![]()

Part I

Overview of Angel Investment

![]()

Chapter 1

The Origin and Development of Angel Investment

The Charitable Origins of Angel Investment

Angels are the messengers of God. In white robes, they fly to the earth with beautiful wings. They have great wisdom and strength and to help people in their time of need. Angels connote spring and hope. Entrepreneurs regard investors as angels to show their endless reverence. In religious beliefs, angels are God’s messengers who pass on his messages to humans and are the saviors of mankind. In the reality of business, angels also play a similar role.

Although the history of angel investment as a career in finance is not a long one, the behavior has existed in economic life for a long time. In early 1874, the young Alexander Bell established the first telephone company in the world with the help of two angel investors. Bell initially wanted to obtain start-up capital from banks, but they believed that his ideas were too bold and risky and did not give him the loan. It was a successful lawyer and a furrier, both from Boston, who funded Bell and made his dream come true. In 1903, five angel investors invested $40,000, which helped Henry Ford realize his automobile dream to eventually establish the economic giant, Ford Motor Company. Amazon, which was listed in 1997, was funded by $1.2 million of angel capital from several investors. Later on, Amazon obtained a venture capital (VC) investment of $8 million (also referred to as start-up investment). Other major technology companies such as Apple and Google also received funds from angel investors at their early stage. People always say that the angel investor1 has nerves of steel and a heart of gold. Without angel investors, there would be no Apple. Without the sharp market sensitivity and decisive judgment of angel investors, there would be no Google, too.

The concept of angel investment first appeared in the Broadway theater in New York at the beginning of the 20th century. Directors and actors had to invest dedication and hard work to rehearse a new play. During directing and rehearsing, they not only had to work hard, but also had to prepare costumes and props, which required a large sum of money. If the show was a big success, their input would bring fame and fortune. However, if it was a flop, all their dedication and hard work would be all for naught. Moreover, all money they had input previously, including their own money and loans from family and friends would come to nothing. It was quite risky to invest in new plays.

This concept was of great significance to one particular play. After substantial amounts of efforts, materials and money were invested in this play, the cast found themselves short of funds and there was a possibility that the play had to be abandoned. Everyone was filled with anxiety. On the one hand, they did not want to give up what they had input, but on the other hand, there were many uncertain factors deciding the success of a future play and it was hard to find external funding sources. People were desperate for help. In time of need, a wealthy man, who had made a successful show on Broadway, eventually reached out with a helping hand. This investor, with his bold and timely decision to invest, was like an angel sent by God to those desperate directors and actors. They called him an investment angel in honor. The term “angel investment” thus came into being.

Angel Investment Introduced to Business Transactions

The initial angel investment in Broadway had the nature of a charity fund. But later, angel investment became associated and used purely for business purposes. Individual equity capital invested in ideas or start-ups at the seed stage/early stage is called angel capital, and an individual who undertakes the high risk in the hope of possible high gains is called an angel investor. Like VC investors, angel investors not only offer start-ups with funding, but they also offer their valuable specialized knowledge, experience and well-connected social network.

Some say angel investing involves a clever combination of gambling and dedication. Like VC investment, angel investment also entails high-risk investment behavior. Before making the investment, angel investors are clearly aware that no matter how much prudential investigation has been conducted to the potential project, no matter how good the project looks like and how great the potential profit is, their future is unpredictable and their inherent risk is very high. Once an investment mistake occurs, it is highly possible that the angel investor's hard earned money will vanish without a trace. Even with such great risk, angel investors still engage in this type of investment, so on the surface, it does look like gambling. However, in reality, each step of investment decision made by the angel investor is prudential in order to avoid risk to the greatest extent. An experienced angel investor is more likely to be successful and will input substantial efforts to make pre-investment preparations, including an overall audit of the project.2 This exercise in prudence is entirely different from gambling. Angel investors are also passionate, romantic and optimistic like an entrepreneur. They expect success and are eager to achieve it. And like an entrepreneur, they devote to it. We cannot understand why angel inverstors are so passionate about angel investment, let alone learn their secrets to success, if we are passionate about do not know their thought-process.

The Global Spread of Angel Investment

In the era of rapid development of the Internet and high technology, some successful and high-profile entrepreneurs have become “angel investors” and brought the little-known market of angel investment to the public’s attention. Over the last five years, the number of individual angels across the world — including active regions such as the Europe and the United States — has increased rapidly. Angel investment through syndicates, groups and network organizations has also experienced a growth.

