eBook - ePub

Problems in Portfolio Theory and the Fundamentals of Financial Decision Making

- 212 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Problems in Portfolio Theory and the Fundamentals of Financial Decision Making

About this book

-->

This book consists of invaluable introductions, tutorials and problems which are helpful for teaching purposes and have a very broad appeal and usage. The problems cover many aspects of static and dynamic portfolio theory as well

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Problems in Portfolio Theory and the Fundamentals of Financial Decision Making by Leonard C MacLean, William T Ziemba in PDF and/or ePUB format, as well as other popular books in Business & Finance. We have over one million books available in our catalogue for you to explore.

SECTION F: DYNAMIC PORTFOLIO THEORY AND ASSET ALLOCATION

The components of financial decision making are financial assets, trading prices, wealth preferences, decision sets, dominance and efficiency. There is a rich literature on financial decision models, where variations on the components are proposed. Some of the models are considered in this final section. Most of the discussion concerns negative power/log utility functions and the associated capital growth. Within the framework of expected utility theory significant qualitative properties of decision behavior can be developed analytically for negative power utility, with log being the most risky power utility function.

An asset class is a group of securities that exhibit similar characteristics, behave similarly in the marketplace, and are subject to the same laws and regulations. The three main asset classes are equities (stocks), fixed income (bonds) and cash equivalents (money market instruments). Additionally, currencies, commodities, real estate and gold are separate asset classes. Asset allocation refers to the specific asset by asset proportional weight in a portfolio.

Strategic asset allocation is passive and describes the practice of creating a portfolio with a mix of assets whose parameters will remain relatively stable over the long term. Because asset prices fluctuate, investors and investment managers may set criteria for rebalancing to the pre-set targets. With a fixed mix, the asset to asset proportions remain constant despite market fluctuation which requires periodic rebalancing.

Tactical asset allocation is active and essentially takes a strategic asset allocation and regularly adjusts it for changing market conditions subject to various forecasts. The premise is that by doing this, one can optimize market exposure to maximize risk-adjusted returns. The primary difference between strategic and tactical asset allocation is active investment management and the belief that it is possible to “beat” the market.

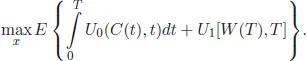

Consider the decision framework, where the investor makes investment decisions constrained by market conditions and capital requirements. The objective is to invest available capital X(t) and consume C(t) in each period, where investment generates wealth, (X(1), . . . ,X(t − 1)) → W(t), through the return on investment, is

The change in wealth from investment in period t is a geometric process governed by a standard diffusion (random walk) and a jump process. The incremental budget condition is

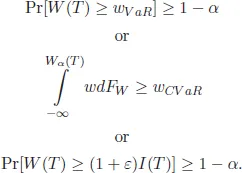

In addition to investment and consumption decisions being constrained by the available capital, the investor may have financial requirements or goals/targets to meet at the horizon such as:

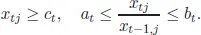

Finally, there also may be limits placed on trading which constrain decisions, e.g., short selling and rebalancing.

The functions defining the decision model are presented in continuous time, but differencing and summation operators could replace the differential and integral. The richest formulations are discrete time stochastic dynamic models which are solved with multi-period stochastic programming (Ziemba, 2003). The continuous time models yield qualitative results which are useful for characterizing decision behavior.

The utility function is overconsumption at each time period and a bequest function of final wealth. Typically these functions are assumed to be concave risk averse. In the models presented in chapters included in this section, either U0 ≡ 0 or U1 ≡ 0.

The budget constraint defines the change in wealth from the returns on investment and the consumption at each time period. The returns have a diffusive process component (x′(α − re)+ r)W dt, and a point process (shock) component θtdNt(λt). The diffusion is geometric Brownian motion (or a geometric random walk) and the point process is a type of Poisson process. An important feature of the point process is the dependence of the shock intensity on market conditions. This generates clusters of up/down shocks (Consigli et al. 2009). Alternatively, the ...

Table of contents

- Cover page

- Title

- Copyright

- Dedication

- Preface

- Contents

- Books for which the Problems are Designed

- Section A: Arbitrage and Asset Pricing

- Section B: Utility Theory

- Section C: Stochastic Dominance

- Section D: Risk Aversion and Static Portfolio Theory

- Section E: Risk Measures

- Section F: Dynamic Portfolio Theory and Asset Allocation

- About the Authors

- Index