neo-classical school has gradually extended to numerous other theoretical areas, including growth and equity, macroeconomic measurement and policy, and the role of government (Wonnacoltt and Wonnacott, 1990).

The most well-known classical economist has been Adam Smith whose pioneering book, An Inquiry Into the Nature and Causes of the Wealth of Nations (1776) (WON hereafter), has defined numerous contemporary economic relationships among individuals and nations. Indeed, the “first lesson” an economic student learns in any economic textbooks is derived largely from the WON (Weinstein, 2001). The WON actually contained five books. The first book begins with the productive power of labor. The division and specialization of labor have become the basis of contemporary economic ideas. The second book that deals with the function of money and role of price in the market economy is covered in every basic economic textbook. The unequal outcome of nations’ wealth due to the different ability in wealth accumulation is discussed in Book III. The political economy and external economic relationships among nations in the form of trade and economic choice of domestic production are discussed in Book IV. The sovereign state discussed in Book V concerns the fiscal role of the state, and the needed fiscal expenditure on public works and sources of revenue have lasting implications on the public finance of contemporary world economies.

Although Adam Smith is regarded as the “father of modern economics”, Krueger (2003, Introduction) agrees that “many of the ideas in WON can be traced to earlier thinkers” and that Adam Smith had literally borrowed from his French contemporaries. It has also become popular to find ancient Chinese philosophers who, though unknown to Adam Smith at the time, advanced related ideas two thousand years earlier. Indeed, Krueger’s (2003) observation has been elaborated by Zhang (2000) who has drawn a comparison between the philosophical work of Adam Smith (1723–1790) and Confucius (551–479 BC) by examining their economic doctrines, moral sentiments and approaches to the free will of an ideal individual. Zhang (2000:29) pointed out that despite the low economic development in China at the time of Adam Smith, Confucius had influenced the “mental and spiritual states” of European philosophers. Zhang (1999:88) elaborated that Confucius “tried to construct a social environment where each individual pursues his own benefits without hurting other people”. While Confucius discussed free will, Adam Smith upheld freedom and “the invisible hand” in exchange and in social order (Zhang, 1999, 2000; Butler, 2007). Before the WON, Adam Smith (1759) had written an earlier work on The Theory of Moral Sentiments that explained “human morality through the sentiment of sympathy” (Krueger, 2003, Introduction).

A key figure in the advocate of economic freedom in the last century is Friedrich A. Hayek, whose famous book The Road to Serfdom was published in 1944. Friedrich Hayek’s economic philosophy has been documented in numerous works, notably in the nineteen volumes of The Collected Works of F. A. Hayek, under the general editorship of Stephen Kresge. Especially in examining the unwanted consequences of the Second World War, Friedrich Hayek (1944) considers freedom as a core value in humanity and that economic intervention by government and economic planning would take away individual freedom in economic decision making, and the growing power of the government would “enslave” the citizens. Put in modern terms, Friedrich Hayek (1944) argues that political and economic power concentrated in the hands of government officials whom planned and distributed all forms of economic resources would leave little choice and room for individuals to make their own economic progress. Friedrich Hayek (1991:385–386) concerns particularly the danger of unlimited government even in a democratic regime because “a government with unlimited power will be forced, [in order] to secure the continued support of the majority, to use its unlimited powers in the service of special interests”.

In Volume 10 on Socialism and War, Caldwell (1997:40) notes that individuals make their own choices in a free market system, but a “code of values” will have to be imposed by the planners in a planned economy, and that “since planners are political appointees who wish to retain power, they will seek ways to justify the choices that they have made”. As such, the planners tend to favor those support their plans and “authoritarian government tends inevitably to expand beyond the economic and into the political domain”. Caldwell (1997:218) goes further to elaborate that central planning necessarily produces a totalitarian system because “whoever control the means must decide which ends they are to serve” and this means a control over all economic activities. Friedrich Hayek concludes that individual liberty will ultimately be sacrificed.

Friedrich Hayek was also a major critique of John M. Keynes, whom had also written extensively and advocated ...