The World Bank issued a research report in 2014 on angel groups, giving an overview of angel investment, cases of global angel groups, establishment frameworks and operation processes of angel groups.3 It could be seen from the report that global angel investors have become much more organized and institutionalized. It made seven key observations:

(1) There were approximately 350 active angel investment organizations and on average each organization had over 60 angels. These organizations were scattered across the country, particularly in the Silicon Valley and Boston. There was an active association of 30 angel organizations in Canada — most of which were established after 2008 in Ontario and British Columbia and their surrounding areas.

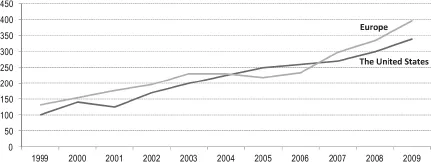

(2) The number of angel groups in Europe has grown rapidly over the past decade, with England and France becoming the most active markets in Europe. European governments have also encouraged public support to angel investment group and networks and the European Commission supported the establishment of the European Business Angel Network (EBAN) in 1999. According to the latest report of EBAN (published in 2014): business angel networks have been growing in number at an average of 17% for the past 10 years. In 2013, the number of active networks in Europe increased to 468.4 The 2011 OECD research report pointed out that the number of angel groups and network organizations in the Europe and the United States increased rapidly during 1999 and 2009 (see Figure 1.1).

(3) China’s formal angel market has been on the rise, attracting both domestic and foreign investors. With this rise in angel groups, the government has begun providing policies to support such investments.

(4) The angel investment market in Australia has had a history of over a decade, but it was only in 2007 that the angel investment market became more formalized and standardized when the Australian Association of Angel Investors (AAAI) was established. In New Zealand, the public sector has established a powerful joint investment fund system to promote the development of an angel investment market.

(5) There were only 21 active angel networks in Latin America in 2013. Argentina, Brazil, Chile and Mexico were taking the lead in the development of angel groups, most of which were established after 2005. While angel investing is growing, the region as a whole struggles to develop a culture of equity investing.

(6) Israel has developed a mature angel investment market while the angel investment markets in Jordan and Bahrain remain underdeveloped. For other smaller markets, nation-wide levels of entrepreneurship have not reached their full potential and hence also remain underdeveloped.

(7) South Africa has the most developed angel investment market in Sub-Saharan Africa. Angel Hub is the first formalized group in the region. Angel groups have also emerged in Nigeria, Kenya and Burkina Faso in recent years. Generally speaking, the entrepreneurial ecosystem in the region is not mature and angel investors face challenges in finding high-quality investment projects.

Fig. 1.1 Number of Angel Groups/Networks in the Europe and the United States (1999–2009).

Source: Adapted from the 2011 OECD research report, “Financing High-Growth Firms: The Role of Angel Investors”.

It is worth noting that the flourishing of equity-based crowd funding and accelerators across the world has led to new changes in project sources, investment modes and management strategies of angel investors.

Notes

1. Considering the various forms of the subject of angel investment, the term “angel investor” is used to refer to an individual angel while “angel investment fund”, “angel group(s)” and “business angel network” are terms that are used to refer to institutional angels.

2. Robert Wiltbank and Warren Boeker, ‘Returns to Angel Investors in Groups,’ Working Paper, SSRN, November 1, 2007, available at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1028592.

3. The World Bank, ‘Creating Angel Investor Groups: A Guide for Emerging and Frontier Markets,’ Working Paper, December 9, 2014, available online at http://www-wds.worldbank.org/external/default/WDSContentServer/WDSP/IB/2014/12/09/000442464_20141209131256/Rendered/PDF/930370WP0Box380ups0guidbook0final00.pdf.

4. EBAN, ‘Statistics Compendium 2014,’ available online at http://www.eban.org/wp-content/uploads/2014/09/13.-Statistics-Compendium-2014.pdf.

![]()

Chapter 2

Concepts and Financial Connotations of Angel Investments

Concepts of Angel Investment

I. Definition of Angel Investment

The Center for Venture Research, based at the University of New Hampshire, is a well-known angel investment research institution. Led by Professor Jeffery Sohl, the Center proposes that angel investment is a behavior of an individual with certain idle capital for equity capital investment in high-growth enterprise (project) in seed stage.

Angel investment is also called “informal VC investment.” Similar to VC investment, angel investment also targets non-listed enterprises, in particular start-ups in seed/early stage for non-controlling investment. The difference between angel investment and VC investment is that the latter is institutional behavior while the former is individual behavior. In addition, VC investors invest with other people’s money (mainly the capital of institutional investors) while angel investors invest with their own money, which is the visible difference between these two types of investment.

Strictly speaking, not all informal VC investments are angel investment. According to the research done by Professor Martin Haemmig, family members of...